Annual Report 2019

Published 2020-02-28 at 11:30

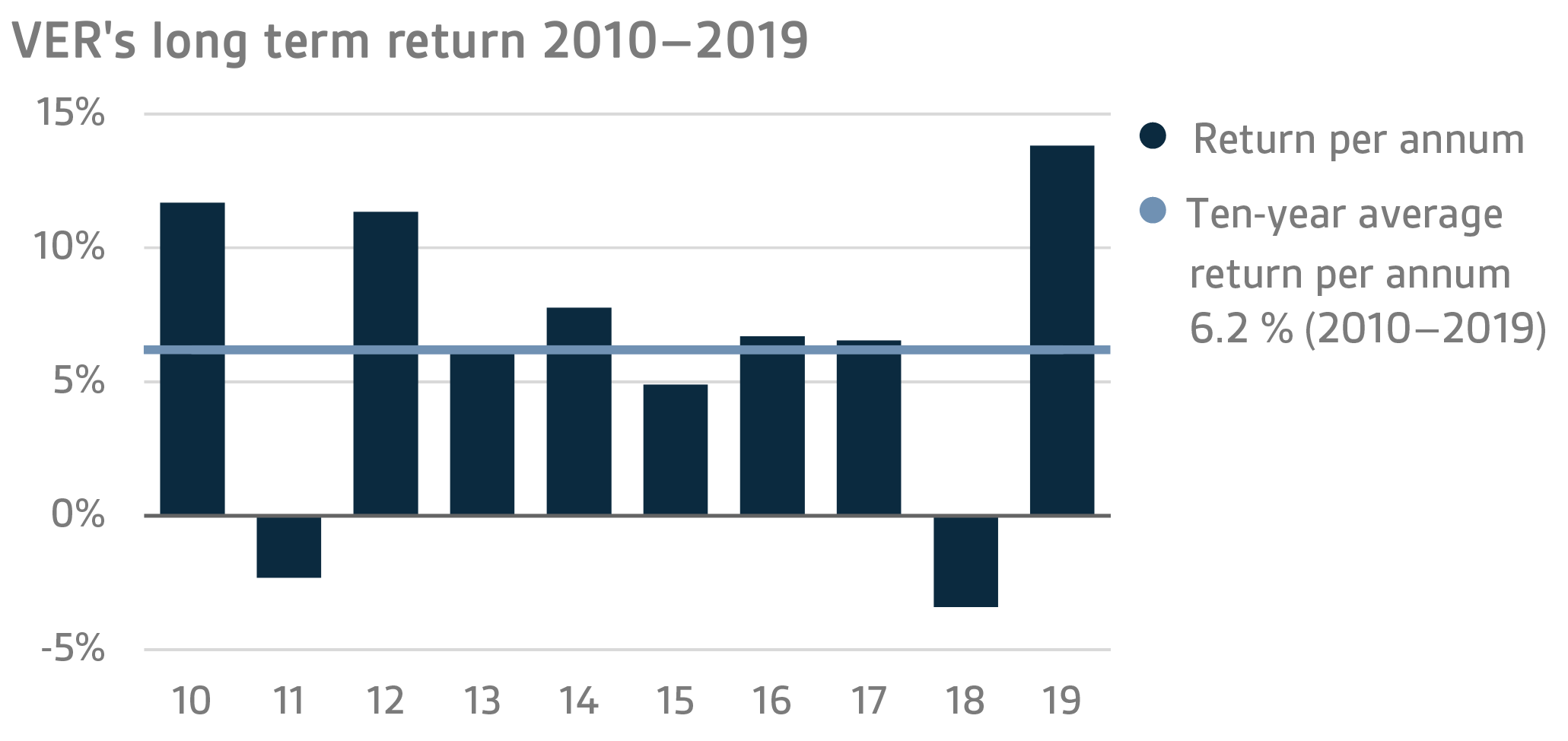

Return on investments 13.8% in 2019; ten-year average return 6.2%

On the whole, the real world economy developed modestly in 2019. At less than three per cent, global growth was the lowest for ten years. The volume of world trade even shrank relative to 2018. In the United States, economic growth levelled off slightly after ten years of robust growth, but no signs of an impending recession were visible. In Europe, industry faced serious problems, particularly in Germany. However, the service sector upheld the overall economic development at a satisfactory level and unemployment continued to fall in the euro area.

From the investors’ point of view, a key development was a significant change in the monetary policy as dozens of countries cut benchmarket rates. In January, the U.S. Federal Reserve adjusted its monetary policy in a more expansive direction. A little later, the European Central Bank followed suit by making yet another interest rate cut and deciding to resume its asset purchase programme.

After the sharp fall in the last few months of 2018, the year 2019 was exceptionally favourable for the investment market as a whole. Underlying this positive development was the relaxation of central banks’ monetary policies as well as expectations of a mitigation of the trade problems towards the end of the year. The stock markets, in particular, performed vigorously around the world. Similarly, the domestic interest rates developed favourably as risk premiums narrowed and interest rates on government bonds declined further.

At fair values, the total return on the investments made by the State Pension Fund (VER) in 2019 was 13.8 per cent, the highest in ten years. VER’s average rate of return was 5.6 per cent for the past five years and 6.2 per cent for the past ten years.

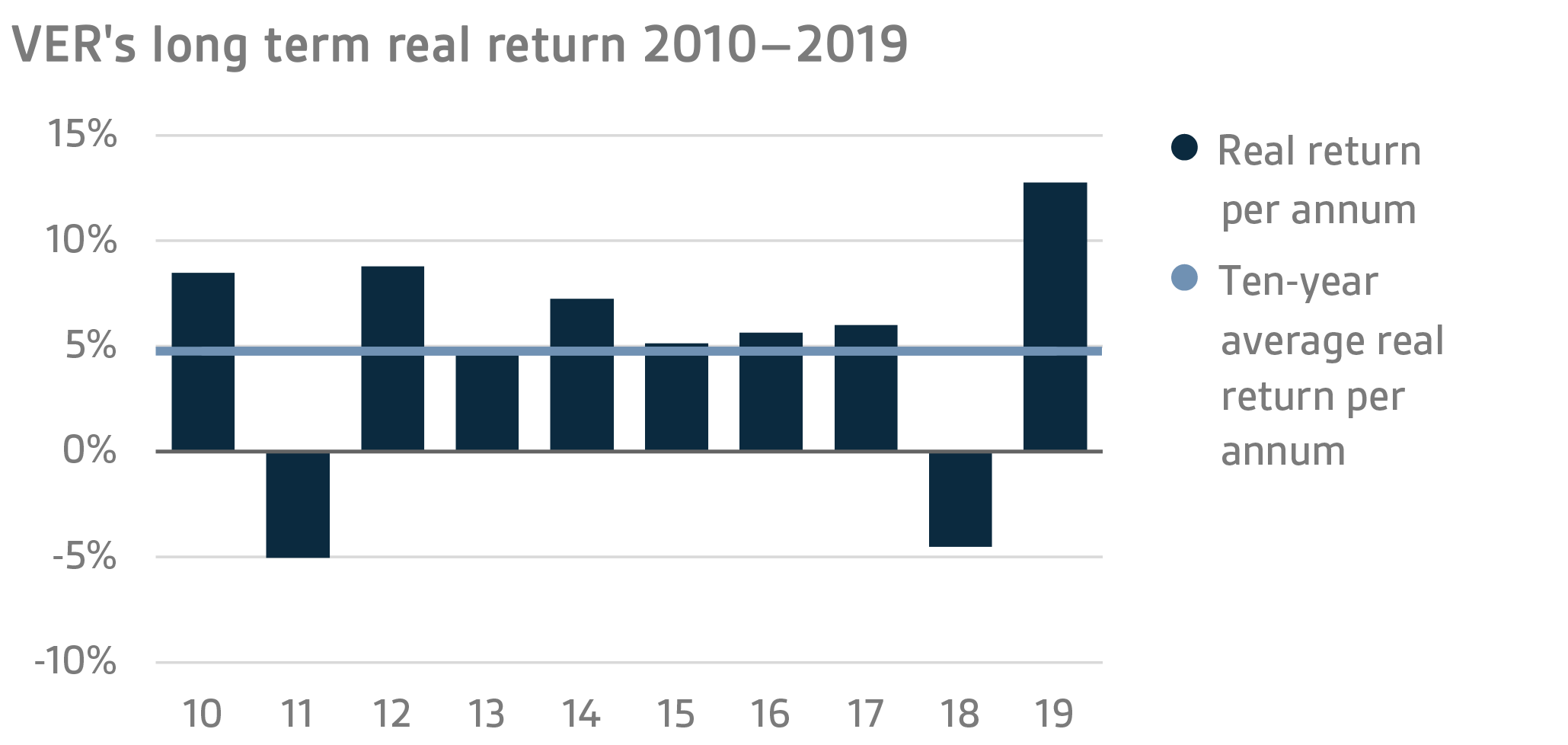

The real rate of return in 2019 was 12.8 per cent. VER’s five-year average real return was 4.8 per cent and ten-year real return 4.8 per cent. The ten-year average real return exceeds the estimates used in the long-term financing calculations by a wide margin.

According to the objective established by the Ministry of Finance, VER’s long-term return must exceed the average cost of net government debt. Over the past ten years, VER’s average market value weighted rate of return has beaten the cost of net government debt by 4.5 percentage points. Since 2001 when VER’s operations assumed their current form, the total returns earned by VER have exceeded the average cost of government debt by about EUR 7.4 billion.

VER’s two large asset classes, liquid fixed income investments and listed equities, gave healthy returns in 2019. The return on liquid fixed income instruments was 5.0 per cent and that of listed equities as high as 24.6 per cent. Other asset classes also generated sound returns, almost without exception. The best performance was put in by listed real estate investment trusts (28.1%), private equity funds (14.2%) and infrastructure funds (12.8%).

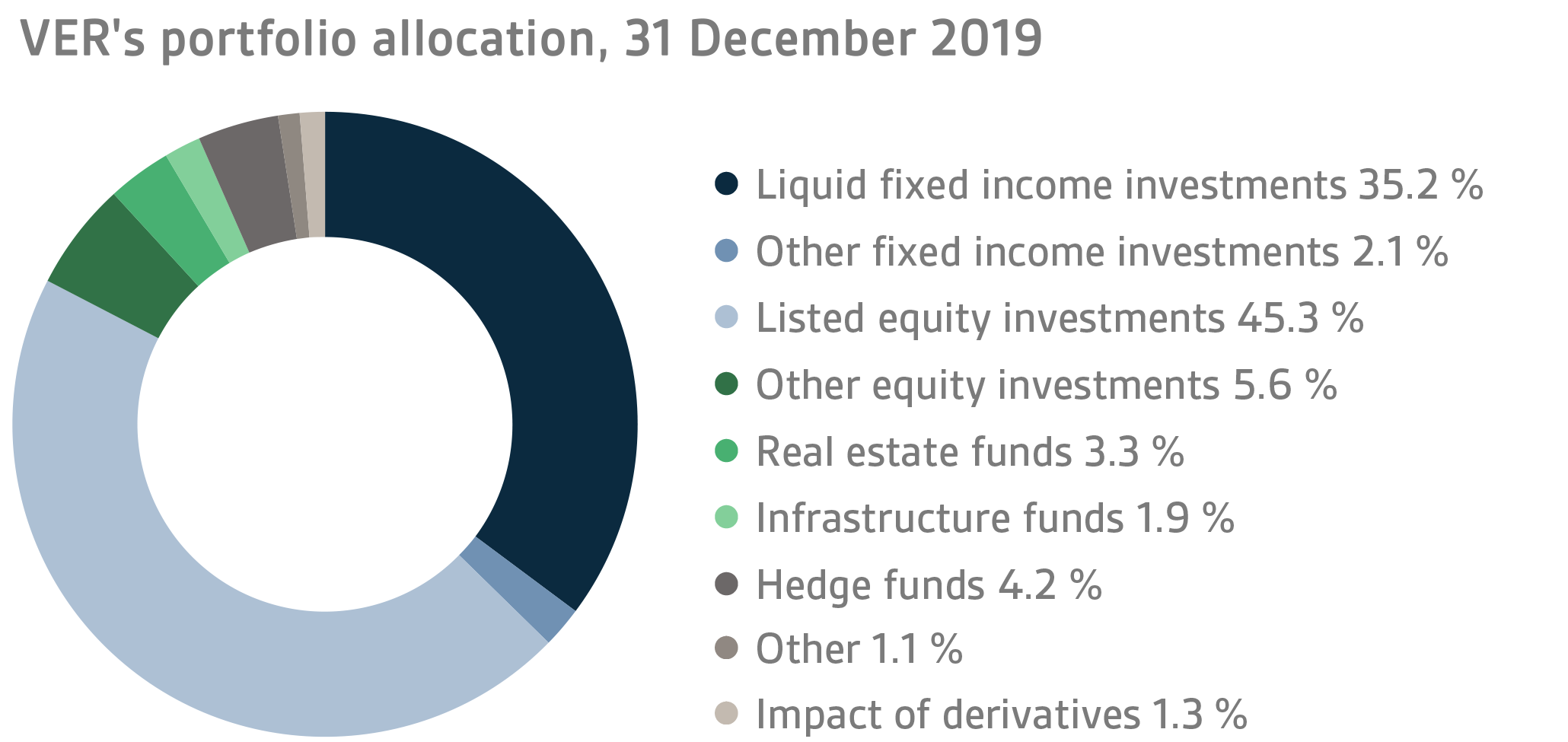

At the end of 2019, the market value of VER’s investment assets stood at EUR 20.6 billion. Of all the investments, fixed income instruments accounted for 37.3 per cent, equities 50.9 per cent and other investments 10.4 per cent of the total. The rest of the effect of risk-adjusted allocation was due to derivatives.

FIXED INCOME INVESTMENTS

Liquid fixed income investments

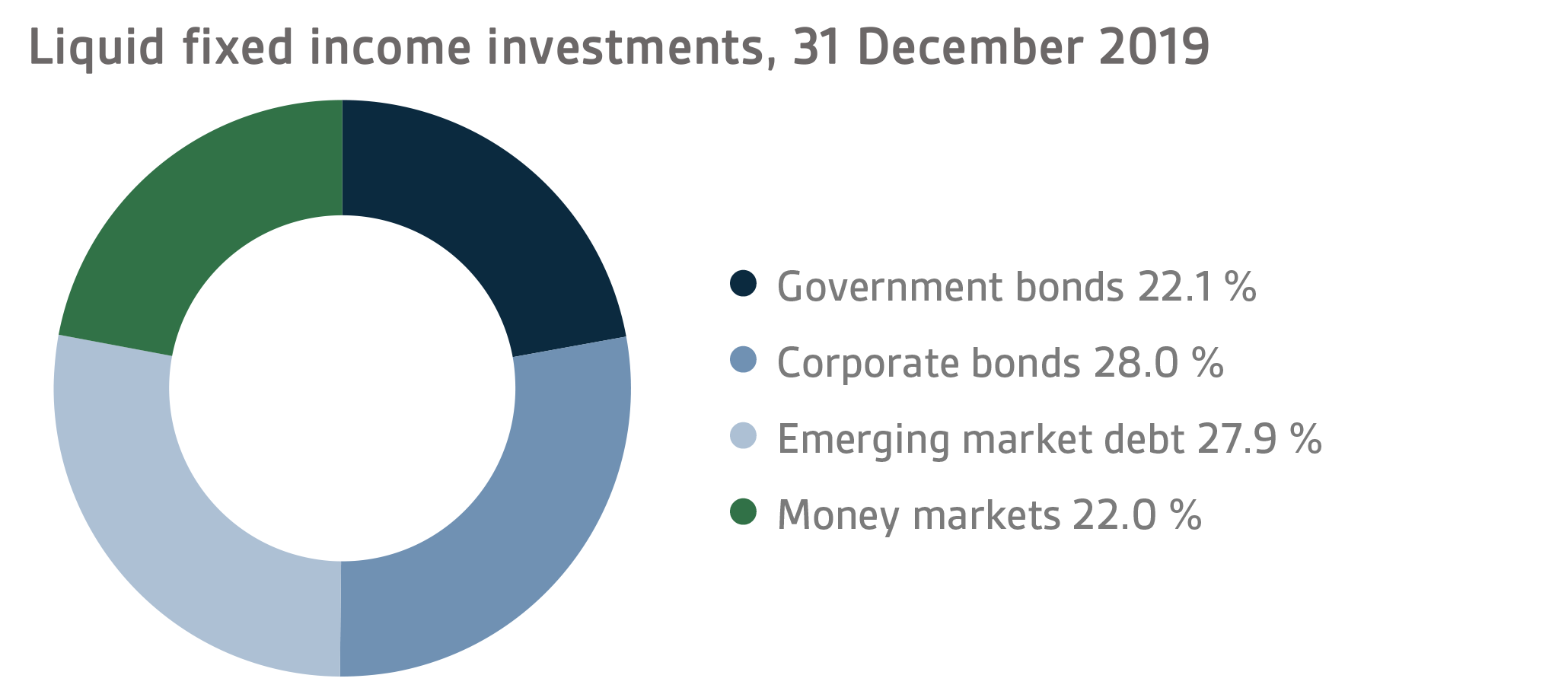

In 2019, the liquid fixed-income portfolio returned 5.0 per cent and its risk-adjusted market value stood at EUR 7.3 billion (EUR 6.7 billion in 2018) at the end of the year. The duration of the fixed-income portfolio remained shorter than the neutral duration of the portfolio for the entire year.

After the third quarter, the fall in interest rates levelled off, while the interests rates on developed market sovereign bonds and interest rate swaps started rising. Credit risk premiums, however, remained relatively low and emerging markets returns improved considerably. The good news that increased interest rates included the progress made in the US-China trade talks, reduced uncertainty about Brexit and the beneficial implications for economic growth and inflation expected from the actions of the central banks when the US Federal Reserve and the ECB relaxed their monetary polices in the latter half of the year, as they had previously indicated.

The FED cut its benchmark rate by 25 points both in July and September and stopped unwinding its balance sheet. The FED announced that it will keep the rates unchanged throughout 2020, but the fixed-income market priced yet another 25-point cut for 2020.

The European Central Bank (ECB) decided at its September meeting to ease its monetary policy considerably. The ECB’s deposit rate was reduced to -0.50 per cent and a decision was made to resume the asset purchase programme at the beginning of November. The deposit rate was staggered so that a negative rate will only be charged when a bank’s deposits exceed the minimum reserve obligations six times. At the same time, the interest rate on the previously adopted TLTRO programme was reduced and maturity extended from two to three years. For all practical purposes, expectations of further interest rate cuts by the ECB had dissipated by the end of 2019.

As a result of the reduced interested rates, mainly due to central banks measures, the interest rate indexes developed extremely favourably during 2019. In VER’s liquid fixed income portfolio, the returns on emerging markets were excellent.

At the end of the reporting period, direct investments accounted for 54 (55) per cent of the entire liquid fixed income portfolio. At the end of the year, fixed income investments were held in 334 (315) debt instruments and fund units in 43 (43) funds.

Other fixed income investments

Other fixed income investments include investments in private credit funds and direct non-liquid loans. Most of the private credit funds in the portfolio are private equity funds investing in non-liquid loans.

Although a correction to the non-liquid fixed income markets had been expected for some time now, investor interest in private credit investments continued to grow. The increase in the capital available for investments and intensifying competition affected the covenant policies adopted by fund managers. Non-existing or weaker loan collateral has given rise to concerns about future returns on private credit funds in the coming years.

The 2019 return on other fixed-income investments was 3.0 (8.4) per cent. The (TWR) return on private credit funds was 1.7 per cent while direct lending yielded 4.9 per cent (TWR). During the reporting period, investments (approx. EUR 90 million) were made in two new funds. Unfunded commitments at the end of 2019 totalled EUR 327 (356) million. VER has extended direct loans to two portfolio companies.

At the end of the year, the weighting of other fixed income investments in the portfolio was 2.1 (2.2) per cent.

EQUITIES

Listed equities

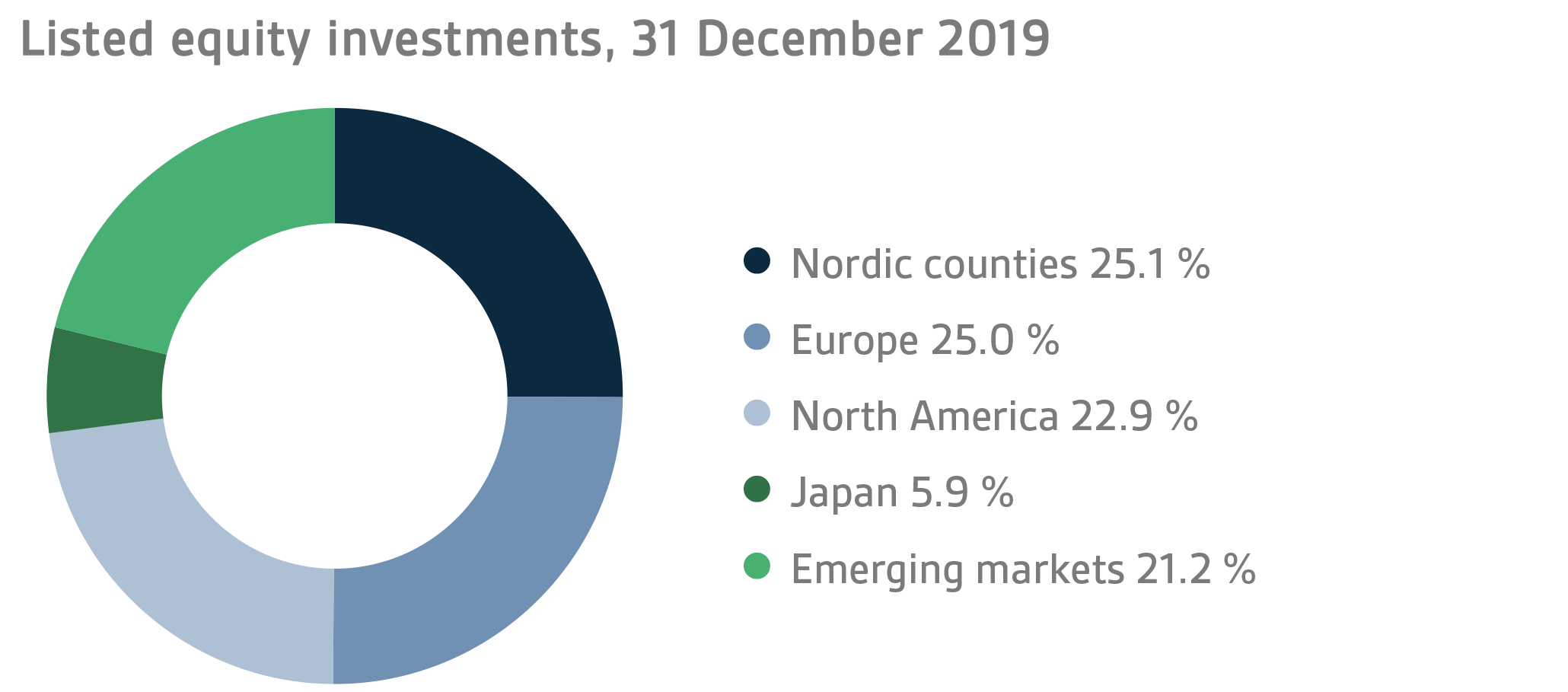

2019 proved to be extremely positive for equity investors. The year got off to a brisk start in January, mainly due to central bank actions, and the uncertain mood that still prevailed in the last quarter of 2018 was quickly dispelled. Except for a few short periods, investors’ risk sentiment remained high throughout the year with the most risky asset classes, such as equities, doing extremely well. By the end of the year, the return on VER’s portfolio of listed equities and unit funds was 24.6 (-7,4) per cent. All the equity portfolios showed positive returns at the end of the year, with the highest yield generated by VER’s investments in the North American stock markets.

Even though the return on equities was sound, the year also witnessed a degree of uncertainty. The US-China trade talks with their twists and turns upset the markets, at times quite strongly. Brexit received extensive media coverage during the year, but the confusing phases of the withdrawal process had a perhaps surprisingly limited effect on the market sentiment. A key role in this was, again, played by central banks and their assurances, and partly even their actions. The continued expansive monetary policy, combined with low interest rates, created conditions that favoured more risk-filled asset classes, leading to the highly positive development witnessed in the stock markets.

In terms of market capitalisation, the value of the listed equities increased from EUR 7.8 billion at the beginning of the year to EUR 9.3 billion at the end. At the end of 2019, direct equity investments accounted for 23.7 (27.0) per cent and fund investments for 76.3 (73.0) per cent of the total. At the end of the year, VER held direct investments in 98 (102) companies and fund units in 67 (67) funds.

Other equity investments

At the end of the reporting period, VER’s other equity investments included investments in private equity funds, non-listed stock and listed real estate investment trusts (REIT). At the end of the year, other equity investments in the portfolio accounted for 5.6 (4.8) per cent of the total.

For private equity funds, 2019 was a positive year as the funds benefitted from the robust equity market. High equity valuation levels also permitted successful exits and an increase in the value of the portfolio companies. The annual return on private equity funds was 14.2 (13.4.) per cent. During the reporting period, VER invested (approx. EUR 144 million) in four new funds. At the end of the year, unfunded commitments totalled EUR 601 (596) million.

Non-listed equities included substantial investments in four companies. The annual return on the portfolio reached 8.2 per cent by the end of the year.

The return on listed real estate investment trusts emulated the strong performance of the equity markets. At the end of the year, the return on the portfolio reached 28.1 per cent.

OTHER INVESTMENTS

VER’s other investments are in real asset funds (real estate and infrastructure funds) as well as hedge funds and risk premium investments. At the end of 2019, the market capitalisation of other investments was EUR 2146 (1823) million accounting for 10.4 (9.9) per cent of VER’s portfolio. Of the assets invested, real estate investment trusts accounted for 3.3 (3.2), infrastructure investments 1.9 (1.6), hedge funds 4.2 (4.2) and risk premiums 1.1 (0.9) percentage points.

As in the previous years, the real estate market continued to develop favourably. However, differences between individual sectors grew: commercial properties, among others, generated a lower return than residential and logistics properties. The return on investments in real estate trusts was 9.8 (11.1) per cent. Two new investments (EUR 115 million) were made in funds, while unfunded commitments at the end of the year totalled EUR 446 (419) million.

The return on infrastructure investments was again very good. Thanks to dividends and successful exits, the return on the portfolio reached 12.8 (11.2) per cent by the end of the year. During the reporting period, VER invested (approx. EUR 156 million) in three new funds. At the end of the year, unfunded commitments totalled EUR 278 (254) million.

The hedge funds gave a return of 4.9 (-2.5) per cent in 2019. The portfolio yielded a sound return despite its low correlation with the equity and fixed income market. An exceptionally high return was generated by relative value and macro funds that gave a healthy return in spite of the low volatility environment. The year was challenging for volatility and quantitative funds.

The return on risk premiums reached -0.5 (-10.3) per cent in 2019. The returns continued to be burdened by losses incurred for value and quality strategies whose weight in the portfolio was reduced during the year. Of the strategies, momentum and carry models performed best. Correlation with the traditional asset classes remained low.

Responsible investing

In autumn 2019, the Board of the State Pension Fund adopted new principles of responsible investing. As of now, environmental, social and governance (ESG) criteria will play a key role in the analysis of long-term risks and opportunities. The new principles of responsible investing help fine-tune VER’s policy. While the principles require the exclusion of certain investments from the investment universe, the primary aim is to incorporate ESG criteria into the processes in more concrete terms. The single most important element is the carbon footprint. VER will not make any equity or fixed income investments in companies which generate more than 10% of their revenue from operations based on the use of coal or lignite or the incineration of peat. Additionally, the principles define the objectives for reducing the coal footprint of direct equity investments across the board.

VER pursues the policy of responsible investing in all investment categories. However, actual policy implementation may vary according to asset class because the applicability of the underlying principles varies. VER has held numerous meetings with representatives of the portfolio funds and companies to address ESG issues and participated actively in the AGMs of Finnish portfolio companies.

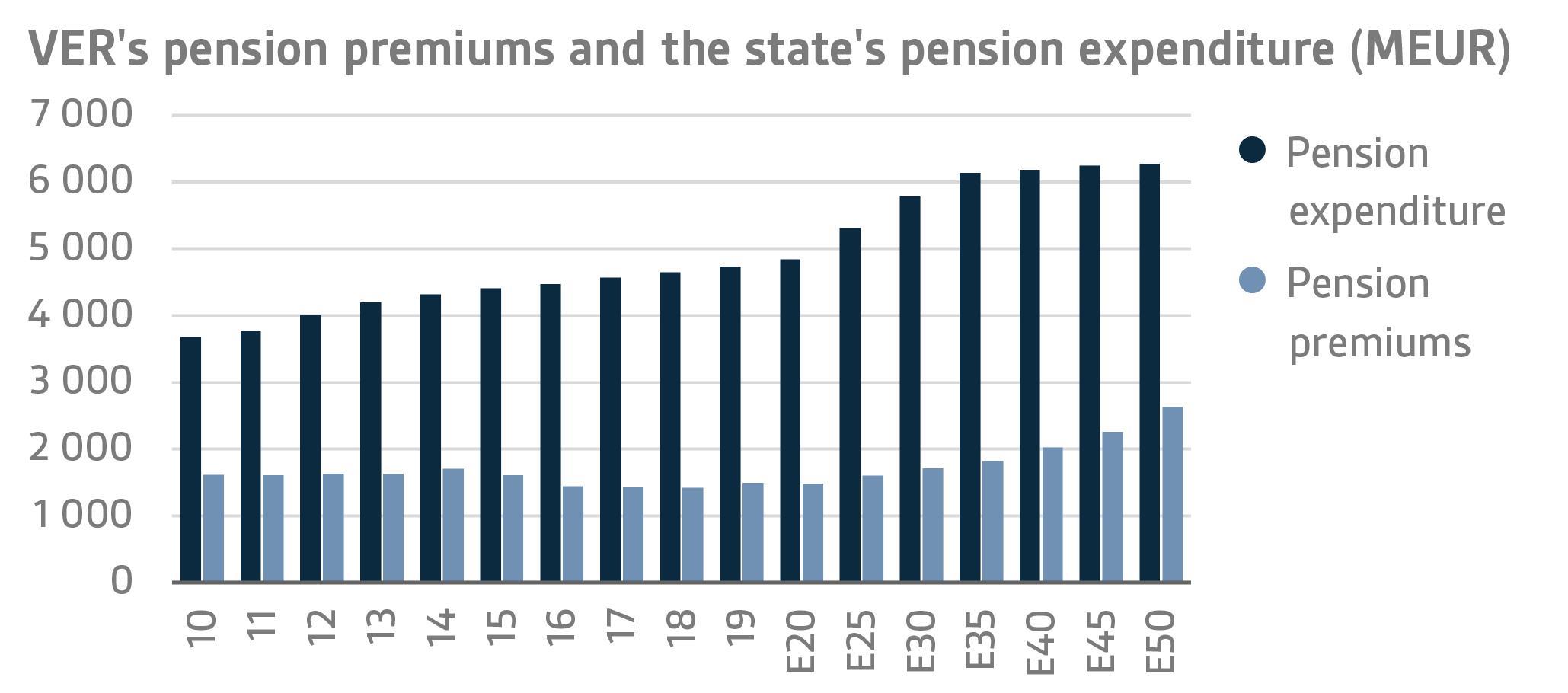

The state’s pension expenditure continues to increase

The State Pension Fund’s role in balancing government finances has grown and will continue to do so. In 2019, the state’s pension expenditure totalled over EUR 4.7 billion. As VER contributes 40 per cent towards these expenses to the government budget, the transfer to the 2019 budget amounted to approximately EUR 1.9 billion. Over the same period, VER received approximately EUR 1.5 billion in pension contributions. Its net pension contribution income has now turned permanently negative, meaning that more money is transferred from the Fund to the government budget than VER receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund.

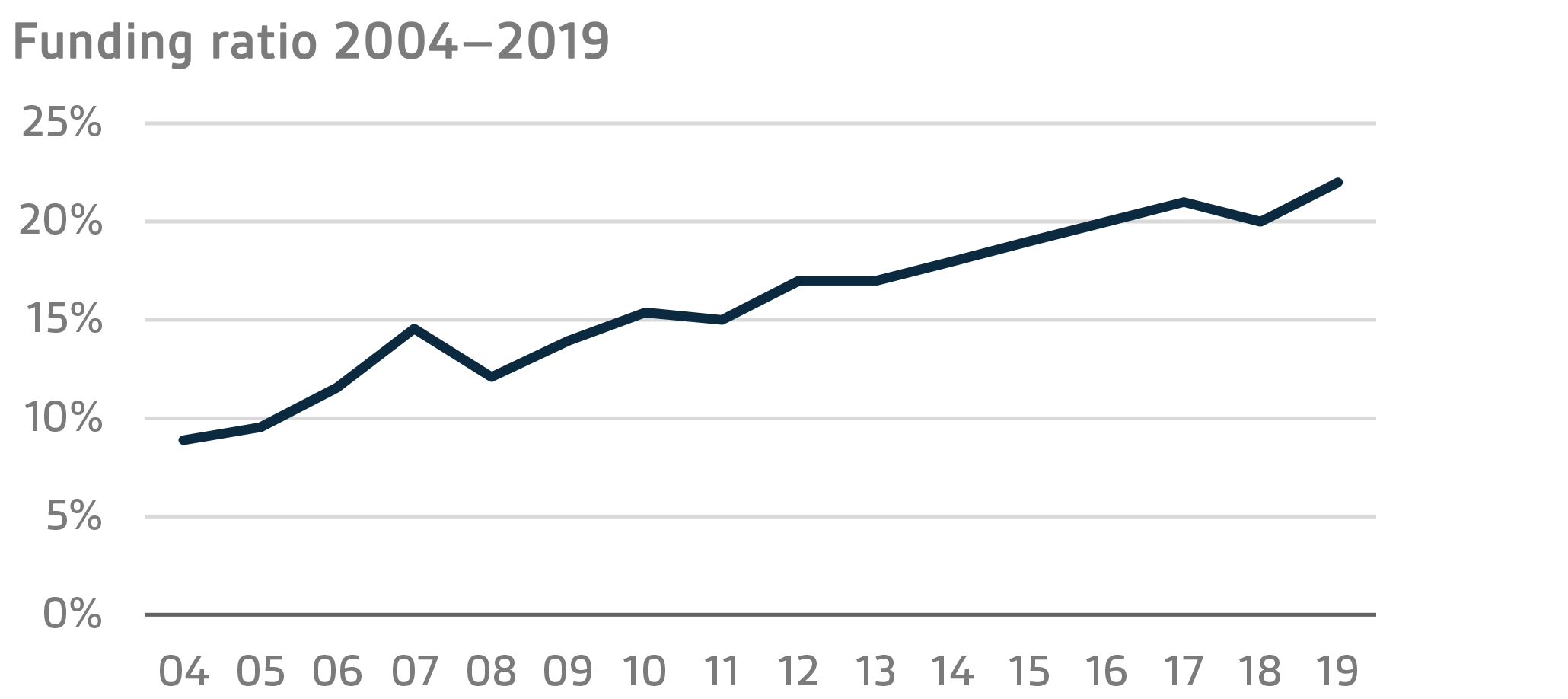

In June 2016, the Board of Directors of the State Pension Fund adopted a strategy that defines its long-term objectives in greater detail. The strategy foresees that the 25 per cent funding ratio target specified by law will be attained by 2033, if not earlier. To achieve this, it is imperative that VER’s pension contribution income remains at the estimated level and that the real return on investments remains relatively high. As the state’s pension liabilities amounted to EUR 92.7 billion at the end of 2019, the funding ratio was approx. 22 per cent. Additionally, the strategy sets out the principles by which the risk level and basic allocation of the investment portfolio are derived from the target funding ratio established for VER.

VER’s administration

The State Pension Fund (VER), established in 1990, is an off-budget entity. VER is an investment organisation with a mission to manage the assets entrusted to it. The collection of pension contributions to the state pension system and related duties, like the processing of pension applications and payment of pensions, are handled by the Local Government Pension Institution Keva. VER pays Keva a management fee for these services, which in 2019 amounted to about EUR 17.3 million.

The responsibility for oversight and control of VER’s operations rests with the Ministry of Finance, which is authorised to issue general instructions regarding the organisation of VER’s administration, financial management and the investment of its assets. According to standing instructions, fixed-income instruments must account for a minimum of 35 per cent, equities for no more than 55 per cent, and other investments for no more than 12 per cent of the market capitalisation of the portfolio. Moreover, real estate investments must be made in the form of fund investments or equivalent indirect investments.

VER’s Board of Directors is appointed by the Ministry of Finance. The Board has seven members, three of whom are appointed from candidates proposed by central staff organisations. The Chair of the Board of Directors is Jukka Pekkarinen and the Chair of the Investment Advisory Committee Jussi Laitinen.

In 2017, VER’s operating costs amounted to EUR 7.5 million, which represents 0.04 per cent of the average annual capital. At the end of the year, VER had 24 employees. The Managing Director is Timo Viherkenttä. VER invests in human resources by maintaining and developing the professional skills of the staff, which is important both in seeking maximum returns on investments and in managing risks.

KEY FIGURES 2019

|

|

2019

|

2018

|

|

Return on investments

|

13,8 %

|

-3,4 %

|

|

Real return

|

12,8 %

|

-4,5 %

|

|

|

|

|

|

Return by asset class

|

|

|

|

Fixed income investments

|

|

|

|

Liquid fixed income investments

|

5,0 %

|

-1,9 %

|

|

Private credit funds

|

1,7 %

|

12,4 %

|

|

Direct non-liquid lending

|

4,9 %

|

3,8 %

|

|

Equities

|

|

|

|

Listed equities

|

24,6 %

|

-7,4 %

|

|

Private equity funds

|

14,2 %

|

13,4 %

|

|

Unlisted equities

|

8,2 %

|

7,3 %

|

|

Real estate investment trusts (REIT)

|

28,1 %

|

-9,6 %

|

|

Other investments

|

|

|

|

Unlisted real estate funds

|

9,8 %

|

11,1 %

|

|

Infrastructure funds

|

12,8 %

|

11,2 %

|

|

Hedge funds

|

4,9 %

|

-2,5 %

|

|

Risk premium investments

|

-0,5 %

|

-10,3 %

|

|

|

|

|

|

Average returns

|

5 years

|

10 years

|

|

Average return on portfolio p.a.

|

5,6 %

|

6,2 %

|

|

Average real return p.a.

|

4,8 %

|

4,8 %

|

|

Average effective interest rate on government debt p.a.

|

1,3 %

|

1,7 %

|

|

|

|

|

|

Portfolio allocation

|

2019

|

2018

|

|

Total investments, EURm

|

20 588,1

|

18 485,7

|

|

Fixed income investments

|

37,3 %

|

38,4 %

|

|

Liquid fixed income investments

|

35,2 %

|

36,2 %

|

|

Other fixed income investments

|

2,1 %

|

2,2 %

|

|

Equity investments

|

50,9 %

|

47,2 %

|

|

Listed equities

|

45,3 %

|

42,4 %

|

|

Other equity investments

|

5,6 %

|

4,8 %

|

|

Other investments

|

10,4 %

|

9,9 %

|

|

Unlisted real estate funds

|

3,3 %

|

3,2 %

|

|

Infrastructure funds

|

1,9 %

|

1,6 %

|

|

Hedge funds

|

4,2 %

|

4,2 %

|

|

Risk premium investments

|

1,1 %

|

0,9 %

|

| |

|

|

|

Key figures

|

2019

|

2018

|

|

Volatility

|

4,7 %

|

6,2 %

|

|

Sharpe ratio

|

3,0

|

-0,5

|

|

|

|

|

|

Other key figures

|

2019

|

2018

|

|

Pension contribution income, EURm

|

1 497

|

1 442

|

|

Budget transfers, EURm

|

1 894

|

1 859

|

|

Net contribution income, EURm

|

-396

|

-417

|

|

Balance sheet total, EURm

|

15 564

|

15 406

|

|

Pension liabilities, EUR bn

|

92,7

|

92,1

|

|

Funding ratio

|

22 %

|

20 %

|

Additional information:

Additional information is provided by CEO Timo Löyttyniemi, firstname.lastname@ver.fi, tel.: +358 295 201 210.

Established in 1990, the State Pension Fund (VER) is an off-budget fund through which the state prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the state’s pension assets professionally. At the end of 2019, the market value of the Fund’s investment portfolio stood at EUR 20.6 billion.