Equity Investments

VER’s investments in stocks consist of two types of instruments: listed equities and other stocks and shares. According to the standing guidelines issued by the Ministry of Finance, a maximum of 60 per cent of all VER’s investments may be made in equities.

Listed equity investments

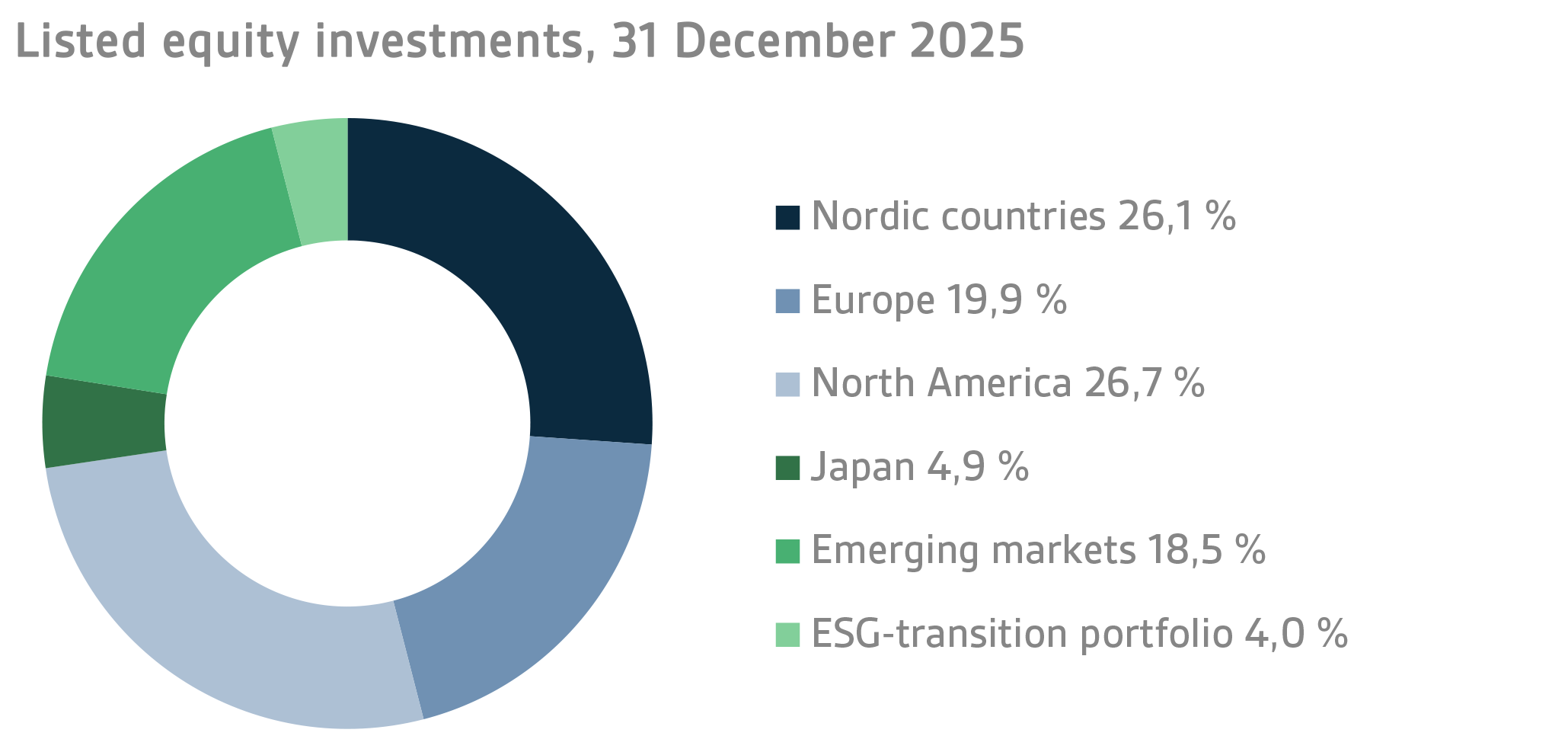

VER’s listed equity investments are spread globally and divided into six sub-portfolios: Europe, the Nordic countries, Emerging Markets, North America, Japan and ESG -transition.

Investments are made directly in listed companies or through funds. Direct investments are made in listed Nordic companies while other geographical areas are addressed through fund investments. They include both passive index investments and active funds of various forms. The strategies pursued by the individual funds may vary greatly depending on the investment policies employed. VER also makes use of exchange-traded funds (EFTs) in its investment operations.

Traditionally, annual changes in the listed equities portfolio have been modest. If necessary, however, trading activity can be quickly increased if so warranted by market developments.

Other equity investments

VER’s other equity investments are made primarily in private equity and infrastructure funds. Additionally, investments ae made in non-listed equities.

Published 2015-01-13 at 16:46, updated 2026-02-12 at 13:19