Annual Report 2020

Published 2021-02-25 at 13:02

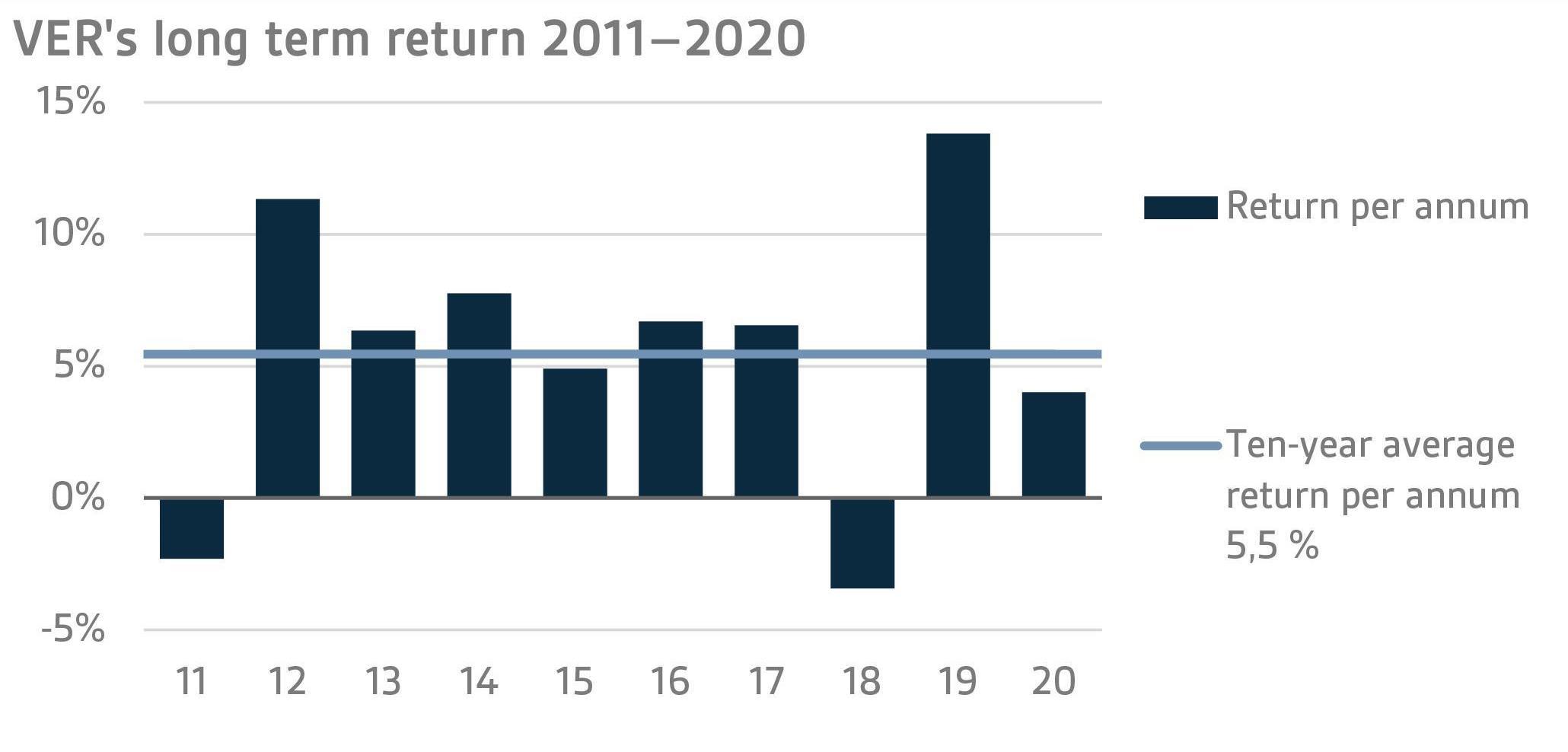

Return on investments 4.0% in 2020; ten-year average return 5.5%

INVESTMENT ENVIRONMENT

The theme of 2020 was set by the COVID-19 virus and its wide-ranging repercussions for society. The spread of the virus and the restrictions imposed to contain it were reflected in the economy and the investment market in many ways during the year. Despite the dramatic changes in people’s daily lives and economic activity, for pension investors the year was nevertheless reasonably favourable in terms of the final outcome. Towards the end of the year, VER’s return on investments turned positive, even though the year saw substantial fluctuations.

Market confidence in the future was sorely tested in March before the massive support were measured launched by the US Federal Reserve and Government. Interest rates continued to fall from already low levels. As a result of the low interest rates and intense economic stimulation, the stock markets and other risky investments boomed sharply in late March.

Stocks and other risky asset classes developed favourably from the spring up to the end of 2020. In the latter half of the year, Europe experienced an intense second wave of the COVID-19 pandemic, compelling governments to impose new restrictions. However, the negative impacts of the second wave were less severe than the effects caused by similar measures in the spring.

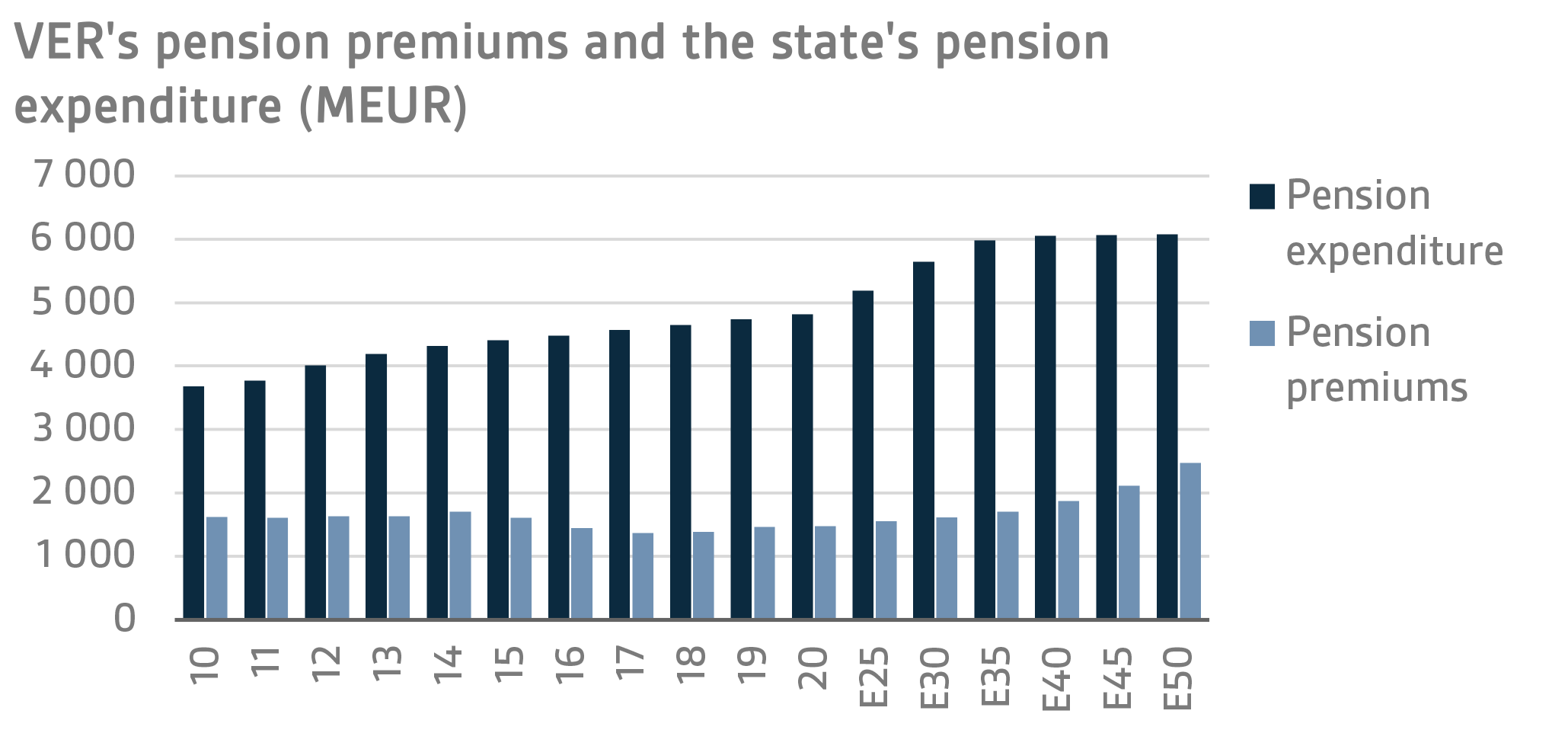

Every year more money is transferred from VER to the government budget than VER receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund.

VER’S RETURNS ON INVESTMENTS

At fair values, the total return on the investments made by the State Pension Fund (VER) in 2020 was 4.0 per cent. VER’s average rate of return was 5.4 per cent for the past five years and 5.5 per cent for the past ten years.

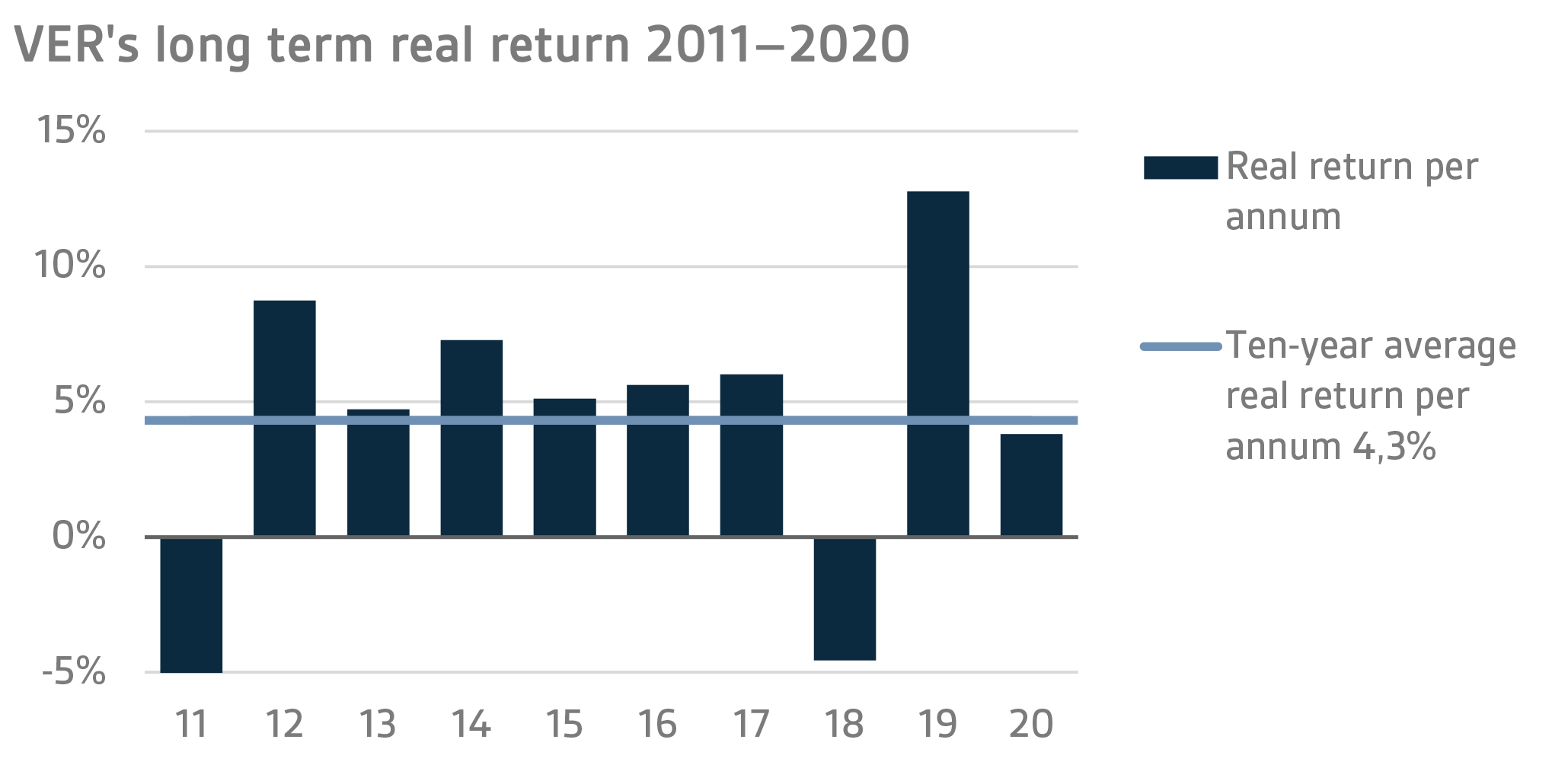

The real rate of return in 2020 was 3.8 per cent. VER’s five-year average real return was 4.6 per cent and ten-year real return 4.3 per cent. The ten-year average real return exceeds the estimates used in the long-term financing calculations by a wide margin.

According to the objective established by the Ministry of Finance, VER’s long-term return must exceed the average cost of net government debt. Over the past ten years, VER’s average market value weighted rate of return has beaten the cost of net government debt by 3.9 percentage points. Since 2001, when VER’s operations assumed their current form, the total returns earned by VER have exceeded the average cost of government debt by about EUR 8 billion.

A CLOSER LOOK AT 2020

VER’s two large asset classes, liquid fixed income investments and listed equities, gave positive returns in 2020. The return on liquid fixed income instruments was 2.1 per cent and that of listed equities 5.9 per cent. The return on other asset classes were also mostly positive, with the unlisted equities (12.2%) and infrastructure funds (12.2%) putting in the best performance.

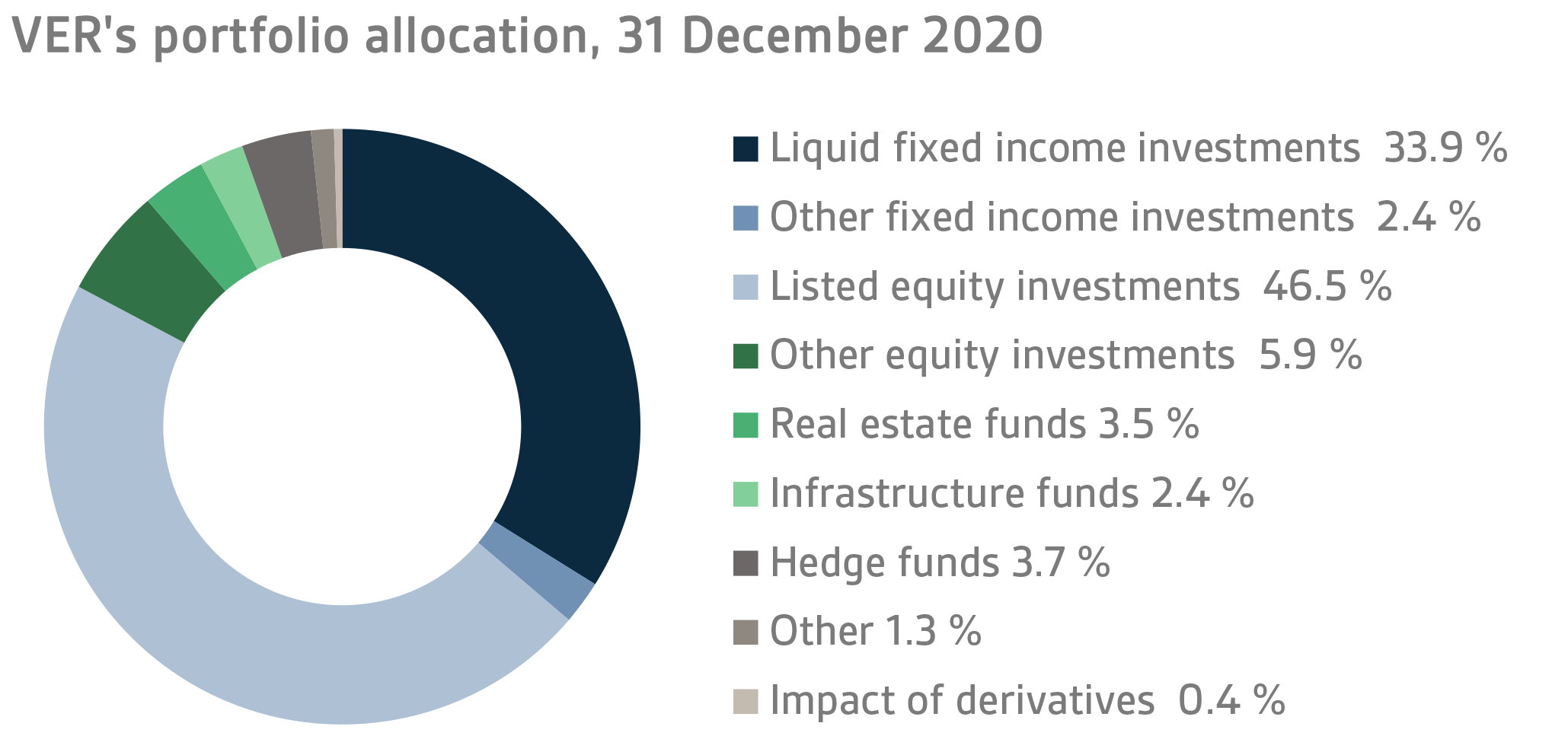

At the end of 2020, the market value of VER’s investment assets stood at EUR 21.0 billion. Of all the investments, fixed income instruments accounted for 36.2 per cent, equities 52.4 per cent and other investments 10.9 per cent of the total. The rest of the effect of risk-adjusted allocation was due to derivatives.

FIXED INCOME INVESTMENTS

Liquid fixed income investments

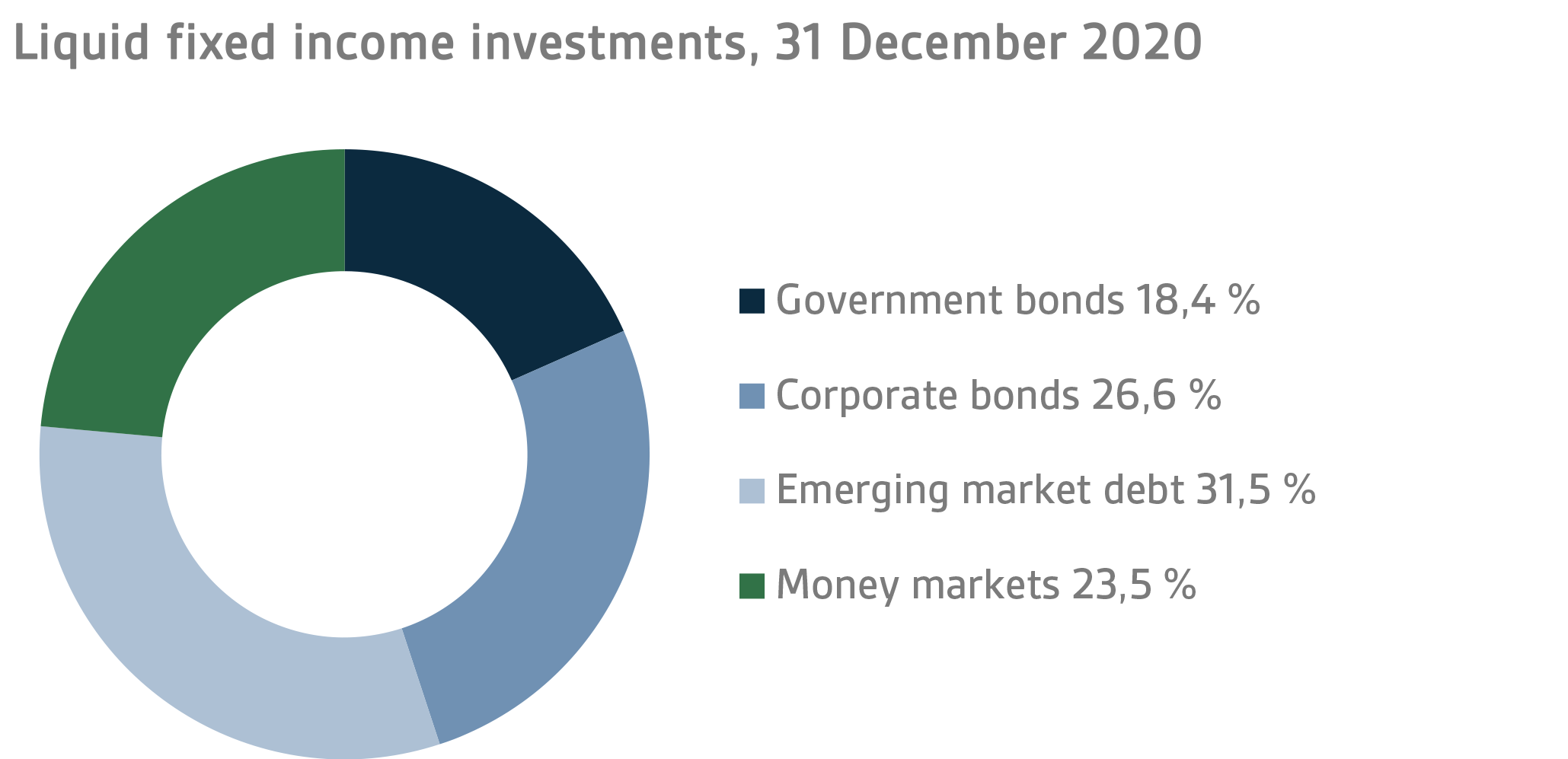

In 2020, the liquid fixed income investments returned 2.1 per cent and its risk-adjusted market value at the end of the year stood at EUR 7.1 billion. The duration of the fixed income portfolio remained shorter than the neutral duration of the portfolio for the entire year, while investments in government bonds were under-weighted.

Developments in 2020 were dominated by the COVID-19 virus: the measures taken to contain the spread of the infection, the impact of these measures on the economy, and the actions taken by central banks and governments to provide support.

The aggravation of the COVID-19 situation in March sharply increased the credit risk premiums of investments in corporate loans and emerging market interest rates. At the same time, quick and big changes were witnessed in the interest rates on sovereign debt. The central banks responded quickly: the US Federal Reserve by cutting interest rates and stimulating the economy through unlimited asset purchases, and the European Central Bank by expanding its asset purchase programme. Globally, central banks sought to mitigate the economic impacts of the coronavirus by revising the conditions for refinancing operations.

As a result of the stimulus measures taken by central banks and governments, the credit risk premiums on corporate bonds and the interest rates in the emerging markets levelled off markedly as of the second quarter after the rise earlier in the year. In particular, the corporate bonds of lower credit ratings and investments in emerging market dollar-denominated loans, which had taken the worst beating in the first quarter, recovered strongly. No comparable changes took place in government bonds perceived as safe havens, as a result of which the differences in returns diminished clearly compared with the first quarter. By the end of the year, credit risk premiums on European corporate loans approached the levels prevailing at the beginning of the year.

Towards the end of the year, the dissipation of the uncertainties related to the US presidential elections and positive vaccine news improved economic prospects, raising long-term interest rates and inflation expectations particularly in the United States.

Overall, the year 2020 was positive for the fixed income market and returns were better than anticipated, especially considering the developments in March. In VER’s liquid fixed income portfolio, the returns on corporate loans in the emerging markets, in particular, were excellent.

Other fixed income investments

VER’s other fixed income investments include investments in private credit funds and direct non-liquid loans. Most of the private credit funds in the portfolio are private equity funds investing in non-liquid loans. At the end of the year, the weighting of other fixed income investments in the portfolio was 2.4 per cent.

The impacts of the COVID-19 pandemic on the global economy were naturally also reflected in private credit investments. In particular, the spring lockdowns were felt in the travel industry and retail trade. For many companies, all business came to a complete halt. As a result, in the spring, funds focused mostly on securing the cash position of portfolio companies. At the same time, the crisis created attractive opportunities for some of the funds whose strategies benefit from emergencies. Accordingly, when screening new investments in 2020, VER focused on funds for which the changed market conditions provided opportunities.

The 2020 return on other fixed income investments was 4.4 per cent. The return on private credit funds was 3.9 per cent while direct lending yielded 5.6 per cent. During the reporting period, a total of EUR 182 million was invested in three new funds. At the end of the year, unfunded commitments totalled EUR 384 million. VER extended direct loans to two portfolio companies.

EQUITIES

Listed equities

The year 2020 will live in history for a number of reasons, not least because of the movements in the financial markets. The mood in the stock market was quite positive at the beginning of 2020, but the eruption of the COVID-19 epidemic, originating most likely in China, into a pandemic turned the situation on its head towards the end of the first quarter. Stock exchanges across the world saw an unprecedentedly fast and intense selling spree, which caused a number of even major stock indexes to fall by 30 per cent, or more. This time, governments and central banks were quick in their response. The massive publicised stimulation schemes were able to calm the financial markets fairly quickly.

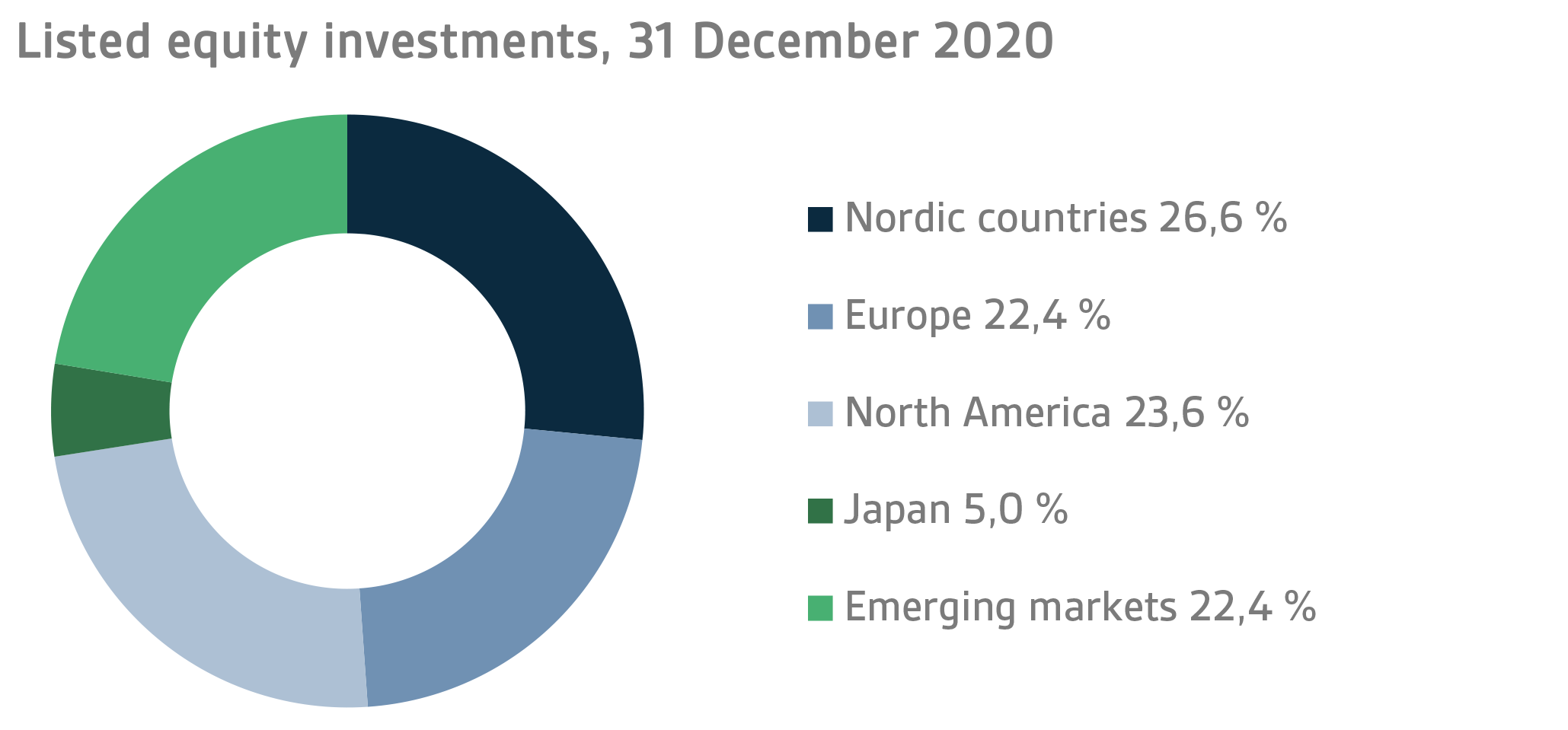

The second quarter was already characterised by the strong recovery of the stock market which continued throughout the year up to the end of 2020, with just a couple of short-lived market corrections. An additional boost to the market was given by the highly positive vaccine news released in early November, which led to a rally that swung VER’s equity investments into the red for the entire 2020. The return on VER’s portfolio of listed equities and fund units reached 6.2 per cent by the end of the year. Of the listed equities, by far the best performance was put in by VER’s investments in the Nordic market. Similarly, all other equity portfolios, except the large Europe portfolio, yielded a positive return by the time the year closed.

In terms of market capitalisation, the value of the listed equities increased from EUR 9.3 billion in 2019 to EUR 9.8 billion by the end of the reporting period. At the end of 2020, direct equity investments accounted for 24.8 per cent and fund investments for 75.2 per cent of the total. At the end of the year, VER held direct investments in 92 companies and fund units in 69 funds.

Other equity investments

VER’s other equity investments included investments in private equity funds, non-listed stock and listed real estate investment trusts (REIT). At the end of the year, other equity investments in the portfolio accounted for 5.5 per cent of the total.

For private equity funds, the effects of the COVID-19 virus were double-edged. Some companies suffered from lockdowns considerably while others escaped more or less unscathed or even benefited from the situation. The fall in share prices in the spring was still reflected in fund valuations in the summer. The recovery of the listed equities market towards the end of the year and successful cutbacks by portfolio companies improved the returns of private equity funds in late 2020. As the anticipated price correction failed to materialise, some funds were able to make successful exits at fairly high valuation levels. The annual return on private equity funds was 6.6 per cent. During the reporting period, investments worth EUR 270 million were made in five new funds. At the end of the year, unfunded commitments totalled EUR 654 million.

Non-listed equities included substantial investments in four companies. The annual return on the portfolio reached 12.2 per cent by the end of the year.

Unlike the stock markets, investments in listed real estate investment trusts failed to recover to the same extent. Underlying the poor performance was the high percentage of commercial properties in REITs. As a result, the impacts of lockdowns were greater than for the rest of the market. At the end of the year, the return on the portfolio stood at -18.0 per cent.

OTHER INVESTMENTS

VER’s other investments are in real asset funds (real estate and infrastructure funds) as well as hedge funds and risk premium investments.

At the end of 2020, the market capitalisation of other investments was EUR 2280 million, accounting for 10.9 per cent of VER’s portfolio. Of the assets invested, listed real estate investment trusts accounted for 3.5, infrastructure investments 2.4, hedge funds 3.7 and risk premiums 1.3 per cent.

In the real estate market, the COVID-19 crisis only highlighted the existing dichotomy of the market. Retail and hotel properties suffered from lockdowns, whereas increased online sales improved returns on logistics properties. Similarly, housing investments survived the crisis with little damage. The return on investments in non-listed real estate trusts was 1.2 per cent. Three new investments of EUR 130 million were made in funds, while unfunded commitments at the end of the year totalled EUR 454 million.

The return on infrastructure investments was again very good. Thanks to dividends and successful exits, the return on the portfolio reached 12.2 per cent by the end of the year. The effects of the coronavirus were primarily felt in companies engaged in the travel sector. The impact of the crisis on basic infrastructure investments was low or non-existent. During the reporting period, some EUR 106 million was invested in two funds. At the end of the year, unfunded commitments totalled EUR 252 million.

Hedge funds yielded a 4.9 per cent return in 2020. The portfolio recovered quickly from the fall in prices in the spring due to COVID-19 and was able to benefit from the positive sentiment in the latter part of the year. All strategies, with the exception of quantitative ones, managed to show a positive return by the end of the year. An exceptionally good performance was put in by volatility and multi strategy funds, which benefitted from the substantial market movements during the year.

The return on risk premium investments was -18.0 per cent in 2020. As the losses were exclusively due to poor return and bad investments, a decision was made not to invest in these funds any more. The systematic strategies implemented using derivatives gave healthy returns throughout the year.

RESPONSIBLE INVESTING

Responsibility is an inherent part of VER’s role as a long-term state-owned investor. The commitment to responsibility is based on the Principles for Responsible Investing adopted by VER’s Board of Directors. These principles were last updated in the autumn of 2020.

The Environmental, Social and Governance (ESG) criteria are central to VER’s review of long-term risks and opportunities. The Principles for Responsible Investing define, inter alia, the fields of activity which VER does not invest in as well as fields requiring closer monitoring of ESG performance. For instance, VER will not make any direct equity or fixed income investments in companies which generate more than 10% of their revenue from operations based on the use of coal or lignite or the incineration of peat. One key element in VER’s responsible approach is the monitoring of the carbon footprint, which is assessed primarily by means of the carbon intensity indicator. Additionally, VER has established objectives for reducing the carbon footprint of equity investments across the board.

Responsibility for considering ESG performance in investment decisions rests with portfolio managers. ESG considerations are complementary to the financial analysis underlying investment decisions and assessed by the portfolio managers side by side with the other variables affecting the investment. While the Principles for Responsible Investing apply to all asset classes, the method of application varies according to asset class and method of investment.

THE STATE’S PENSION EXPENDITURE CONTINUES TO INCREASE

The State Pension Fund’s role in balancing government finances has grown and will continue to do so. In 2020, the state’s pension expenditure totalled approx. EUR 4.8 billion. As VER contributes 40 per cent towards these expenses to the government budget, the transfer to the 2020 budget amounted to approximately EUR 1.9 billion. Over the same period, VER received approximately EUR 1.5 billion in pension contributions. Its net pension contribution income has now turned permanently negative, meaning that more money is transferred from VER to the government budget than it receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund.

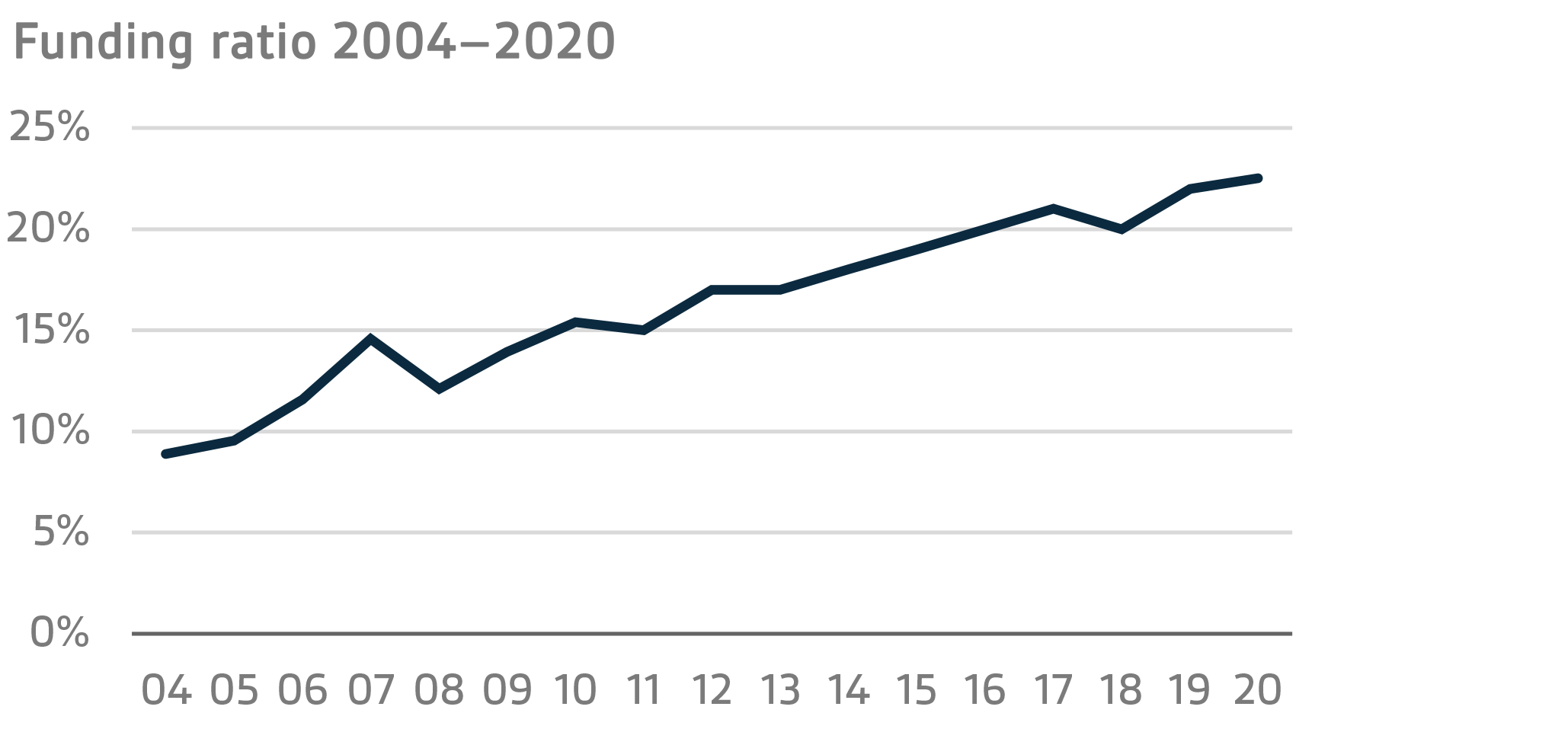

In June 2016, the Board of Directors of the State Pension Fund adopted a strategy that defines its long-term objectives in greater detail. The strategy foresees that the 25 per cent funding ratio target specified by law will be attained by 2033, if not earlier. To achieve this, it is imperative that VER’s pension contribution income remains at the estimated level and that the real return on investments remains relatively high. As the state’s pension liabilities amounted to EUR 93.1 billion at the end of 2020, the funding ratio was approx. 23 per cent. Additionally, the strategy sets out the principles by which the risk level and basic allocation of the investment portfolio are derived from the target funding ratio established for VER.

VER’S ADMINISTRATION

The State Pension Fund (VER), established in 1990, is an off-budget entity. VER is an investment organisation with a mission to manage the assets entrusted to it. The collection of pension contributions to the state pension system and related duties, like the processing of pension applications and payment of pensions, are handled by the Local Government Pension Institution Keva. VER pays Keva a management fee for these services, which in 2020 amounted to about EUR 15.9 million.

The responsibility for oversight and control of VER’s operations rests with the Ministry of Finance, which is authorised to issue general instructions regarding the organisation of VER’s administration, financial management and the investment of its assets. According to standing instructions, fixed income instruments must account for a minimum of 35 per cent, equities for no more than 55 per cent, and other investments for no more than 12 per cent of the market capitalisation of the portfolio. Moreover, real estate investments must be made in the form of fund investments or equivalent indirect investments.

VER’s Board of Directors is appointed by the Ministry of Finance. The Board has seven members, three of whom are appointed from among candidates proposed by central staff organisations. The Chair of the Board of Directors is Jukka Pekkarinen and the Chair of the Investment Advisory Committee Jussi Laitinen.

VER’s operating costs amounted to EUR 7.4 million, which represents 0.04 per cent of the average annual capital. During the year VER had an average of 25 employees. Timo Viherkenttä served as Chief Executive Officer up to 29 February 2020 when the position was resumed by Timo Löyttyniemi on 1 March 2020. VER invests in human resources by maintaining and developing the professional skills of the staff, which is important both in seeking maximum returns on investments and in managing risks.

KEY FIGURES 2020

|

|

|

|

|

|

2020

|

2019

|

|

Return on investments

|

4,0 %

|

13,8 %

|

|

Real return

|

3,8 %

|

12,8 %

|

|

|

|

|

|

Return by asset class

|

|

|

|

fixed income investments

|

|

|

|

Liquid fixed income investments

|

2,1 %

|

5,0 %

|

|

Private credit funds

|

3,9 %

|

1,7 %

|

|

Direct non-liquid lending

|

5,6 %

|

4,9 %

|

|

Equities

|

|

|

|

Listed equities

|

6,2 %

|

24,6 %

|

|

Private equity funds

|

6,6 %

|

14,2 %

|

|

Unlisted equities

|

12,2 %

|

8,2 %

|

|

Real estate investment trusts (REIT)

|

-18,0 %

|

28,1 %

|

|

Other investments

|

|

|

|

Unlisted real estate funds

|

1,2 %

|

9,8 %

|

|

Infrastructure funds

|

12,2 %

|

12,8 %

|

|

Hedge funds

|

4,9 %

|

4,9 %

|

|

Risk premium investments

|

-18,0 %

|

-0,5 %

|

|

|

|

|

|

Average returns

|

5 years

|

10 years

|

|

|

|

|

|

Average return on portfolio p.a.

|

5,4 %

|

5,5 %

|

|

Average real return p.a.

|

4,6 %

|

4,3 %

|

|

Average effective interest rate on government debt p.a.

|

1,1 %

|

1,6 %

|

|

|

|

|

|

Portfolio allocation

|

2020

|

2019

|

|

|

|

|

|

Total investments, EURm

|

20 963,6

|

20 588,1

|

|

|

|

|

|

fixed income investments

|

36,2 %

|

37,3 %

|

|

Liquid fixed income investments

|

33,9 %

|

35,2 %

|

|

Other fixed income investments

|

2,4 %

|

2,1 %

|

|

Equity investments

|

52,4 %

|

50,9 %

|

|

Listed equities

|

46,5 %

|

45,3 %

|

|

Other equity investments

|

5,9 %

|

5,6 %

|

|

Other investments

|

10,9 %

|

10,4 %

|

|

Unlisted real estate funds

|

3,5 %

|

3,3 %

|

|

Infrastructure funds

|

2,4 %

|

1,9 %

|

|

Hedge funds

|

3,7 %

|

4,2 %

|

|

Risk premium investments

|

1,3 %

|

1,1 %

|

|

|

|

|

Key figures

|

2020

|

2019

|

|

|

|

|

|

Volatility

|

14,0 %

|

4,7 %

|

|

Sharpe ratio

|

0,3

|

3,0

|

|

|

|

|

|

Other key figures

|

2020

|

2019

|

|

|

|

|

|

Pension contribution income, EURm

|

1 509

|

1 497

|

|

Budget transfers, EURm

|

1 931

|

1 894

|

|

Net contribution income, EURm

|

-423

|

-396

|

|

Balance sheet total, EURm

|

15 841

|

15 564

|

|

Pension liabilities, EUR bn

|

93,1

|

92,7

|

|

Funding ratio

|

23 %

|

22 %

|

Inquiries:

Additional information is provided by CEO Timo Löyttyniemi, firstname.lastname@ver.fi, tel. +358 (0)295 201 210.

Established in 1990, the State Pension Fund (VER) is an off-budget fund through which the state prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the state’s pension assets professionally. At the end of 2020, the market value of the Fund’s investment portfolio stood at EUR 21.0 billion.