During the first quarter of the year, the pace of society, the economy and the marketplace has been set by the coronavirus (covid-19). The positive trend prevailing in the equity markets early this year was reversed over a period of one month from 24 February to 23 March, when the full extent of the infection and the speed at which it was spreading were revealed. At the same time, individual countries were compelled to introduce drastic measures that restricted economic activity and the freedom of movement of individuals. By the end of the quarter, a large number of European countries and the United States had imposed restrictions on the movement of people both inside the countries and across the borders. The decline of economic activity was unprecedented in scope and form.

At the same time, central banks and governments announced a number of strong support measures. The U.S. Federal Reserve made substantial cuts in interest rates and the Federal Government announced a major 2.3 billion dollar support package. Similarly, in Europe, the ECB launched a number of actions to support liquidity in the financial market while European governments introduced measures to support businesses and citizens.

The biggest daily falls in stock prices in the U.S. market, which carries the greatest weight in the global index, were witnessed on 12 March (-9.5%) and 16 March (-12.0%). Sharp rallies are also typical for these types of crises. The strongest increase was experienced after the Federal Reserve’s announcement of the financial package on 24 March when the equity markets soared by +9.3% in a single day.

VER’S RETURNS ON INVESTMENTS

Future monitoring and evaluation of the State Pension Fund’s investment activities will increasingly focus on long-term outcomes and future prospects instead of quarterly reporting. However, VER will continue to post quarterly figures and comments to the same extent as previously.

On 31 March 2020, VER’s investment assets totalled EUR 17.9 billion. During the first quarter, the return on investments at fair values was -12.6 per cent.

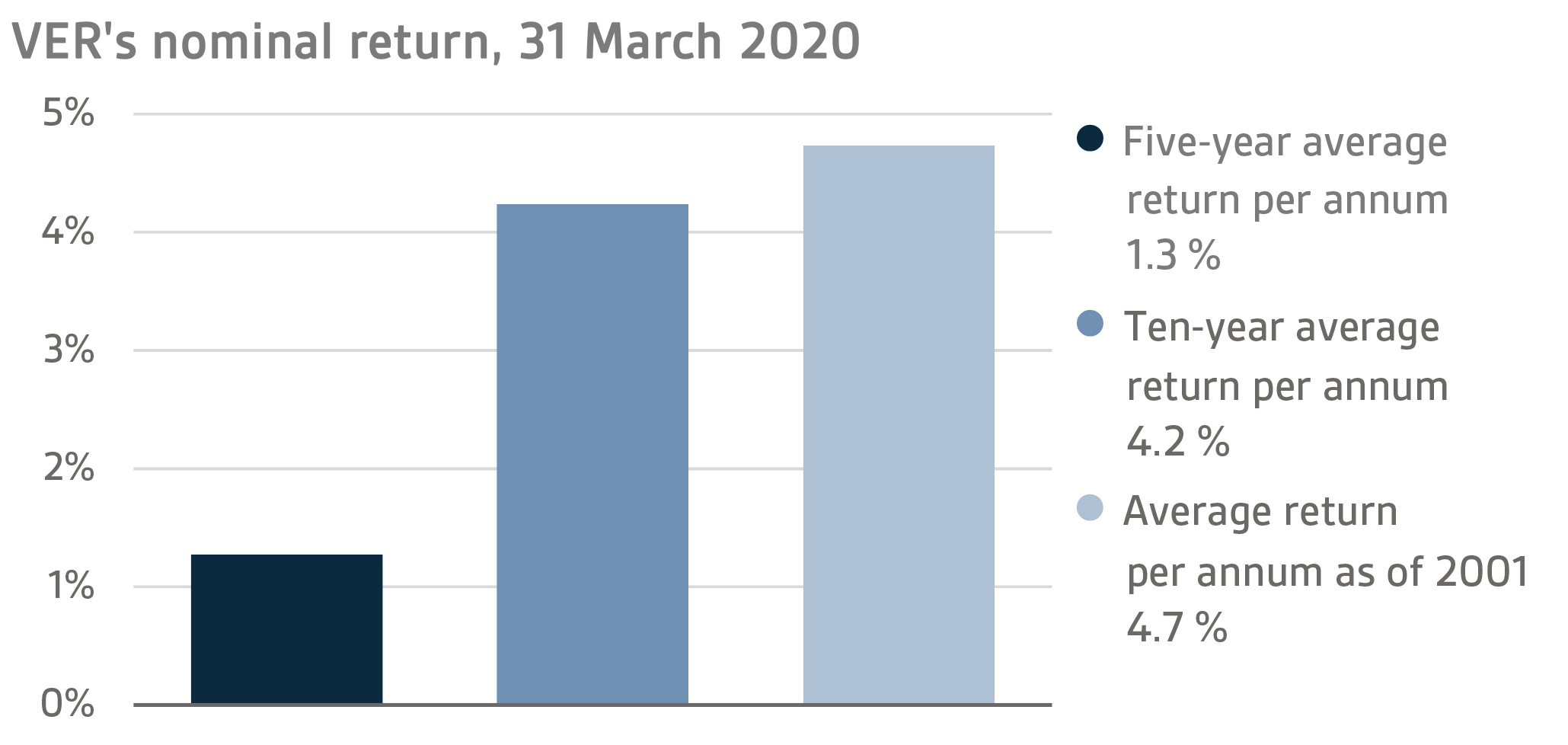

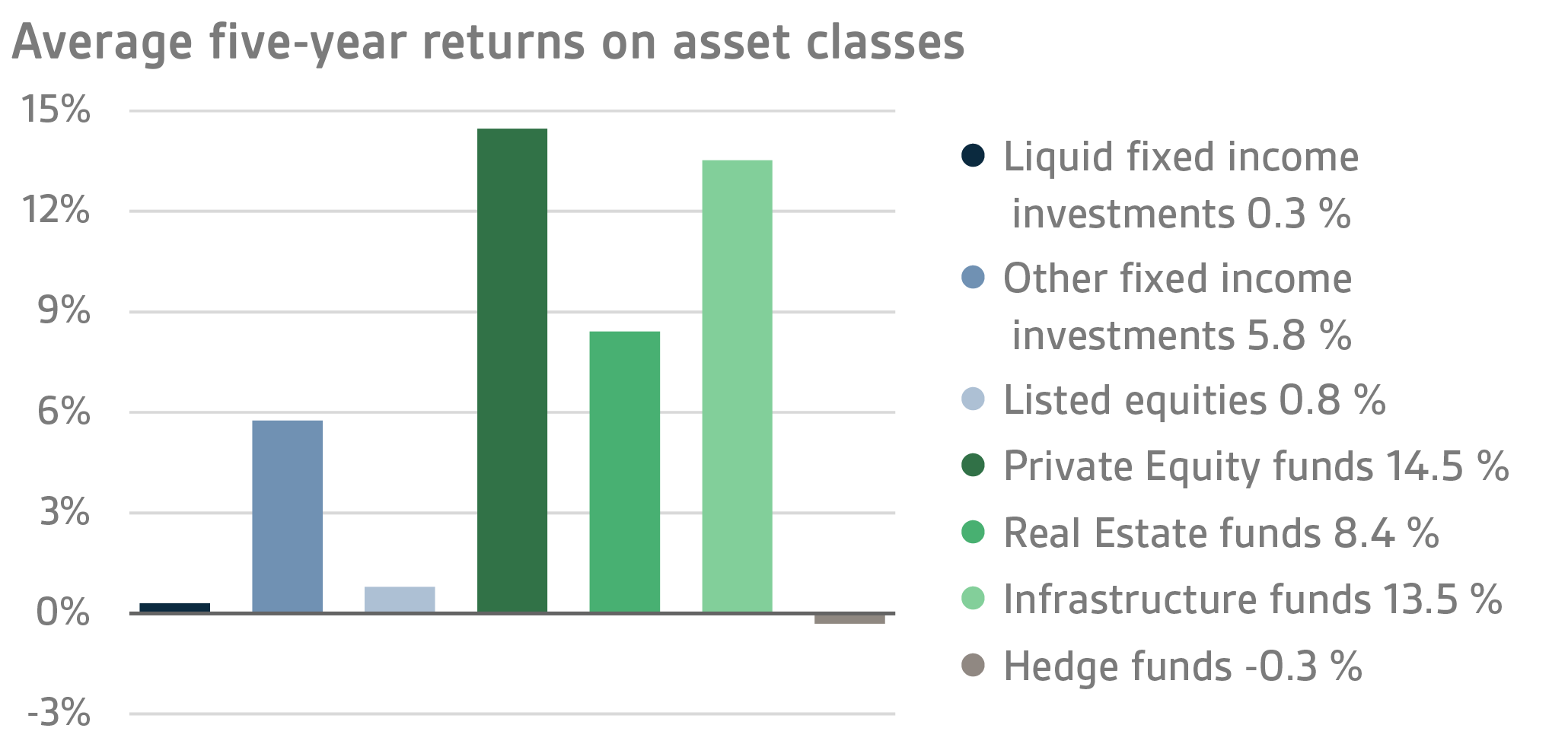

The average nominal rate of return over the past five years (1 April 2015–31 March 2020) was 1.3 per cent and the annual ten-year return 4.2 per cent. Since 2001, when VER’s activities assumed their current form, the average rate of return has been 4.7 per cent.

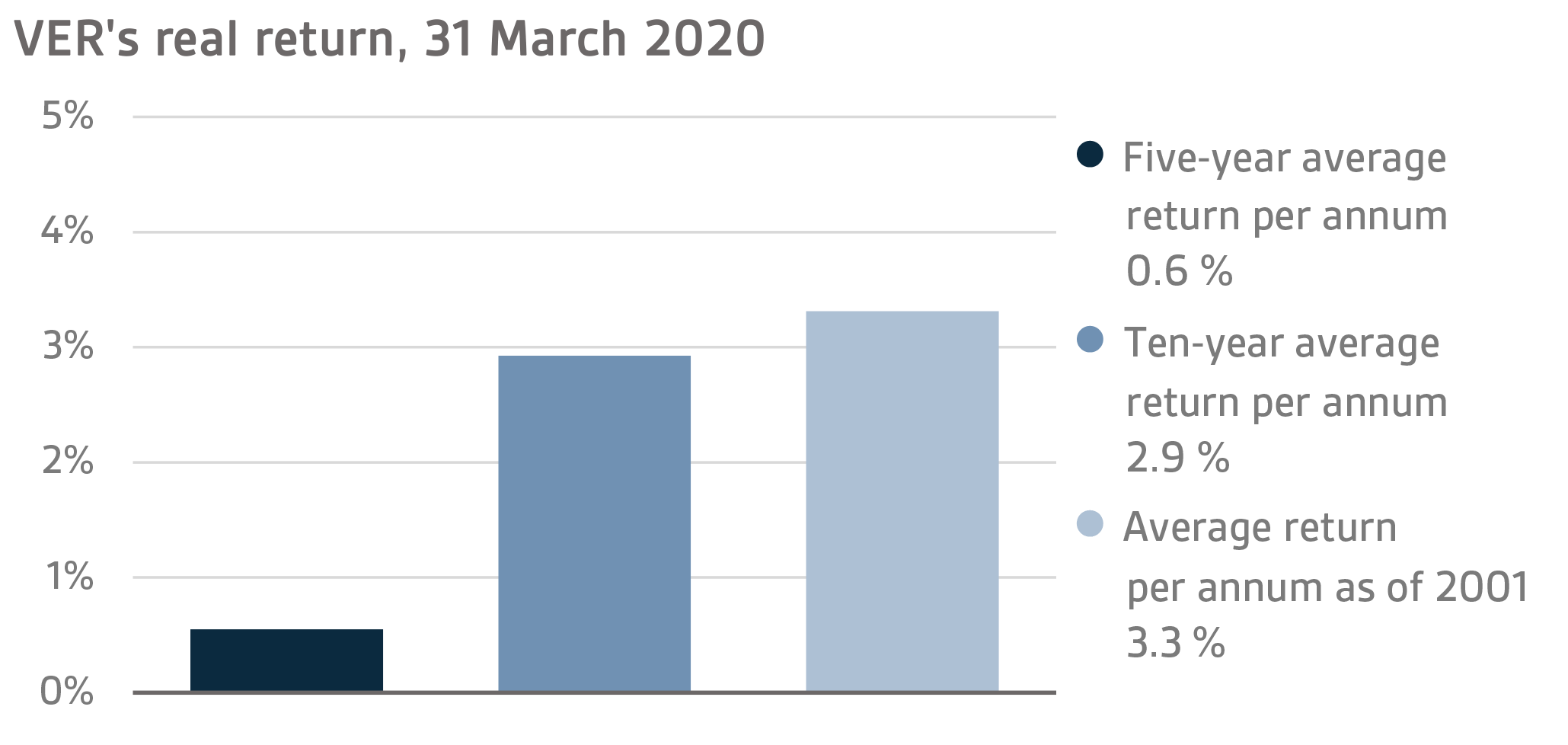

The real rate of return during the first quarter of 2020 was -12.5 per cent. VER’s five-year average real return was 0.6 per cent and ten-year real return 2.9 per cent. Since 2001, when VER’s activities assumed their current form, the average rate of return has been 3.3 per cent.

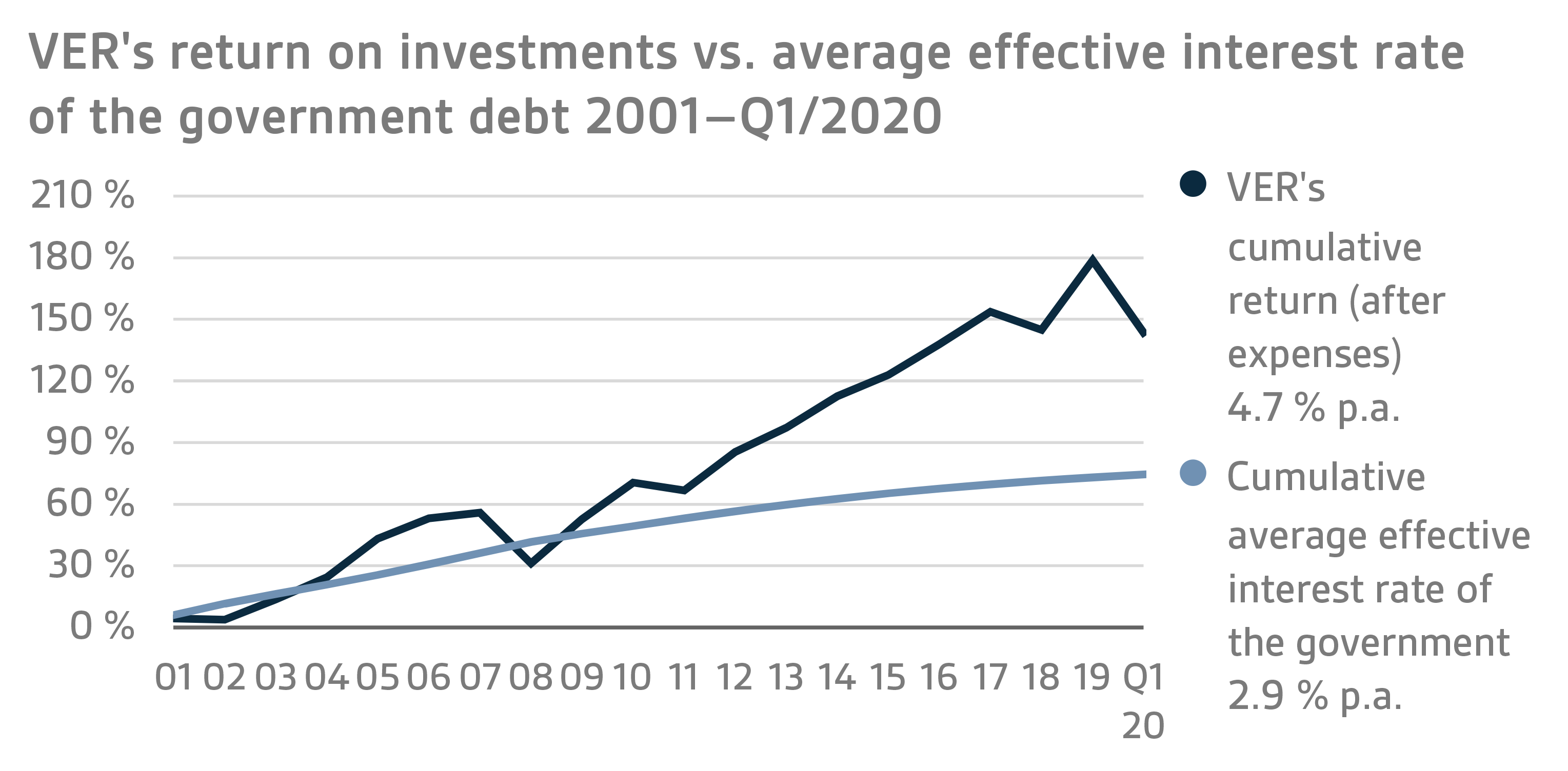

From the State’s point of view, it is pertinent to compare the return on investments with the cost of net government debt, because the funds accumulated in preparation for future pension expenditure can be deemed to reduce such debt. Over the past ten years, VER’s average annual rate of return has beaten the cost of net government debt by 2.6 percentage points. Since 2001, the total market-value returns earned by VER have exceeded the cumulative average cost of equivalent government debt by about EUR 4.6 billion over the same period.

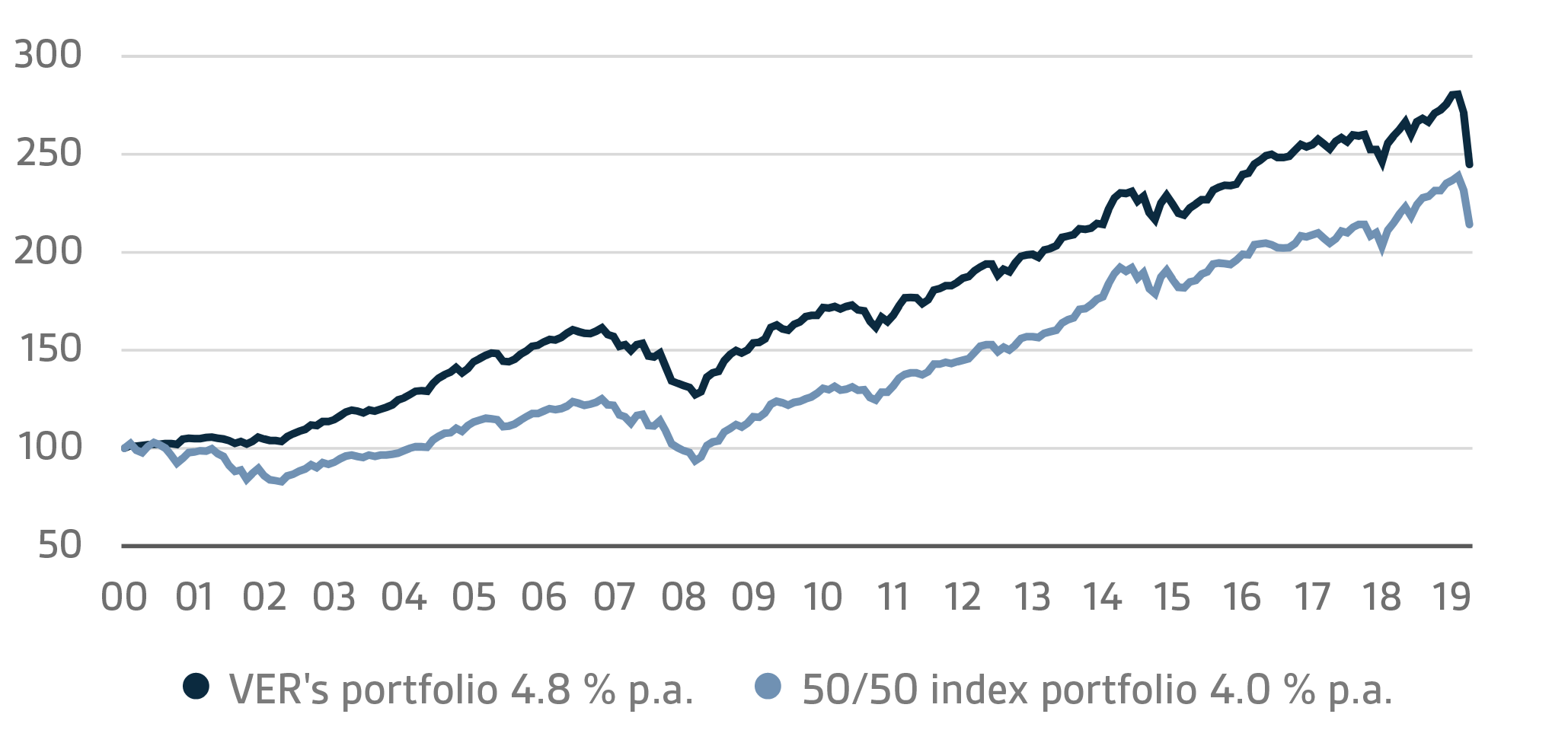

VER monitors long-term return relative to overall market developments by comparing the actual return with a global index, in which the weight of both equities and currency-hedged bonds is 50 per cent.

A CLOSER LOOK AT JANUARY–MARCH 2020

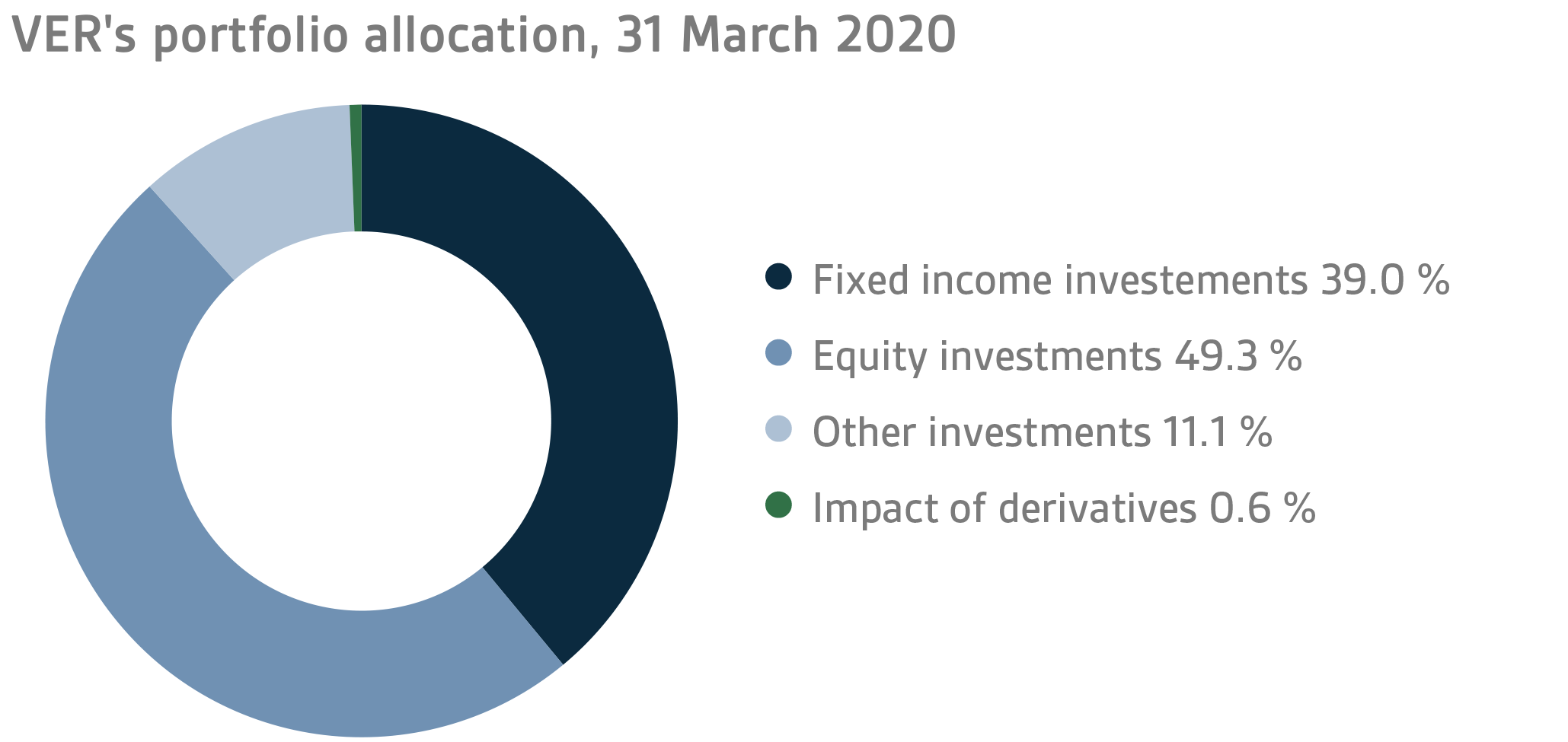

In accordance with the directive of the Ministry of Finance, VER’s investments are divided into fixed income instruments, equities and other investments. At the end of March, fixed income instruments accounted for 39.0 per cent, equities 49.3 per cent and other investments 11.1 per cent of the total. Of the large asset classes, liquid fixed income instruments generated a return of -5.6 per cent and listed equities -21.6 per cent during the first quarter of the year.

FIXED INCOME INVESTMENTS

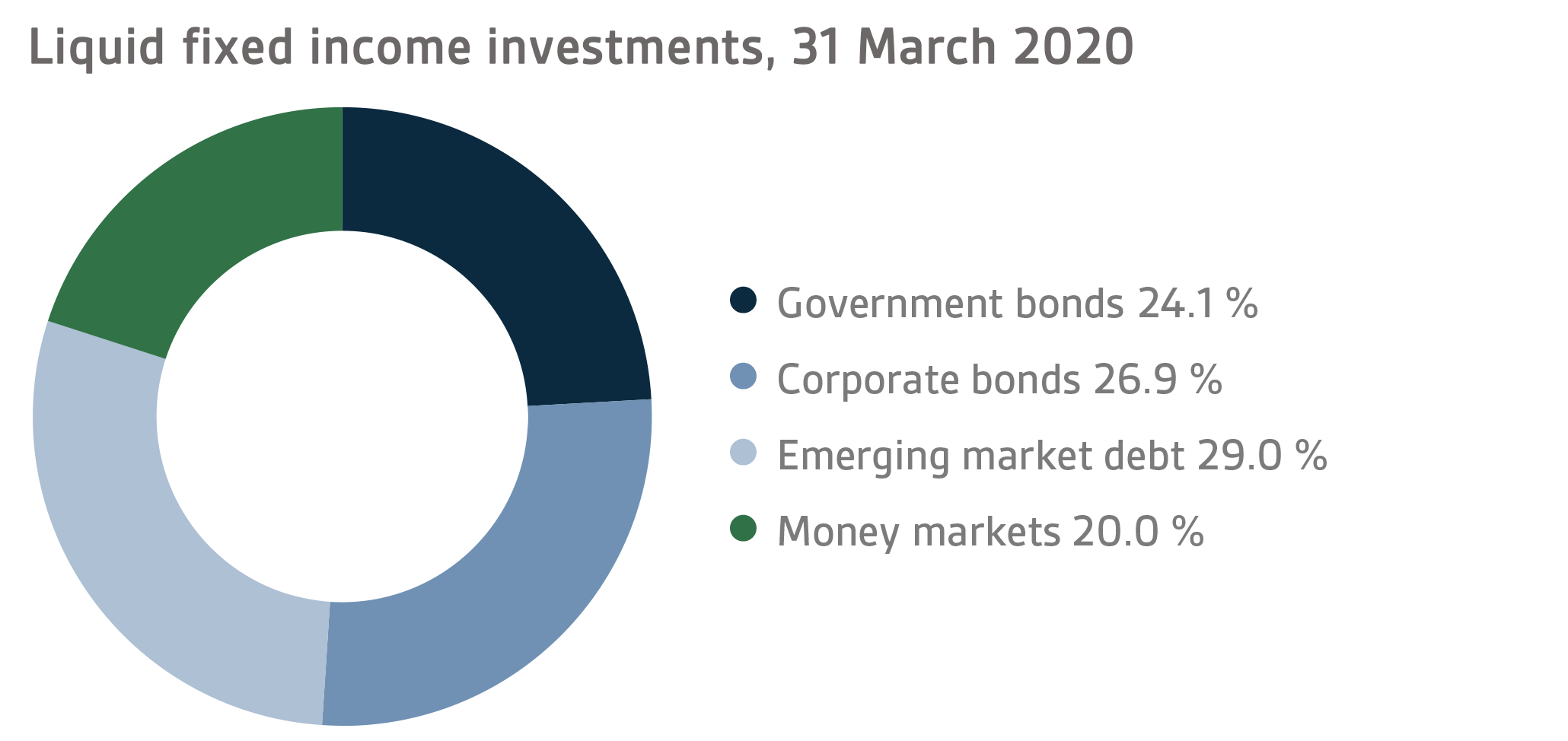

Liquid fixed income investments

During the first quarter, the return on liquid fixed income was -5.6 per cent.

Developments in the first quarter of the year were dominated by the covid-19 virus: the measures taken to contain the spread of the infection, the impact of these measures on the economy and the actions taken by central banks and governments to provide support.

In March, the U.S. Federal Reserve cut its benchmark rate twice between interest-rate meetings by a total of 150 basis points to 0–0.25 per cent. At the same time, the FED announced the launch of a stimulation programme to buy an unlimited number of government bonds and mortgages as well as corporate loans. Additionally, the FED made it possible to seek dollar liquidity through USD swap and repo operations. Although the European Central Bank (ECB) made no adjustments to the benchmark rates, it did increase quantitative easing for the current year by EUR 120+750 billion, and set the interest rate for the TLTRO III programme 25 basis points below the rate specified in the previous TLTRO conditions. At the same time, the capital requirements on banks were relaxed and access to short-term financing for companies improved by the introduction of a commercial paper purchase programme. Central banks are making a global effort to diminish the impact of the covid-19 virus on the economy.

However, the actions taken by central banks failed to calm the fixed income market despite the massive measures. The economic effects of the covid-19 pandemic sharply increased the credit risk premiums of investments in corporate loans and emerging market interest rates. At the same time, quick and big changes were witnessed in the interest rates on sovereign debt; for instance, the interests on U.S. and German government bonds, which have traditionally been seen as safe havens, fell to record lows in early March.

Two distinct trends were in evidence in returns on fixed income instruments in early 2020. Government bonds issued by developed countries, particularly the United States, gave healthy returns, whereas more risk-filled fixed income investments and corporate loans with a low credit rating fell in the red by more than ten per cent.

Other fixed income investments

Other fixed income investments include investments in private credit funds and direct lending to companies.

Fixed income instruments yielded a return of 1.1 per cent and private credit funds 1.6 per cent.

An adjustment to the private credit market was long overdue. When it finally materialised as a result of the covid-19 virus, it proved to be unexpectedly drastic and the adverse effects of the lockdown on businesses and, in particular, the travel industry and retail trade were substantial.

As in the previous years, the first-quarter return on private credit funds is in practice based on updated year-end valuations of 2019. Hence, the effects of the corona crisis are not yet reflected in the reported returns. As the year progresses and the crisis persists, returns on funds will suffer as a result of the weakening economy.

EQUITIES

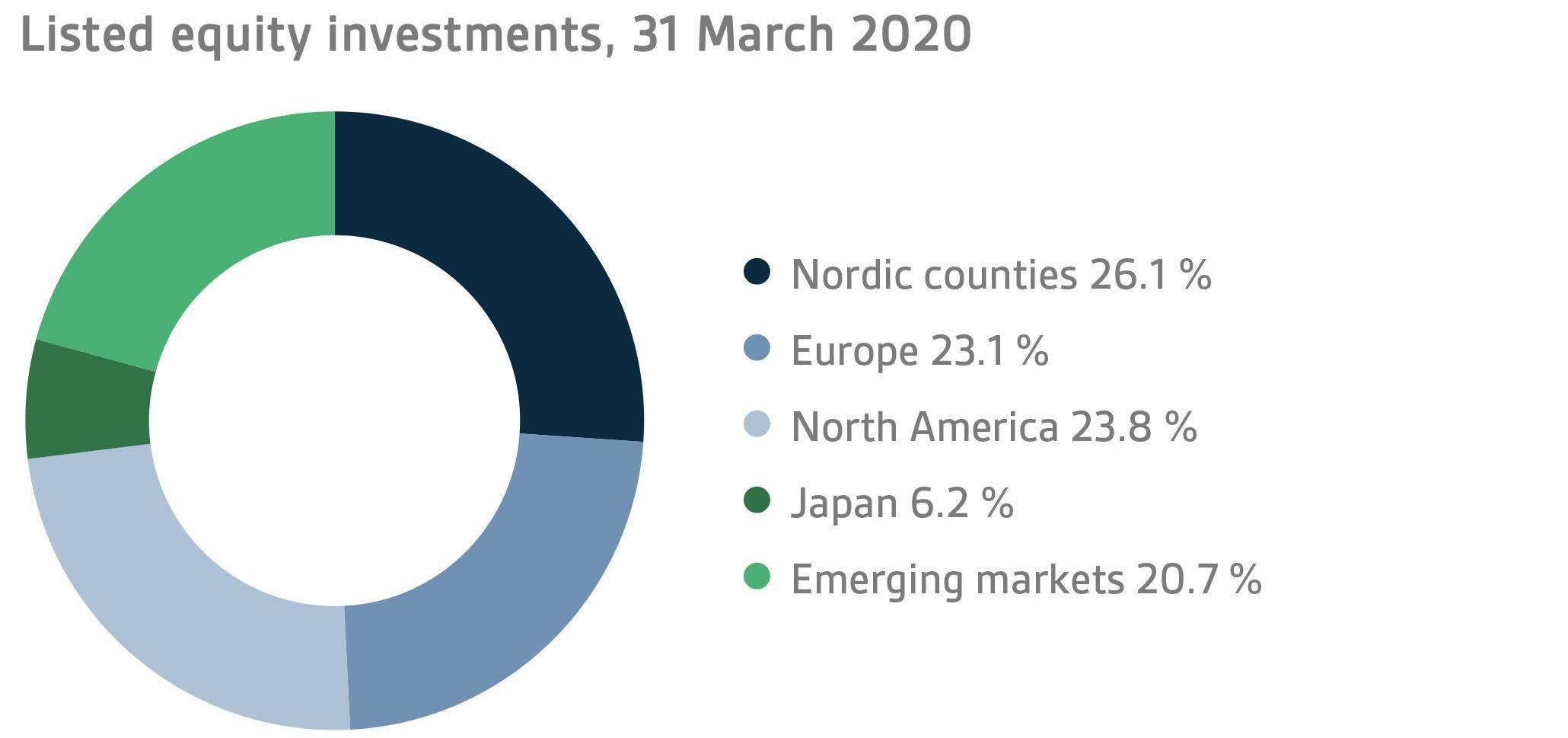

Listed equities

The return on listed equities during the first quarter of the year was -21.6 per cent.

Year 2020 got off to a brisk start in the equities market, but the mood changed dramatically towards the end of February, when the covid-19 pandemic began to spread in spades from China to the other continents. In many respects, the wave of viruses shook the financial markets, first in the form of an epidemic and then a pandemic, in a way that has never been experienced before. Although the market recovered slightly towards the end of the quarter, the returns for early 2020 remained negative.

At the beginning of 2020, the mood in the equity market was initially positive and investor’s risk appetite remained mostly at a high level up to mid-February. Most of the results reported for the last quarter of 2019 matched expectations and projections made by companies for the current year were largely favourable. While the spread of the coronavirus in China already made headlines in January, it appeared as if the relatively harsh measures taken by the Chinese government were effective in stopping the virus.

However, the mood in the market changed dramatically when the virus first spread to other Asian countries and then to Europe, primarily via northern Italy. Over a very short period of time, the situation escalated into a global pandemic. The measures announced by governments to contain the virus were massive. As entire countries self-isolated, the equity markets experienced an unprecendentedly quick and widespread fall. Equities were sold across the board with little regard to sector or continent. It all resulted in a global wave of equity sales unequalled by the financial crisis. However, governments and the world’s central banks were quick to announce unprecedented support packages, which, combined with new details on the nature of the virus, helped calm the markets towards the end of the quarter. Even so, performance in the first quarter of 2020 remained clearly negative.

Other equity investments

VER’s other equity investments include investments in private equity funds, non-listed stock and listed real estate investment trusts (REITs).

Private equity investments returned 2.8 per cent, unlisted equities 10.4 per cent and listed real estate investment trusts -25.8 per cent.

As in the previous years, the first-quarter return on private equity investments is based on updated returns earned in the last quarter of 2019. Hence, the fall of the equity market in early 2020 is not yet reflected in the returns. However, the administrative orders issued by governments as a result of the coronavirus are affecting company performance, and the new valuation levels to be released for the first quarter will decline. Future prospects are hazy and it is impossible to assess the total impact at this point.

The negative first-quarter return on listed real estate investment trusts is a reflection of the adverse developments taking place in the equity market.

OTHER INVESTMENTS

VER’s other investments are investments in real estate, infrastructure, hedge funds and risk premium strategies.

The return on unlisted real estate funds was 0.1 per cent while infrastructure investments yielded 1.3 per cent.

In real asset classes, the first-quarter returns are still updates on last year’s performance, and so the current market conditions are not yet visible. The effects of the coronavirus on the real estate market remained fairly modest in early 2020, although commercial and hotel properties, in particular, are feeling the impact. If the crisis is prolonged, the blow will also affect other types of properties, albeit to a lesser extent than, say, hotels and shopping centres. With infrastructure funds, all transport-related investments are suffering from the current situation, and a fall in values is evident in Q1 reports.

During the first quarter, the return on hedge funds was -8.3 per cent. The marked intermittent decline in liquidity in the first quarter posed problems to many strategies, some of which managed to recover quite well due to improved liquidity made possible by the FED. The best performance among VER’s funds was put in by the volatility fund, which benefited from much increased volatility on all fronts. In VER’s portfolio, the period was hardest for the macro and quantitative funds.

Risk premium strategies returned -14.8 per cent during the first quarter. Most of the losses incurred by risk premium funds were due to macro models and sharply increased volatility. By contrast, the derivative-based strategies in the portfolio did well in the reporting period.

STATE PENSION EXPENDITURE, VER’S TRANSFERS TO THE GOVERNMENT BUDGET, PENSION CONTRIBUTION INCOME AND FUNDING RATIO

The State Pension Fund’s role in balancing government finances has grown and will continue to do so. In 2019, the state’s pension expenditure totalled over EUR 4.7 billion while the 2020 budget foresees an expenditure of nearly EUR 4.8 billion. As VER contributes 40 per cent towards these expenses to the government budget, the transfer to the 2020 budget will amount to about EUR 1.9 billion.

During the first quarter, VER transferred EUR 486 million to the government budget. Over the same period, VER’s pension contribution income totalled EUR 358 million. The pension contribution income matched the forecast. VER’s net pension contribution income has now turned permanently negative, meaning that clearly more money is transferred from the Fund to the government budget than VER receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund.

In June 2016, the Board of Directors of the State Pension Fund adopted a strategy that defines its long-term objectives in greater detail. The strategy foresees that the 25 per cent funding ratio target specified by law will be attained by 2033, if not earlier. To achieve this, it is imperative that VER’s pension contribution income remains at the estimated level and that the real return on investments remains relatively high. As the state’s pension liabilities amounted to EUR 92.7 billion at the end of 2019, the funding ratio was approx. 22 per cent. Additionally, the strategy sets out the principles by which the risk level and basic allocation of the investment portfolio are derived from the target funding ratio established for VER.

All figures presented in this interim report are preliminary and unaudited.