VER’s return on investment 5.8% during 1 Jan–30 September 2025; ten-year average annual return 6.0%

Published 2025-10-28 at 16:07

INVESTMENT ENVIRONMENT

From the perspective of the investment markets, economic development has been favourable. High inflation and interest rates are a thing of the past, which has laid the foundation for sound investment returns. The biggest fluctuations so far occurred in April, when the United States announced its new tariff policy. However, over the course of the year, the markets have learned to interpret US policy commentaries and changes. As a result, the significance of individual announcements in terms of market reactions has diminished.

While economic growth is not particularly strong in Europe, the prospects are expected to continue to improve in the coming year. Expectations for corporate earnings growth are equally encouraging. Even so, real growth has been sluggish throughout 2025. The fall in interest rates is expected to improve the growth outlook.

Economic growth in the United States has been robust, which has partly prevented the central bank from making substantial interest rate cuts. However, the markets appear to foresee several cuts. At the same time, the independence of the central bank in these matters is being debated, something that is expected to continue for some time to come. This will increase the likelihood of mistaken assessments and policy choices.

Geopolitical uncertainty persisted during the reporting period. Major efforts have been made to resolve crises locally, often with the assistance of the United States. A prime example is the ceasefire between Israel and Hamas. The war in Ukraine continues with no solution in sight.

Despite the numerous risks, conditions in the investment markets have been favourable. Valuation levels related to artificial intelligence and technology companies in general have raised concerns among experts about the continued positive development of the stock market.

VER’S RETURN ON INVESTMENTS

Future monitoring and evaluation of the State Pension Fund’s investment activities will focus on long-term outcomes and future prospects instead of quarterly reporting. However, VER will continue to post quarterly figures and comments.

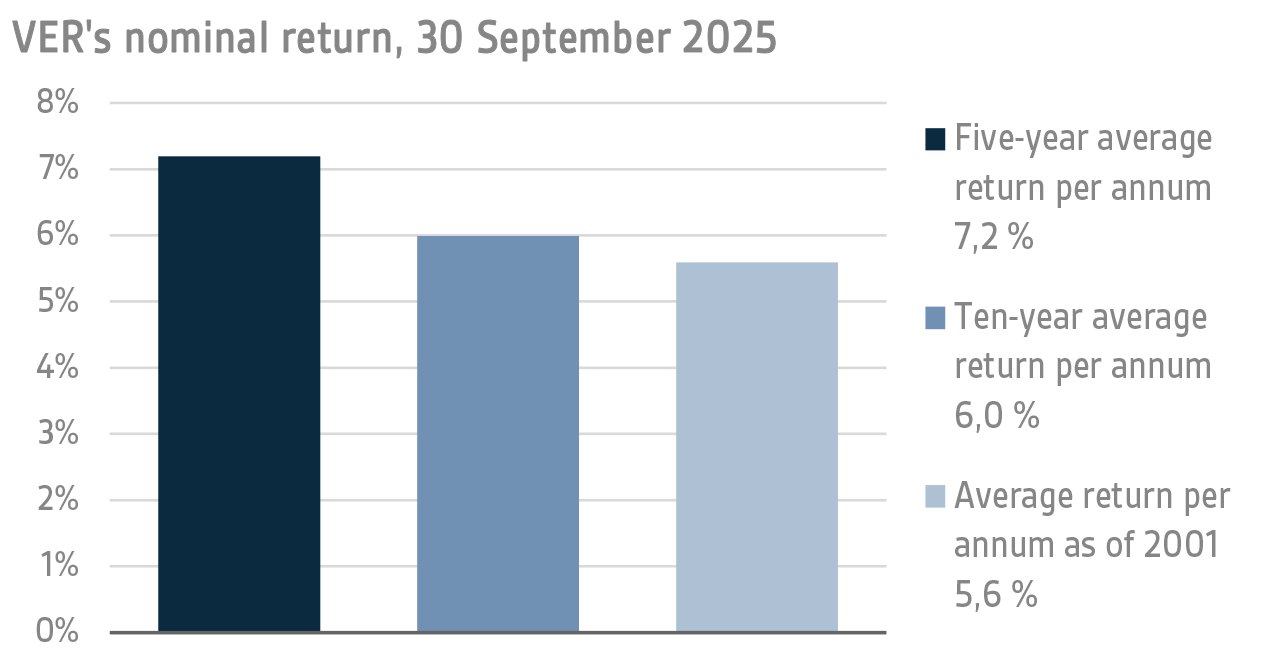

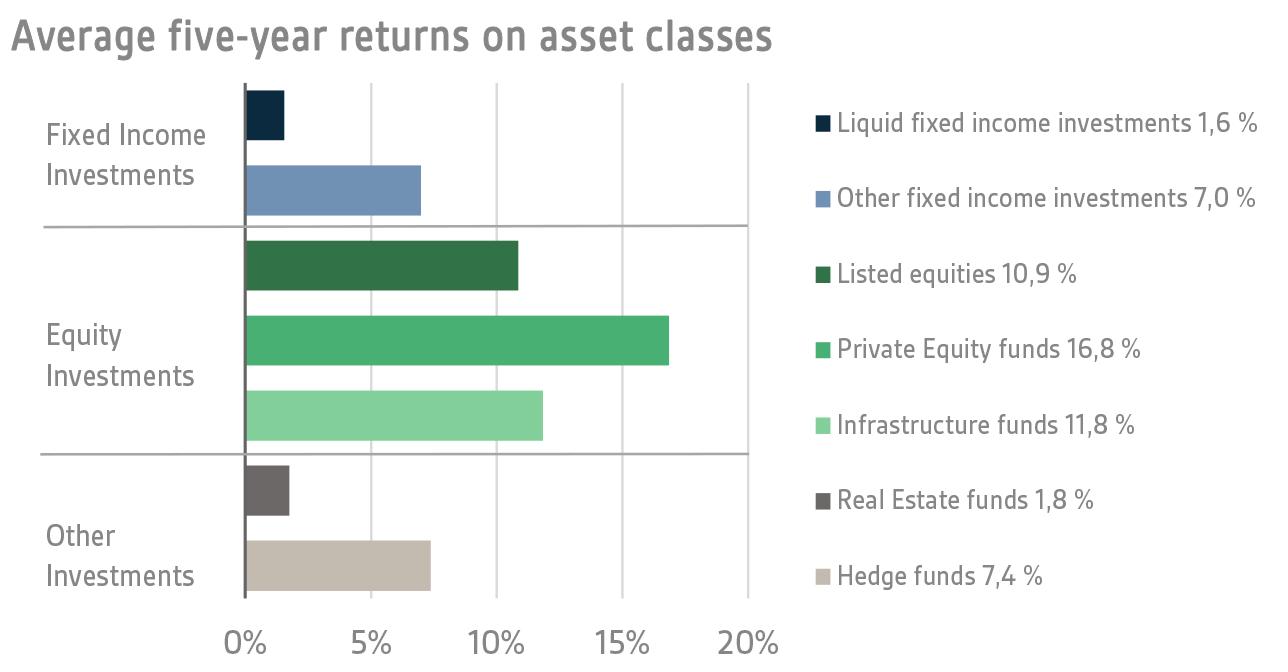

On 30 September 2025, VER’s investment assets totalled EUR 25.1 billion. During the first three quarters, the return on investments at fair values was 5.8 per cent. The average nominal rate of return over the past five years (1 October 2020–30 September 2025) was 7.2 per cent and the annual ten-year return 6.0 per cent. Since 2001, when VER’s activities assumed their current form, the average rate of return has been 5.6 per cent.

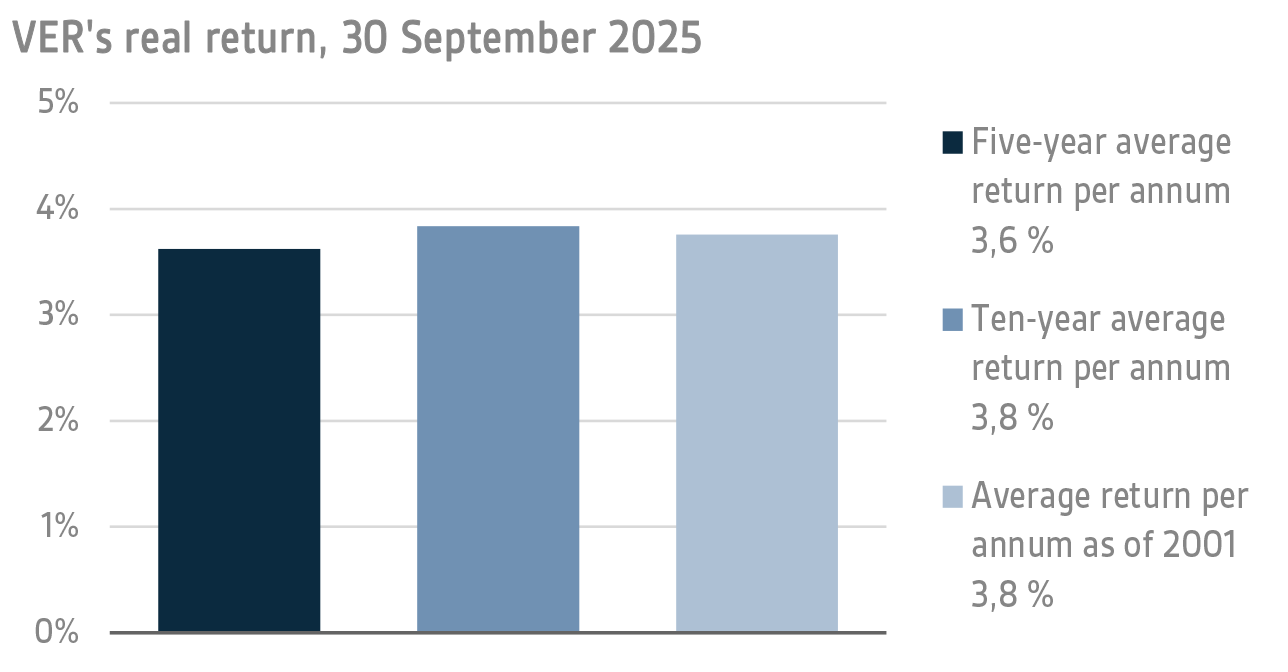

To determine real returns, the Finnish consumer price index has been used as the inflation indicator. The real rate of return during the first three quarters was 5.4 per cent. VER’s five-year average real return was 3.6 per cent and ten-year real return 3.8 per cent per year. Since 2001, when VER’s activities assumed their current form, the average real rate of return has been 3.8 per cent.

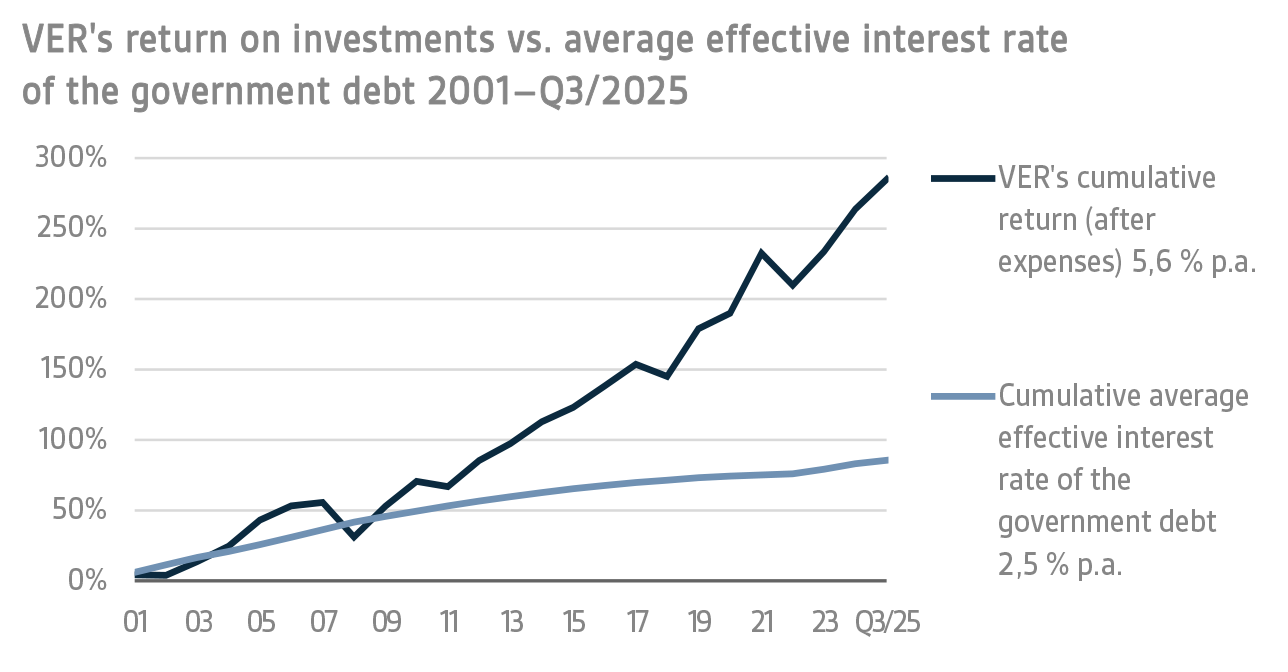

From the State’s point of view, it is pertinent to compare the return on investments with the cost of net government debt, because the funds accumulated in preparation for future pension expenditure can be deemed to reduce such debt. Over the past ten years, VER’s average annual rate of return has beaten the cost of net government debt by 4.8 percentage points. Since 2001, the total market-value returns earned by VER have exceeded the cumulative average cost of equivalent government debt by about EUR 13.1 billion over the same period.

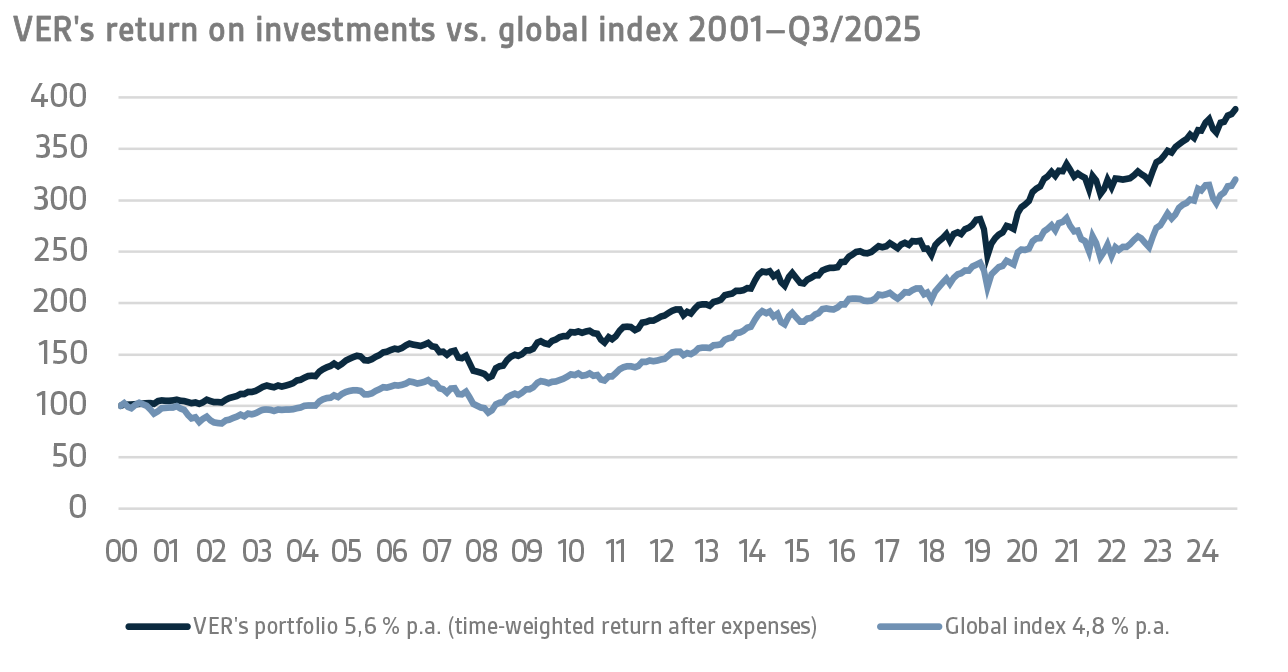

VER monitors long-term return relative to overall market developments by comparing the actual return with a global index, in which the weight of both equities and currency-hedged fixed income instruments is 50 per cent.

A CLOSER LOOK AT JANUARY–SEPTEMBER 2025

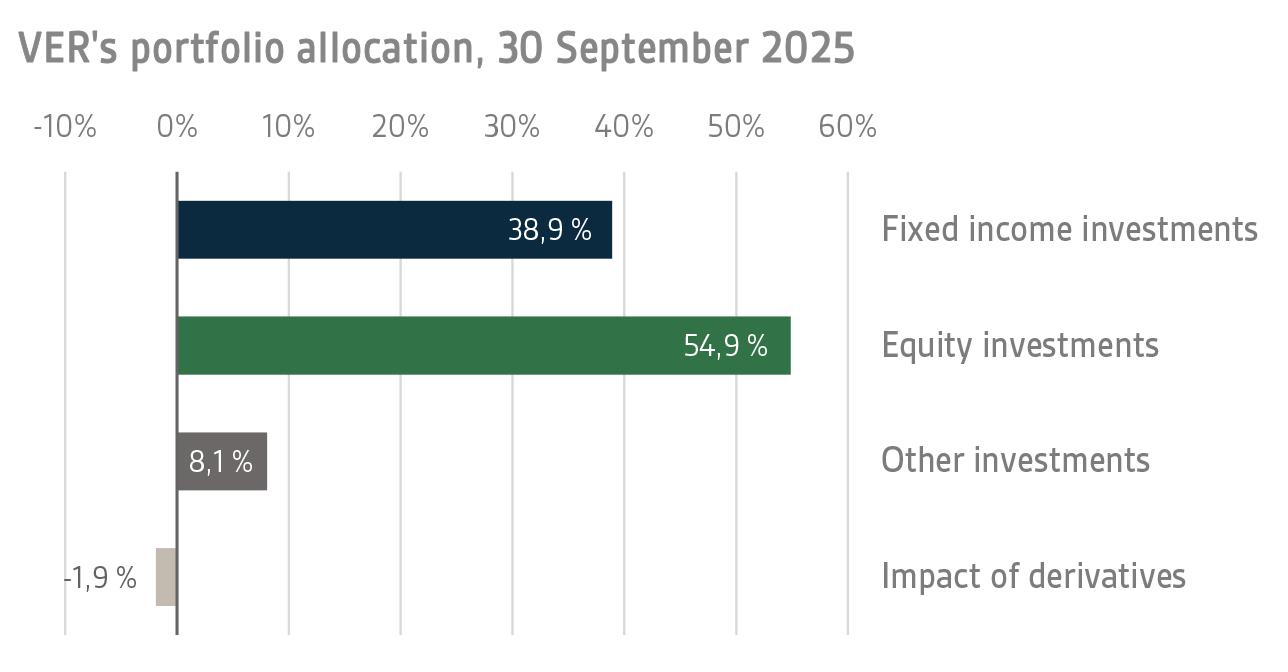

In accordance with the guidelines of the Ministry of Finance, VER’s investments are divided into fixed income instruments, equities and other investments. At the end of September, fixed income instruments accounted for 38.9 per cent, equities 54.9 per cent and other investments 8.1 per cent of the total. Of the large asset classes, liquid fixed income instruments generated a return of 3.4 per cent and listed equities 9.1 per cent during the first three quarters.

FIXED INCOME INVESTMENTS

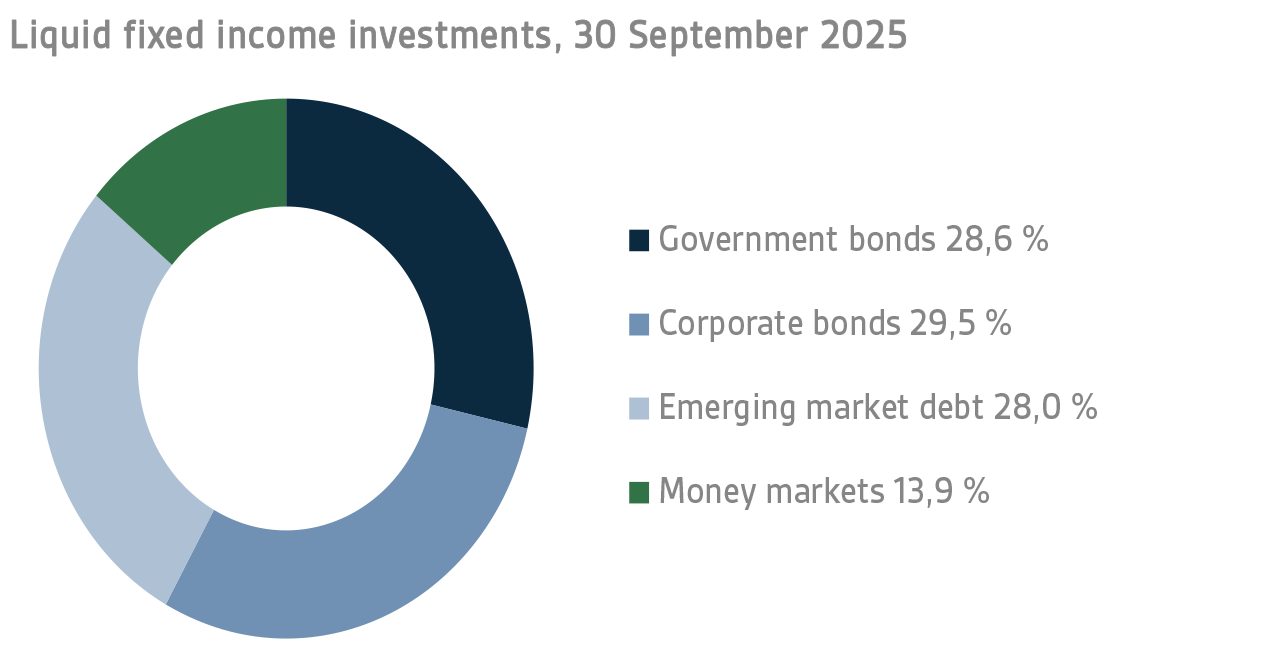

Liquid fixed income investments

During the first three quarters of 2025, the return on liquid fixed income instruments was 3.4 per cent.

The third quarter was fairly calm on the interest rate markets after the turbulence of the second quarter. Market rates continued to rise in Europe and decline in the United States at a moderate pace. The European Central Bank left its key policy rates intact in the third quarter after having cut them by a total of 100 basis points earlier in the year. At the end of September, the interest rate market was still pricing in a 25 basis point rate cut for the rest of the year with a probability of around 40%. The domestic political situation in France and the collapse of the government caused French government bond yields to rise, with the spread between 10-year bonds widening by 15 basis points relative to German government bonds.

For the first time this year, the US Federal Reserve lowered its key interest rates by 25 basis points at its September meeting, although inflation remained slightly above the FED's target level. The rate cut was justified by the weakening labour market situation. For the rest of the year, the central bank's interest rate indications still predicted interest rate cuts of 50 basis points, which was close to market expectations.

Movements in risk premiums on corporate bonds and emerging bond markets remained modest in the third quarter, with premiums ending up at the same or slightly higher levels compared to the beginning of the quarter.

Of VER's liquid fixed income investments, the best returns were generated by higher-risk instruments, such as the investments in emerging market debt and lower-rated corporate bonds, as well as in low-risk investments in US Treasuries.

Other fixed income investments

Other fixed income investments include investments in private credit funds and direct lending to companies.

During the first three quarters of 2025, the return on liquid fixed income instruments was 3.3 per cent. Private credit funds returned 3.5 per cent and direct lending 2.4 per cent.

Private credit funds have suffered to some extent from the quiet transaction market for private equity investments. However, they have been able to participate in refinancing rounds for companies owned by private equity investors on highly favourable terms. So far, there have been no signs of significant problems with VER's portfolio, and the returns earned by managers who have financed LBO transactions have developed positively during the year.

EQUITIES

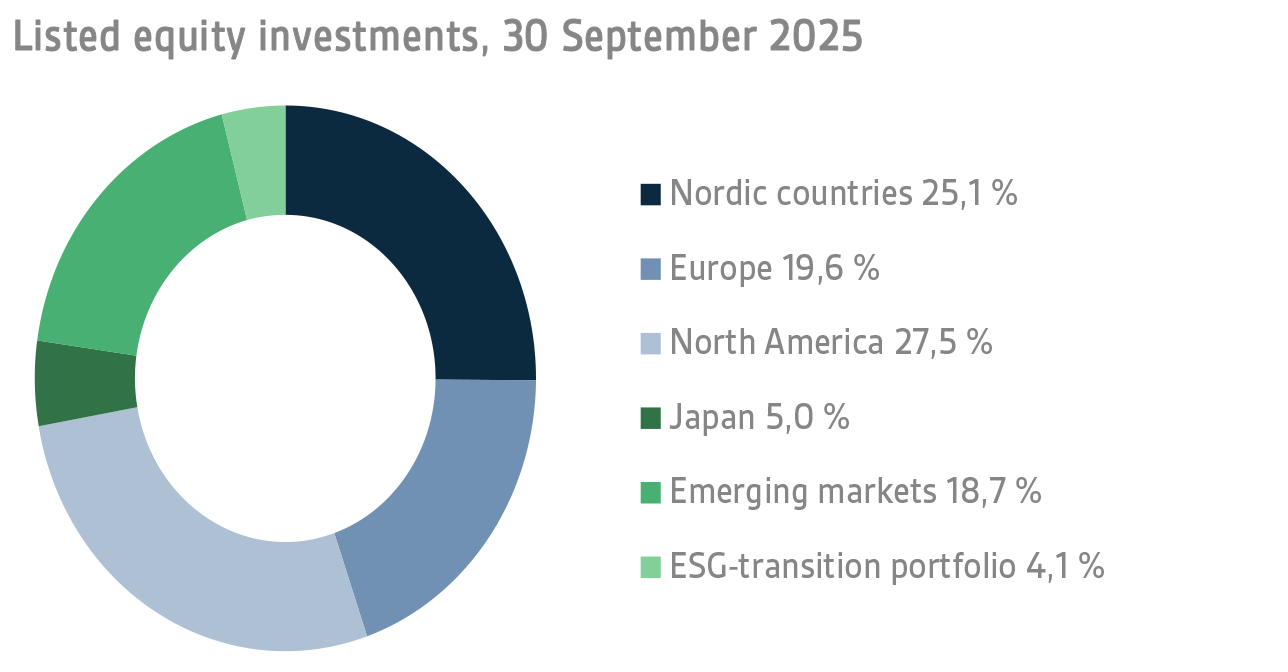

Listed equities

At the end of the reporting period, the return on listed equities was 9.1 per cent.

Equities performed well in the third quarter, and by the end of the reporting period, the return for 2025 had already reached a fairly sound level. The import tariffs imposed by the US administration were a clear theme in the stock markets during the early part of the year, but by the summer, the tariffs and the twists and turns surrounding them were attracting less and less attention in the markets. Many of the trade agreements concluded,

inter alia

, with the European Union entered into force during the quarter, which helped dispel some of the uncertainty in the market, although the final outcomes of the agreements sparked widespread debate and, in some cases, criticism. Ultimately, the stock market rally in the third quarter was fairly steady, and major market corrections were avoided altogether. Earnings forecasts for listed companies declined sharply in the second quarter, mainly due to US tariff announcements, but the forecast decline levelled off in the third quarter, and some markets even saw a slight improvement towards the end of the reporting period.

Among the best-performing securities during the year were VER's investments in the Nordic stock markets, where Finnish stocks in particular continued to perform well. Similarly, investments in other European stock markets put in a solid performance during the year, just like investments in emerging markets. The poorest returns in 2025 were earned in the North American market, where the sharp depreciation of the US dollar against the euro eroded the returns of euro-denominated investors.

Other equity investments

VER’s other equity investments include investments in private equity funds, infrastructure and unlisted stock.

Private equity

investments returned 0.5 per cent, infrastructure funds 2.6 per cent and unlisted equities 23.3 per cent.

Although there has been a slight upturn in the private equity transaction market, the numbers have remained fairly modest. Towards the end of the year, expectations are cautiously positive as managers seek to sell companies that they have held in their portfolios for a record long time. Additionally, uncalled fund capital remains close to record levels, which creates pressures for managers to start making investments. The weakened dollar has had a significant impact on VER's capital investment returns, even though cash flow in the portfolio has, surprisingly, been positive.

The return on VER's infrastructure portfolio was mainly based on the positive performance of European core/core+ funds. Compared to riskier strategies, lower-risk funds offer steadier returns, which are mainly based on cash flows rather than increase in value. Year-end returns are also expected to improve at a moderate pace.

OTHER INVESTMENTS

VER’s other investments include investments in real estate investment trusts, hedge funds and systematic strategies.

During the first three quarters of 2025, the return on unlisted real estate investment trusts was 0.1 per cent.

Hence, these returns turned slightly positive after a couple of weaker years. For the time being, the returns are still based on rental cash flows, and any increase in property values will be seen at the turn of the year, when managers carry out property valuations. A degree of optimism is in the air, as the market believes that real estate values have bottomed out. Moreover, the current moderate interest rates are likely to contribute to a rise in property values.

Hedge funds and derivative strategies for position management returned 7.5 per cent in January–September.

Hedge funds continued to put in a robust performance in the third quarter of the year. The positive development of risk markets, in particular, supported equity strategies, which gave healthy returns. Trend-based CTA strategies performed well during the quarter, marking a clear improvement compared to the lacklustre performance in the early part of the year. Looking at the whole year, quantitative strategies remain among the best performers in the portfolio. More modest returns in the latest quarter were earned by macro funds. Despite sound returns in the last quarter, the CTA strategy remains the weakest performer in the portfolio in terms of full-year returns.

STATE PENSION EXPENDITURE, VER’S TRANSFERS TO THE GOVERNMENT BUDGET, PENSION CONTRIBUTION INCOME AND FUNDING RATIO

The role of the State Pension Fund in equalising the government’s pension expenditure continues to grow. In 2024, the State’s pension expenditure totalled over EUR 5.5 billion while the 2025 budget foresees an expenditure of nearly EUR 5.6 billion. As VER contributes 42 per cent towards these expenses to the government budget, the transfer to the 2025 budget will amount to over EUR 2.4 billion.

By the end of September, VER had transferred EUR 1.8 billion to the government budget. Over the same period, VER’s pension contribution income totalled EUR 1.3 billion. The pension contribution income matches the forecast. VER’s net pension contribution income has now turned permanently negative, meaning that clearly more money is transferred from VER to the government budget than VER receives in pension contribution income. According to current estimates, this gap between budget transfers and income will continue to grow up to the mid-2030s, which will slow down the growth of the Fund and the improvement of the funding ratio. The negative cash flow is expected to continue until the 2050s.

The Act on the State Pension Fund was amended in spring 2022. As part of this amendment, VER’s contribution to the government budget was increased as of 2024. Consequently, VER’s budget transfers will be gradually increased from the current 41 per cent to 45 per cent during 2024–2028. If the funding ratio exceeds 25 per cent for two consecutive calendar years, an additional transfer of three percentage points will be made to the government budget. Additional revenue transfers from 2026 onwards, presented by the Government to Parliament in April 2025, are currently being prepared. It is proposed that the budget transfer be increased by 1.2 percentage points so that in 2028 the transfer would be 46.2 per cent of pension expenditure. Additionally, the Government has proposed that the budget transfer for 2027 be increased on a one-off basis to reach 63.9 per cent of the state's annual pension expenditure. The government's budget negotiations carried out during the reporting period resulted in decisions on further permanent additional transfers from 2027 onwards. VER will assess the impact of these decisions on its investment activities.

|

KEY FIGURES

|

|

|

|

|

30.9.2025

|

31.12.2024

|

30.9.2024

|

|

Investments, MEUR (market value)

|

25 123

|

24 240

|

24 138

|

|

Fixed income investments

|

9 776

|

9 936

|

9 942

|

|

Equity investments

|

13 791

|

12 784

|

12 907

|

|

Other investments

|

2 026

|

1 949

|

1 798

|

|

Impact of derivatives

|

-469

|

-429

|

-509

|

|

|

|

|

|

Breakdown of the investment portfolio

|

|

|

|

|

Fixed income investments

|

38,9 %

|

41,0 %

|

41,2 %

|

|

Equity investments

|

54,9 %

|

52,7 %

|

53,5 %

|

|

Other investments

|

8,1 %

|

8,0 %

|

7,4 %

|

|

Impact of derivatives

|

-1,9 %

|

-1,8 %

|

-2,1 %

|

|

|

|

|

|

1.1.–30.9.2025

|

1.1.-31.12.2024

|

1.1.–30.9.2024

|

|

Return on investment

|

5,8 %

|

9,0 %

|

7,8 %

|

|

Fixed income investments

|

|

|

|

|

Liquid fixed income investments

|

3,4 %

|

3,1 %

|

3,4 %

|

|

Private Credit funds

|

3,5 %

|

8,5 %

|

5,6 %

|

|

Direct lending

|

2,4 %

|

5,4 %

|

3,8 %

|

|

Equity investments

|

|

|

|

|

Listed equity investments

|

9,1 %

|

14,6 %

|

14,1 %

|

|

Private Equity investments

|

0,5 %

|

13,4 %

|

5,9 %

|

|

Infrastructure funds

|

2,6 %

|

13,4 %

|

5,3 %

|

|

Unlisted equity investments

|

23,3 %

|

3,9 %

|

4,2 %

|

|

Other investments

|

|

|

|

|

Unlisted Real Estate funds

|

0,1 %

|

-5,0 %

|

-5,8 %

|

|

Hedge funds and systematic strategies

|

7,5 %

|

10,9 %

|

6,6 %

|

|

|

|

|

|

Pension contribution income, MEUR

|

1 257

|

1 709

|

1 300

|

|

Transfer to state budget, MEUR

|

1 767

|

2 274

|

1 715

|

|

Net contribution income, MEUR

|

-510

|

-565

|

-415

|

|

Pension liability, BnEUR

|

|

101

|

|

|

Funding ratio, %

|

|

24,2 %

|

|

Additional information:

Additional information is provided by Chief Executive Officer

Timo Löyttyniemi

, firstname.lastname@ver.fi, tel. +358 (0)295 201 210

Established in 1990, the State Pension Fund (VER) is an off-budget fund through which the State prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the State’s pension assets professionally. At the end of September 2025, the market value of the Fund’s investment portfolio stood at EUR 25.1 billion.

All figures presented in this interim report are preliminary and unaudited.