VER’s return on investment 2.2% during 1 Jan–31 March 2023; ten-year average annual return 5.2%

Published 2023-04-26 at 13:55

INVESTMENT ENVIRONMENT

The investment year 2023 started on an optimistic note. Markets continued to perform well as fears of an ever-tighter monetary policy began to dissipate. Interest rate increases by the US and euro area central banks were expected to continue until the spring, after which the monetary policy was believed to move in a more expansionary direction in the face of falling inflation rates and weakening economic prospects. However, in February, the hopes of an abating inflation were dimmed.

Problems with Silicon Valley Bank surfaced in the USA in early March. The bank was taken over by the government. Effective action by the authorities, the Department of the Treasury and the Federal Reserve succeeded in calming the markets. At the same time, Credit Suisse of Switzerland ran into trouble. The developments created distrust in several banks. By the end of March, financial markets had calmed down thanks to the timely decisions and supportive measures taken by the authorities.

Economic performance was mixed. In early 2023, China lifted its Covid restrictions, which boosted expectations of economic growth in China. It was believed to generate additional demand and benefit a large number of companies. As far as business cycles were concerned, questions were raised as to whether the US and European economies would enter a downturn and for how long.

Military operations in Ukraine continued during the early 2023 and were expected to intensify in the spring. One major change was China’s growing role as a sympathizer of Russia. China has been trying to find a solution to the situation in Ukraine, but this has not led to serious negotiations.

VER’S RETURN ON INVESTMENTS

Future monitoring and evaluation of the VER’s investment activities will focus on long-term outcomes and future prospects instead of quarterly reporting. However, VER will continue to post quarterly figures and comments.

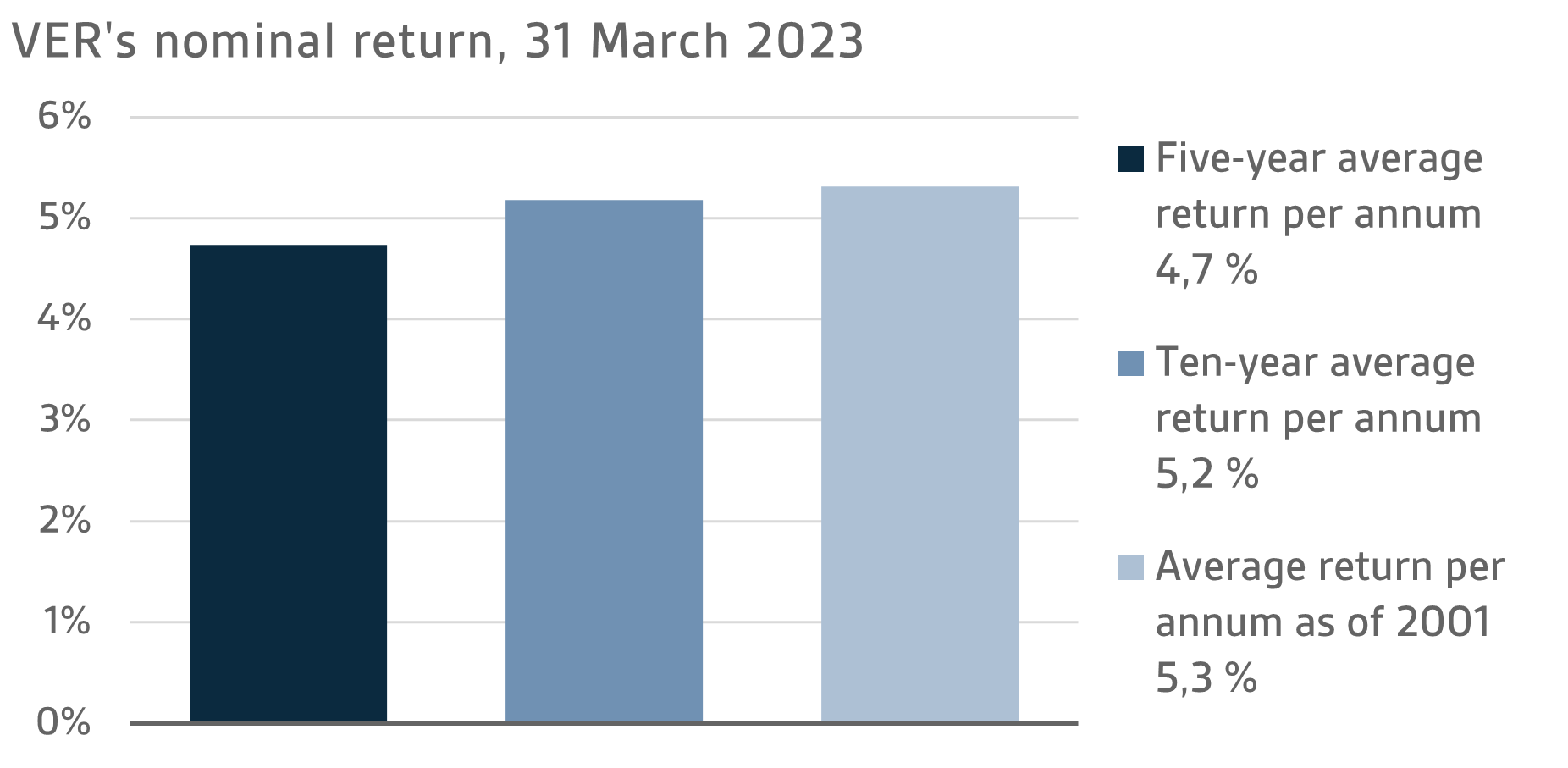

On 31 March 2023, VER’s investment assets totalled EUR 21.9 billion. During the first quarter, the return on investments at fair values was 2.2 per cent. The average nominal rate of return over the past five years (1 April 2018–31 March 2023) was 4.7 per cent and the annual ten-year return 5.2 per cent. Since 2001, when VER’s activities assumed their current form, the average rate of return has been 5.3 per cent.

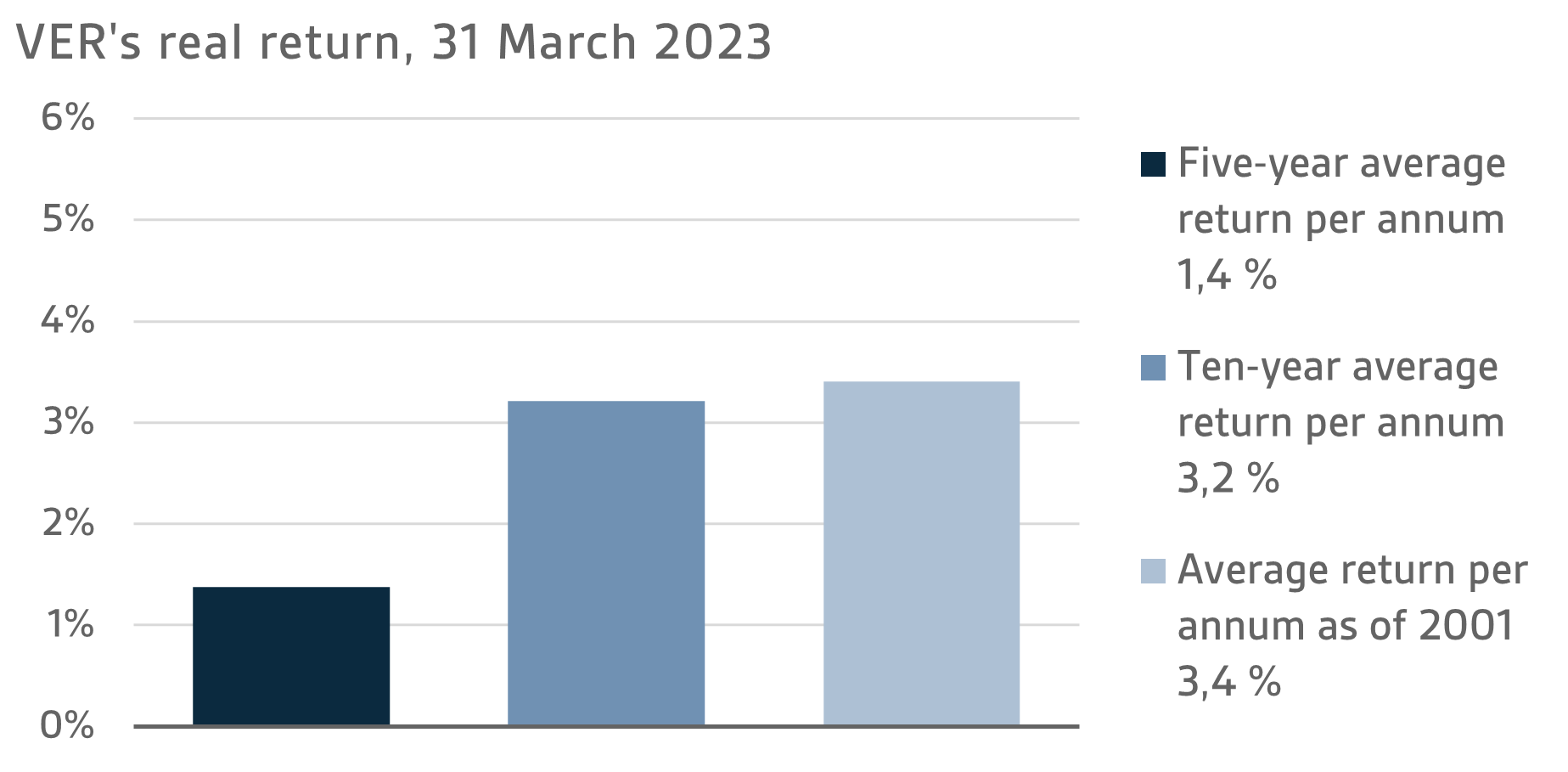

The real rate of return during the first quarter of 2023 was 0.1 per cent. VER’s five-year average real return was 1.4 per cent and ten-year real return 3.2 per cent. Since 2001, when VER’s activities assumed their current form, the average real rate of return has been 3.4 per cent.

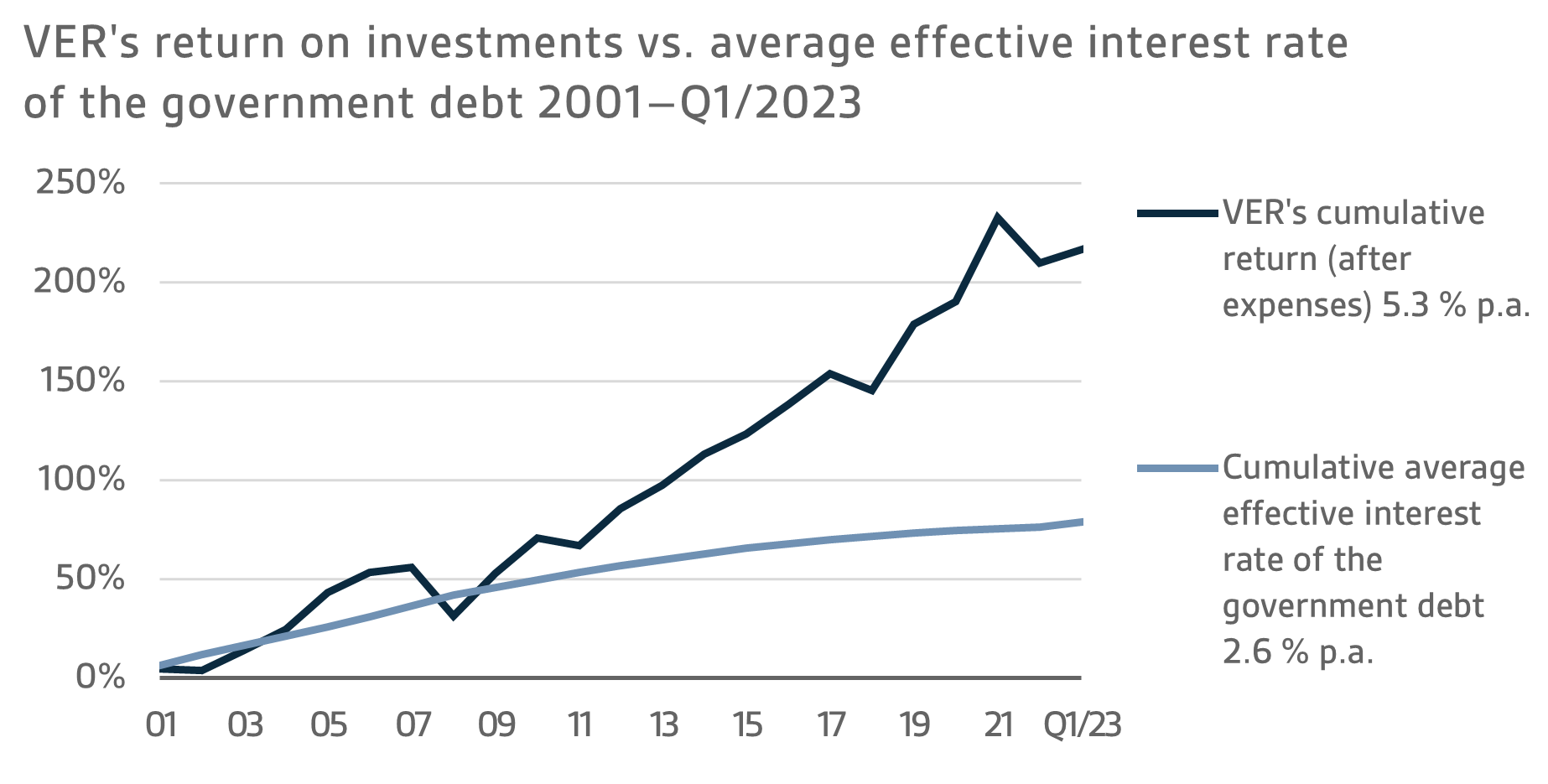

From the State’s point of view, it is pertinent to compare the return on investments with the cost of net government debt, because the funds accumulated in preparation for future pension expenditure can be deemed to reduce such debt. Over the past ten years, VER’s average annual rate of return has beaten the cost of net government debt by 4.0 percentage points. Since 2001, the total market-value returns earned by VER have exceeded the cumulative average cost of equivalent government debt by about EUR 9.3 billion over the same period.

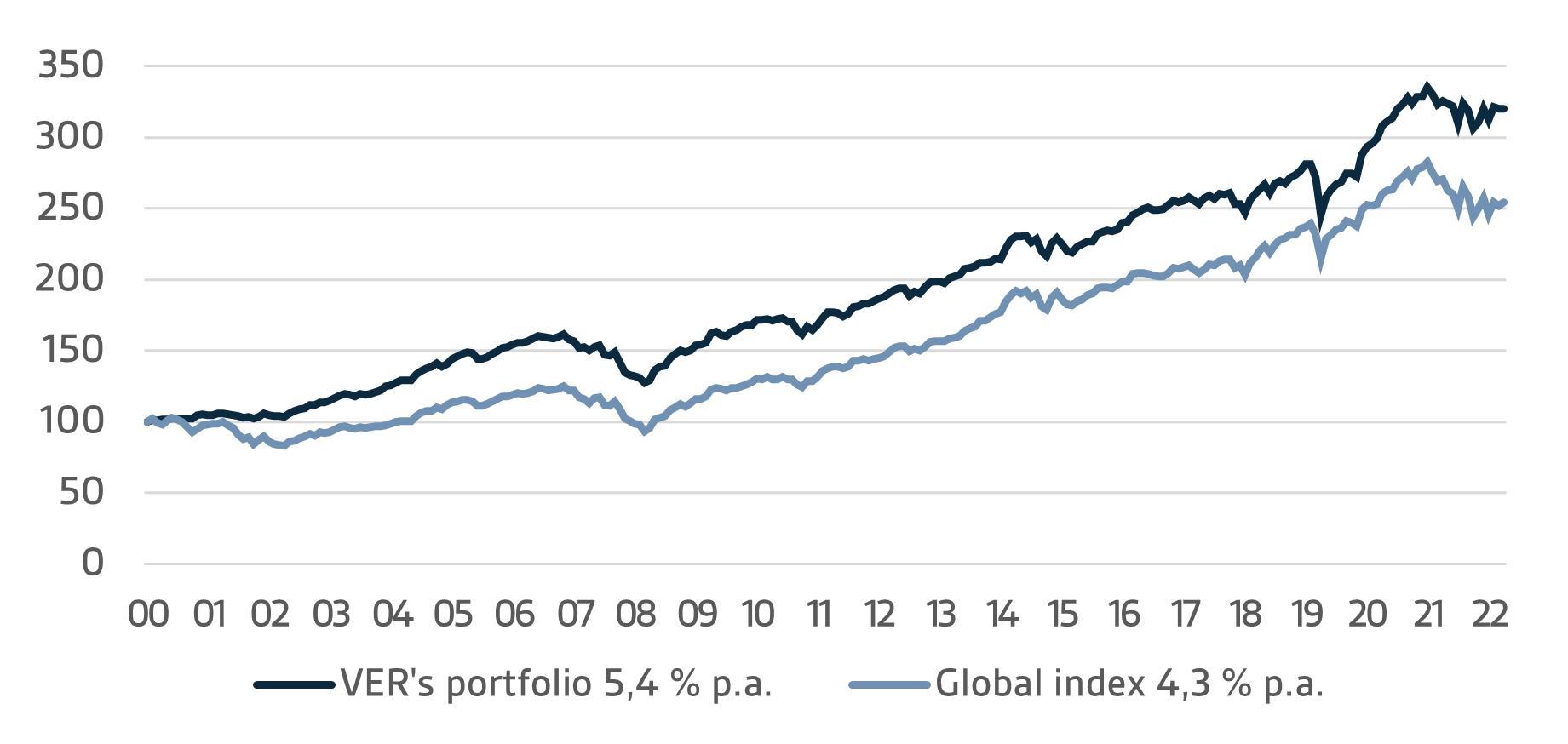

VER monitors long-term return relative to overall market developments by comparing the actual return with a global index, in which the weight of both equities and currency-hedged fixed income investments is 50 per cent.

A CLOSER LOOK AT JANUARY–MARCH 2023

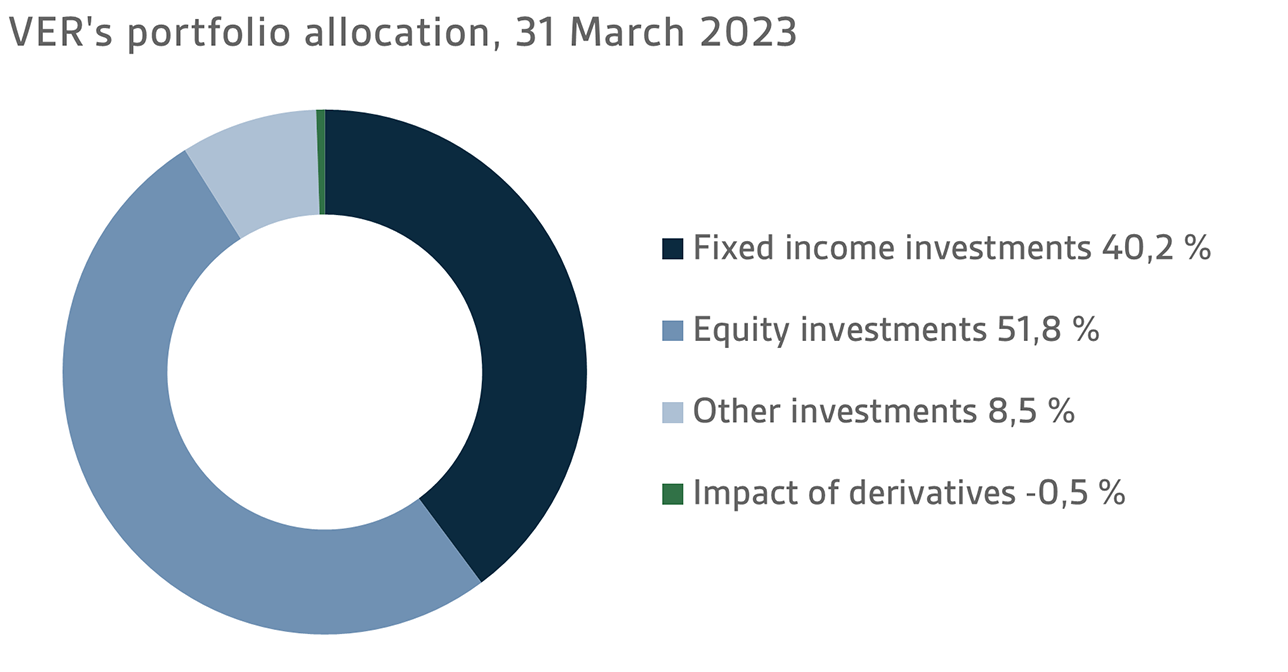

In accordance with the directive of the Ministry of Finance, VER’s investments are divided into fixed income instruments, equities and other investments. At the end of March, fixed income instruments accounted for 40.2 per cent, equities 51.8 per cent and other investments 8.5 per cent of the total. Of the large asset classes, liquid fixed income instruments generated a return of 1.7 per cent and listed equities 4.1 per cent during the first quarter of the year.

FIXED INCOME INVESTMENTS

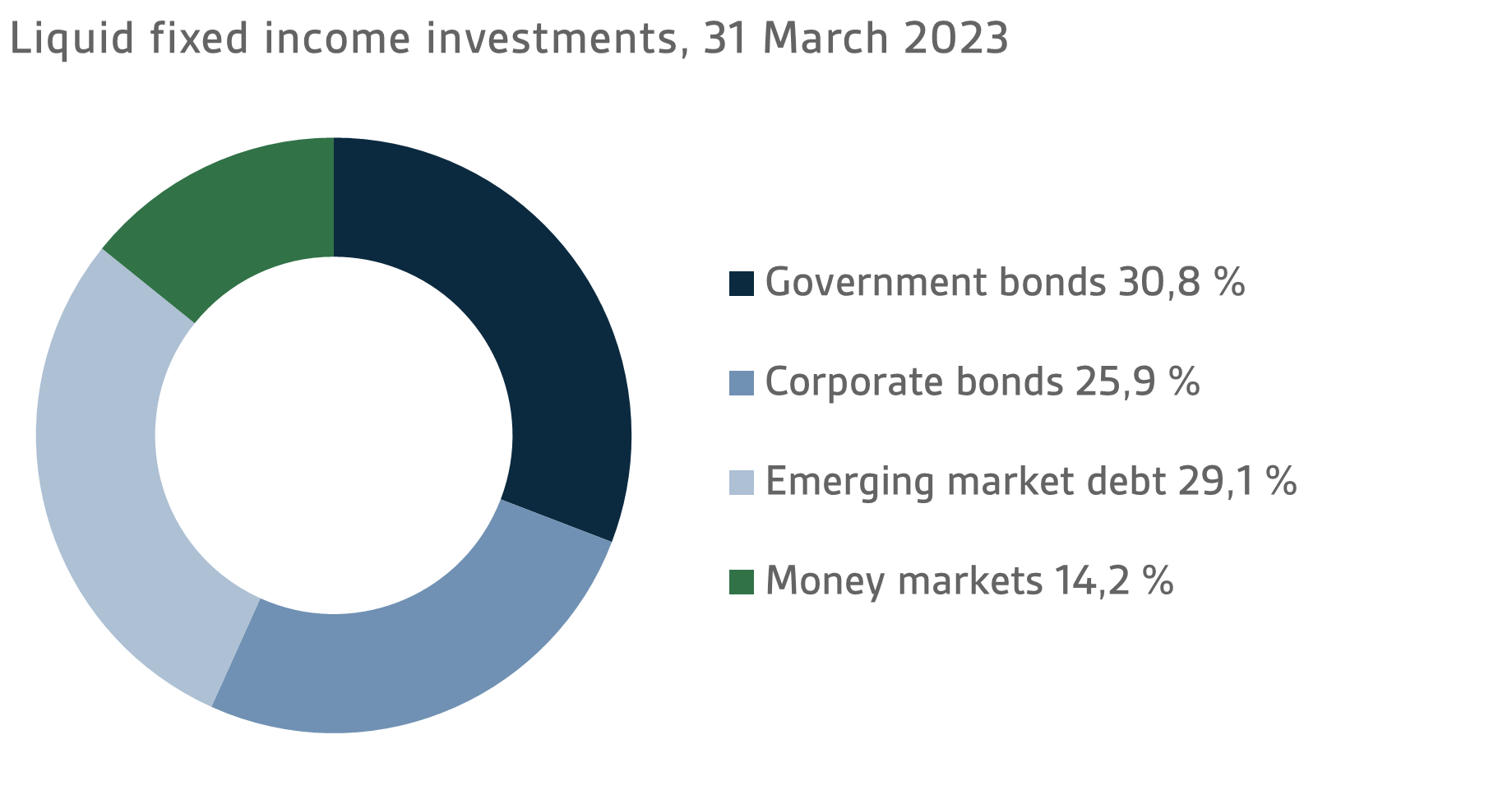

Liquid fixed income investments

During the first quarter, the return on liquid fixed income instruments was 1.7 per cent.

During the same period, both the US Federal Reserve (FED) and the European Central Bank (ECB) continued to tighten monetary policy by raising their policy rates in both February and March. The FED raised bank rates by 25 basis points at both meetings to range from 4.75% to 5.00%, and the March update of the FED's interest rate projections still forecast one more hike for 2023. For its part, the ECB raised its policy rates by 50 points at both meetings, bringing the deposit rate to 3.0%, the highest since 2008. Assumptions of interest rate hikes by the central banks peaked in early March, after which the expectations of a need for a monetary tightening were reversed by the problems in the banking sector on both sides of the Atlantic.

The collapse of Silicon Valley Bank in the US following a bank run and the takeover of Credit Suisse by UBS in Europe raised concerns about potential wide-spread problems in the banking sector. This situation will complicate central banks' future decision-making on monetary policy, as the problems are at least partly attributable to the fast pace at which monetary policy was tightened considerably. The authorities responded swiftly to the problems and a number of measures were taken to maintain financial stability. At the end of March, the risk premiums on corporate bonds were restored close to year-end levels after having spread in early March following the problems with the banks. However, interest rate volatility increased markedly in March, as uncertainty about economic growth, inflation, the state of banks and the future monetary policy of central banks grew.

Of VER's liquid fixed income investments, the best returns were generated by higher-risk instruments, such as the investments in emerging market debt denominated in local currencies and lower-rated corporate bonds. Returns on all liquid fixed income asset classes were clearly positive in the first quarter after the weak performance in 2022.

Other fixed income investments

Other fixed income investments include investments in private credit funds and direct lending to companies.

The return on other fixed income investments was -0.3 per cent. Private credit funds returned -0.6 per cent and direct lending 1.2 per cent.

The rise in interest rates as of the autumn created a highly attractive environment for private credit funds, as illiquid loans are mostly floating rate loans. However, the markets were concerned about a potential increase in corporate defaults as a result of rising financing costs. So far, VER's portfolio funds have been quite stable. The returns generated in the first quarter of the current year still reflect the sentiment prevailing at the end of the previous year, as the portfolio's return is based on updated year-end returns.

EQUITIES

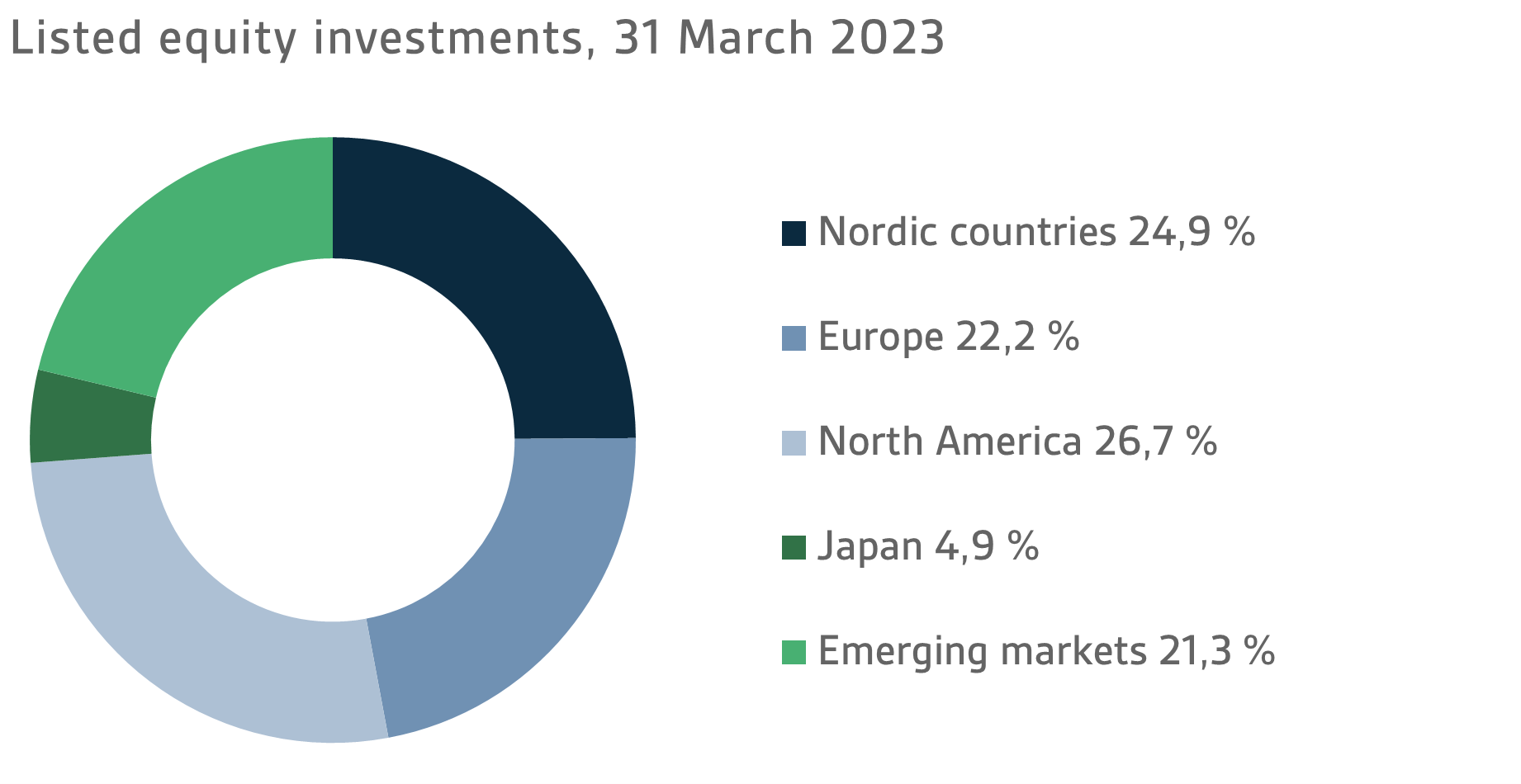

Listed equities

The return on listed equities during the first quarter was 4.1 per cent.

At the beginning of 2023, the mood in the stock market was positive. Share prices around the world began to rise at the turn of the year, and January proved to be a very strong month for equities. Many of the sectors that had been among the worst performers in 2022 were now among the best, such as technology companies, especially in the USA, which put in a robust performance. While the rise was driven by a number of factors, the early 2023 inflation figures showed a slight slowdown, which reflected positively on riskier asset classes such as equities. China's re-opening following the relaxation of strict Covid restrictions was another bullish development giving a further boost to growth.

In the second week of March, however, the mood in the stock market took a dramatic turn for the worse. The main reason for this was the "regional bank crisis" in the United States, which was triggered by the problems at Silicon Valley Bank. Soon the crisis spread creating great uncertainty throughout the financial markets. Bank shares, in particular, fell sharply on both sides of the Atlantic. The US authorities quickly took major steps to contain the crisis, but despite these actions the uncertainty concerning the banking sector, and the financial system as a whole, persisted. Europe too experienced scary moments when Credit Suisse’s old problems resurfaced, sending shivers across the European banking industry. Again, the authorities acted promptly, and the bank was forced to merge with UBS very quickly indeed. The situation on financial markets calmed down markedly towards the end of March, as the banking crisis seemed to be easing, and stock markets recovered nicely at the end of March, although they still remained far from the levels seen at the beginning of the month. Although the bank crisis seems to be abating, it is still too early to assess its overall impact. Most likely, the bank crisis will continue to figure as a major theme in the financial markets for a long time to come.

Other equity investments

VER’s other equity investments include investments in private equity funds, infrastructure and unlisted equities.

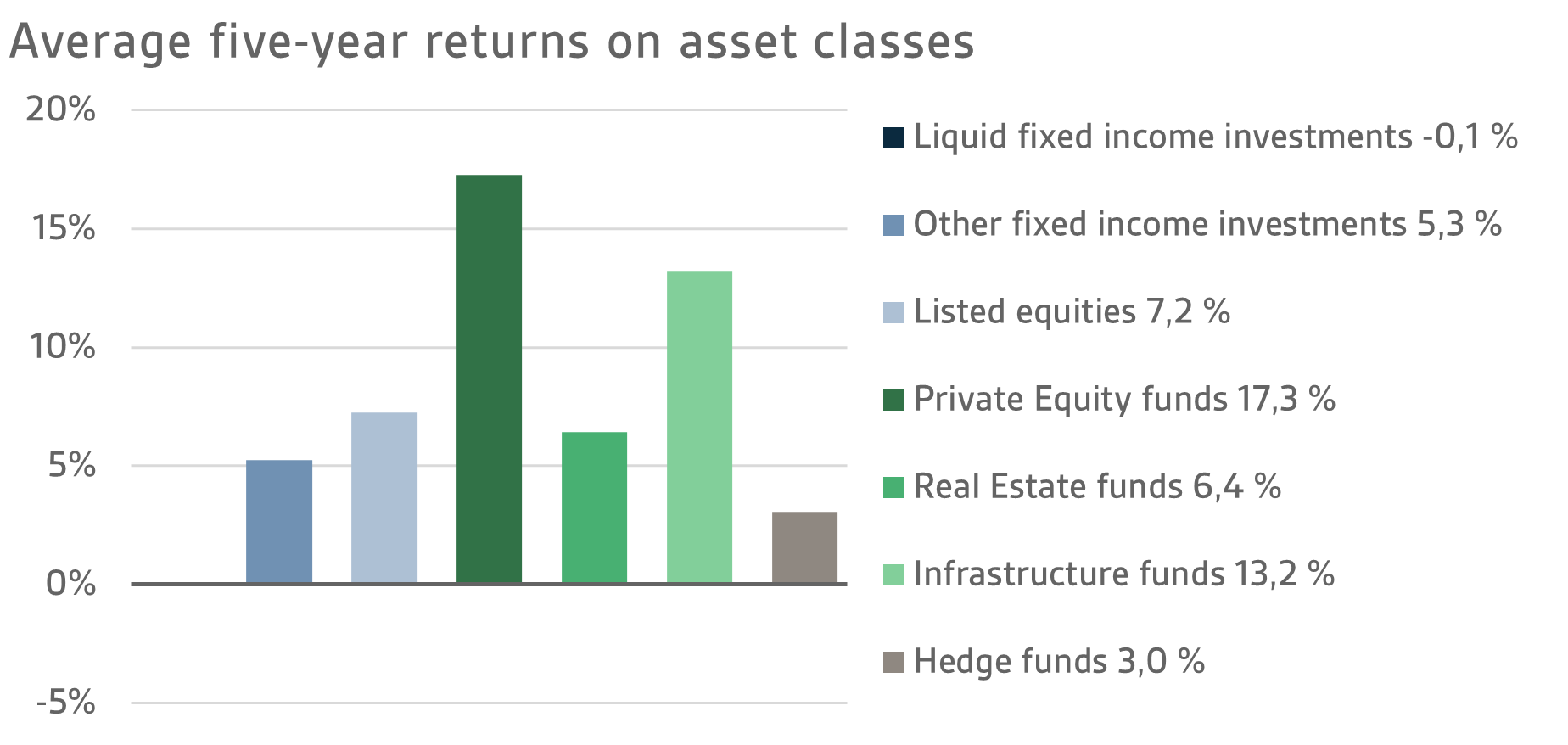

Private equity investments returned 0.1 per cent, infrastructure funds 0.1 per cent and unlisted equities 4.1 per cent.

Private equity investments gave surprisingly high returns in 2022. As a result, expectations for the current year have been mixed, especially in terms of valuation levels. Finding new funds proved to be challenging during the first quarter as investors struggled with over-allocations. As institutions strive to restore allocations to target levels, it is the secondary players who have benefited from the market. As in the past, the first-quarter returns on private equity funds are based on the updated values of the returns actually earned in the last quarter of the previous year. The first quarterly reports to be published later this spring will finally reveal the levels at which fund valuations ended up at the beginning of the year.

Similarly, the first-quarter returns on infrastructure funds represent updated returns actually earned in the last quarter of the previous year. Infrastructure assets have continued to perform relatively well in the prevailing market environment. As an inflation hedge, they have helped offset the valuation pressure due to rising interest rates.

OTHER INVESTMENTS

VER’s other investments consists of investments in real estate investment trusts, hedge funds and risk premium strategies.

The return on investments in unlisted real estate funds was -1.8 per cent.

During the first quarter, the transaction market in real estate investments remained rather quiet. Rising interest rates are exerting pressure on property yields, resulting in falling property values. If the problems in the banking sector persist, they could restrict access to debt financing, affecting the developments in the transaction market and real estate values.

Hedge funds and systematic strategies returned -0.4 per cent in the first quarter.

The best performing hedge funds in early 2023 were quantitative funds, all of which gave clearly positive returns. The multistrategy funds that did well last year returned close to zero during the first few months of the year. The least successful performers were macro funds, which returned -2.5 per cent overall. Movements in short interest rates, in particular, caused problems for this category of funds. By contrast, systematic strategies managed to benefit from the changes in interest rate curves.

STATE PENSION EXPENDITURE, VER’S TRANSFERS TO THE GOVERNMENT BUDGET, PENSION CONTRIBUTION INCOME AND FUNDING RATIO

The role of the State Pension Fund in equalising the government’s pension expenditure continues to grow. In 2022, the State’s pension expenditure totalled over EUR 5.0 billion while the 2023 budget foresees an expenditure of nearly EUR 5.3 billion. As VER contributes 40 per cent towards these expenses to the government budget, the transfer to the 2023 budget will amount to over EUR 2.1 billion.

During the first quarter, VER transferred EUR 532 million to the government budget. Over the same period, VER’s pension contribution income totalled EUR 384 million. The pension contribution income matched the forecast. VER’s net pension contribution income has now turned permanently negative, meaning that clearly more money is transferred from VER to the government budget than VER receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund.

VER reached its 25% funding ratio target on 31 December 2021, much earlier than expected. Following the attainment of the funding ratio, the Act on the State Pension Fund was amended and entered into force in April 2022. As part of this amendment, VER’s contribution to the government budget was increased as of 2024. Consequently, VER’s budget transfers will be increased from the current 40 per cent to 45 per cent during 2024–2028. If the funding ratio exceeds 25 per cent for two consecutive calendar years, an additional transfer of three percentage points will be made to the government budget. Given VER’s growing role in offsetting government pension expenditure and the increase in negative net transfers, VER’s funding ratio is expected to fall in the coming years.

Following the legal reform, VER’s Board of Directors initiated a strategy development process. The strategy was updated concurrently with the 2023 investment plan and adopted in January 2023. The objectives set out in the strategy create the basis for future investment activities. The baseline allocation of the investment portfolio is determined in the annual investment plan. Simulations suggest that the baseline allocation of the portfolio will achieve the long-term objectives established for VER.

KEY FIGURES

|

|

|

|

|

31.3.2023

|

31.12.2022

|

30.6.2022

|

|

Investments, MEUR (market value)

|

21 936

|

21 604

|

21 566

|

|

Fixed income investments

|

8 827

|

8 791

|

8 680

|

|

Equity investments

|

11 359

|

10 285

|

10 254

|

|

Other investments

|

1 867

|

2 777

|

2 640

|

|

Impact of derivatives

|

-117

|

-249

|

-8

|

|

|

|

|

|

Breakdown of the investment portfolio

|

|

|

|

|

Fixed income investments

|

40,2 %

|

40,7 %

|

40,2 %

|

|

Equity investments

|

51,8 %

|

47,6 %

|

47,5 %

|

|

Other investments

|

8,5 %

|

12,9 %

|

12,2 %

|

|

Impact of derivatives

|

-0,5 %

|

-1,2 %

|

0,0 %

|

|

|

|

|

|

1.1.–31.3.2023

|

1.1.-31.12.2022

|

1.1.–30.6.2022

|

|

Return on investment

|

2,2 %

|

-6,8 %

|

-7,3 %

|

|

Fixed income investments

|

|

|

|

|

Liquid fixed income investments

|

1,7 %

|

-8,2 %

|

-7,4 %

|

|

Other fixed income investments

|

-0,3 %

|

0,4 %

|

1,6 %

|

|

Private Credit funds

|

-0,6 %

|

-0,5 %

|

1,4 %

|

|

Equity investments

|

|

|

|

|

Listed equity investments

|

4,1 %

|

-12,4 %

|

-13,5 %

|

|

Private Equity investments

|

0,1 %

|

12,5 %

|

10,6 %

|

|

Unlisted equity investments

|

4,1 %

|

7,8 %

|

7,6 %

|

|

Other investments

|

|

|

|

|

Unlisted Real Estate funds

|

-1,8 %

|

4,1 %

|

3,9 %

|

|

Infrastructure funds

|

0,1 %

|

15,6 %

|

10,0 %

|

|

Hedge funds

|

-0,4 %

|

5,0 %

|

3,7 %

|

|

|

|

|

|

Pension contribution income, MEUR

|

384

|

1 610

|

819

|

|

Transfer to state budget, MEUR

|

532

|

1 982

|

999

|

|

Net contribution income, MEUR

|

-148

|

-372

|

-180

|

|

Pension liability, BnEUR

|

|

97

|

|

|

Funding ratio, %

|

|

22 %

|

|

Additional information: CEO Timo Löyttyniemi, firstname.lastname@ver.fi, tel.: +358 (0)295 201 210

Established in 1990, the State Pension Fund of Finland (VER) is an off-budget fund through which the State prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the State’s pension assets professionally. At the end of March 2023, the market value of the Fund’s investment portfolio stood at EUR 21.9 billion.

All figures presented in this interim report are preliminary and unaudited.