VER’s return on investment 3.2% during 1 Jan–30 Sept 2023; ten-year average annual return 5.2%

Published 2023-10-25 at 17:30

INVESTMENT ENVIRONMENT

The investment market developed favourably in early 2023. The interest rates made it possible to earn healthy returns on fixed income instruments during the early part of the year at the same time as the equity markets performed well. However, the global economy is weakening.

The developments in the investment market have been driven by the interest rate policies pursued by central banks. In the third quarter, interest rates showed a clear upward trend, while inflation rates came down in the USA and the euro area. However, the reduced inflation rate and moderate inflation expectations were not enough to bring interest rates down. Hence, it may be this picture of the future economy and the threat of a potential recession that will determine later developments. The tightness of the central bank policy and the beliefs as to its future trends were slightly more moderate than earlier.

The geopolitical picture is becoming clearer. The United States and the EU are forced to pursue their own interests in the global economy with greater focus and intensity. In particular, geopolitics is disrupted by China and Russia as well as the ominous developments threatening the West. Economies are seen diverging, and this may have implications for economic growth and possibly inflation.

The impact of artificial intelligence can be seen in the movements and valuations of technology stocks. In particular, leading US technology companies have put in a great performance during the first half of the year. This is partly explained by the expectations of accelerating economic growth driven by AI. It is not yet clear how and on what timescale AI will impact the economy.

VER’S RETURN ON INVESTMENTS

Future monitoring and evaluation of the State Pension Fund’ of Finland’s (VER) investment activities will focus on long-term outcomes and future prospects instead of quarterly reporting. However, VER will continue to post quarterly figures and comments.

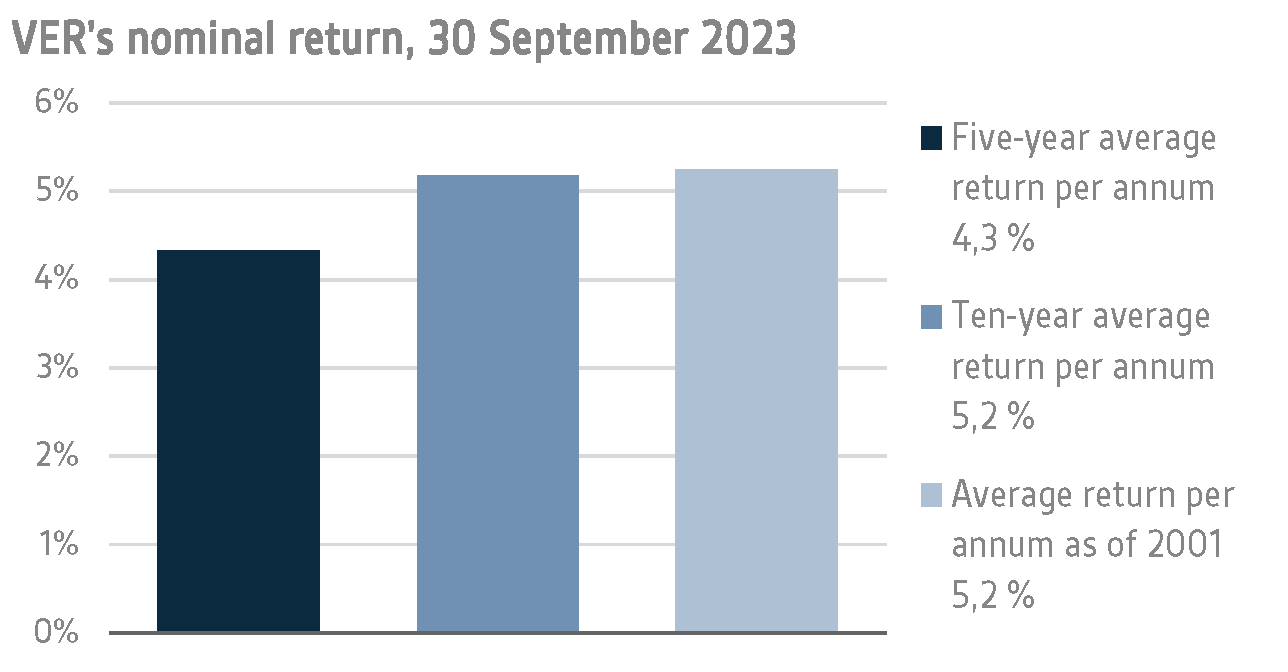

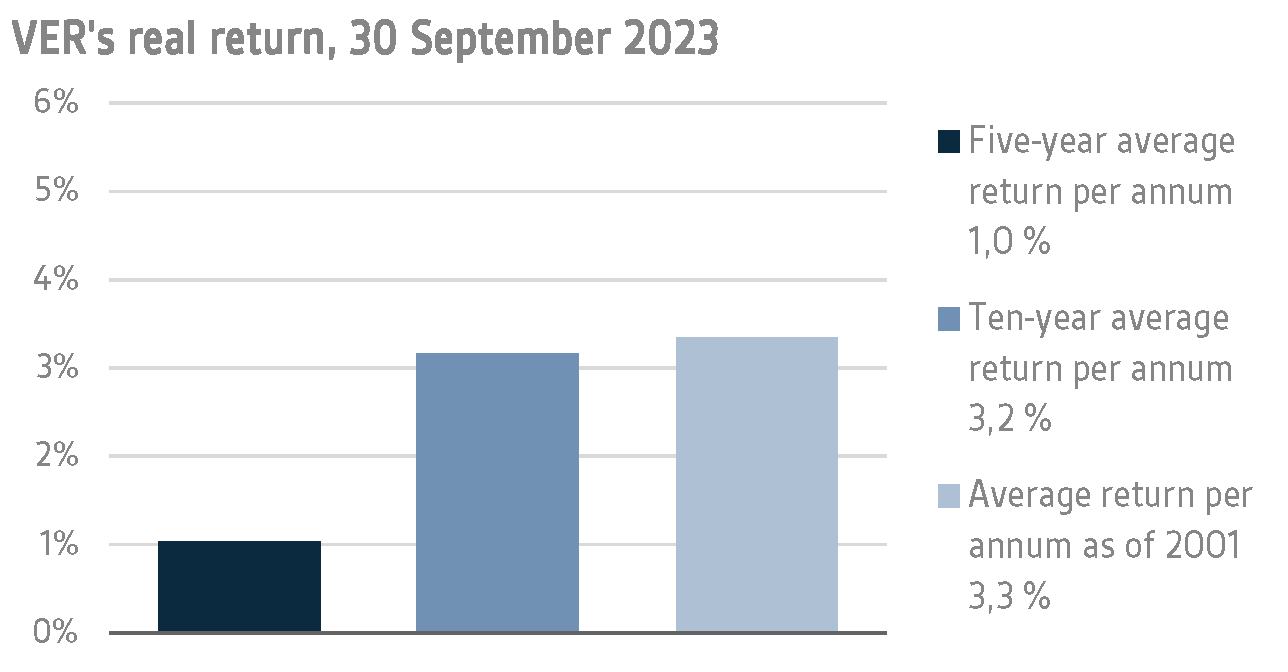

On 30 September 2023, VER’s investment assets totalled EUR 22.0 billion. During the first three quarters, the return on investments at fair values was 3.2 per cent. The average nominal rate of return over the past five years (1 October 2018–30 September 2023) was 4.3 per cent and the annual ten-year return 5.2 per cent. Since 2001, when VER’s activities assumed their current form, the average rate of return has been 5.2 per cent.

The real rate of return during the first three quarters was 0.6 per cent. VER’s five-year average real return was 1.0 per cent and ten-year real return 3.2 per cent. Since 2001, when VER’s activities assumed their current form, the average rate of return has been 3.3 per cent.

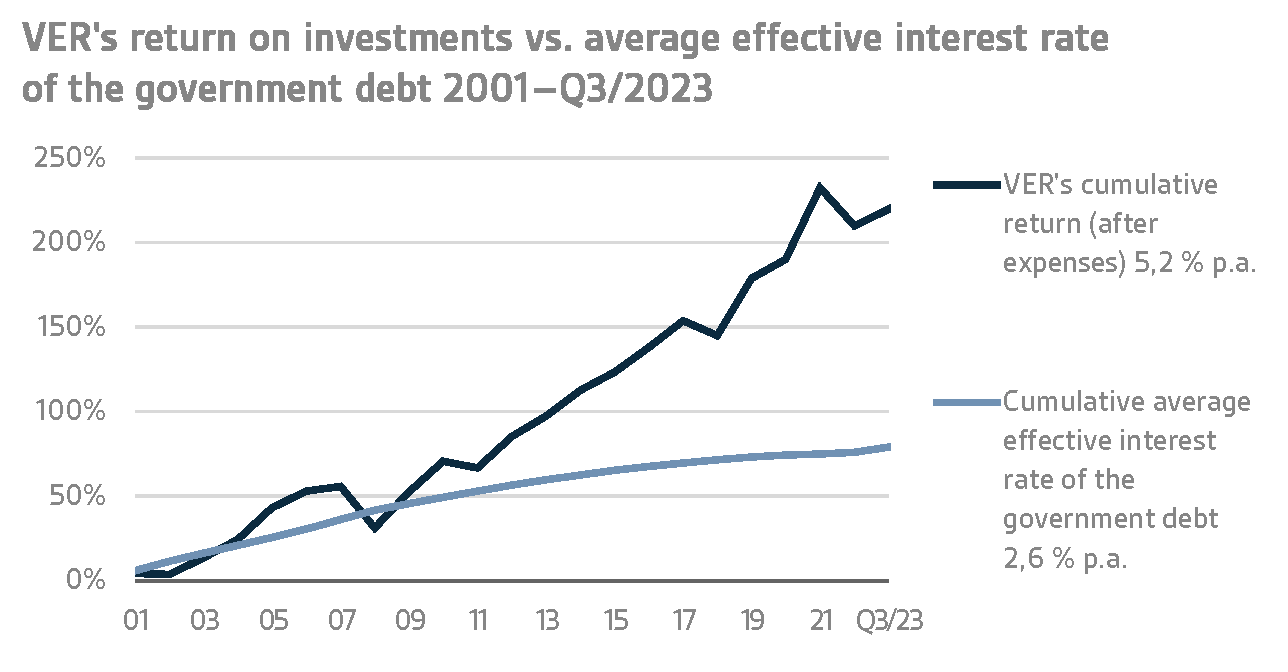

From the State’s point of view, it is pertinent to compare the return on investments with the cost of net government debt, because the funds accumulated in preparation for future pension expenditure can be deemed to reduce such debt. Over the past ten years, VER’s average annual rate of return has beaten the cost of net government debt by 4.0 percentage points. Since 2001, the total market-value returns earned by VER have exceeded the cumulative average cost of equivalent government debt by about EUR 9.6 billion over the same period.

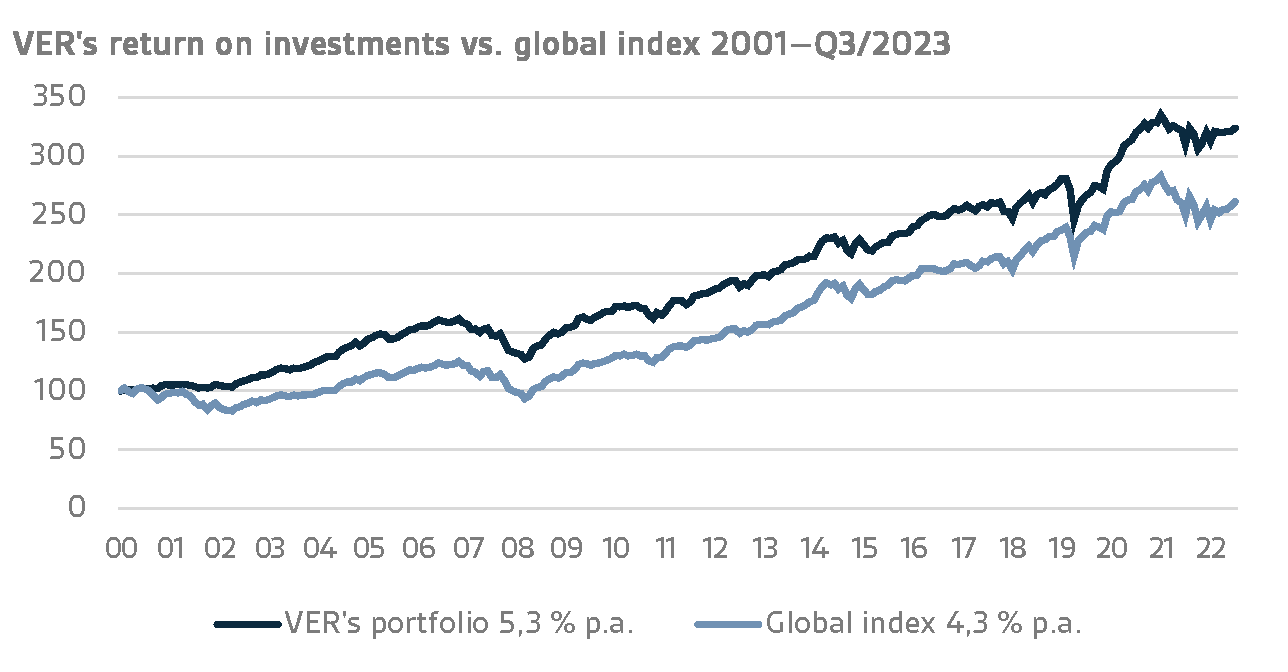

VER monitors long-term return relative to overall market developments by comparing the actual return with a global index, in which the weight of both equities and currency-hedged fixed income instruments is 50 per cent.

A CLOSER LOOK AT JANUARY–SEPTEMBER 2023

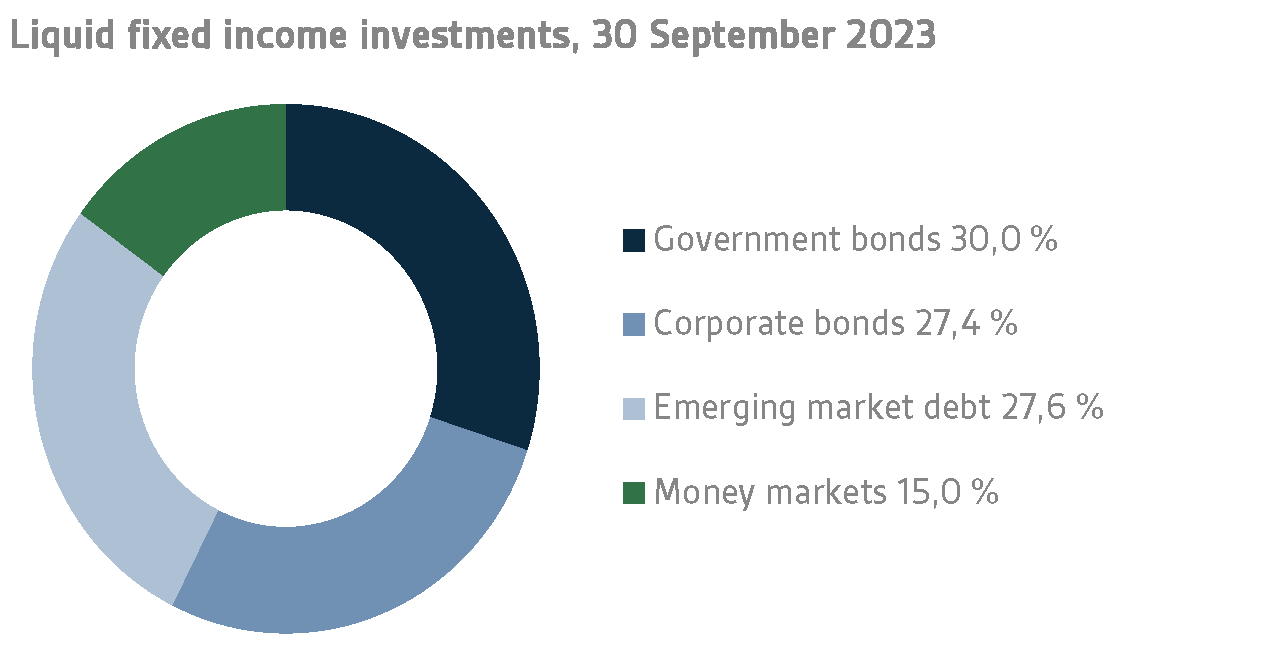

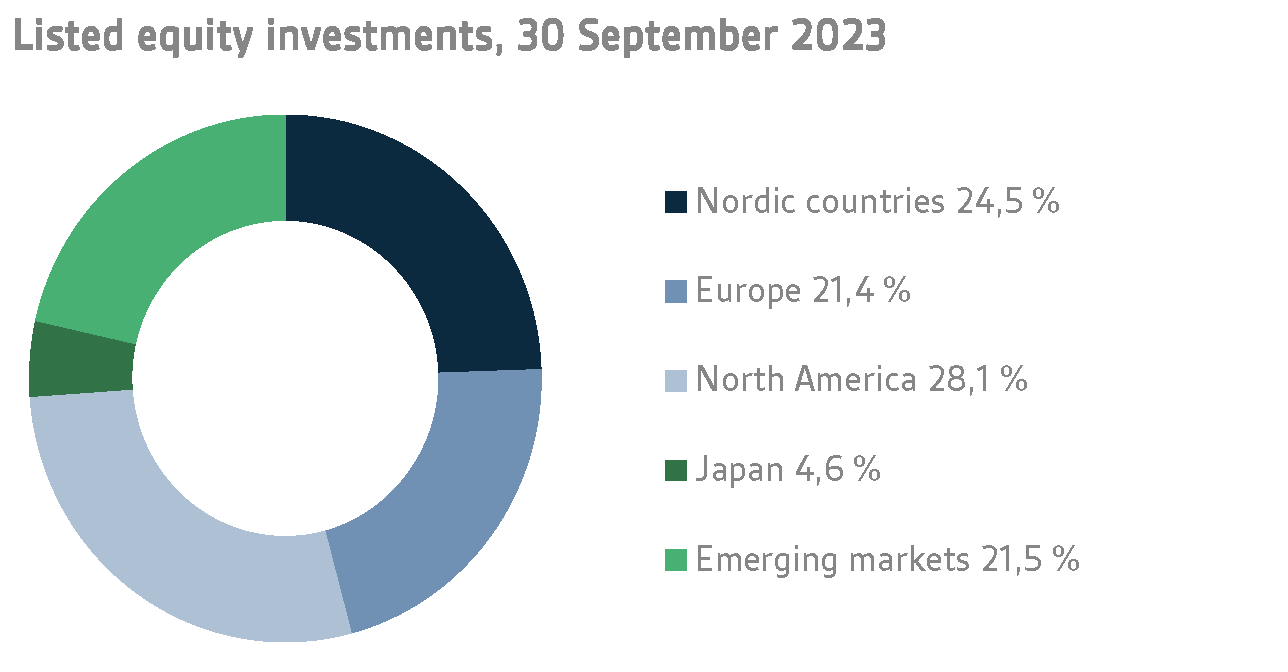

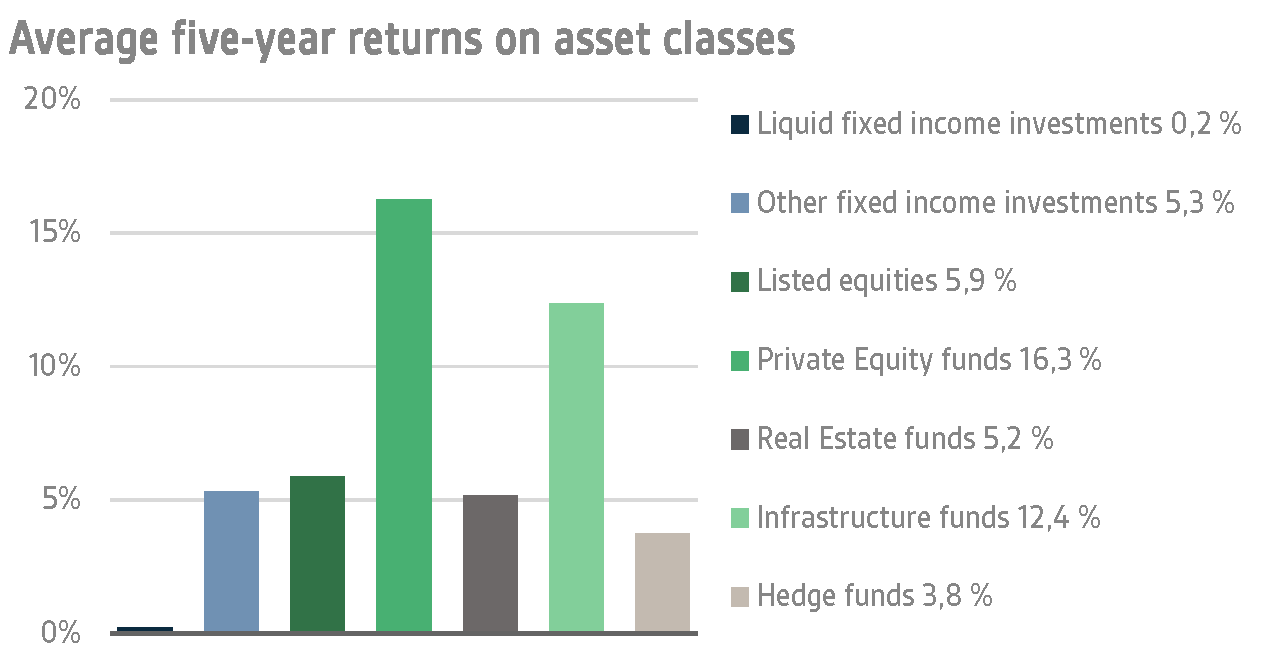

In accordance with the guidelines of the Ministry of Finance, VER’s investments are divided into fixed income instruments, equities and other investments. At the end of September, fixed income instruments accounted for 41.7 per cent, equities 52.4 per cent and other investments 8.5 per cent of the total. Of the large asset classes, liquid fixed income instruments generated a return of 2.1 per cent and listed equities 5.9 per cent during the first three quarters.

FIXED INCOME INVESTMENTS

Liquid fixed income investments

During the first three quarters of 2023, the return on liquid fixed income instruments was 2.1 per cent.

In the third quarter, central banks continued to tighten monetary policy as previously communicated. The European Central Bank (ECB) raised its policy rates by 25 points in both July and September, bringing the ECB deposit rate to 4% from 2% at the turn of the year. At its September meeting, the ECB estimated that interest rates had risen to levels that, if sustained for long enough, would push inflation to the ECB's target level.

For its part, the US Federal Reserve (FED) raised policy rates by 25 basis points at its July meeting, ending the year at a range of 5.25%-5.50%, up from 4.25%-4.50% at the start of 2023. As expected, the FED kept interest rates unchanged at its September meeting, but continued to signal one more rate hike for this year. The FED raised its future policy rate forecast by half a percentage point for 2024 and 2025 compared with its June estimates, based on expectations of stronger economic growth.

Following the September FED meeting, the US Treasury yield curve became much less downward sloping. The two-year rate fell by around 10 points to 5.04%, while the ten-year rate rose by around 20 points to 4.60%. A similar – albeit slightly less pronounced – movement was seen in European government bonds, with the German 10-year government bond rate reaching 2.90%.

The rise in long-term interest rates towards the end of September also pushed up risk premiums on corporate bonds and emerging market debt. At the end of the third quarter, risk premiums were more or less at year-end levels, having narrowed in the second quarter.

As far as VER's liquid fixed income investments are concerned, the third quarter was weaker than the first one, but quarterly returns on lower-rated corporate bonds, among others, were still sound. Since the beginning of 2023, the best returns have been generated by higher-risk instruments, such as lower-rated corporate bonds and the investments in emerging market debt denominated in local currencies, both of which delivered excellent results.

Other fixed income investments

Other fixed income investments include investments in private credit funds and direct lending to companies.

The return on other fixed income investments was 4.1 per cent. Private credit funds returned 4.2 per cent and direct lending 3.7 per cent.

As most private credit loans are floating rate loans, the increase in interest rates has had a positive impact on returns on private credit funds during the current year. Additionally, demand for private debt financing in the corporate sector has also increased significantly in Europe, creating a substantially larger investment space for funds than before. The record high level of unallocated capital in private equity funds has contributed to increased demand for funding from funds, and enabled a highly judicious selection process.

EQUITIES

Listed equities

At the end of the reporting period, the return on listed equities was 4.6 per cent.

2023 has been another very interesting year for global stock markets, with no shortage of drama. The year got off to a brisk start after a weak 2022, but by March the mood had already reversed as a result of the regional banking crisis in the USA. The crisis was overcome, at least temporarily, largely thanks to the swift action of the authorities, preventing the situation from spiralling out of control. While the pressure on the market continued for the next couple of months, the theme had all but disappeared from the headlines by the summer. New dark clouds gathered in the sky in the autumn in the form of the Chinese real estate sector, among others. The crisis, which started a couple of years ago, reared its head again, causing uncertainty primarily in Chinese stock markets while also having wider implications. The tense geopolitical situation has shown few signs of abating during the year; by contrast, the conditions have deteriorated even further since the end of the reporting period.

The biggest theme of the year has been inflation, and in particular its greater-than-expected persistence. Central banks across the world have raised their policy rates in response to the rising inflation, and the interest rates in 2023 have risen to levels not seen for a very long time indeed. In stock markets, interest rate movements have been watched more closely than in years. Similarly, the central banks' interest rate decisions and the briefings at their meetings have been followed keenly. Despite the uncertainties, the earnings forecasts of listed companies have held up surprisingly well, which has underpinned the relatively strong performance of stock markets. Of VER’s sub-portfolios of listed equities, the best performance during the first part of the year was put in by Japan, whereas the Nordic countries did not do so well, mainly due the poor performance of Finnish stocks in early 2023.

Other equity investments

VER’s other equity investments include investments in private equity funds, infrastructure and unlisted equities.

Private equity investments returned 4.0 per cent, infrastructure funds 5.1 per cent and unlisted equities 5.9 per cent.

For private equity funds, the year has been reasonably good, despite rising interest rates and inflation. While the transaction market has been clearly less lively in recent years, some funds have still managed to make successful exits. Similarly, the valuations of portfolio companies have so far remained stable, despite stock market volatility. Valuation levels have been sustained by the surprisingly healthy performance of the portfolio companies.

The sound returns on unlisted stocks is also due to improved valuations. Although infrastructure investors very much rely on debt leverage, the rise in interest rates has so far had a very modest impact on investment valuations. As infrastructure investments serve as inflation hedges, they compensate for the increase in interest costs due to higher interest rates. Investors continue to show keen interest in infrastructure investments, which is why valuation levels in the new transactions have remained high.

OTHER INVESTMENTS

VER’s other investments consists of investments in real estate investment trusts, hedge funds and risk premium strategies.

The return on investments in non-listed real estate trusts was -2.3 per cent.

The transaction market in real estate investments is still rather quiet. Rising interest rates have increased pressures on property yield requirements, although changes in value have remained relatively moderate. Towards the end of the year, property yields are expected to fall as some owners value their properties once a year in November and December. At the same time, the high inflation rate pushes up property rents. However, not all real estate sectors have been able to increase rents at the same pace as the inflation rate.

Hedge funds and systematic strategies gave a 1.9 per cent return during the first three quarters.

The excellent performance of hedge funds during the third quarter turned the current-year return clearly positive. Of the investment styles, only macro funds showed negative returns at the close of the third quarter. For multi-strategy and quantitative funds, the period was exceptionally favourable in a market with major changes in the macro factors. As far as derivatives strategies are concerned, the positions previously taken in currency derivatives and credit derivatives performed well.

STATE PENSION EXPENDITURE, VER’S TRANSFERS TO THE GOVERNMENT BUDGET, PENSION CONTRIBUTION INCOME AND FUNDING RATIO

The role of the State Pension Fund in equalising the government’s pension expenditure continues to grow. In 2022, the State’s pension expenditure totalled over EUR 5.0 billion while the 2023 budget foresees an expenditure of nearly EUR 5.3 billion. As VER contributes 40 per cent towards these expenses to the government budget, the transfer to the 2023 budget will amount to over EUR 2.1 billion.

By the end of September, VER had transferred EUR 1.6 billion to the government budget. Over the same period, VER’s pension contribution income totalled EUR 1.3 billion. The pension contribution income matches the forecast. VER’s net pension contribution income has now turned permanently negative, meaning that clearly more money is transferred from VER to the government budget than VER receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund.

VER reached its 25% funding ratio target on 31 December 2021, much earlier than expected. Following the attainment of the funding ratio, the Act on the State Pension Fund was amended and entered into force in April 2022. As part of this amendment, VER’s contribution to the government budget was increased as of 2024. Consequently, VER’s budget transfers will be gradually increased from the current 40 per cent to 45 per cent during 2024–2028. If the funding ratio exceeds 25 per cent for two consecutive calendar years, an additional transfer of three percentage points will be made to the government budget. Given VER’s growing role in offsetting government pension expenditure and the increase in negative net transfers, VER’s funding ratio is expected to fall in the coming years.

Following the legal reform, VER’s Board of Directors initiated a strategy development process. The strategy was updated concurrently with the 2023 investment plan and adopted in January 2023. The objectives set out in the strategy create the basis for future investment activities. The baseline allocation of the investment portfolio is determined in the annual investment plan. Simulations suggest that the baseline allocation of the portfolio will achieve the long-term objectives established for VER.

KEY FIGURES | | | |

| 30.9.2023 | 31.12.2022 | 30.9.2022 |

Investments, MEUR (market value) | 21 965 | 21 604 | 21 265 |

Fixed income investments | 9 159 | 8 791 | 8 532 |

Equity investments | 11 510 | 10 285 | 9 806 |

Other investments | 1 866 | 2 777 | 2 835 |

Impact of derivatives | -571 | -249 | 92 |

| | | |

Breakdown of the investment portfolio | | | |

Fixed income investments | 41,7 % | 40,7 % | 40,1 % |

Equity investments | 52,4 % | 47,6 % | 46,1 % |

Other investments | 8,5 % | 12,9 % | 13,3 % |

Impact of derivatives | -2,6 % | -1,2 % | 0,4 % |

| | | |

| 1.1.–30.9.2023 | 1.1.–31.12.2022 | 1.1.–30.9.2022 |

Return on investment | 3,2 % | -6,8 % | -8,7 % |

Fixed income investments | | | |

Liquid fixed income investments | 2,1 % | -8,2 % | -8,6 % |

Other fixed income investments | 4,1 % | 0,4 % | 0,8 % |

Private Credit funds | 4,2 % | -0,5 % | 0,2 % |

Equity investments | | | |

Listed equity investments | 4,6 % | -12,4 % | -16,2 % |

Private Equity investments | 4,0 % | 12,5 % | 13,4 % |

Unlisted equity investments | 5,9 % | 7,8 % | 6,9 % |

Other investments | | | |

Unlisted Real Estate funds | -2,3 % | 4,1 % | 5,0 % |

Infrastructure funds | 5,1 % | 15,6 % | 10,5 % |

Hedge funds | 1,9 % | 5,0 % | 5,3 % |

| | | |

Pension contribution income, MEUR | 1 276 | 1 610 | 1 221 |

Transfer to state budget, MEUR | 1 595 | 1 982 | 1 499 |

Net contribution income, MEUR | -319 | -372 | -278 |

Pension liability, BnEUR | | 97 | |

Funding ratio, % | | 22 % | |

| | | |

Additional information: CEO Timo Löyttyniemi, firstname.lastname@ver.fi, tel. +358 (0)295 201 210

Established in 1990, the State Pension Fund (VER) is an off-budget fund through which the State prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the State’s pension assets professionally. At the end of September 2023, the market value of the Fund’s investment portfolio stood at EUR 22.0 billion.

All figures presented in this interim report are preliminary and unaudited.