Mission

The State Pension Fund of Finland (VER) was established in 1989 and commenced operations in 1990. The Fund is tasked to manage and invest the pension assets entrusted to it to ensure that the assets are used to provide for and offset the cost of future state pensions.

VER’s activities are governed by the Act on the State Pension Fund (1297/2006). Other pieces of legislation relevant to VER’s operations are the Public Sector Pensions Act (91/2016) and the Act on the Financing of State Pension Security (67/2016), which entered into force at the beginning of 2017 as part of a comprehensive pension reform.

VER plays an important role in Finnish society. It is part of the State’s partially pre-funded pension system, and when established it was modelled on the TyEL employment system and the Local Government Pension Institution Keva. The guiding principle of pre-funding is to allocate the burden of cost to the right generation. In Finland, only a certain percentage of the cost of pensions is pre-funded through collective funds.

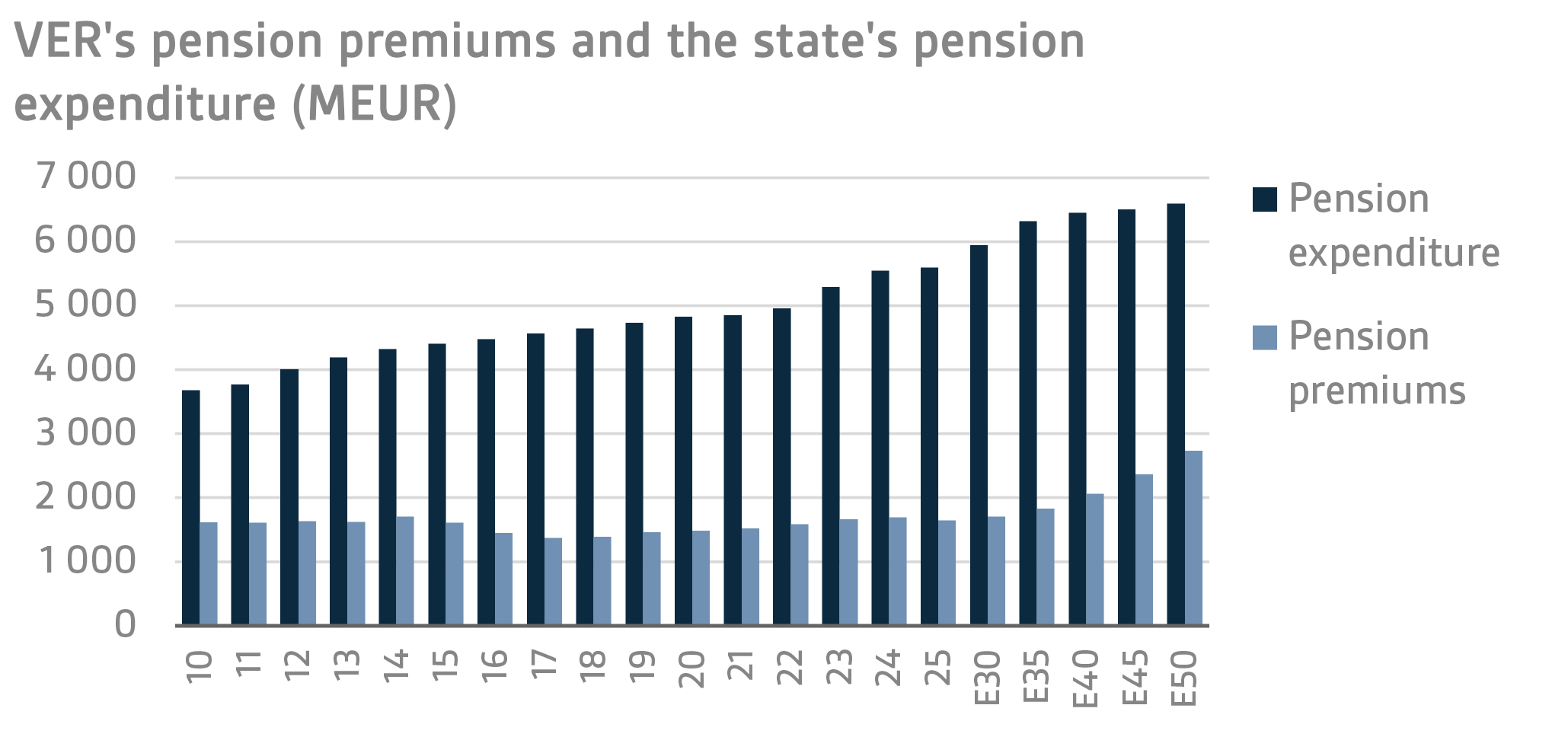

In 2025, the state pension system covered 121,000 people. The pension expenditure was EUR 5.6 billion. A total of 462,000 persons received government pensions.

After the 2005 pension reform, the pension security provided by the State is equal to that provided by the municipal and private sector. With the pension reform, the government introduced a career model under which the amount of pension is calculated according to employees’ annual earnings and the pension accrual rate.

Even after the pension reform effective as of 2017, the pension cover under the state pension scheme is similar to that of the private and municipal sector: The reform provided for a gradual increase in the minimum retirement age, which will in future be adapted to changes in life expectancy. At the same time, the provisions governing the accrual of pensions were updated.

The reform will also affect the financing of the system.

VER is a part of a partially pre-funded pension system

Structurally, the Finnish employment pension system is partially pre-funded. Partial pre-funding is implemented differently in the private and public sector. The pensions of private-sector employees are pre-funded individually, whereas public sector funds are buffer funds. On the private side (under the TyEL employment pension scheme), part of the pension contributions are used to pre-fund old age and disability pensions. Every year, a large percentage of the pension contributions paid by the private sector is allocated to finance an equalisation component, which is used to pay for pensions funded by pension institutions collectively in the year in which the contributions are collected. In the private-sector system, the capital value of pre-funded pensions is often referred to as ‘pension liability’.

State pension contributions are paid to the State Pension Fund, which serves as a buffer fund to finance part of the public sector pensions. A large percentage of state employment pensions are funded directly out of the government budget. The State’s pension liabilities are calculated at the system level individually for each person who has accrued any pension under the state pension plan at some point in their working career. Pension liability represents the present value of accrued pensions, and the funding ratio of state pensions refers to the ratio of the State Pension Fund’s assets to the State’s pension liability. For the purposes of the government financial statements, pension liability is determined with reference to all the pensions accrued by central and local government employees. Liability for state pensions rests with the State.

State employees’ pensions are financed by pension contributions, the buffer fund’s assets and the returns earned on the investments made by the fund, as well as the government budget. The pension contributions collected for state employees are paid to the State Pension Fund. Each year VER transfers a pre-defined percentage of the State's total annual pension expenditure to the government budget. An increasing amount of VER’s assets are being used to pay for pensions. Up to the end of 2024, VER’s budget transfers will account for 41 per cent of the annual pension expenditure, to be gradually increased to 45 per cent by 2028.

Operating policy

The State Pension Fund of Finland earns its income from pension insurance premiums and certain payments associated with the contributions as well as returns on investments. Pension premiums are paid by the employers and employees covered by the state pension system. However, instead of paying out pensions directly, VER collects and invests the accumulated assets. As a ‘buffer fund’, VER – unlike the TyEL pension insurance companies governed by the Employees Pensions Act – does not incur any direct pension liabilities itself. As a result, VER is not to subject to any solvency regulations.

Responsibility for actual pension payments was reassigned from the State Treasury to the Local Government Pension Institution Keva in 2011, which has since then served as the state pension institute. Similarly, employer services were taken over by Keva as of the beginning of 2013. VER pays Keva a management fee for the provision of these services.

The pensions to be paid out by the State are included in the government budget to which VER transfers an amount equivalent to 45 per cent of the annual pension expenditure as provided in the Act on the State Pension Fund. Monies that are not transferred remain in the Fund.

Extensive pension liability of the state

Pension liability refers to the sum of money (including future investment returns) sufficient at any given time to cover the future cost of pensions accrued by the date when such determination is made. This liability also includes all paid-up pensions (pensions accrued under expired government employment contracts). Pension liability involves an assumption of future returns on investments. The State’s pension liability indicates the total cost of the pensions promised by the State to its current and previous employees at the time of calculation.

Aside from expected returns, the liability calculation draws upon other assumptions such as assumptions regarding changes in life expectancy and retirement age, as well as the number of people anticipated to retire on a disability pension in the future. When pension liability is determined, it is essential to know the exact aggregate amount of pensions accrued by the date when such determination is made. In reality, pension liability varies from year to year: those employed earn more pension day by day, people retire on an on-going basis, and some of the pensioners die.

Pension liability consists of claims outstanding and the provision for unearned premiums. Claims outstanding refer to pensions event that have already materialised, i.e., the capital value of old-age, survivors', invalidity, unemployment and part-time pensions that have already commenced. Provision for unearned premiums, in turn, means the capital value of pension rights accrued by the date of determination in respect of pensions not yet paid out.

| million € |

2024 |

2025 |

| Pension contributions |

1,709 |

1,656 |

| - of which employees´ share |

527 |

511 |

| Transfer to state budget |

2,274 |

2,350 |

| Net pension contribution |

-565 |

-695 |

| Within the state pension scheme |

2024 |

2025 |

| Insured |

approx. 132,000 |

approx. 121,000 |

| Pensioners |

approx. 460,000 |

approx. 462,000 |

| Pension liability |

101.0 billion € |

97.8 billion € |

| Funding rate |

24.2% |

26.5% |

| Investment portfolio |

21.6 billion € |

25.8 billion € |

| Return on investment portfolio |

9.0% |

9.3% |

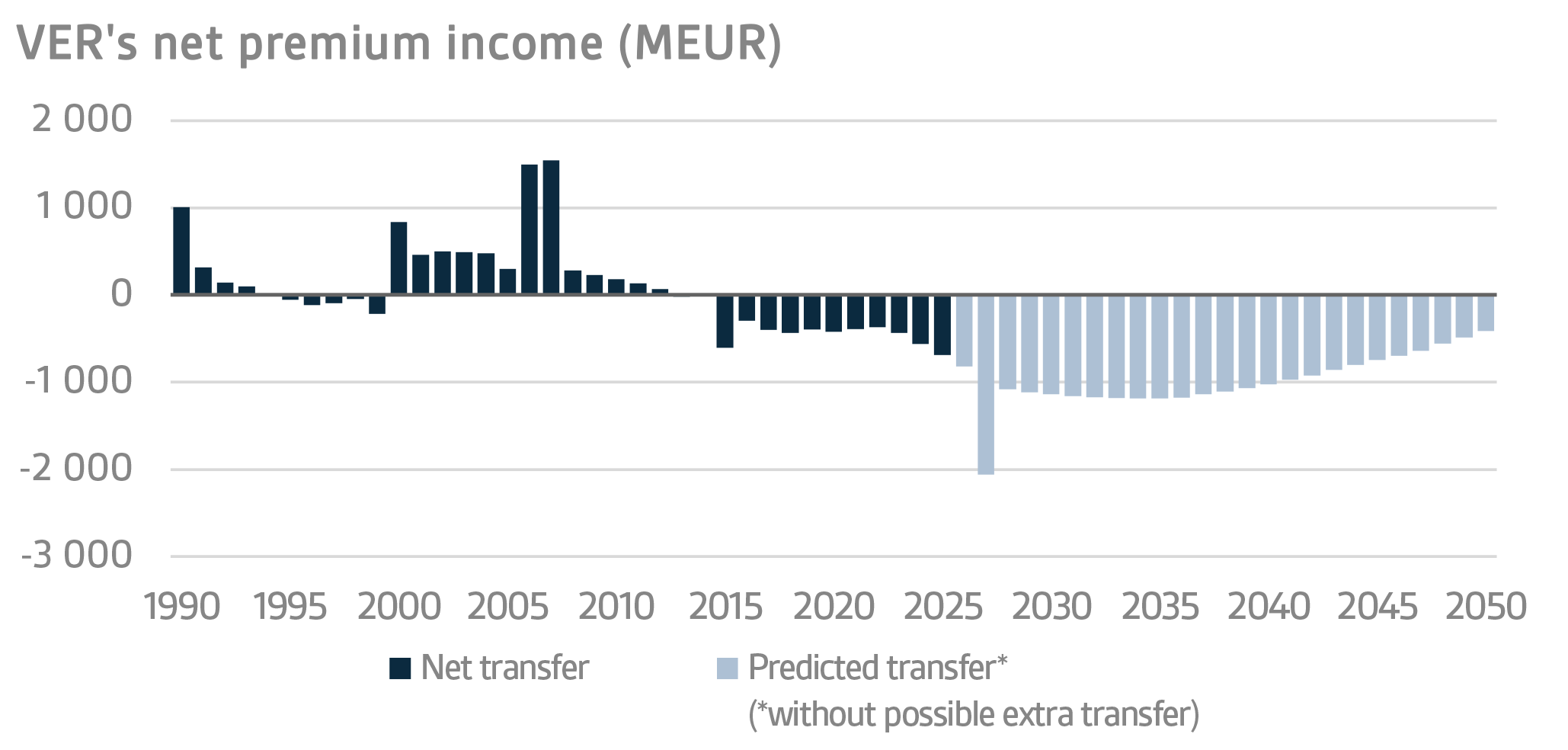

Net premium income turned negative

The new Act on the State Pension Fund took effect on 8 April 2022. A key amendment was an increase in government budget transfers from 40 to 45 per cent, to be phased in during 2024–2028. Additionally, if VER's funding ratio rises above 25 per cent for two consecutive calendar years, an additional 3 per cent transfer will be made until the funding ratio falls below 25 per cent. At the end of 2025, the State’s pension liabilities amounted to EUR 97.8 billion, while the funding ratio was 26.5 per cent.

VER’s net contribution income (pension contribution income less budget transfers) turned negative in 2013. Hence, VER contributes to the government budget more than it receives by way of contribution income. The negative net contribution income is projected to change over the 2020s, with VER’s role in offsetting government pension expenditure increasing towards the end of the decade. Net transfers from VER to the government budget will increase as a result of the amendment to the VER Act, because VER’s contribution towards state pension expenditure will increase from 41% to 45% between 2024 and 2028.

In the early 2030s, the negative net cash flow will continue to increase and the annual net transfers will reach around EUR 1 billion each year. Towards the end of the 2030s, the net transfers out of the Fund will begin to fall gradually to turn positive again in the 2050s.

In 2020, the ratio of pension expenditure to the wage bill was about 79 per cent. It is expected to peak at the end of the 2030s when it reaches 85 per cent of the wage bill. After that, pension expenditure relative to the wage bill is projected to decline slowly at least up to the 2050s.

The number of people covered by the state pension system is expected to fall steadily up to the mid-2040s. The decrease in the number of government employees will affect both future pension contribution income and pension expenditure. The fall in number will largely be due to privatisation and legal reforms. Some of these arrangements involve long-term transitional arrangements that will see primary and secondary school teachers and university staff gradually transferred to private sector pension schemes.

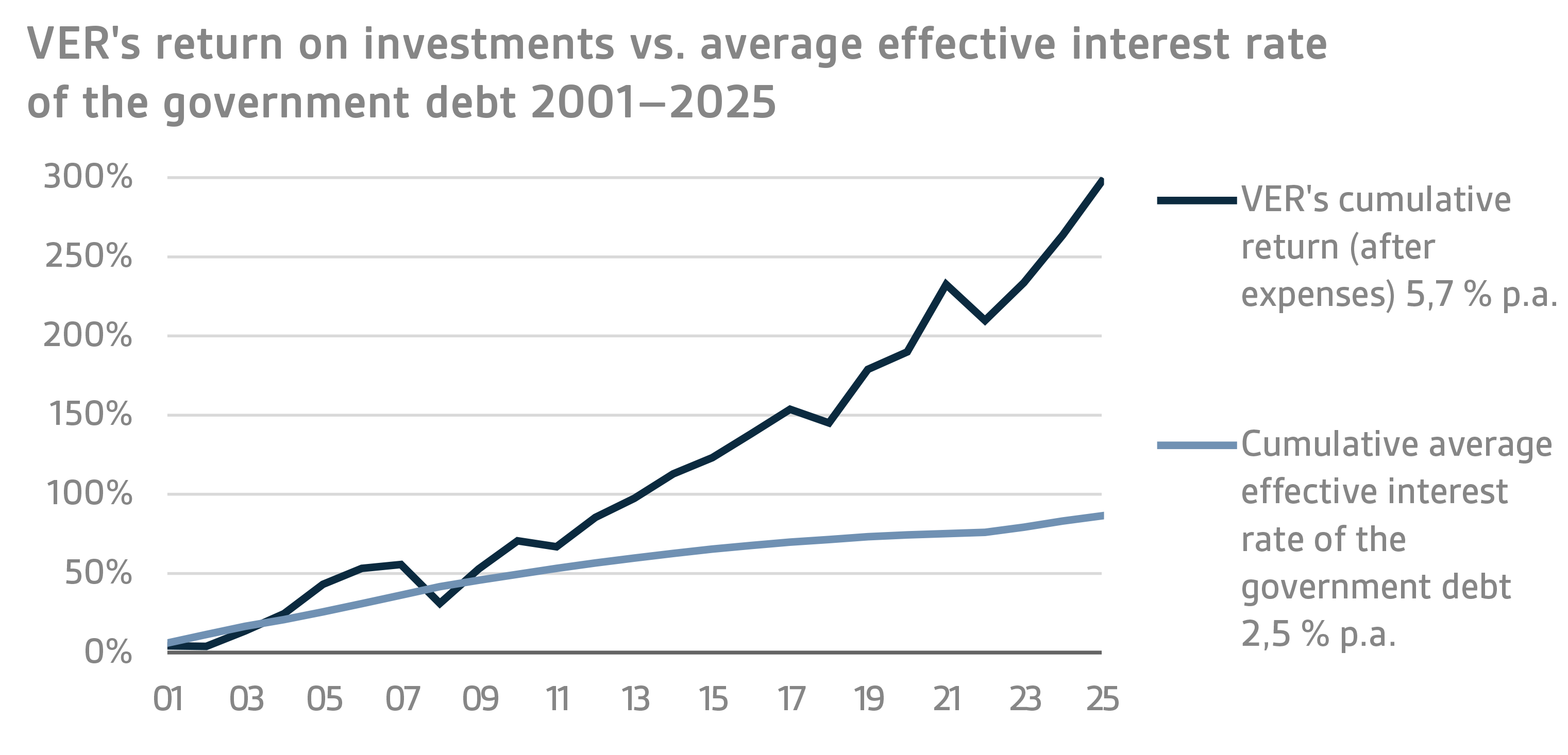

EXPECTED RETURN OF INVESTMENTS AND ACHIEVEMENT OF ITS GOALS

The target return established for VER by the Ministry of Finance is to earn a higher rate of return than an alternative investment considered risk-free from the State’s point of view, in other words the cost of net government debt.

From 2001 to 2025, VER created over EUR 14 billion in value added for the State. This value added is determined in terms of returns exceeding the average net cost of government debt.