INVESTMENT ENVIRONMENT

Geopolitics and inflation have dominated market developments in the first three quarters of the year. Central banks have been compelled to react by tightening monetary policies, and interest rates have risen across the board and globally. These developments have made the investment environment challenging and reduced returns on many investments.

The high inflation in Europe has been driven by Russia’s war of aggression, which has affected the availability and pricing of energy. In August, the record-high energy prices created problems for energy companies. Consumer inflation remained high throughout the third quarter and is not yet showing any signs of abating. Faced with a situation where inflation remains high and is escalating into wage inflation, central banks have tightened monetary policies and raised their benchmark rates. At the same time, long-term interest rates have risen to levels not seen for a decade.

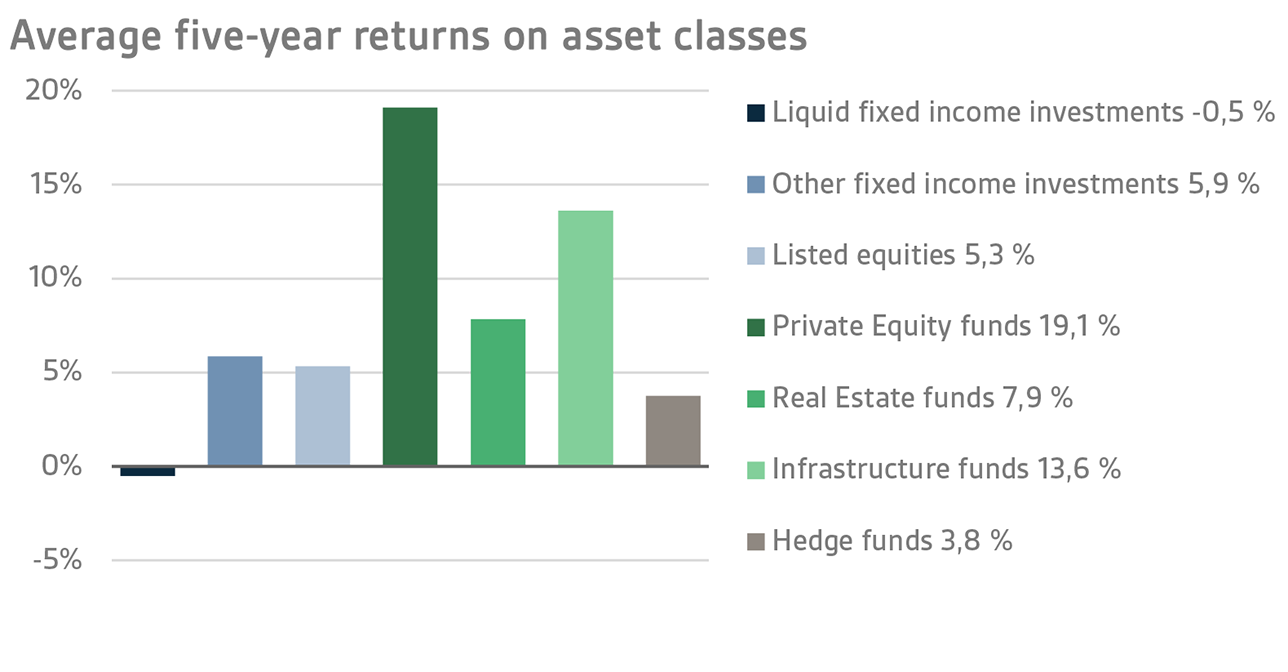

In the investment market, returns on fixed income instruments and equities have remained low during the early 2022. By contrast, returns on illiquid investments are still positive; hence, the added value provided by these investments has been significant. The general rise in interest rates will make fixed income investments increasingly attractive in the future.

VER’S RETURN ON INVESTMENTS

Monitoring and evaluation of VER’s investment activities focuses on long-term outcomes and future prospects instead of quarterly reporting. However, VER continues to post quarterly figures and comments.

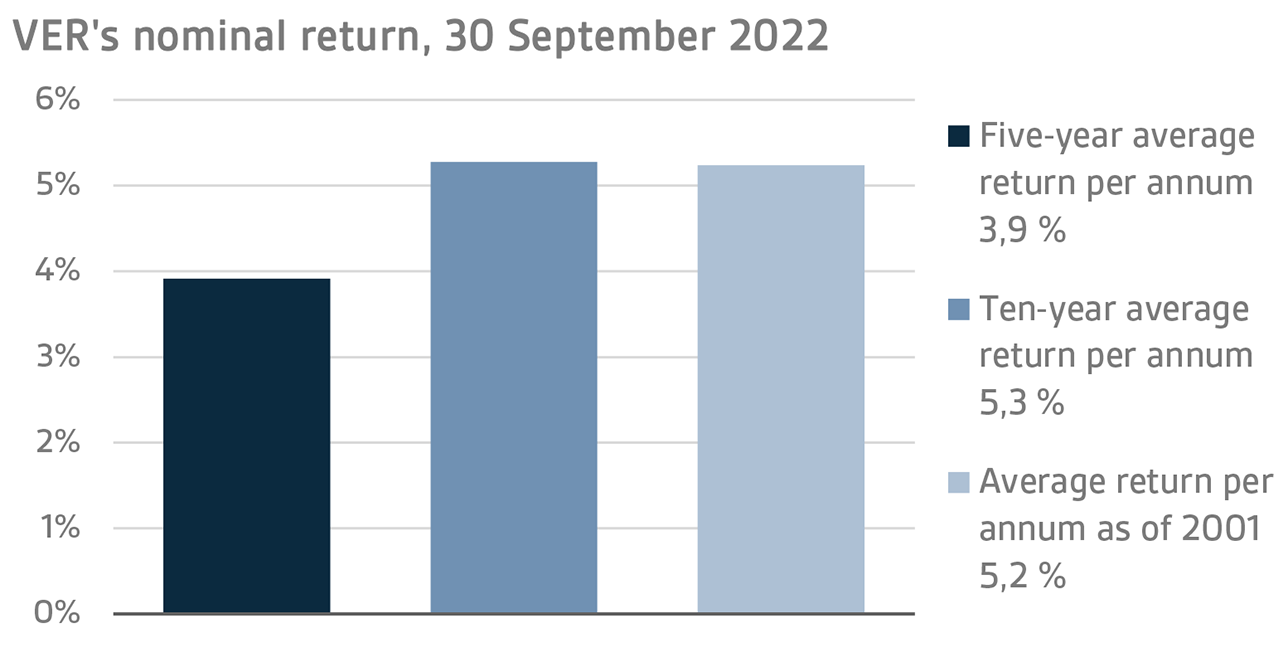

On 30 September 2022, VER’s investment assets totalled EUR 21.3 billion. During the first three quarters, the return on investments at fair values was -8.7 per cent. The average nominal rate of return over the past five years (1 October 2017–30 September 2022) was 3.9 per cent and the annual ten-year return 5.3 per cent. Since 2001, when VER’s activities assumed their current form, the average rate of return has been 5.2 per cent.

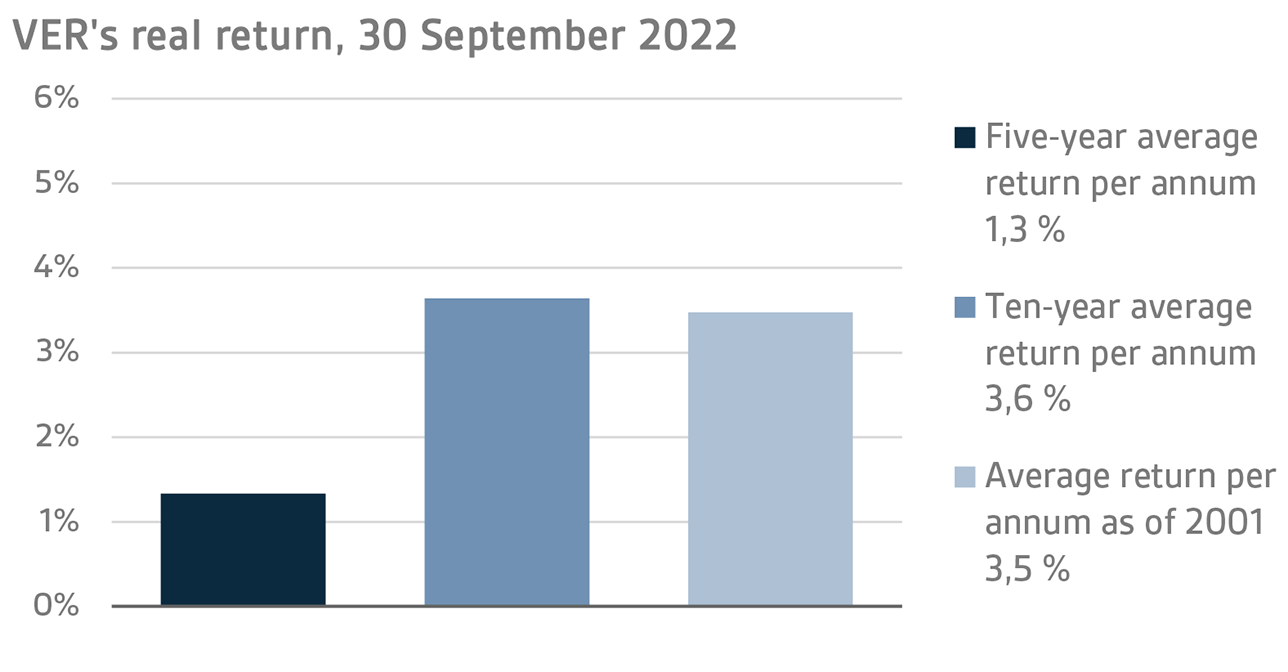

The real rate of return during the first three quarters was -14.6 per cent. VER’s five-year average real return was 1.3 per cent and ten-year real return 3.6 per cent. Since 2001, when VER’s activities assumed their current form, the average real rate of return has been 3.5 per cent.

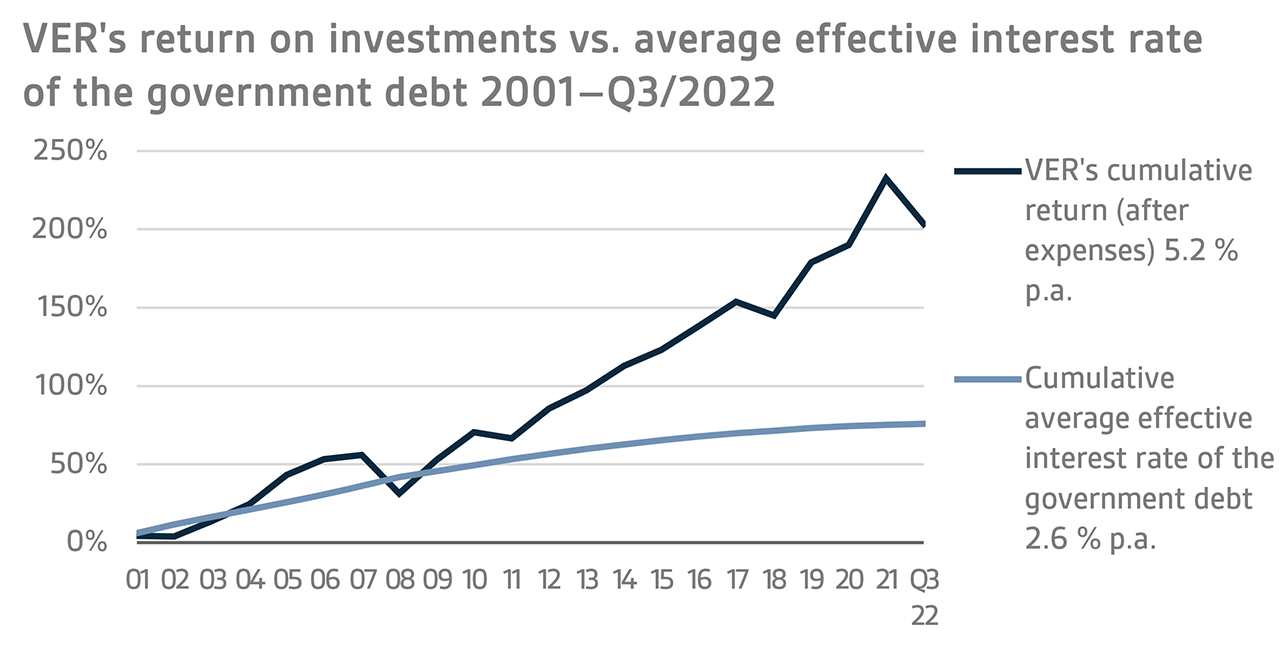

From the State’s point of view, it is pertinent to compare the return on investments with the cost of net government debt, because the funds accumulated in preparation for future pension expenditure can be deemed to reduce such debt. Over the past ten years, VER’s average annual rate of return has beaten the cost of net government debt by 4.1 percentage points. Since 2001, the total market-value returns earned by VER have exceeded the cumulative average cost of equivalent government debt by about EUR 8.9 billion over the same period.

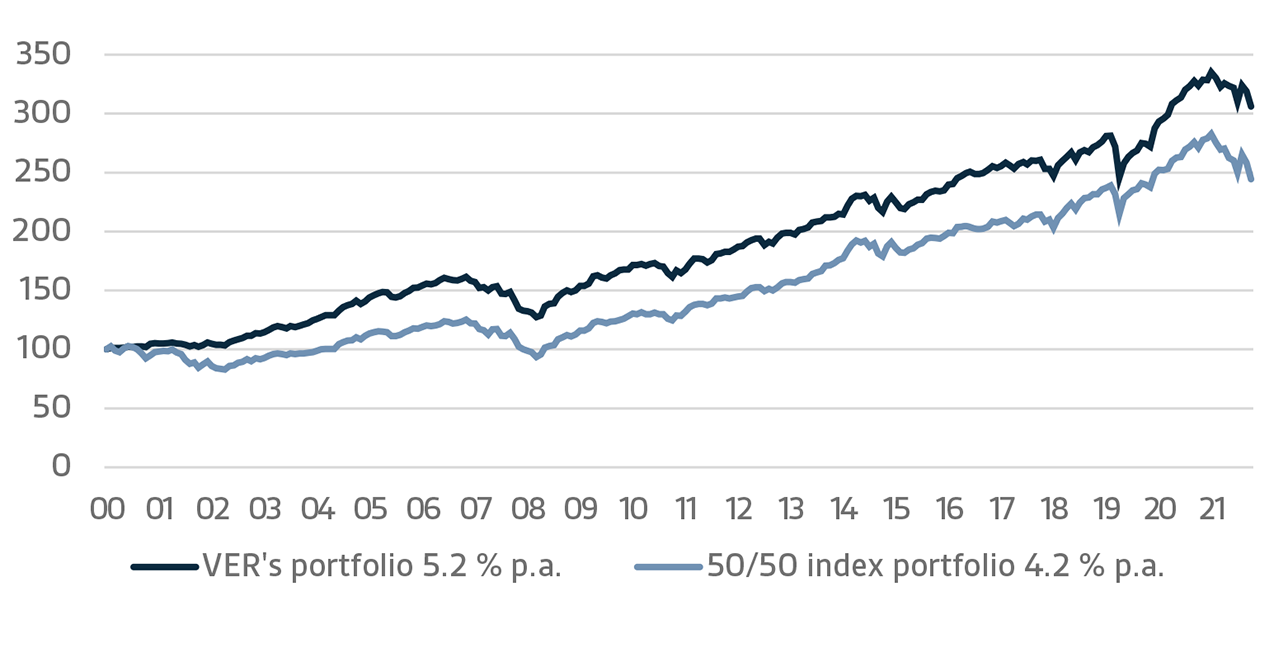

VER monitors long-term return relative to overall market developments by comparing the actual return with a global index, in which the weight of both equities and currency-hedged bonds is 50 per cent.

A CLOSER LOOK AT JANUARY–SEPTEMBER 2022

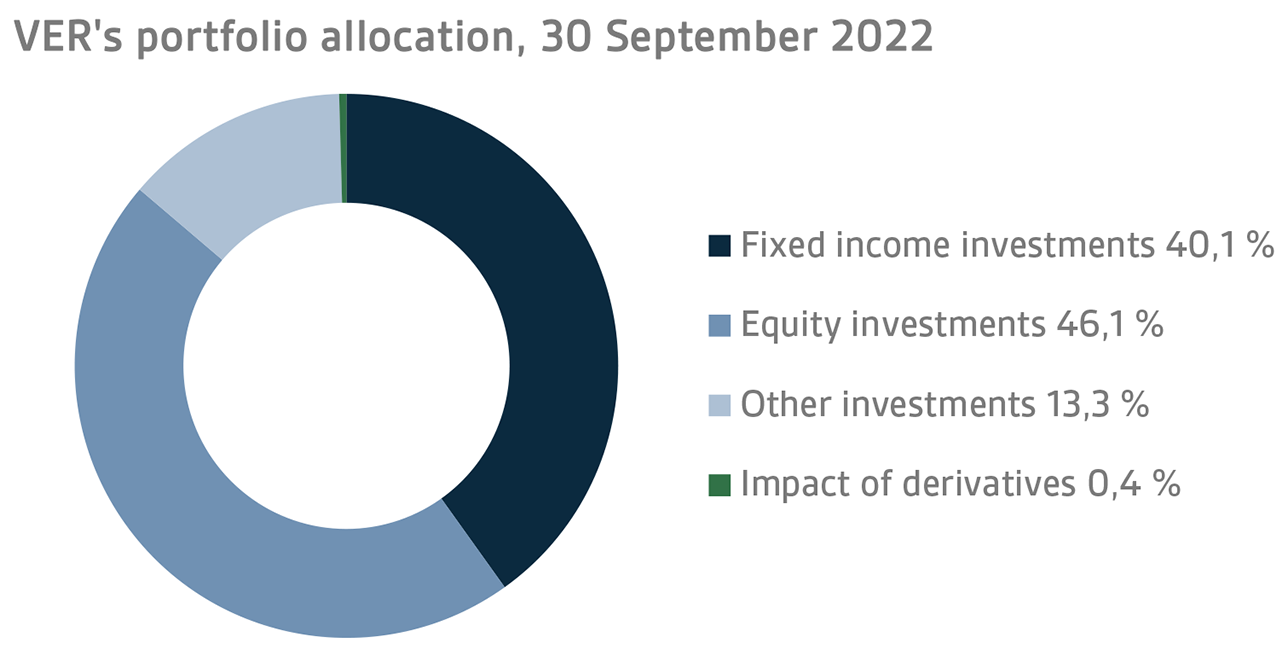

In accordance with the directive of the Ministry of Finance, VER’s investments are divided into fixed income instruments, equities and other investments. At the end of September, fixed income instruments accounted for 40.1 per cent, equities 46.1 per cent and other investments 13.3 per cent of the total. Of the large asset classes, liquid fixed income instruments generated a return of -8.6 per cent and listed equities -16.2 per cent during the first three quarters.

FIXED INCOME INVESTMENTS

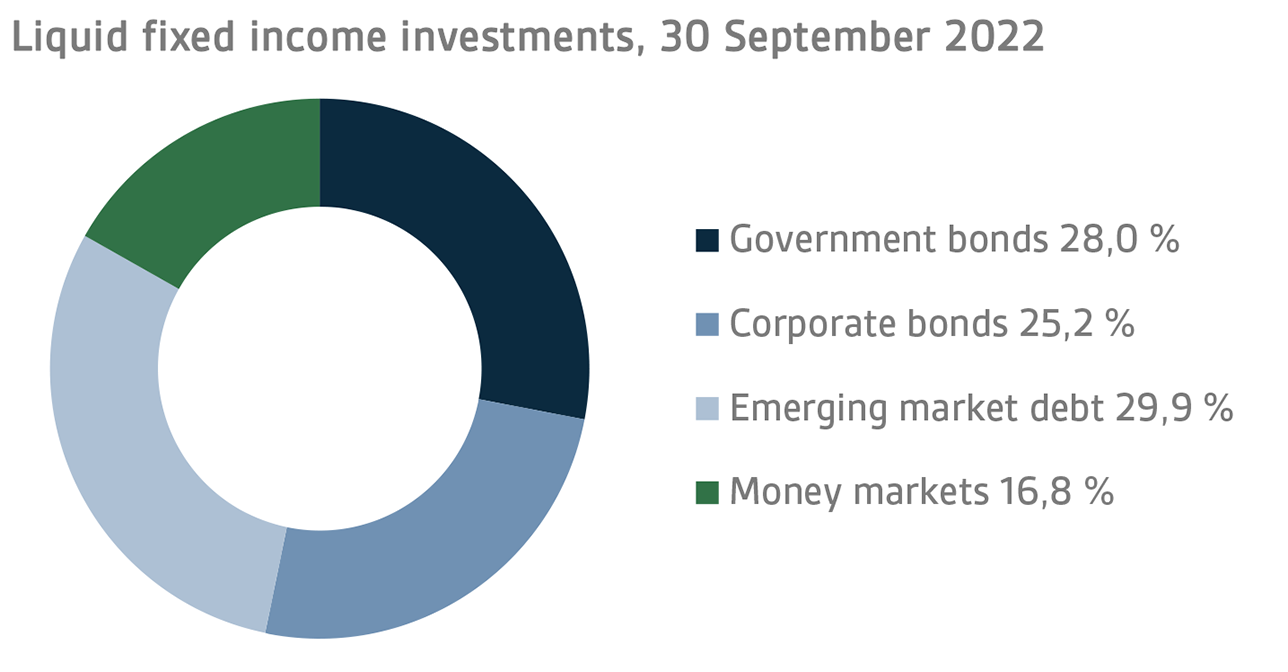

Liquid fixed income investments

During the first three quarters of the year, the return on liquid fixed income instruments was -8.6 per cent.

In the third quarter, central banks stepped up their response to higher inflation and tightened monetary policy more than anticipated. Interest rates fell slightly in July, but then increased sharply as a result of high inflation figures and aggressive rate hikes by central banks. From the end of July to the end of September, ten-year government bond yields rose by around 130 basis points in both the United States and Germany. Rising interest rates and the weakened risk sentiment pushed credit spreads on corporate bonds close to the highest levels reached during the spring 2020 interest rate crisis.

The Federal Reserve continued to raise interest rates in the third quarter at a faster pace than during the first half of the year, raising the federal funds rate by 50 points both in July and September. At its June meeting, the FED implied that the bank rate would reach 4.4 per cent by the end of the year (as opposed to (3.4% in June). Moreover, the FED is off-loading its balance sheet at a rate of USD 95 billion per month, as announced earlier.

The European Central Bank (ECB) raised its interest rates by 50 points in July, more than previously indicated by the ECB. In September, the ECB continued to tighten its monetary policy by raising interest rates by a historical 75 basis points, indicating that more rate hikes would be announced at future meetings to contain inflation expectations. At the end of September, the fixed income markets foresaw additional interest rate increases totalling around 140 basis points by the end of the year.

The spread in risk premiums on corporate loans continued to grow in the third quarter as the economic outlook weakened following the sharp rise in interest rates. For example, the iTraxx Crossover cds index rose to almost 645 points in the third quarter after starting the year below 250.

As far as VER’s liquid fixed income investments are concerned, the increase in interest rates eroded returns on emerging market dollar-denominated bonds in particular. Moreover, the absolute returns generated by other fixed income assets classes were not that great, either, due to the increase in interest rates and growing spreads in risk premiums. However, in terms of financial performance, the third quarter was better than the second.

Other fixed income investments

Other fixed income investments include investments in private credit funds and direct lending to companies.

The return on other fixed income investments was 0.8 per cent. Private credit funds returned 0.2 per cent and direct lending 3.8 per cent.

Private credit managers are benefitting from the current market of rising interest rates. As most private credit loans are floating rate loans, an increase in interest rates has a positive impact on expected returns. Additionally, the demand for private money has been intensified by the growing difficulties of companies to raise financing from banks or the markets. The challenging market situation has provided an excellent opportunity for special situation strategies in particular, and their returns have been among the best in VER's portfolio this year.

EQUITIES

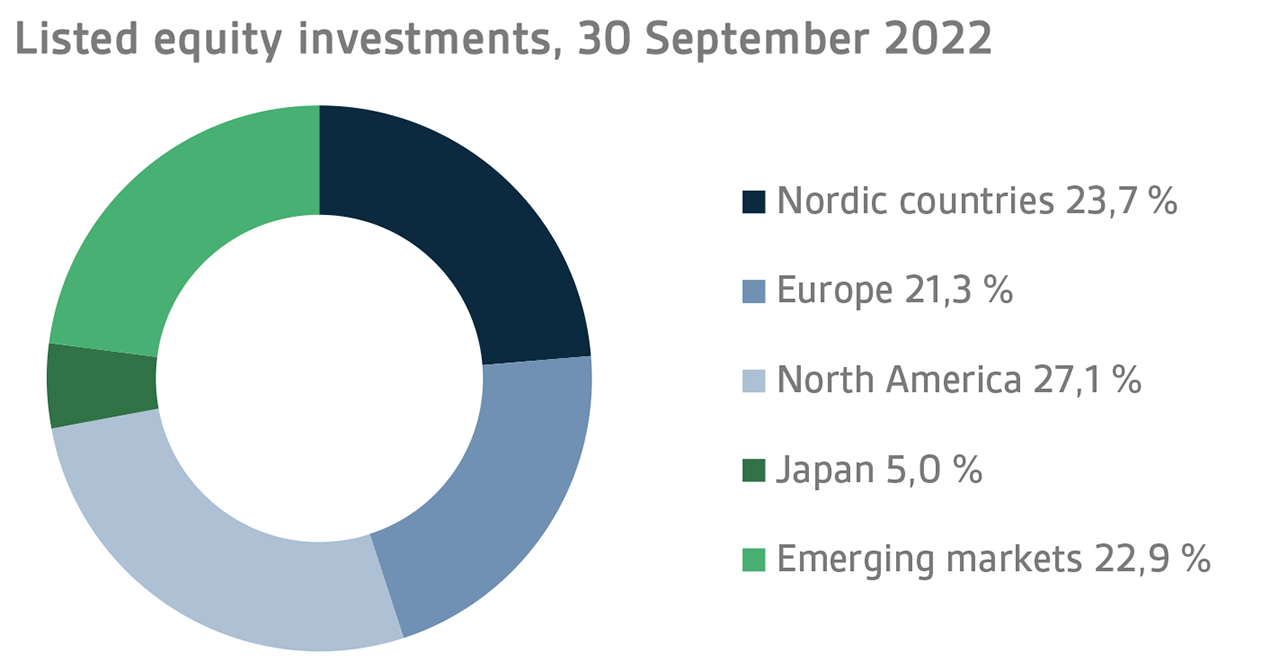

Listed equities

At the end of the reporting period, the return on listed equities was -16.2 per cent.

So far, 2022 has been an extremely weak year for the global stock market and the third quarter brought no relief in this respect. Although the third quarter got off to a positive start with equity prices rising up to mid-August, the mood changed quite dramatically and September, in particular, was a very difficult month for stock markets all over the world. The drivers were the same as earlier in the year, with very high inflation figures in particular, and the resulting rise in interest rates, playing a major role in creating uncertainty. Additional uncertainty was naturally created by geopolitical developments, especially the conflict in Ukraine, and the growing tensions between China and Taiwan did nothing to calm the already jittery market. Of the listed equities, the best performance was put in by VER’s stock investments in the North American market, but even there the return was negative at around 10 per cent.

The year 2022 has brought about many changes in the world around us. An overall increase in interest rates is something we have not seen for a long time and it will have widespread implications for governments and listed companies as well as a direct impact on consumers. Moreover, energy prices have risen considerably during the year, which has further eroded consumers’ purchasing power. Add to this the growing geopolitical tensions in the autumn, and it is easy to see why there is little risk appetite in the financial markets this year. For the time being, all this uncertainty is still faintly reflected in the earnings forecasts of listed companies, but we are likely to see a further decline in foreseen financial performance during the rest of this year. The fall in share prices during the year is therefore quite understandable, given the widespread uncertainties. However, when looking at this year's weak returns, it is advisable to bear in mind that we have had an extremely long period of near-excellent returns on risky asset classes, including equities. Another point worth remembering is that for long-term investors with a high risk-bearing capacity, a general fall in share prices may provide opportunities for gradually increasing equity risks. Indeed, valuation levels have become more reasonable, as shown by several indicators.

Other equity investments

VER’s other equity investments include investments in private equity funds and non-listed stock.

Private equity investments returned 13.4 per cent and unlisted equities 6.9 per cent.

At least so far, 2022 has been an excellent year for private equity funds. Although stock markets have been volatile, equity fund values have risen or remained stable. Other factors contributing to healthy returns include successful exits. However, expectations for year-end valuations are more pessimistic and values are expected to fall significantly towards the end of the year.

Underlying the sound returns on unlisted stocks is, again, the positive development of the private equity market.

OTHER INVESTMENTS

VER’s other investments are investments in real estate, infrastructure, hedge funds and systematic strategies.

The return on unlisted real estate funds was 5.0 per cent while infrastructure investments yielded 10.5 per cent.

So far the real estate market has remained reasonably stable, although rising interest rates and economic uncertainty have already had some impact on property values. They are expected to fall further towards the end of the year, but this will be partly offset by increasing rental income as a result of higher inflation. Even so, investor interest in sound real estate properties remains strong, although the transaction market is expected to slow down to some extent.

As in the previous year, the returns on infrastructure investments have been excellent in 2022. As a significant part of VER's infrastructure fund portfolio consists of so-called core infrastructure assets, market volatility, financial appreciation and high inflation have not been felt in the portfolio, at least for the time being. However, the expectations regarding the rest of the year are cautious, with rising interest rates still affecting the valuation levels of companies.

Hedge funds and systematic strategies gave a 5.3 per cent return during the first three quarters.

Hedge funds also performed well in the third quarter and, as a rule, all funds generated positive returns this year. An exceptionally impressive performance is being put in by macro and quantitative funds. Similarly, multistrategy funds have been successful in taking advantage of the higher-volatility environment. For systematic strategies, the reporting period has been more challenging, as reflected in the performance of equity-focused strategies in particular.

STATE PENSION EXPENDITURE, VER’S TRANSFERS TO THE GOVERNMENT BUDGET, PENSION CONTRIBUTION INCOME AND FUNDING RATIO

VER’s role in balancing government finances has grown and will continue to do so over the next few years. In 2021, the state’s pension expenditure totalled over EUR 4.9 billion while the 2022 budget foresees an expenditure of nearly EUR 4.9 billion. As VER contributes 40 per cent towards these expenses to the government budget, the transfer to the 2022 budget will amount to about EUR 1.9 billion.

By the end of September, VER had transferred EUR 1499 million to the government budget. Over the same period, VER’s pension contribution income totalled EUR 1221 million. The pension contribution income matched the forecast. VER’s net pension contribution income has now turned permanently negative, meaning that clearly more money is transferred from VER to the government budget than VER receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund.

On 31 December 2021, the State’s pension liabilities amounted to EUR 93.3 billion, while the funding ratio was 25.4 per cent.

The Act on the State Pension Fund was amended in spring 2022. As part of this amendment, VER’s contribution to the government budget was increased as of 2024. Consequently, VER’s budget transfers will increase from the current 40 per cent to 45 per cent during 2024–2028. Additionally, if the funding ratio exceeds 25 per cent for two years running, an additional 3 percentage point transfer to the budget will be carried out. Hence, the 25 per cent limit serves as a sort of ceiling for VER’s funding ratio.

As part of the legal amendment, the Ministry of Finance also decided to update VER’s standing orders, which sets out guidelines and restrictions for VER’s management of pension funds. Under the new orders, VER shall invest a minimum of 30 per cent in fixed income instruments and 20 per cent in liquid and low-risk fixed income instruments. The ceiling for equity investments was raised from the current 55 to 60 per cent and that of other investments to 15 per cent. Fixed income and equity investments also include illiquid long-term fund investments in private equity, private credit and infrastructure funds.

VER will review its strategy based on these amendments. The strategy will be updated over the next few months at the same time as VER prepares its investment plan for 2023.

All figures presented in this interim report are preliminary and unaudited.