Fixed Income Investments

VER’s investments in fixed income instruments are divided into two categories: liquid and other fixed income investments. According to the Ministry of Finance’s directive, fixed-income instruments must account for a minimum of 30 per cent, and liquid and low-risk fixed-income instruments for a minimum of 20 per cent of the value of the portfolio.

Liquid fixed income investments

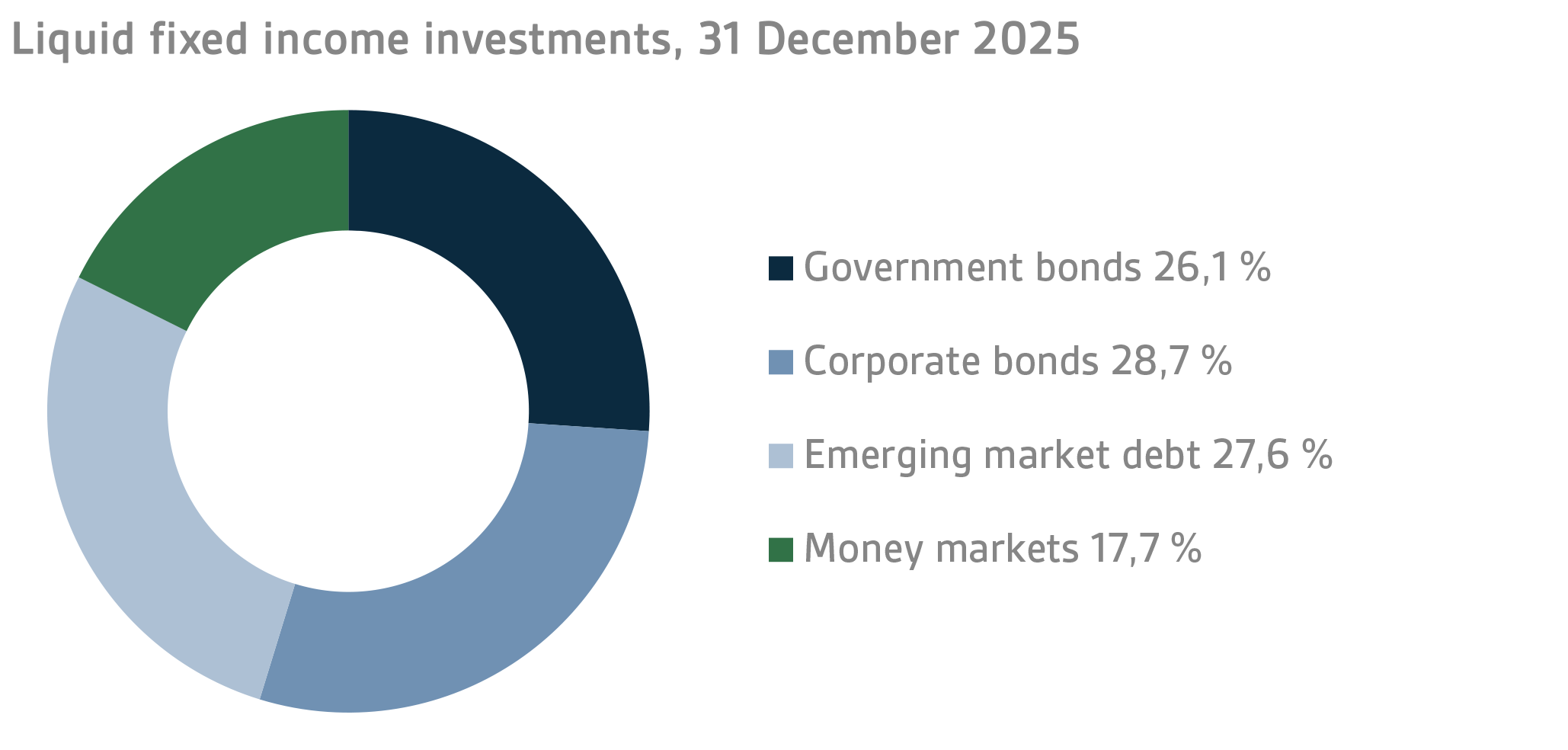

Investments in liquid fixed income instruments are designed to offset the risks associated with equities. Under normal market conditions, the defensive element in the portfolio consisting of government bonds and money market instruments has a negative or very weak correlation to equities. Government bonds are used primarily for generating income through the management of interest rate risks by modifying the portfolio duration and interest curve position.

The money markets serve as a kind of liquidity buffer when investments in the other asset classes increase or decrease.

By contrast, the most risk-laden investments in the fixed income portfolio exhibit a stronger correlation with listed equities. In these asset classes, the objective is to generate returns by taking risks in addition to managing the interest rate risks. These categories include investments in corporate bonds and emerging market debt.

Other fixed income investments

The other fixed-income instruments consist primarily of investments in illiquid private credit funds.

VER's private credit portfolio focuses on direct lending and senior loan funds, but also includes higher risk funds such as distressed credit and special situation funds.

Published 2015-01-13 at 17:11, updated 2026-02-12 at 13:17