The first half of the year was dominated by the upheaval caused by the coronavirus in the world economy and equity markets. Inescapably, the economy came to a standstill because of the restrictions. Towards the end of the reporting period, the spread of the coronavirus had been successfully contained in several areas, but signs of a second wave were emerging in late summer and the prospects of large-scale distribution of an effective vaccine remained cloudy.

The support measures taken by governments and central banks continued throughout the second quarter. The actions taken by central banks at the end of the first quarter were massive and determined. The banks cut interest rates, announced bank refinancing programmes and extended asset purchase programmes, particularly in the United States and Europe. During the second quarter, the focus shifted to government action and a range of targeted support measures. As a result, the purchasing power of households remained sound even if the savings rate increased.

The economy suffered considerably during the second quarter, as the GPD shrank by -9.5 per cent in the United States and -12.1 per cent in the euro area. The challenging conditions are expected to persists until an effective vaccine is introduced on a large scale. It is not expected to happen before 2021.

VER’S RETURNS ON INVESTMENTS

Future monitoring and evaluation of the State Pension Fund’s investment activities will increasingly focus on long-term outcomes and future prospects instead of quarterly reporting. However, VER will continue to post quarterly figures and comments to the same extent as previously.

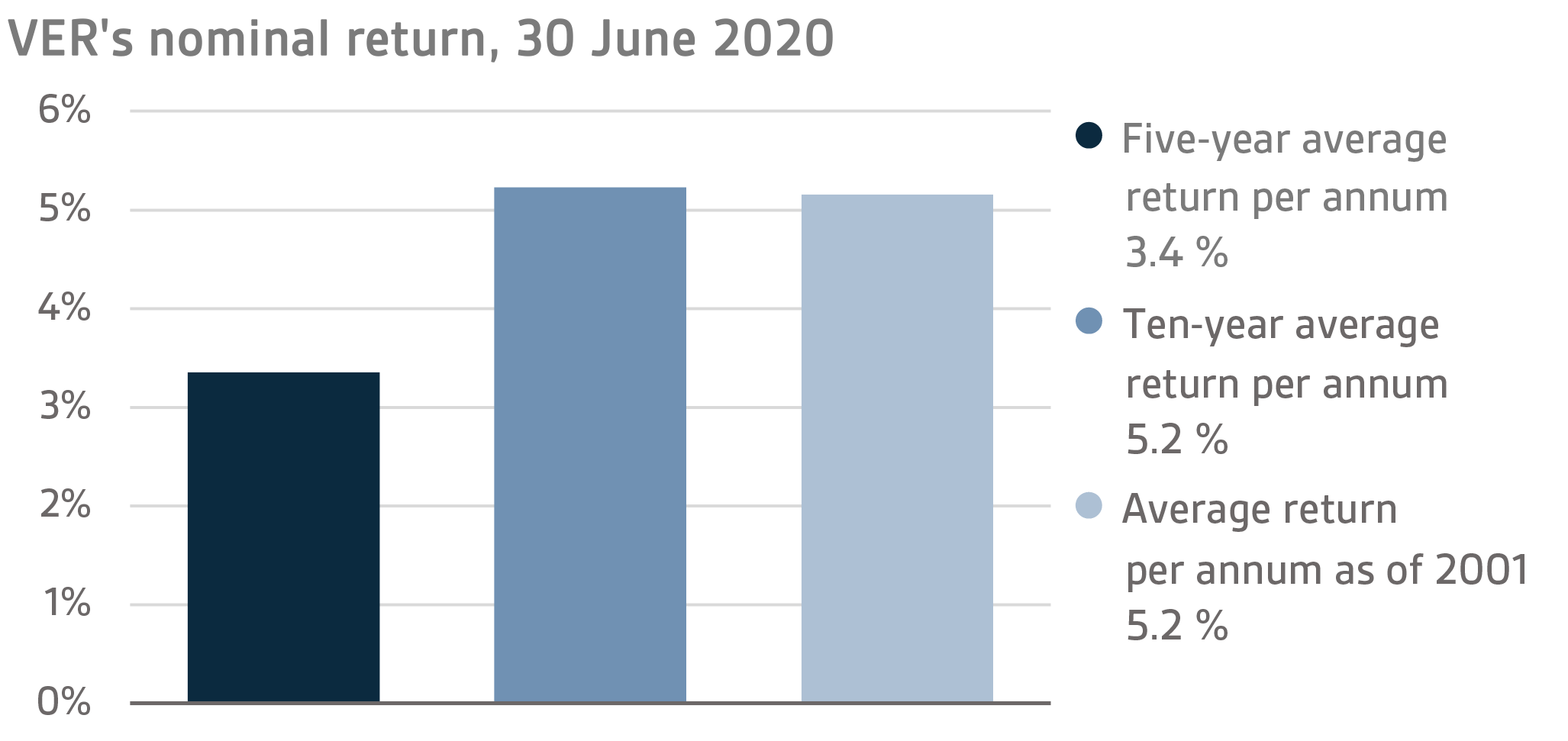

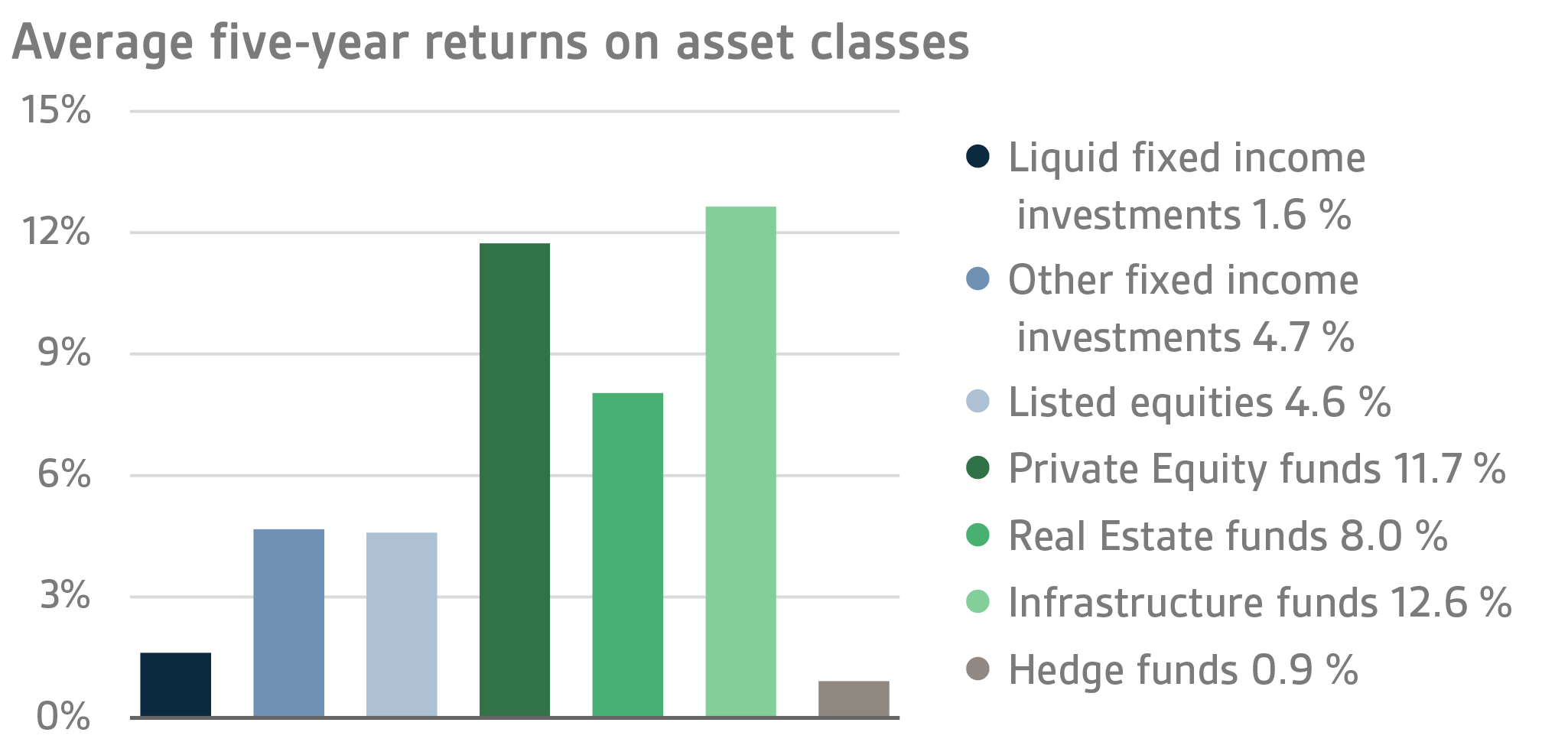

On 30 June 2020, VER’s investment assets totalled EUR 19.3 billion. During the first half of the year, the return on investments at fair values was -5.1 per cent. The average nominal rate of return over the past five years (1 July 2015–30 June 2020) was 3.4 per cent and the annual ten-year return 5.2 per cent. Since 2001, when VER’s activities assumed their current form, the average rate of return has been 5.2 per cent.

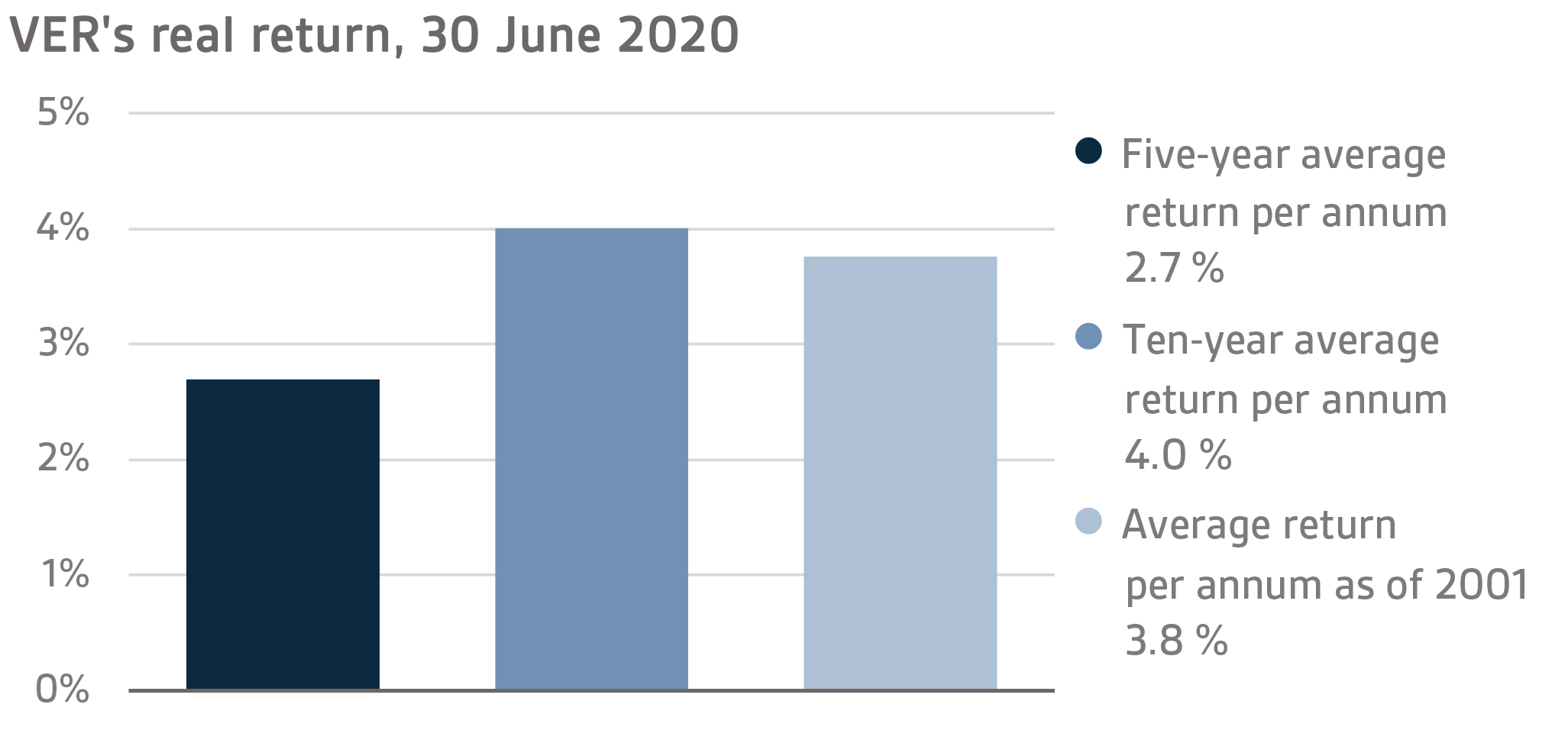

The real rate of return during the first half of 2020 was -4.7 per cent. VER’s five-year average real return was 2.7 per cent and ten-year real return 4.0 per cent. Since 2001, when VER’s activities assumed their current form, the average rate of return has been 3.8 per cent.

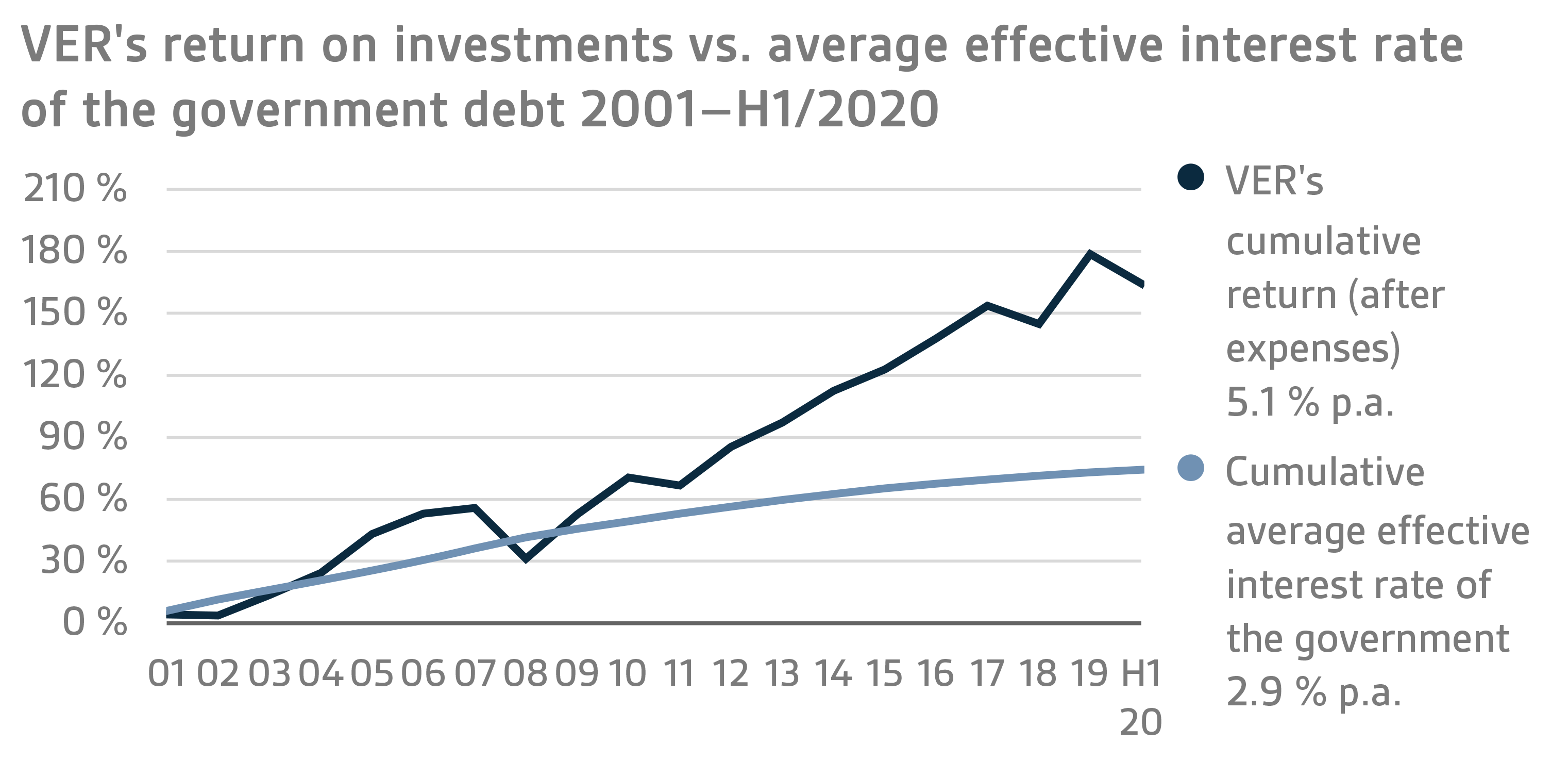

From the State’s point of view, it is pertinent to compare the return on investments with the cost of net government debt, because the funds accumulated in preparation for future pension expenditure can be deemed to reduce such debt. Over the past ten years, VER’s average annual rate of return has beaten the cost of net government debt by 3.8 percentage points. Since 2001, the total market-value returns earned by VER have exceeded the cumulative average cost of equivalent government debt by about EUR 6.2 billion over the same period.

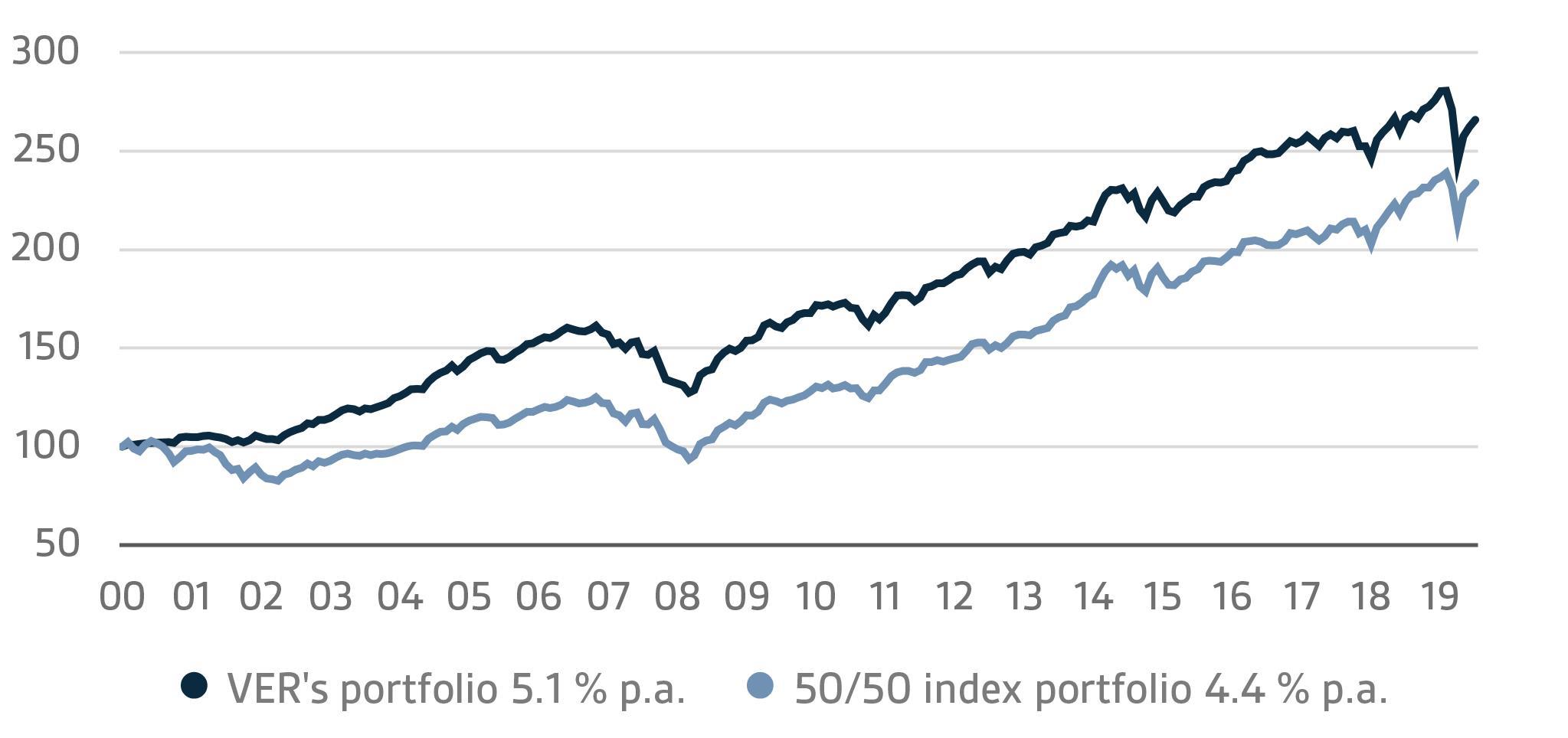

VER monitors long-term return relative to overall market developments by comparing the actual return with a global index, in which the weight of both equities and currency-hedged bonds is 50 per cent.

A CLOSER LOOK AT JANUARY–JUNE 2020

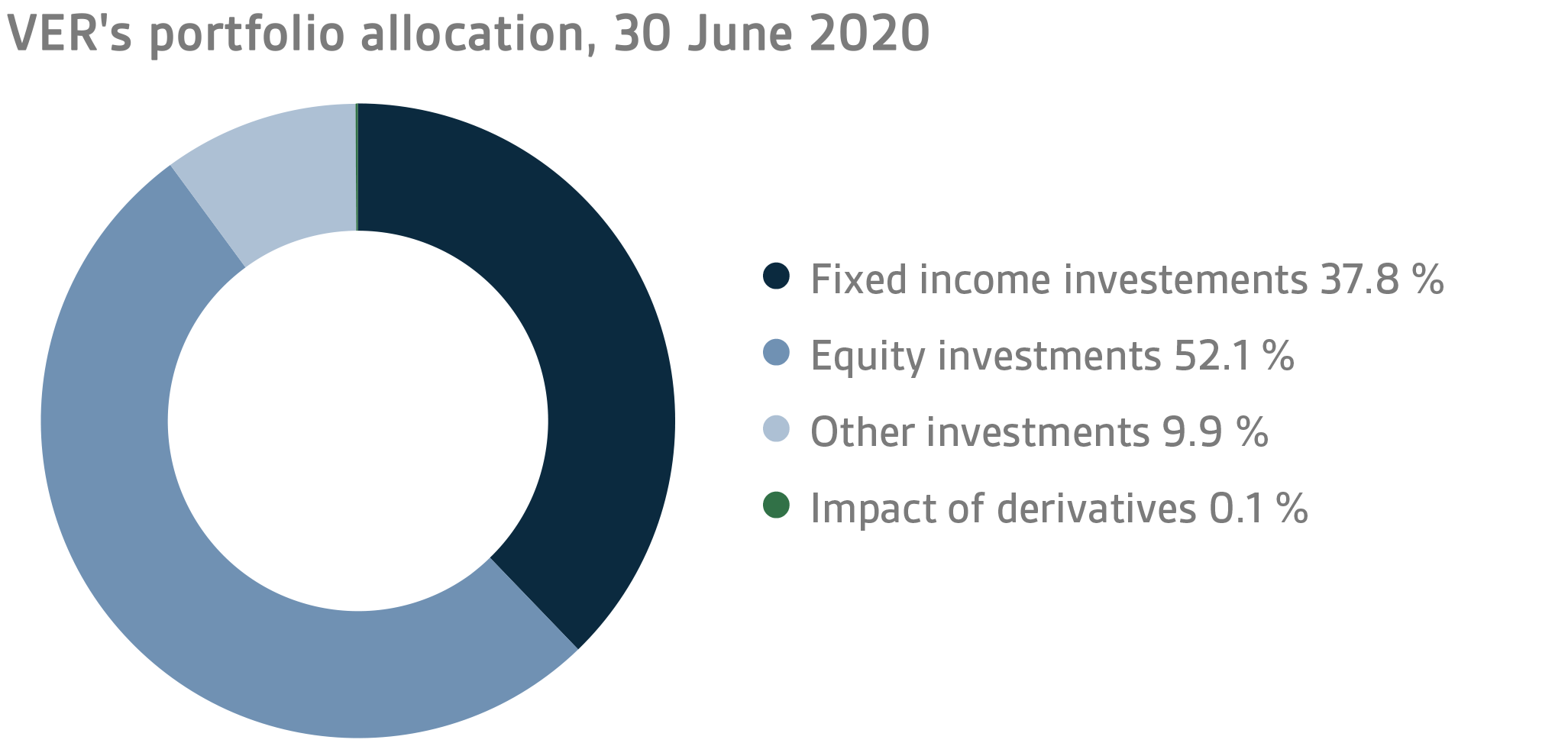

In accordance with the directive of the Ministry of Finance, VER’s investments are divided into fixed-income instruments, equities and other investments. At the end of June, fixed income instruments accounted for 37.8 per cent, equities 52.1 per cent and other investments 9.9 per cent of the total. Of the large asset classes, liquid fixed-income instruments generated a return of -1.1 per cent and listed equities -8.5 per cent during the first half of the year.

FIXED INCOME INVESTMENTS

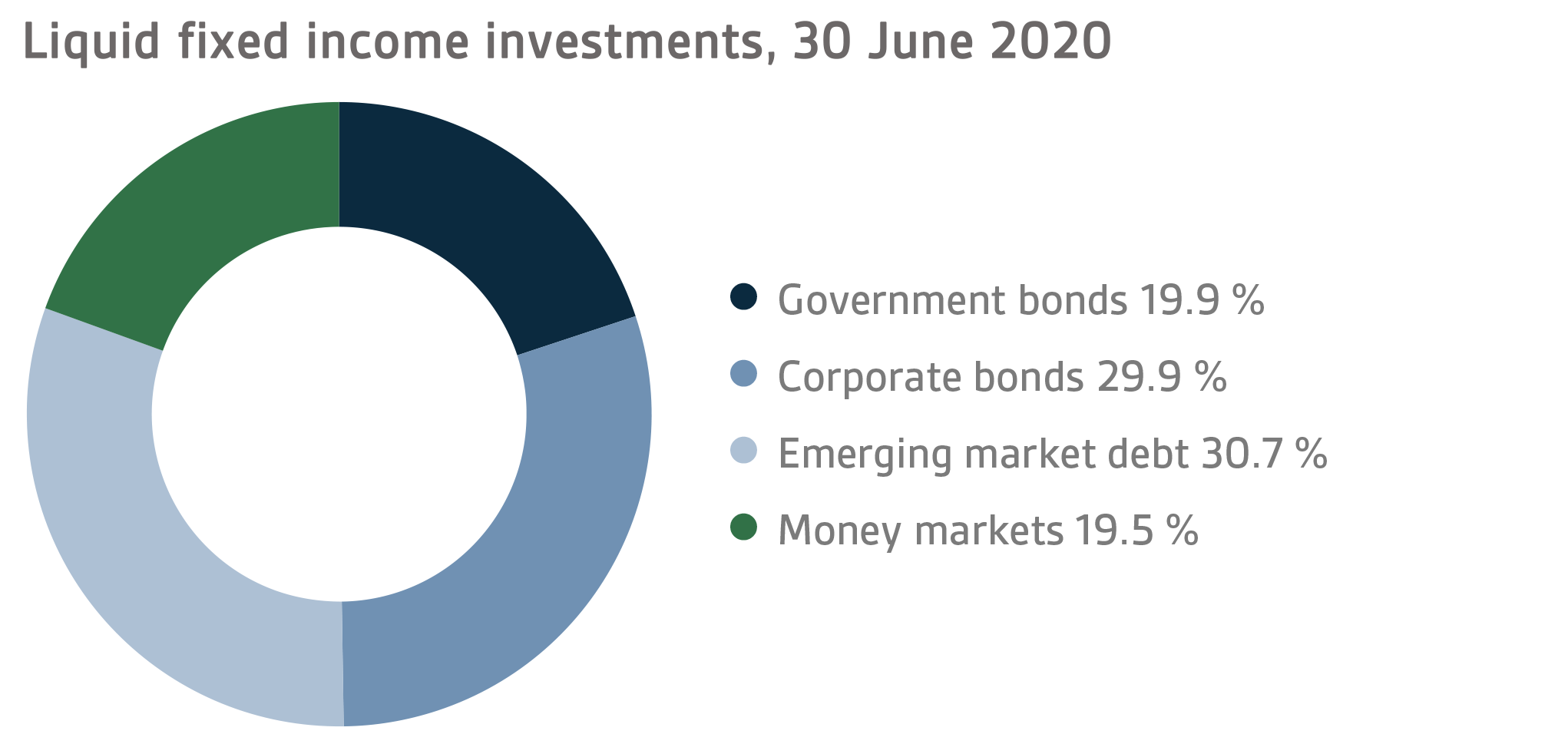

Liquid fixed income investments

During the first half of the year, the return on liquid fixed income instruments was -1.1 per cent.

Developments in the first half of the year were dominated by the COVID-19 virus: the measures taken to contain the spread of the infection, the impact of these measures on the economy and the actions taken by central banks and governments to provide support.

During the second quarter, central banks continued to pursue the stimulus measures they had adopted at the beginning of the year. In addition to the massive actions taken in March, the US Federal Reserves launched a programme in the second quarter to buy fixed income instruments of lower credit rating. The European Central Bank (ECB), in turn, continued its stimulus measures by relaxing the banks’ capital requirements and intensifying quantitative easing by increasing the size of its pandemic emergency purchase programme (PEPP) to EUR 1350 billion and extending its duration. At the same time, the ECB reduced the interest rate on the future TLTRO III programme by another 25 basis points in addition to the publicised cuts, and announced a new PELTRO programme offering financing for banks at 25 basis points below the benchmark rate. Central banks are making a global effort to diminish the impact of the COVID-19 virus on the economy.

As a result of the stimulus measures taken by central banks and governments, the credit risk premiums on corporate bonds and the interest rates in the emerging markets levelled off markedly after the rise earlier in the year. In particular, the corporate bonds of lower credit rating and investments in emerging market dollar-denominated loans, which had taken the worst beating in the first quarter, recovered strongly. No comparable changes took place in the second quarter in government bonds perceived as safe havens, as a result of which the differences in returns diminished clearly compared with the first quarter.

Other fixed income investments

Other fixed-income investments include investments in private credit funds and direct lending to companies.

Private credit investments gave a return of -1.5 per cent.

Because of the pandemic, 2020 has also been challenging for private credit investments. Lockdowns had a major impact on the business operations of companies engaged in travel and trade. So far, the funds are doing relatively well, but if the pandemic persists, we will probably see growing problems at individual companies. At the same time, the market situation has created new opportunities for distress and special situation strategies, among others.

EQUITIES

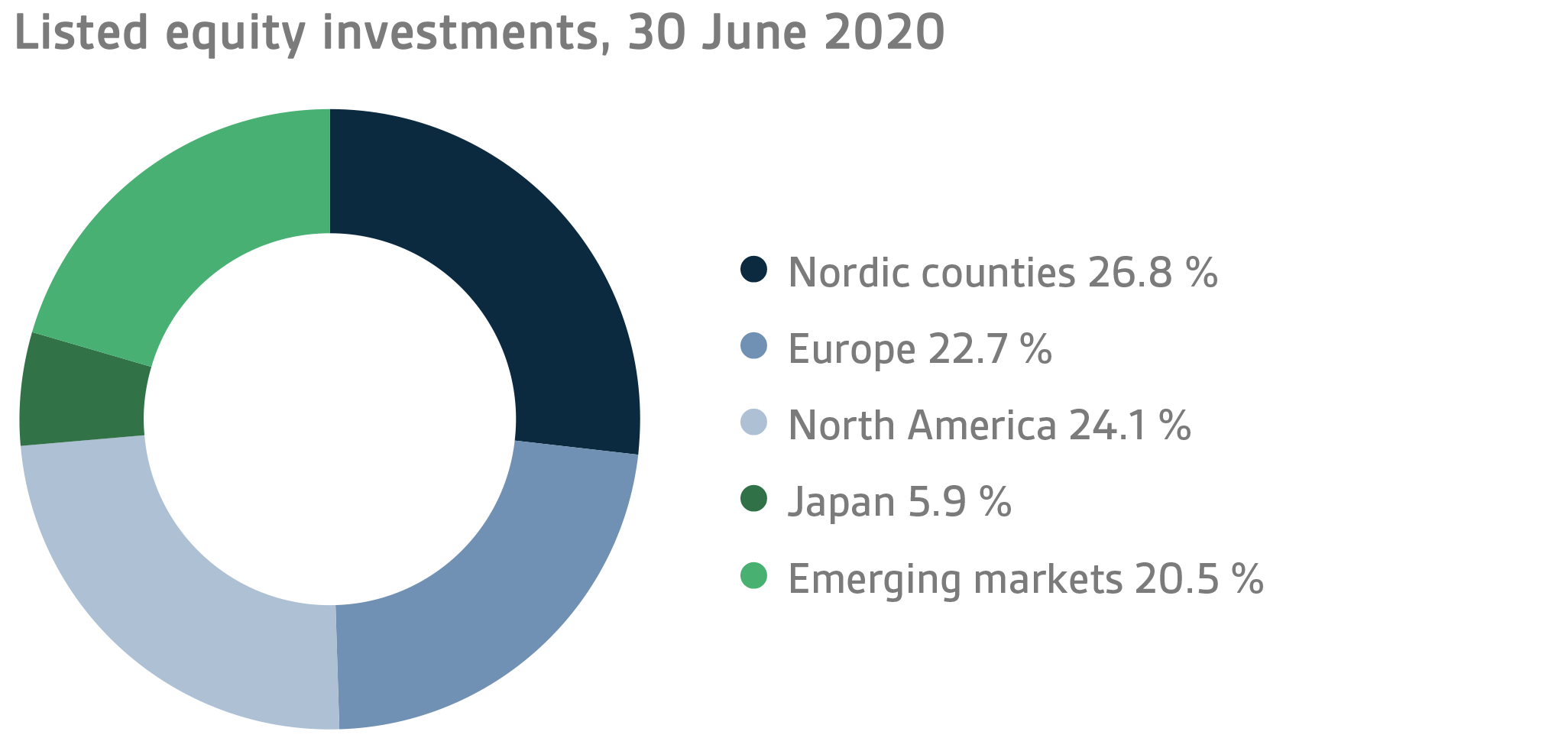

Listed equities

During the first half of the year, the return on listed equities was -8.5 per cent.

The mood in the stock market was quite positive at the beginning of 2020, but the eruption of the coronavirus epidemic into a pandemic turned the situation on its head towards the end of the first quarter. The second quarter, in turn, was characterised by a strong recovery of the market, yet returns remained negative at the end of the first half of the year.

Early 2020 will live in history as far as the evolution of the stock market is concerned. As a result of the eruption of the coronavirus epidemic into a pandemic and the consequential global lockdowns, we saw the extensive collapse of the global market in record time. True enough, governments and central banks across the world responded to the new situation very quickly with massive measures and support packages. When more data was gathered and the virus and its behaviour was better understood, this was enough to calm the financial markets despite the widespread uncertainty. As a result, the second quarter proved very strong for equities.

The coronavirus and news about it fully dominated the stock markets and market behaviour during the first half of the year, eclipsing all other conventional market drivers. Towards the end of the first half of the year, the markets focused on the re-opening of economies in spite of the fact that the coronavirus pandemic had not yet been brought under control, even if some encouraging signs had been discerned. Although the re-openings of economies went fairly well, corporate financial performance will in 2020, in most cases, fall clearly short of previous years. However, the measures taken by governments and central banks are felt to be sufficient to ensure full economic recovery in the coming years. Still, there is a lot of uncertainty in the air, and coronavirus reporting will most likely determine movements in the financial market for the rest of the year.

Other equity investments

VER’s other equity investments include investments in private equity funds, non-listed stock and listed real estate investment trusts (REITs).

Private equity investments returned -6.3 per cent, unlisted equities 11.0 per cent and listed real estate investment trusts -21.7 per cent.

Both private equity investments and listed real estate investment trusts suffered as a result of the negative developments in early 2020. Although the stock markets experienced a strong recovery in the second quarter, its effects were not yet reflected in the valuation levels of private equity investments at the end of June. Listed properties felt the adverse impact of the pandemic more clearly than the rest of the stock market. In particular, those investing in shopping centres were in trouble because of shop closures.

OTHER INVESTMENTS

VER’s other investments are investments in real estate, infrastructure, hedge funds and risk premium strategies.

The return on unlisted real estate funds was -1.1 per cent while infrastructure investments yielded 1.3 per cent.

The effects of the pandemic on individual real estate classes varied greatly. Lockdowns and travel restrictions primarily affected hotels and commercial properties, excluding consumer staples. Logistics and the housing market did fairly well under the circumstances and fund returns have held up better than other sectors.

Underlying the returns on infrastructure funds are extremely skilful exits by some managers as well as dividends. Even though all mobility-related investments have suffered because of the pandemic, basic infrastructure is still needed and operations of companies engaged in this line of business have got off with little damage.

The return on hedge funds during the first half of the year was -2.3 per cent. Hedge funds recovered fine during the second quarter from the losses incurred as a result of the crisis. Aside from the volatility funds that benefit from market turbulence, funds focusing on the Asian market also gave healthy returns during early 2020.

The return on risk premiums was -18.3 per cent during the first half of the year. The return was poor and unlike hedge funds, the risk premium funds failed to recover from the crisis. Derivative strategies, which are included in risk premium investments along with funds, gave a good return in early 2020.

STATE PENSION EXPENDITURE, VER’S TRANSFERS TO THE GOVERNMENT BUDGET, PENSION CONTRIBUTION INCOME AND FUNDING RATIO

The State Pension Fund’s role in balancing government finances has grown and will continue to do so. In 2019, the state’s pension expenditure totalled over EUR 4.7 billion while the 2020 budget foresees an expenditure of nearly EUR 4.8 billion. As VER contributes 40 per cent towards these expenses to the government budget, the transfer to the 2020 budget will amount to about EUR 1.9 billion.

By the end of June, VER had transferred EUR 972 million to the government budget. Over the same period, VER’s pension contribution income totalled EUR 772 million. The pension contribution income matched the forecast. VER’s net pension contribution income has now turned permanently negative, meaning that clearly more money is transferred from the Fund to the government budget than VER receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund.

In June 2016, the Board of Directors of the State Pension Fund adopted a strategy that defines its long-term objectives in greater detail. The strategy foresees that the 25 per cent funding ratio target specified by law will be attained by 2033, if not earlier. To achieve this, it is imperative that VER’s pension contribution income remains at the estimated level and that the real return on investments remains relatively high. As the state’s pension liabilities amounted to EUR 92.7 billion at the end of 2019, the funding ratio was approx. 22 per cent. Additionally, the strategy sets out the principles by which the risk level and basic allocation of the investment portfolio are derived from the target funding ratio established for VER.

All figures presented in this interim report are preliminary and unaudited.