Strategy

The strategy of the State Pension Fund (VER) sets the framework for investment activities to serve as a basis for its annual investment plans. A key point in the strategy is to define the return target and allocation criteria for investments.

VER reached its 25% funding ratio target on 31 December 2021, much earlier than expected. Following the attainment of the target funding ratio, the Act on VER was amended by a new law that entered into force in April 2022. Given VER’s growing role in offsetting government pension expenditure and the increase in negative net transfers, VER’s funding ratio is expected to fall in the coming years.

VER’s annual net transfer to the state budget relative to current amount of assets will increase to -4.5%. As a result of pension expenditure and the structure of the employment-based contribution income system, net transfers to the state budget are most negative in 2034 and will gradually increase after that. State pension contributions and expenditure are expected to reach an equilibrium in the 2050s.

VER’s significantly negative net contribution income imposes severe constraints on its investment activities. However, as a buffer fund, VER is able to accommodate fluctuations in the funding ratio as well as occasional years of negative returns. The buffer fund means that the state’s pension expenses are covered mainly from the state budget.

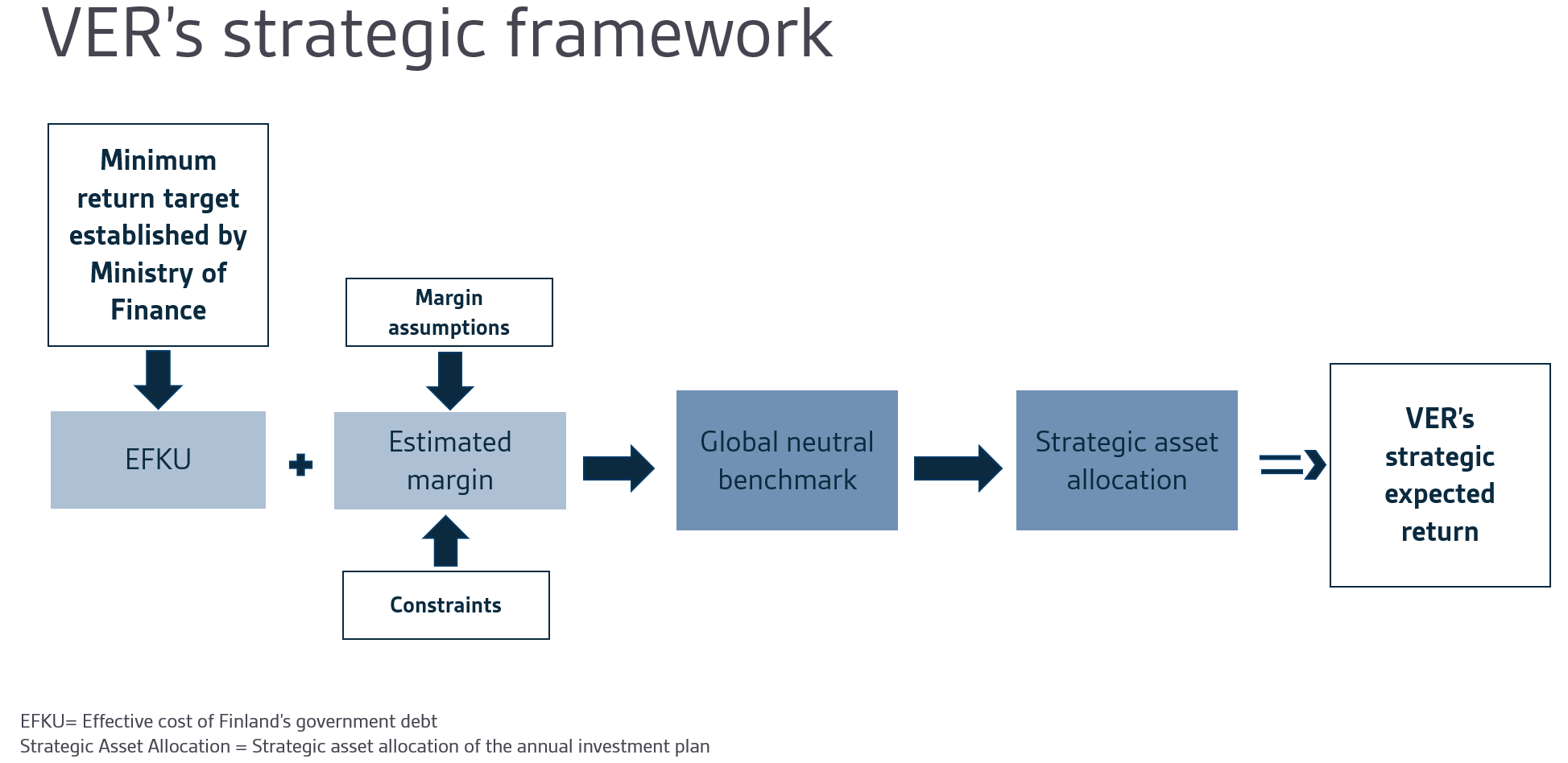

The operating order of the Ministry of Finance sets a minimum requirement for VER’s investment activities to exceed the effective interest rate on government debt in the long term. Effective interest rate means the actual average cost of government debt.

In the long term, VER seeks maximum additional return over and above the government's financing costs at a reasonable level of risk with due regard to the specified allocation limits and foreseen net contribution income. In its own calculations, VER uses a yield assumption that exceeds the average cost of government debt by an estimated 2-3 percentage points in the long term. This is also supported by long-term historical returns achieved by VER and the return assumptions for the Finnish pension system estimated by the Finnish Centre for Pensions.

In the process to set the asset allocation leading to the achievement of the return target, VER employs a hierarchy of two benchmark indexes. The first is a global neutral benchmark index which consists of equities and bonds. As a sort of buffer fund, VER is able to engage in long-term investment activities where the expected return is adequate but where the return on investments may fluctuate considerably. VER is exempted from the solvency computation requirements typically applied to pension funds, but VER's negative net contribution income may lead to situations that make it difficult to freely allocate liquid assets and shorten the investment horizon. Despite this, a global neutral benchmark index is used as a starting point for steering investment activities.

VER’s Board of Directors determines annually in the investment plan a more detailed strategic basic allocation specifying the weights of individual asset classes to serve as a benchmark index for the investment plan. These two benchmarks are used for governing investment activities and measuring strategic and operative performance.

VER believes that the strategic asset allocation for asset classes set out in VER's investment plan is capable of achieving the above longer-term objectives.

Published 2016-09-01 at 9:50, updated 2023-09-06 at 13:47