Annual Report 2021

Published 2022-02-28 at 13:00

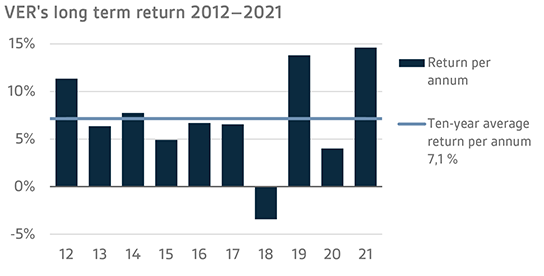

Return on investments was 14.6% in 2021 and ten-year average return 7.1%

INVESTMENT ENVIRONMENT

The return on the pension assets of the State Pension Fund of Finland (VER) was excellent in 2021. The interest rates remained historically low while economic growth gained momentum during the year. All the main asset classes yielded a positive return. Non-liquid investments and equities, in particular, gave excellent returns. The interest rates started creeping up as the economy recovered and the stock markets developed favourably throughout the year despite temporary dips.

Attempts to contain the spread of the coronavirus failed in spite of the newly introduced vaccines. Return to normalcy continued to be hampered by the virus and its new mutations. However, the support measures undertaken by governments and central banks created favourable conditions for the economy and investments.

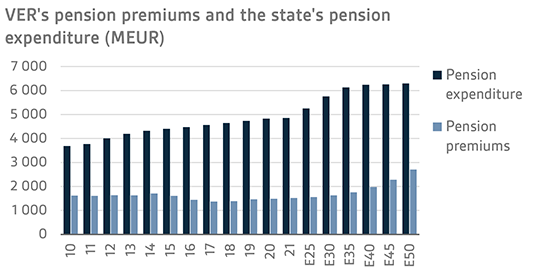

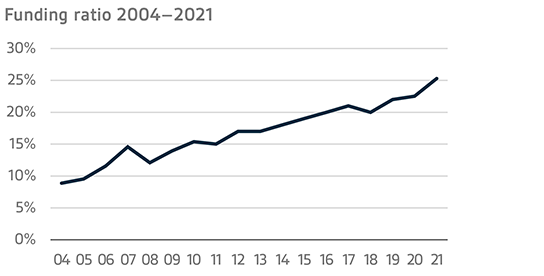

Every year more money is transferred from VER to the government budget than VER receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund. The Ministry of Finance has initiated a project to revise the Act on the State Pension Fund based on the proposal of the law review working party appointed in 2019. The funding ratio, i.e., the ratio of fund assets to pension liabilities, specified in the Act was achieved at the end of the year thanks to good returns. At the year-end, the funding ratio was 25.4 per cent. The amount of the State’s pension liabilities is determined annually based on the situation on 31 December.

VER’S RETURN ON INVESTMENTS

At fair values, the total return on the investments made by VER in 2021 was 14.6 per cent. VER’s average rate of return was 6.9 per cent for the past five years and 7.1 per cent for the past ten years.

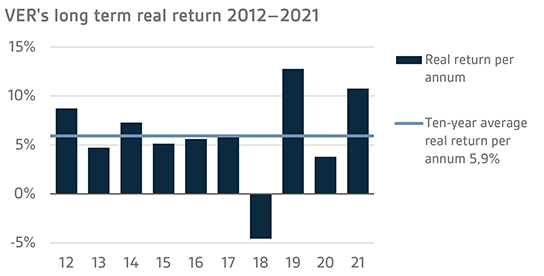

The real rate of return on investments in 2021 was 10.8 per cent. VER’s five-year average real return was 5.6 per cent and ten-year real return 5.9 per cent. The ten-year average real return exceeds the estimates used in the long-term financing calculations by a wide margin.

According to the objective established by the Ministry of Finance, VER’s long-term return must exceed the average cost of net government debt. Over the past ten years, VER’s average market value weighted rate of return has beaten the cost of net government debt by 5.8 percentage points. Since 2001, when VER’s operations assumed their current form, the total returns earned by VER have exceeded the average cost of government debt by about EUR 10 billion.

A CLOSER LOOK AT 2021

Both of VER’s two large asset classes, liquid fixed income investments and listed equities, gave positive returns in 2021. The return on liquid fixed income instruments was 0.7 per cent and that of listed equities 24.2 per cent. The returns on other asset classes were also positive, with unlisted equities (57.9%), private equity funds (47.7%) and infrastructure funds (14.9%) putting in the best performance.

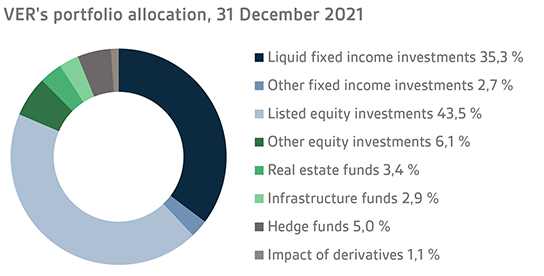

At the end of 2021, the market value of VER’s investment assets stood at EUR 23.6 billion. Of all the investments, fixed income instruments accounted for 37.9 per cent, equities 49.5 per cent and other investments 11.4 per cent of the total. The rest of the effect of risk-adjusted allocation was due to derivatives.

FIXED INCOME INVESTMENTS

Liquid fixed income investments

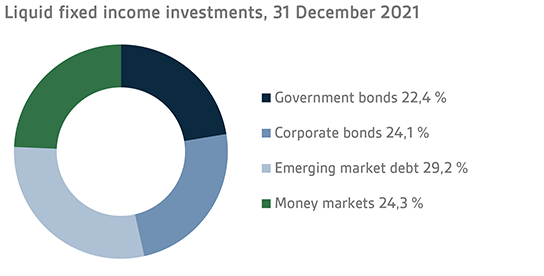

In 2021, the liquid fixed income investments returned 0.7 per cent and its risk-adjusted market value at the end of the year stood at EUR 8.3 billion. The duration of the fixed income portfolio remained shorter than the neutral duration of the portfolio for the entire year, while investments in government bonds were under-weighted.

Developments in 2021 were characterised by Covid-19, accelerating inflation and partly by the measures adopted by central banks to gradually tighten the monetary policy with a view to a return to more normal times.

During the year, the Federal Reserve revised up its growth and inflation forecasts substantially and updated its assessment of labour market prospects in a more positive direction. As a result, the FED reassessed, in the third quarter, its forecast for future interest rate hikes in 2022. At the beginning of the year, the bank had still believed that the first increases would not take place until after 2023. In December, the FED foresaw three 25-point hikes in 2022. Additionally, it started cutting back on its asset purchases in November, the plan being to end them completely in the first quarter of 2022. A positive trend in employment and economic growth and, above all, the accelerating inflation and growing inflationary expectations call for a normalization of monetary policy.

Similarly, the European Central Bank (ECB) started normalizing its monetary policy in September by scaling down purchases under the PEPP programme that had been temporarily increased. The ECB will stop the PEPP asset purchases in March 2022, but it will increase the rate of purchases under the APP programme in Q2 and Q3, partly to offset the impact of the closure of the PEPP programme. The ECB expects the surge in inflation to be short-lived and fall below the two per cent target without any material tightening of the monetary policy.

As far as VER’s liquid fixed income investments are concerned, the increase in interest rates eroded returns on emerging market dollar-denominated debt in particular. By contrast, US government bonds gave a healthy return thanks to the short duration and a stronger dollar despite the increase in interest rates. The risk premiums on corporate loans remained steady, and despite the increase in the underlying interest rate, the return on these loans was clearly positive, with loans of lower credit rating giving a downright excellent return.

Other fixed income investments

VER’s other fixed income investments include investments in private credit funds and direct non-liquid loans. Most of the private credit funds in the portfolio are private equity funds investing in non-liquid loans. At the end of the year, the weighting of other fixed income investments in VER’s portfolio was 2.7 per cent.

Although the year 2021 continued to be overshadowed by Covid-19 and a number of economic uncertainties, corporate financial performance improved on 2020. This was also reflected in private credit funds’ portfolio companies as the problems that had hampered the operations of a sizeable percentage of the businesses eased off. For companies engaged in mobility and retail-related sectors, the market situation remained difficult, even if some signs of recovery were discernible. The best performance was put in by funds with strategies designed to benefit from the uncertain market conditions.

The return on other fixed income investments was 11.6 per cent in 2021. The return on private credit funds was 13.1 per cent while direct lending yielded 6.1 per cent. One new fund investment of approx. EUR 88 million was made during the reporting period. At the end of the year, unfunded commitments totalled EUR 315 million.

EQUITIES

Listed equities

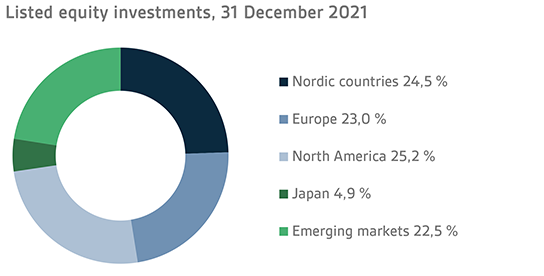

The year 2021 was very good for VER’s listed equities, which yielded a return of 24.2 percent. Another sign of the robust performance of the stock market was that VER’s equities portfolio did not show any monthly losses until September. The positive mood in the stock market was boosted by the recovery from the pandemic, particularly in regards to the financial performance of listed companies. Profits and expected returns continued to rise throughout the year, which contributed to the favourable development of the market. While a number of uncertainties persisted, they were not grave enough to reverse the positive trend. Among the main concerns during the year was the shortage of components, notably chips. There were also other uncertainties, such as the sharp increase in energy prices, that continued to trouble many listed companies. At the same time, investors continued to watch the rise in inflation closely. Despite all these uncertainties, 2021 proved extremely favourable for VER’s investments in listed equities. The best returns, no less than 36 per cent, were generated on the North American stock market.

In terms of market capitalisation, the value of the listed equities increased from EUR 9.8 billion at the end of 2020 to EUR 10.3 billion. During the reporting period, VER off-loaded stock-related risks by divesting large chunks of listed equities and fund units. At the end of 2021, direct equity investments accounted for 22.5 per cent and fund investments for 77.5 per cent of the total. At the end of the year, VER held direct investments in 89 companies and fund units in a total of 58 funds.

Other equity investments

VER’s other equity investments included investments in private equity funds and unlisted stock. At the end of the year, other equity investments in the portfolio accounted for 6.1 per cent of the total.

For private equity funds, the year 2021 was really favourable. Although still facing the pandemic and adversely affected by increased energy prices and chips shortage, most of the portfolio companies put in a positive performance. Moreover, the companies’ valuation levels increased throughout the year driven by the strong equity market. High valuation levels also permitted extremely successful exits. The year 2021 will be remembered not only for good returns on private equity funds but also for a large number of new fund launches.

The year-end return on private equity funds was 47.7 per cent. During the reporting period, some EUR 297 million was invested in seven funds. Unfunded commitments totalled EUR 726 million at the end of the year.

Investments in unlisted stocks consisted of investments in three companies. One was divested during the year. The return on the portfolio was 57.9 per cent at the end of the year.

OTHER INVESTMENTS

VER’s other investments are made in real asset funds (real estate and infrastructure funds) as well as hedge funds and systematic strategies.

At the end of 2021, other investments accounted for 11.4 per cent of VER’s portfolio. Of the invested assets, 3.4 per cent was placed in real estate investment trusts, 2.9 per cent in infrastructure funds and 5.0 per cent in hedge funds.

For unlisted real estate investment trusts, the year was extremely good. By the end of the year, the return on the portfolio reached 13.3 per cent. The factors contributing to the generous returns included the positive mood in the real estate sector as the uncertainty created by Covid-19 faded and the transaction market continued to recover. This was also reflected in increased property values. In terms of sectors, logistics generated excellent returns while housing investments continued to enjoy popularity.

During the year three new fund investments were made, in which the invested capital amounted to approx. EUR 188 million. Unfunded commitments totalled EUR 593 million at the end of the year.

As in 2020, infrastructure funds generated a healthy return. Underlying this positive performance were successful exits, dividend income and increased corporate valuations. On the whole, VER’s infrastructure investments have fared well amidst the Covid-19 crisis, event though companies engaged in the travel business have suffered from the restrictions. Much of VER’s portfolio focuses on ‘basic infrastructure’ where the impact of the crisis has been low. At the end of the year, the return on the portfolio reached 14.9 per cent.

During the reporting period, decisions were made to invest EUR 180 million in four new funds. Unfunded commitments totalled EUR 245 million at the end of the year.

The return on hedge funds and systematic strategies in 2021 was 5.1 per cent, practically the same as in the previous year. Of the hedge funds, the best performance was put in by multistrategy funds that managed to benefit from the persistently high risk sentiment. The year was more challenging to funds focusing on the emerging markets as they suffered from the movements in interest rates as well as the problems in the Chinese credit risk market. In regards to systematic strategies using derivatives, strategies focusing on emerging market currencies and commodities performed well, while strategies focusing on equity markets underperformed over the period.

RESPONSIBLE INVESTING

As a long-term state-owned investor, VER is called upon to incorporate responsibility and sustainability into its investment activities. The commitment to responsibility is based on the Principles for Responsible Investing adopted by VER’s Board of Directors, last updated in the autumn of 2021.

The Environmental, Social and Governance (ESG) criteria are central to VER’s assessment of long-term risks and opportunities. The Principles for Responsible Investing define, inter alia, the fields of activity which VER does not invest in as well as fields requiring closer monitoring of ESG performance. In addition, VER will not make any direct equity or fixed income investments in companies which generate more than 10% of their revenue from operations based on the use of coal or lignite or the incineration of peat. One key element in VER’s responsible approach is the monitoring of the carbon footprint, which is assessed primarily by means of the carbon intensity indicator. Additionally, VER has established objectives for reducing the carbon footprint of equity investments across the board.

Responsibility for considering ESG performance in investment decisions rests with portfolio managers. ESG considerations are complementary to the financial analysis underlying investment decisions and assessed by the portfolio managers side by side with the other variables affecting the investment. While the Principles for Responsible Investing apply to all asset classes, application varies according to asset class and method of investment.

THE STATE’S PENSION EXPENDITURE CONTINUES TO INCREASE

The role of the State Pension Fund in equalising the government’s pension expenditure continues to grow. In 2021, the State’s pension expenditure totalled a little over EUR 4.8 billion. As VER contributes 40 per cent towards these expenses to the government budget, the transfer to the 2021 budget amounted to approximately EUR 1.9 billion. Over the same period, VER received approximately EUR 1.5 billion in pension contributions. Its net pension contribution income has now turned permanently negative, meaning that more money is transferred from VER to the government budget than it receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund.

VER’s target funding ratio, as defined in the Act on the State Pension Fund (2006/1297), is 25 per cent of the State’s pension liabilities. The Ministry of Finance has launched a legislative project to revise the the regulations governing VER’s transfers to the government budget once the 25 per funding ratio laid down by law is met. The Government Proposal to this effect was given to Parliament at the beginning of February 2022. As the State’s pension liabilities amounted to EUR 93.3 billion at the end of 2021, the funding ratio was approx. 25.4 per cent.

The State Pension Fund’s long-term goals are set out in greater detail in its strategy adopted in 2016. In seeking adequate long-term return, VER accepts short-term investment risks. However, the portfolio is duly diversified and market risks are also managed proactively using both cash instruments and derivatives. The Board of Directors of the State Pension Fund will update its long-term objectives after the reform to the Act on the State Pension Fund currently under preparation is adopted.

VER’S ADMINISTRATION

VER, established in 1990, is an off-budget entity. VER is an investment organisation with a mission to manage the assets entrusted to it. The collection of pension contributions to the state pension system and related duties, like the processing of pension applications and payment of pensions, are handled by the Local Government Pension Institution Keva. VER pays Keva a management fee for these services, which in 2021 amounted to about EUR 15.5 million.

The responsibility for oversight and control of VER’s operations rests with the Ministry of Finance, which is authorised to issue general instructions regarding the organisation of VER’s administration, financial management and the investment of its assets. According to the standing instructions, fixed income instruments must account for a minimum of 35 per cent, equities for no more than 55 per cent, and other investments for no more than 12 per cent of the market capitalisation of the portfolio. Moreover, real estate investments must be made in the form of fund investments or equivalent indirect investments.

VER’s Board of Directors is appointed by the Ministry of Finance. The Board has seven members, three of whom are appointed from among candidates proposed by central staff organisations. The Chair of the Board of Directors is Jukka Pekkarinen and the Chair of the advisory Investment Consultative Committee Jussi Laitinen.

VER’s operating costs amounted to EUR 7.4 million, which represents 0.03 per cent of its average annual capital. During the year VER had an average of 25 employees. Serving as the Chief Executive Officer was Timo Löyttyniemi. VER invests in human resources by maintaining and developing the professional skills of the staff, which is important both in seeking maximum returns on investments and in managing risks.

KEY FIGURES 2021

|

|

|

|

|

|

|

|

|

2021

|

2020

|

|

Return on investments

|

14,6 %

|

4,0 %

|

|

Real return

|

10,8 %

|

3,8 %

|

|

|

|

|

|

Return by asset class

|

|

|

|

fixed income investments

|

|

|

|

Liquid fixed income investments

|

0,7 %

|

2,1 %

|

|

Private credit funds

|

13,1 %

|

3,9 %

|

|

Direct non-liquid lending

|

6,1 %

|

5,6 %

|

|

Equities

|

|

|

|

Listed equities

|

24,2 %

|

6,2 %

|

|

Private equity funds

|

47,7 %

|

6,6 %

|

|

Unlisted equities

|

57,9 %

|

12,2 %

|

|

Other investments

|

|

|

|

Unlisted real estate funds

|

13,3 %

|

1,2 %

|

|

Infrastructure funds

|

14,9 %

|

12,2 %

|

|

Hedge funds and systematic strategies

|

5,1 %

|

4,9 %

|

|

|

|

|

|

Average returns

|

5 years

|

10 years

|

|

|

|

|

|

Average return on portfolio p.a.

|

6,9 %

|

7,1 %

|

|

Average real return p.a.

|

5,6 %

|

5,9 %

|

|

Average effective interest rate on government debt p.a.

|

0,9 %

|

1,3 %

|

|

|

|

|

|

Portfolio allocation

|

2021

|

2020

|

|

|

|

|

|

Total investments, EURm

|

23 595,3

|

20 963,6

|

|

|

|

|

|

fixed income investments

|

37,9 %

|

36,2 %

|

|

Liquid fixed income investments

|

35,3 %

|

33,9 %

|

|

Other fixed income investments

|

2,7 %

|

2,4 %

|

|

Equity investments

|

49,5 %

|

52,4 %

|

|

Listed equities

|

43,5 %

|

46,5 %

|

|

Other equity investments

|

6,1 %

|

5,9 %

|

|

Other investments

|

11,4 %

|

10,9 %

|

|

Unlisted real estate funds

|

3,4 %

|

3,5 %

|

|

Infrastructure funds

|

2,9 %

|

2,4 %

|

|

Hedge funds and systematic strategies

|

5,0 %

|

3,7 %

|

|

|

|

|

|

Key figures

|

2021

|

2020

|

|

|

|

|

|

Volatility

|

4,9 %

|

14,0 %

|

|

Sharpe ratio

|

3,1

|

0,3

|

|

|

|

|

|

Other key figures

|

2021

|

2020

|

|

|

|

|

|

Pension contribution income, EURm

|

1 550

|

1 509

|

|

Budget transfers, EURm

|

1 941

|

1 931

|

|

Net contribution income, EURm

|

-391

|

-423

|

|

Balance sheet total, EURm

|

16 869

|

15 841

|

|

Pension liabilities, EUR bn

|

93,3

|

93,1

|

|

Funding ratio

|

25 %

|

23 %

|

Additional information:

Additional information is provided by CEO Timo Löyttyniemi, firstname.lastname@ver.fi, tel. +358 (0)295 201 210.

Established in 1990, the State Pension Fund of Finland (VER) is an off-budget fund through which the state prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the State’s pension assets professionally. At the end of 2021, the market value of the Fund’s investment portfolio stood at EUR 23.6 billion.