ANNUAL REPORT OF THE STATE PENSION FUND OF FINLAND 2025

Published 2026-02-12 at 11:43

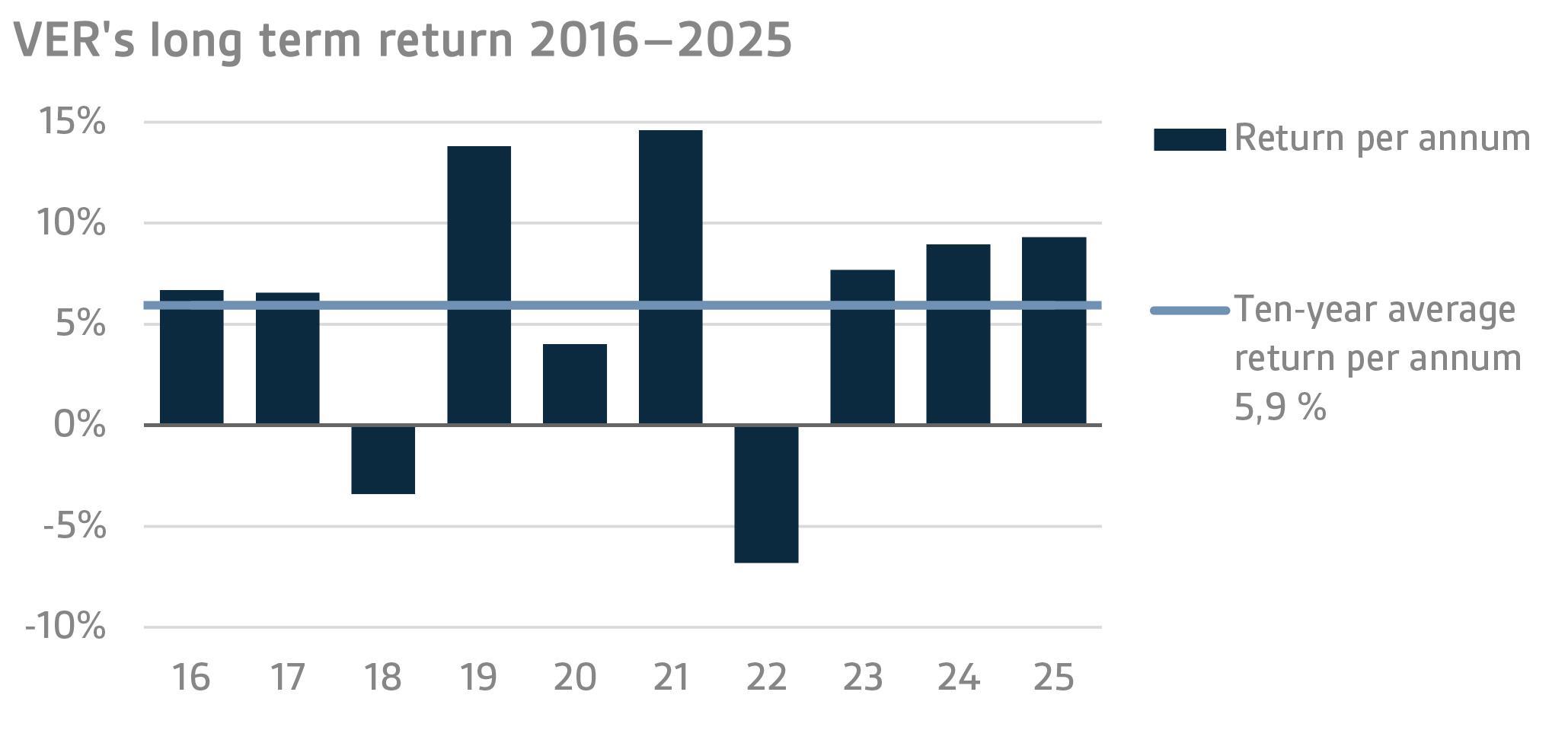

Return on investments 9.3% in 2025; ten-year average return 5.9%

INVESTMENT ENVIRONMENT

For pension investors, 2025 was a good year. While economic and geopolitical uncertainties were present, the investment market ultimately performed well across all asset classes. Share prices developed exceptionally well during the year. VER's investments in the Nordic countries, and the Finnish market in particular, put in a robust performance. The Finnish stock market yielded returns of up to 35 per cent after a long period of weakness. The impact of strong US returns on euro investors was weakened by the depreciation of the dollar during the year.

US customs policy was one of the biggest economic news stories of the year. On April 2, President Trump announced substantial tariffs on various countries. This was followed by negotiations, many of which led to a better outcome during the course of the year than the original announcement had suggested. However, these events caused a great deal of confusion, which global companies now have to sort through while adapting their logistics to the realities of the new customs policy.

Geopolitical uncertainty continued, with no signs of easing. Although there was occasional progress in the negotiations on the Ukraine-Russia conflict, this did not lead to peace, a truce, or a ceasefire. The fighting has been going on for four years. With regard to the Gaza-Israel conflict, a negotiated outcome was reached, which the parties are trying to comply with. A road to reconciliation was opened, but the burden of history is heavy.

Economic growth was moderate in Europe and weak in Finland. Inflation figures in Europe returned close to the target level, enabling the European Central Bank to lower its key policy rate to 2 per cent. This can be taken as an indication of return to normality and an opportunity for economic growth, provided that the positive outlook is not undermined by other uncertainties.

VER’S RETURN ON INVESTMENTS

At fair values, the total return on the investments made by the State Pension Fund of Finland (VER) in 2025 was 9.3 per cent. VER’s average rate of return was 6.5 per cent for the past five years and 5.9 per cent for the past ten years.

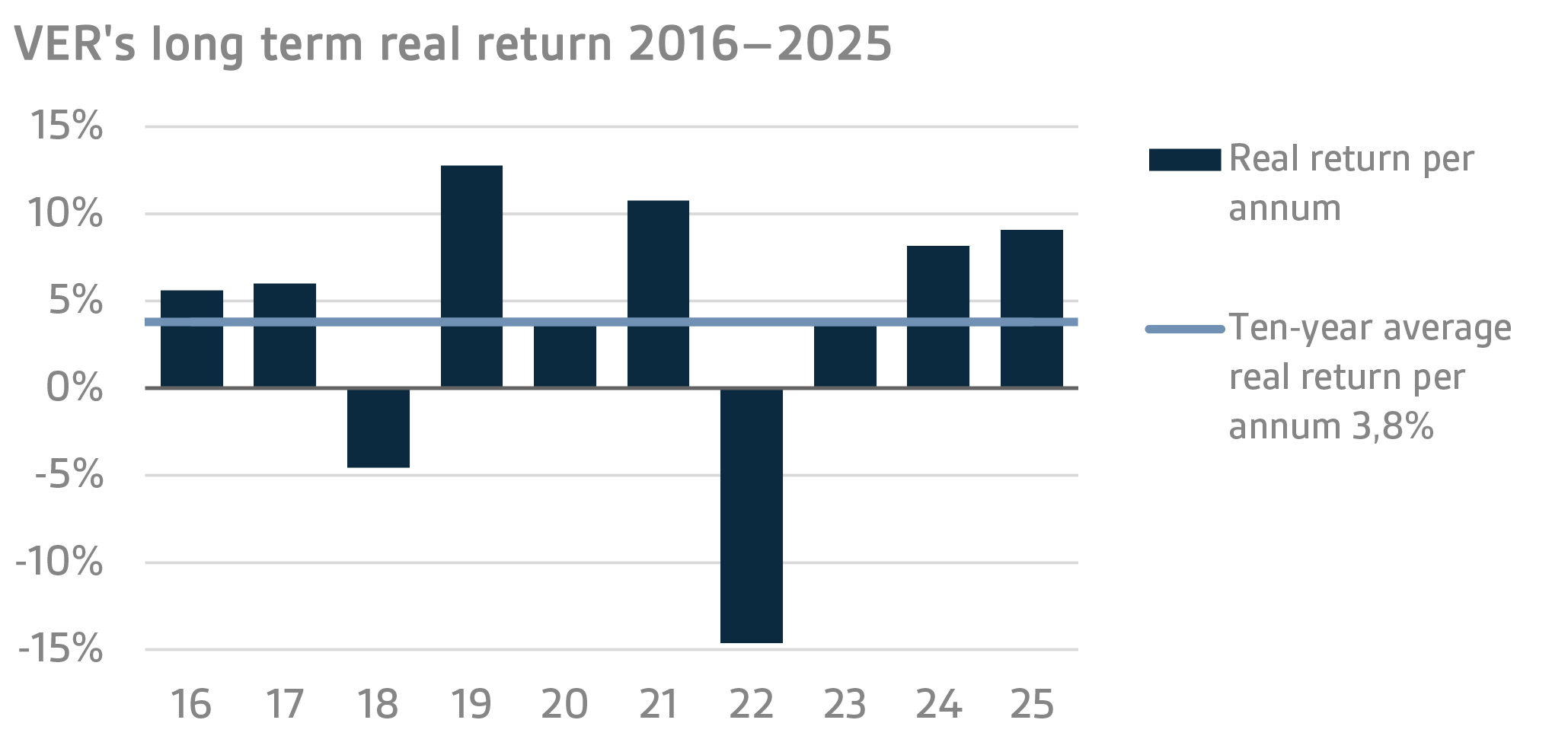

To determine real returns, the Finnish consumer price index has been used as the inflation indicator. The real rate of return on investments in 2025 was 9.1 per cent. The five-year average real return was 3.0 per cent and ten-year real return 3.8 per cent.

According to the objective established by the Ministry of Finance, VER’s long-term return must exceed the average cost of net government debt. Over the past ten years, VER’s average market value weighted rate of return has beaten the cost of net government debt by 4.7 percentage points. Since 2001, when VER’s operations assumed their current form, the total returns earned by VER have exceeded the average cost of government debt by about EUR 14 billion.

A CLOSER LOOK AT 2025

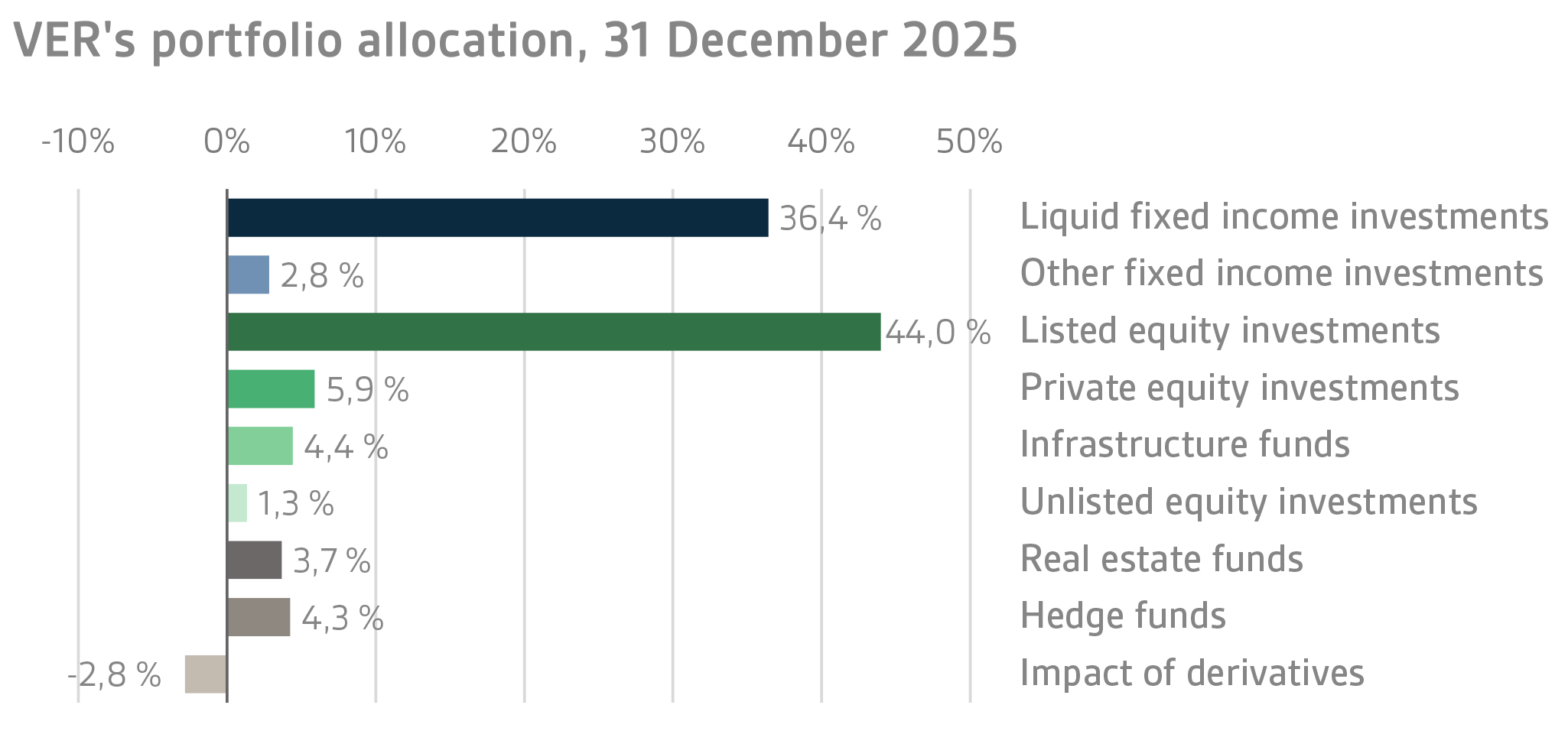

VER’s two largest asset classes, liquid fixed income investments and listed equities, gave positive returns in 2025. The return on liquid fixed income instruments was 4.3 per cent and that of listed equities 15.4 per cent. Of the other asset classes, the best performance was put in by non-listed equities at 28.6 per cent, as well as hedge funds and systematic strategies at 11.3 per cent.

At the end of 2025, the market value of VER’s investment portfolio stood at EUR 25.8 billion. Of all the investments, fixed income instruments accounted for 39.2 per cent, equities 55.6 per cent and other investments 7.9 per cent of the total. The allocation effect of derivatives was -2.8 per cent.

FIXED INCOME INVESTMENTS

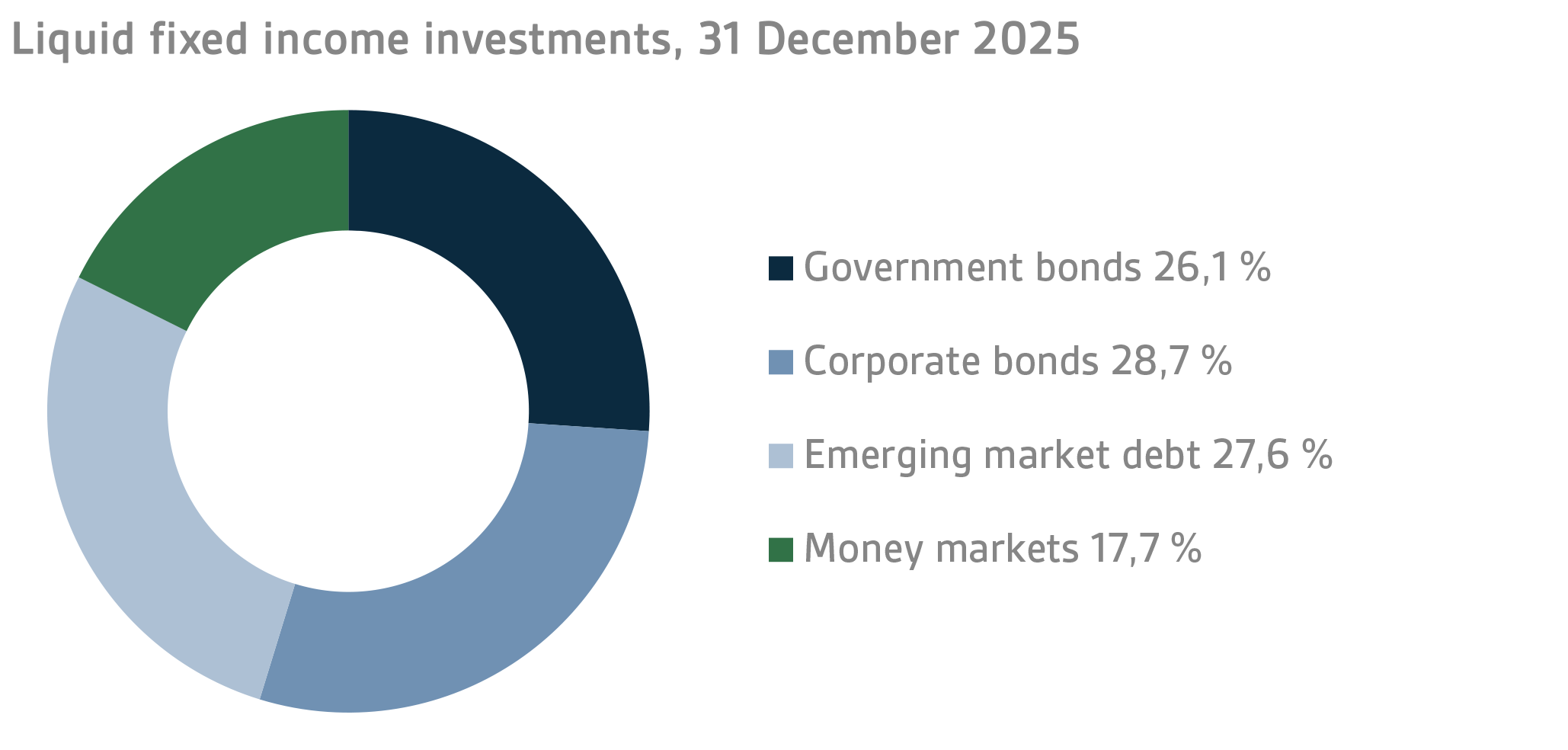

Liquid fixed income investments

In 2025, the liquid fixed income investments returned 4.3 per cent and their risk-adjusted market value at the end of the year stood at EUR 9.4 billion. Towards the end of the year, the duration of the fixed income portfolio was slightly shorter than the neutral duration of the benchmark index, while the modified duration of the convertible bond portfolio was 4.9 per cent.

During the year, market interest rates rose in Europe, with the exception of the shortest-term rates, despite the European Central Bank (ECB) cutting its key rates by 100 basis points in the first half of the year. Market interest rates were pushed up in particular by plans for major defence and infrastructure projects in Europe and, for example, the domestic political situation in France.

In the United States, market interest rates were falling as the Federal Reserve (FED) lowered its key policy rates by a total of 75 basis points towards the end of the year, despite inflation remaining slightly above the FED's target level. The rate cuts were justified by the weakening labour market situation. At the end of the year, the market was still foreseeing two 25 basis-point cuts in rates by FED for 2026, but the ECB was expected to keep its key interest rates unchanged in 2026.

Risk premiums on corporate bonds and emerging bond markets continued to narrow down in 2025, except for a momentary sharp widening in April after President Trump announced extensive import tariffs. As a result of tightening risk premiums and falling US market interest rates, emerging market interest income was very good in 2025. Corporate bond yields were also sound, with tightening credit risk premiums offsetting the rise in interest rates in Europe.

Of VER's liquid fixed income investments, the best returns were generated by the investments in emerging market debt and lower-rated corporate bonds. In particular, dollar-denominated and local currency-denominated government bonds in emerging markets performed exceptionally well.

Other fixed income investments

V

ER’s other fixed income investments include investments in private credit funds and direct non-liquid loans. Most of the private credit funds in the portfolio are private equity funds investing in non-liquid loans. At the end of 2025, other fixed income investments accounted for 2.8 per cent of VER’s portfolio.

The quiet transaction market in private equity investments, particularly in the first half of 2025, was also reflected to some extent in the activities of private credit managers. However, managers participated, on highly favourable terms, in the refinancing rounds of companies owned by private equity investors, as well as in new transactions. Overall, direct lending managers who financed LBO transactions at the end of the year performed well.

The return on other fixed income investments was 4.4 per cent in 2025. Private credit funds returned 4.8 per cent and direct loans 2.5 per cent. At the end of 2025, unfunded commitments totalled EUR 368 million.

EQUITIES

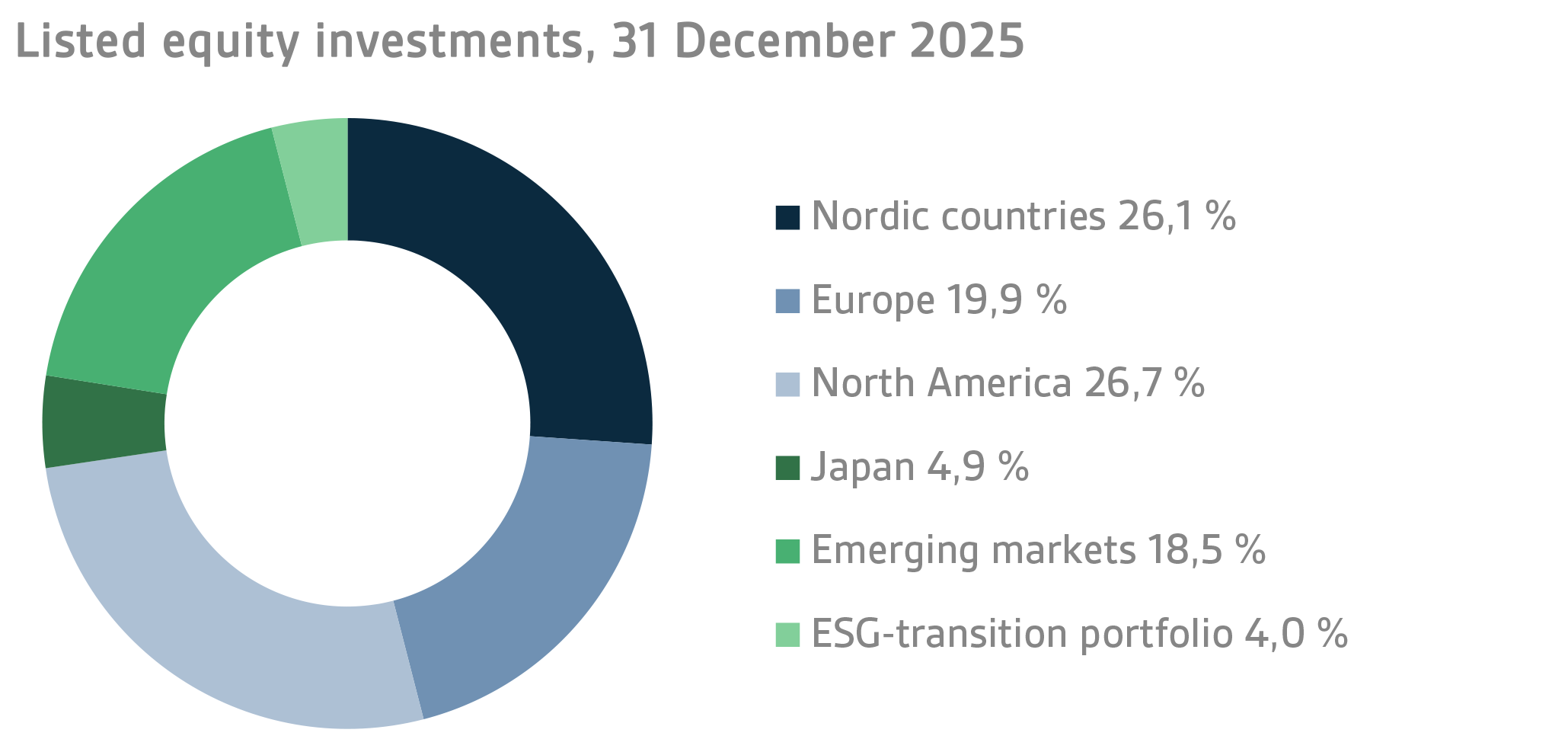

Listed equities

2025 turned out to be a strong year for VER's listed shares, with a return of 15.4 per cent by the end of the year. The stock market saw major fluctuations during the year, but optimism regarding the future prospects of listed companies strengthened towards the end of the year. The last quarter of 2025 was favourable for the global stock market.

During the early part of the year, the markets experienced considerable uncertainty, mainly as a result of the tariffs imposed by the US administration. In the course of the summer, uncertainty decreased significantly as a result of new trade agreements, and the mood on the stock market turned positive. As far as geopolitics was concerned, the situation appeared to worsen on almost all fronts during 2025, but this had virtually no impact on stock market sentiment. The earnings forecasts of listed companies declined during the first half of the year, but the trend stopped towards the end of 2025, and revisions to earnings forecasts turned positive. Among stock market themes, artificial intelligence continued to play a very strong role, particularly in the United States, but also in other markets, such as China.

Of VER's listed equities, the best performers, with returns exceeding 30 per cent, were investments in the Nordic stock markets, where Finnish stocks in particular reached very high levels after several years of weak performance. Similarly, investments in other European stock markets and emerging markets performed well. The weakest returns in 2025 were generated by investments in North America, whose euro-denominated returns were weakened by the clear depreciation of the US dollar during the year.

In terms of market capitalisation, the value of VER’s listed equities increased from EUR 9.8 to EUR 11.3 billion during 2025. At the end of the year, direct equity investments accounted for 24 per cent and fund investments 76 per cent of the total. At the close of 2025, VER held direct interests in 85 companies and fund units in a total of 60 funds.

Other equity investments

VER’s other equity investments include investments in private equity funds, infrastructure and unlisted stock. At the end of 2025, other equity investments accounted for 11.6 per cent of VER’s portfolio. Private equity investments returned 5.9 per cent, infrastructure investments 4.4 per cent and unlisted equities 1.3 per cent.

The year 2025 was still fairly quiet in the private equity market, although the transaction market picked up to some extent towards the end of the year. Attracting new investments was difficult for many operators because investors were unable to make new commitments at the same pace as before due to low distributions. As a result of the quiet transaction market, the role of continuation funds has become a way of providing liquidity to investors. At the portfolio level, in contrast to the market, VER's capital investment cash flow was clearly positive, partly as a result of the liquidity provided by continuation funds, but also thanks to extremely successful exits. However, the negative impact of the weakened US dollar on returns was significant.

The year-end return on private equity funds was 2.8 per cent. At the end of 2025, unfunded commitments totalled EUR 643 million.

Infrastructure funds performed well, although they fell clearly short of last year's figures. Most of the returns were based on the positive performance of European core/core+ funds. Renewable energy funds suffered,

inter alia

, from lower-than-expected electricity prices. The biggest single negative contribution to the portfolio's return came from a single fund investing in wind power.

The return on infrastructure investments was 5.7 per cent. At the end of the year, unfunded commitments totalled EUR 197 million.

Investments in unlisted stocks consisted of investments in five companies. The year-end return on the portfolio was 28.6 per cent.

OTHER INVESTMENTS

VER’s other investments are made in real estate investment trusts and hedge funds. At the end of 2025, other investments accounted for 7.9 per cent of VER’s portfolio. Of the invested assets, 3.7 per cent was placed in real estate investment trusts and 4.3 per cent in hedge funds.

The year 2025 ended on a positive note in the real estate market. Property values are largely believed to have bottomed out. After a few difficult years, several VER portfolio funds posted positive returns in 2025. However, some funds still ended the year in negative territory, even though the last quarter showed positive returns. Property values depended very much on the line of business concerned. Several sectors, such as logistics, performed well. For housing, the year was still challenging. However, an improved market sentiment is foreseen for 2026.

The return on investments in non-listed real estate investment trusts was 0.1 per cent. At the end of the year, unfunded commitments totalled EUR 384 million.

The return on hedge funds and systematic strategies reached 11.3 per cent in 2025. Despite turbulence, the year was strong overall and risk-friendly for hedge funds. Clearly the best performance was put in by funds focusing on Asia and event-driven strategies, where allocation was increased during the year. Strong performance in Asian stock markets, increased mergers and acquisitions activity, and regional market dispersion contributed to healthy returns.

Generally, the market environment was quite favourable for macro strategies, but there was considerable variation between managers. CTA strategies ultimately ended the year with positive returns after facing difficulties due to the challenging market environment and rapid changes in direction at the beginning of the year. Overall, however, CTA strategies were the weakest performers in terms of annual returns.

RESPONSIBLE INVESTING

The goal of VER’s responsible investment activities is to identify and manage long-term ESG risks and promote sustainable development. ESG factors are taken into account both when making investment decisions and during the investment period. In this way, VER seeks to reduce ESG-related risks and seize the opportunities offered by the sustainability transition. VER's approaches to sustainability consist of investments based on its corporate values and international standards, ESG integration and the efforts to exert influence.

The sustainability policy adopted by VER’s Board of Directors provides the basis for its responsible investment activities and serves as a guideline for setting sustainability objectives. VER’s shareholder control policy, in turn, sets out the sustainability criteria established for investments, which are designed to ensure that portfolio companies pay due attention to the sustainability aspects foreseen in VER’s objectives.

Responsibility for defining the policy for the implementation of sustainability and developing portfolio management practices rests with VER’s senior management. Portfolio managers ensure that their own investment portfolios are sustainable and to engage in dialogue with companies and asset managers if necessary.

Mitigating climate change is VER's key sustainability goal. VER’s principles for responsible investment address the climate risk along with other sustainability risks. To contribute to the attainment of the goals set out in the Paris Climate Agreement, VER aims to make its entire investment portfolio carbon neutral by 2050.

The ESG transition portfolio established by VER in 2024 has developed as expected and remains focused on supporting the transition. The portfolio consists of globally active funds whose goal is to promote changes in companies' operating policies and,

inter alia

, reduce their carbon dioxide emissions.

VER publishes annual reports on the carbon footprint of the portfolio covering the carbon intensity and absolute emissions of its portfolio of listed equities and corporate bonds. VER’s latest climate report was released in spring 2025. Additionally, VER reports annually on the sustainability performance of its investment activities and the carbon footprint of its portfolio to the Ministry of Finance.

Aside from emissions, VER monitors the performance of its equities and fixed income portfolios in terms of relevant international standards governing human rights, anti-corruption, labour rights, and environmental issues. VER’s goal is to ensure that no portfolio company violates these standards. The directly held equity and fixed income portfolio is reviewed four times a year by an external service provider.

VER is a member of organisations such as PRI, CDP, and Finsif. As a PRI signatory, VER reports regularly on its sustainability performance. Beside membership, VER takes part in investor initiatives.

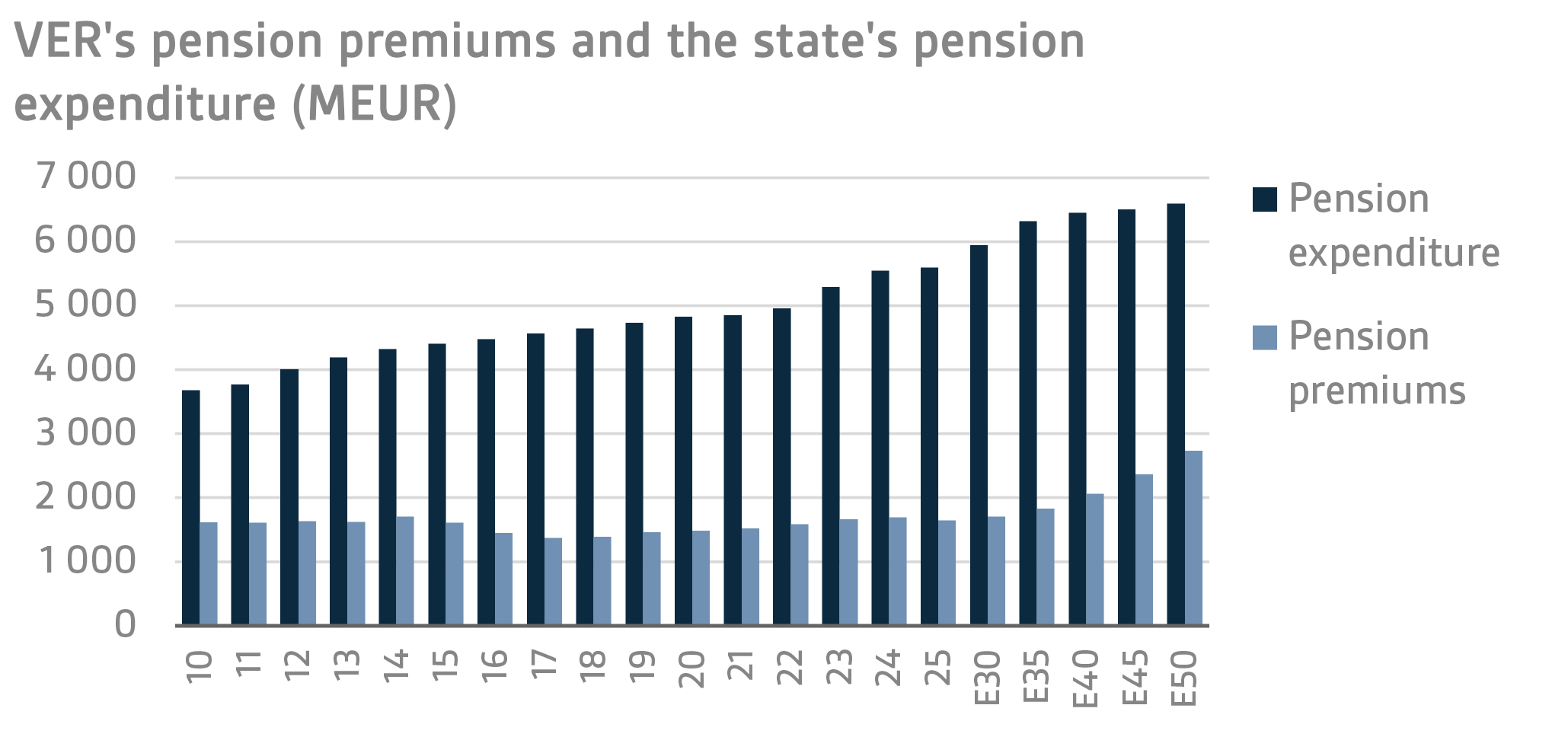

THE STATE’S PENSION EXPENDITURE CONTINUES TO INCREASE

The

role of VER in equalising the government’s pension expenditure continues to grow. In 2025, the State’s pension expenditure totalled a little over EUR 5.6 billion. As VER contributes 42 per cent towards these expenses to the government budget, the transfer to the budget amounted to approximately EUR 2.4 billion. Over the same period, VER received approximately EUR 1.7 billion in pension contributions. Its net pension contribution income has now turned permanently negative, meaning that more money is transferred from VER to the government budget than VER receives in pension contribution income. The amount to be transferred will continue to grow year on year and slow down the growth of the Fund.

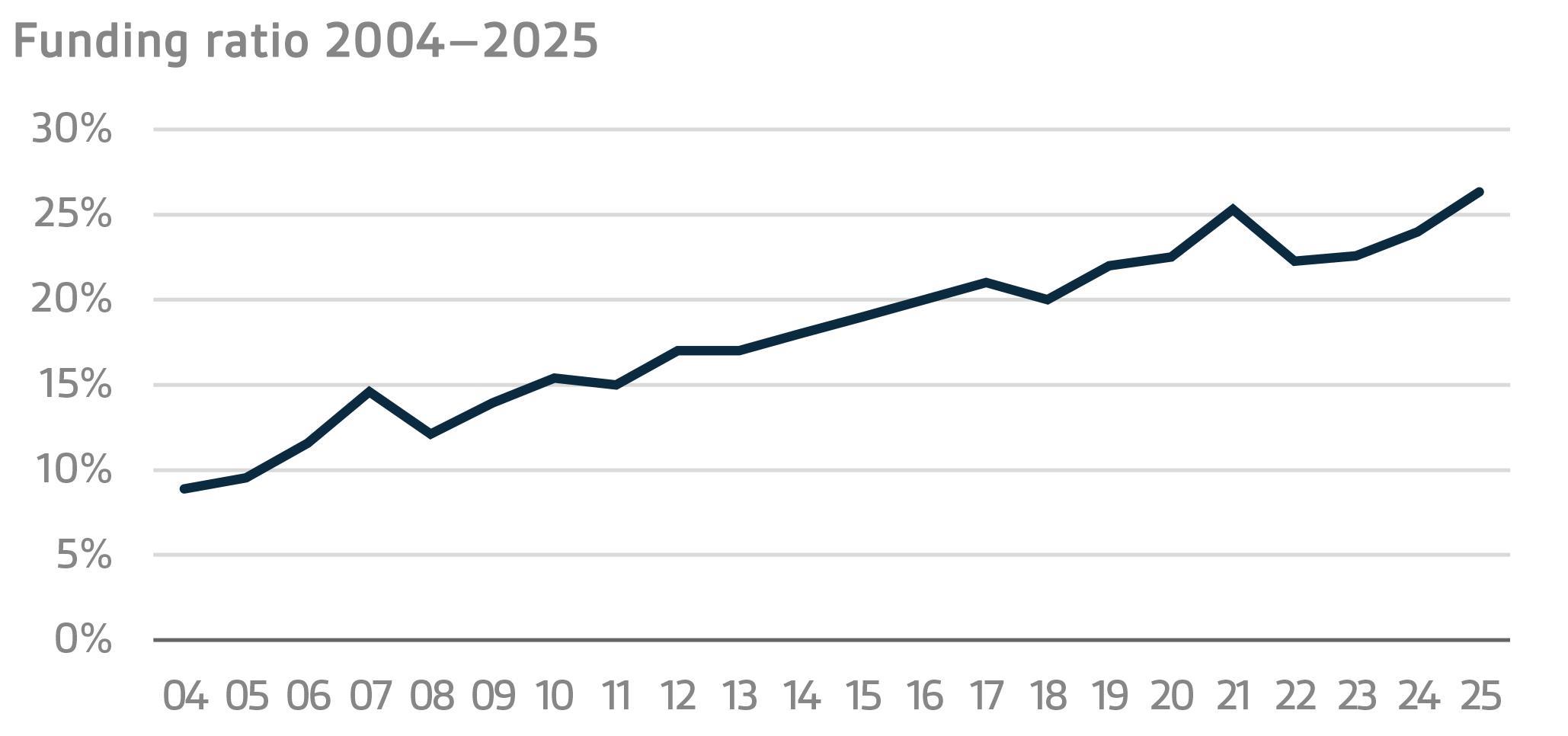

At the end of the year, the State’s pension liabilities amounted to EUR 97.8 billion, while the funding ratio was 26.5 per cent. The Act on the State Pension Fund was amended in spring 2022. As part of this amendment, VER’s contribution to the government budget was increased as of 2024. If the funding ratio exceeds 25 per cent for two consecutive calendar years, an additional transfer of three percentage points will be made to the government budget.

At the Government’s 2025 mid-term economic policy review, it was proposed that the budget transfer be increased by 1.2 percentage points so that in 2028 the transfer would be 46.2 per cent of pension expenditure. Additionally, the Government proposed that the budget transfer for 2027 be increased on a one-off basis to reach 63.9 per cent of the state's annual pension expenditure. These amendments were signed into law in 2025 and become effective as of 1 January 2026. In addition to the above-mentioned increases, the autumn 2025 budget session proposed a permanent increase in the budget transfer, which is estimated at 1.8 percentage points from 2027 onwards. Following the legislative amendment effective as of 2026 and the budget proposal, the budget transfer, relative to state pension expenditure, will be 44.2 per cent in 2026, 65.7 per cent in 2027, and 48 per cent from 2028 onwards.

The objectives set out in VER’s strategy create the basis for future investment activities. The current strategy was formally adopted on 24 January 2023. The baseline allocation of the investment portfolio is determined in the annual investment plan. Simulations suggest that the baseline allocation of the portfolio will achieve the long-term objectives established for VER.

VER’S ADMINISTRATION

The State Pension Fund of Finland, established in 1990, is an off-budget entity. Through VER, the State prepares for financing future pensions and seeks to equalise pension expenditure over time. By nature, VER is a buffer fund. VER’s assets are not used to pay out pensions directly; instead, all state pensions are paid out of the appropriations allocated for this purpose in the government budget.

The collection of pension contributions to the state pension system and related duties, such as the processing of pension applications and payment of pensions, are handled by the Local Government Pension Institution Keva. VER pays Keva a management fee for these services, which in 2025 amounted to about EUR 16.8 million.

The responsibility for oversight and control of VER’s operations rests with the Ministry of Finance, which is authorised to issue general instructions regarding the organisation of VER’s administration, financial management and the investment of its assets. According to the current operational guidelines issued by the Ministry of Finance (dated 9 Aug 2022), equity investments must not exceed 60 per cent of the value of VER’s portfolio. Fixed income instruments must account for a minimum of 30 per cent, and liquid and low-risk fixed income instruments for a minimum of 20 per cent of the value of the portfolio. Other investments must not exceed 15 per cent of the value of the portfolio at the time the investment is made. Real estate investments must be made in the form of fund investments or equivalent indirect investments.

VER’s Board of Directors is appointed by the Ministry of Finance. The Board has seven members, three of whom are appointed from among candidates proposed by the central staff organisations of government employees. Vesa Vihriälä, Doctor of Political Science, serves as Chair and member of the Board of Directors. The Chair of the Investment Advisory Committee is Jussi Laitinen.

VER’s operating costs in 2025 amounted to EUR 8.7 million, which represents 0.04 per cent of its average annual capital. During the year VER had an average of 28 employees. Job satisfaction at VER is good. VER invests in human resources and offers ample opportunities for skills development, which is important both in seeking maximum returns on investments and in managing risks.

|

KEY FIGURES 2025

|

|

|

|

|

|

|

|

|

2025

|

2024

|

|

Return on investments

|

9.3 %

|

9.0 %

|

|

Real return

|

9.1 %

|

8.2 %

|

|

|

|

|

|

Return by asset class

|

|

|

|

fixed income investments

|

|

|

|

Liquid fixed income investments

|

4.3 %

|

3.1 %

|

|

Private credit funds

|

4.8 %

|

8.5 %

|

|

Direct lending

|

2.5 %

|

5.4 %

|

|

Equities

|

|

|

|

Listed equities

|

15.4 %

|

14.6 %

|

|

Private equity funds

|

2.8 %

|

13.4 %

|

|

Infrastructure funds

|

5.7 %

|

13.4 %

|

|

Unlisted equities

|

28.6 %

|

3.9 %

|

|

Other investments

|

|

|

|

Unlisted real estate funds

|

0.1 %

|

-5.0 %

|

|

Hedge funds and systematic strategies

|

11.3 %

|

10.9 %

|

|

|

|

|

|

Average returns

|

5 years

|

10 years

|

|

|

|

|

|

Average return on portfolio p.a.

|

6.5 %

|

5.9 %

|

|

Average real return p.a.

|

3.0 %

|

3.8 %

|

|

Average effective interest rate on government debt p.a.

|

1.4 %

|

1.2 %

|

|

|

|

|

|

Portfolio allocation

|

2025

|

2024

|

|

|

|

|

|

Total investments, EURm

|

25 760.1

|

24 240.1

|

|

|

|

|

|

fixed income investments

|

39.2 %

|

41.0 %

|

|

Liquid fixed income investments

|

36.4 %

|

37.8 %

|

|

Other fixed income investments

|

2.8 %

|

3.2 %

|

|

Equity investments

|

55.6 %

|

52.7 %

|

|

Listed equities

|

44.0 %

|

40.5 %

|

|

Other equity investments

|

11.6 %

|

12.2 %

|

|

Other investments

|

7.9 %

|

8.0 %

|

|

Unlisted real estate funds

|

3.7 %

|

3.7 %

|

|

Hedge funds and systematic strategies

|

4.3 %

|

4.3 %

|

|

|

|

|

|

|

|

|

|

Key figures

|

2025

|

2024

|

|

|

|

|

|

Volatility

|

7.4 %

|

5.5 %

|

|

Sharpe ratio

|

1.1

|

1.1

|

|

|

|

|

|

Other key figures

|

2025

|

2024

|

|

|

|

|

|

Pension contribution income, EURm

|

1 656

|

1 709

|

|

Budget transfers, EURm

|

2 350

|

2 274

|

|

Net contribution income, EURm

|

-695

|

-565

|

|

Balance sheet total, EURm

|

19 902

|

17 683

|

|

Pension liabilities, EUR bn

|

97.8

|

101.0

|

|

Funding ratio

|

26.5 %

|

24.2 %

|

Additional information:

Additional information is provided by Chief Executive Officer

Timo Löyttyniemi

, firstname.lastname@ver.fi, tel. +358 295 201 210.

Established in 1990, the State Pension Fund of Finland (VER) is an off-budget fund through which the State prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the State’s pension assets professionally. At the end of 2025, the market value of the Fund’s investment portfolio stood at EUR 25.8 billion.