Interim report of the State Pension Fund 1 January – 30 September 2015

Published 2015-10-20 at 11:40

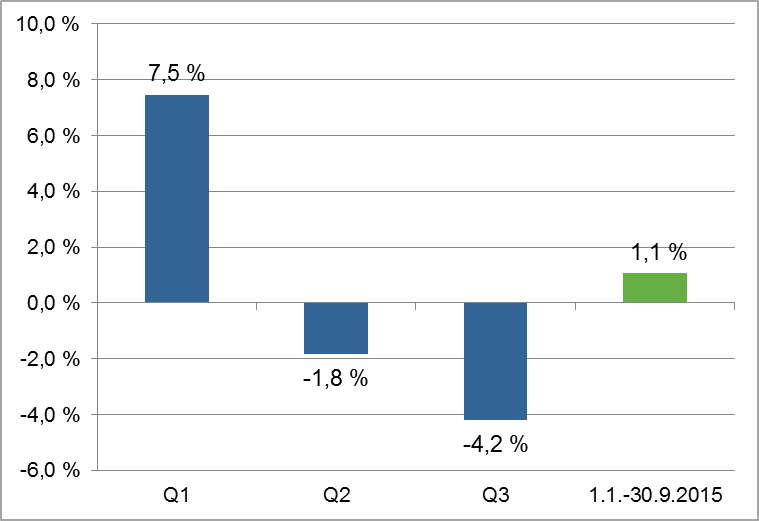

The return on investments made by the State Pension Fund (VER) reached 1.1 per cent during 1 January – 30 September 2015.

VER’s average rate of return is 4.4 per cent over the past ten years and 5.3 per cent over the past five years.

Of the investments made by VER, fixed income instruments accounted for 50.8 per cent, equities for 41.7 per cent and other investments for 7.5 per cent of the total.

During the first three quarters, the best return was generated by private equity investments (15.8%) and unlisted equities (7.2%). Listed equities yielded a return of 2.0 per cent and liquid fixed-income instruments -0.3%.

“Investments during the first three quarters of the year were characterised by two distinct trends. The overall fall in share prices following the strong market performance during the first few months of the year continued with twists and turns up to the end of September. The plunge was deepest in August when fears about stalling economic growth in China caused investors to flee the emerging markets,” says CEO Timo Viherkenttä.

“By contrast, the last quarter of the reporting year started in a more upbeat mood. For long-term investors like the State Pension Fund, great fluctuations in share prices also offer new opportunities. Early this year, VER sold large chunks of equities, but after the fall in share prices during late summer we’ve been shopping around again,” continues Viherkenttä.

As VER was in this year required to contribute an additional EUR 500 million to the government budget, the market value of its investments at the end of September was lower than at the beginning of the year. At the end of September, the market value of the Fund’s assets amounted to EUR 17.4 billion (EUR 17.6 billion on 31 December 2014). During January–September VER’s premium income amounted to EUR 1,252 million while a total of EUR 1,705 million was transferred to the government budget.

Relatively speaking, the state’s pension liabilities have been pre-funded to a lesser extent than in the private and municipal sector. At the end of 2014, the state’s pension liabilities amounted to EUR 95.4 billion and the funding ratio was 18 per cent. According to the State Pension Act, the State Pension Fund will be grown until its assets cover 25 per cent of the state’s pension liabilities.

FIXED-INCOME INVESTMENTS

Liquid fixed-income instruments

Liquid fixed-income investments gave a return of -0.3 per cent.

While the economic prospects in Europe improved slightly in early 2015, the markets were concerned about the developments in Greece that came to a head in the summer. As the situation in Greece receded into the background, the third quarter was characterised by expectations of a series of rate increases by the US Federal Reserve (FED) on the one hand and fears of stagnating growth on the other, especially in the emerging markets in the wake of China’s dimming prospects. The devaluation of the yuan triggered a process in which the currencies of the emerging economies weakened considerably and share prices plummeted at the same time as interest rates went up. This was one of the reasons underlying FED’s decision in September not to raise interest rates despite robust GDP growth (3.9%) in the second quarter and a low unemployment rate (5.1%). Credit risk spreads grew globally with the waning general risk sentiment.

Other fixed-income investments

Other fixed-income investments consist of investments in private credit funds.

The private credit investments gave a 4.3 per cent return. This market continued to grow, particularly in Europe. Banks’ difficulties in financing small and medium-sized enterprises have fuelled demand for private funding. VER intends to increase its private credit investments both in Europe and the United States.

EQUITIES

Listed equities

The return on investments in listed equities was 2.0 per cent.

The stock markets have been seesawing during 2015. At the beginning of the year, equity prices increased across the board, only to plummet towards the end of the summer. While the period has been beset by a larger number of uncertainties, the main concerns in the market were related to China and its GDP growth over the next few years. As a result of these concerns, the prices of many raw materials, such as basic metals, exhibited relatively strong downward trends during the third quarter.

Other equity investments

VER’s other equity investments consist mainly of investments in private equity funds and unlisted stock. Investments in listed real estate funds and balanced funds also fall into this category.

Private equity investments earned a yield of 15.8 per cent and unlisted equities 7.2 per cent.

So far, the current year has been relatively good for private equity funds. The positive development in the stock market early in the year has been reflected on the values of the funds with some delay during the summer and early autumn. At the same time, these funds have succeeded in divesting investments in their portfolio companies with hefty profits.

OTHER INVESTMENTS

VER’s other investments consist of investments in real estate, infrastructure and hedge funds and risk premium strategies.

The return from investments in real estate funds was 4.3 per cent.

A positive mood was sustained in the real estate market throughout the year. Transaction volumes are approaching the levels of previous peak years while expected returns from real estate investments remain, in places, below the levels expected prior to the financial crisis.

The biggest change in infrastructure funds took place in September when VER transferred its 12 per cent interest in Fingrid Plc to Aino Holding company Limited Partnership, in which VER holds 45.4 per cent of the authorised capital.

Hedge funds earned a return of 1.8 per cent. Despite high volatility in August and September, the highest return in the reporting period was yielded by funds targeting the equity market. The turbulent market resulted significant differences in performance between individual funds.

Risk premium funds, particularly equity-based risk premiums, yielded a healthy return during the reporting period.

2015 RATES OF RETURN BY QUARTER

|

VER KEY FIGURES

|

| |

30.9.2015*

|

30.9.2014

|

31.12.2014

|

| Investments, MEUR (market value) |

17 373 |

17 415 |

17 600 |

| Fixed-income investments |

8 820 |

9 006 |

8 874 |

| Equity investments |

7 247 |

6 888 |

6 951 |

| Other investments |

1 305 |

1 521 |

1 774 |

| |

| Breakdown of the investment portfolio |

| Fixed-income investments |

50,8 % |

51,7 % |

50,4 % |

| Equity investments |

41,7 % |

39,6 % |

39,5 % |

| Other investments |

7,5 % |

8,7 % |

10,1 % |

| |

| |

1.1.-30.9.2015

|

1.1.-30.9.2014

|

1.1.-31.12.2014

|

| Return on investment |

1,1 % |

6,5 % |

7,8 % |

| Liquid fixed-income investments |

-0,3 % |

4,4 % |

4,9 % |

| Listed equity investments |

2,0 % |

9,8 % |

11,7 % |

| Private equity funds (incl. Infrastructure and Private credit funds) |

9,0 % |

5,6 % |

7,9 % |

| Unlisted equities |

7,2 % |

0,0 % |

2,4 % |

| Real Estate funds |

4,3 % |

5,5 % |

10,3 % |

| Hedge funds |

1,8 % |

4,3 % |

6,0 % |

| |

| Pension contribution income, MEUR** |

1 252 |

1 319 |

1 732 |

| Transfer to state budget, MEUR |

1 705 |

1 305 |

1 728 |

| Net premiums, MEUR |

-453 |

14 |

4 |

| Pension liability, MEUR |

|

|

95 400 |

| Funding ratio |

|

|

18 % |

| |

| * Figures are not comparable, changes in portfolio allocation |

| ** Amount includes transition contributions per 30 June 2015. Comparison amounts are corrected respectively. |

Inquiries:

CEO Timo Viherkenttä tel.: (09) 2515 7010

Established in 1990, the State Pension Fund (VER) is an off-budget fund through which the state prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the state’s pension assets professionally. At the end of 2015, the market value of the Fund’s investment portfolio stood at EUR 17.4 billion.