VER’s return on investment 2.5% during 1 Jan–30 June 2025; ten-year average annual return 5.2%

Published 2025-08-21 at 14:47

INVESTMENT ENVIRONMENT

Economic and market developments in the first half of 2025 were driven by US trade policy and related uncertainties. The debate over US trade tariffs created uncertainty, which was particularly reflected in the decline of stock markets in April. Overall, however, the first half of the year was favourable for institutional investors, with positive returns on equities and fixed income investments.

The decline in inflation has enabled central banks to lower their key policy rates. The US Federal Reserve and the European Central Bank lowered interest rates in the first half of the year. The markets expect key interest rates to continue falling, creating a favourable investment environment for the stock market.

Economic growth has been modest in Europe but is expected to pick up slightly. The high level of uncertainty surrounding economic growth has been linked to US President Donald Trump's trade policy. His announcement of tariff increases on 2 April caused turmoil in the stock market. However, decisions were put off and the United States sought to reach a negotiated settlement, which calmed the markets. Gradually, it transpired that trade tariffs are a negotiating tool and that the final tariffs will be lower than the threats made.

The geopolitical situation has remained tense. The war in Ukraine has been going for over three years now. No lasting ceasefire was reached in the conflict between Israel and Hamas during the reporting period. In addition, there were occasional violent clashes between Israel and Iran. However, a number of indications during the reporting period suggested that there is a will to find solutions, but the road to peace is complex.

VER’S RETURN ON INVESTMENTS

Future monitoring and evaluation of VER’s investment activities will focus on long-term outcomes and prospects instead of quarterly reporting. However, VER will continue to post quarterly figures and comments.

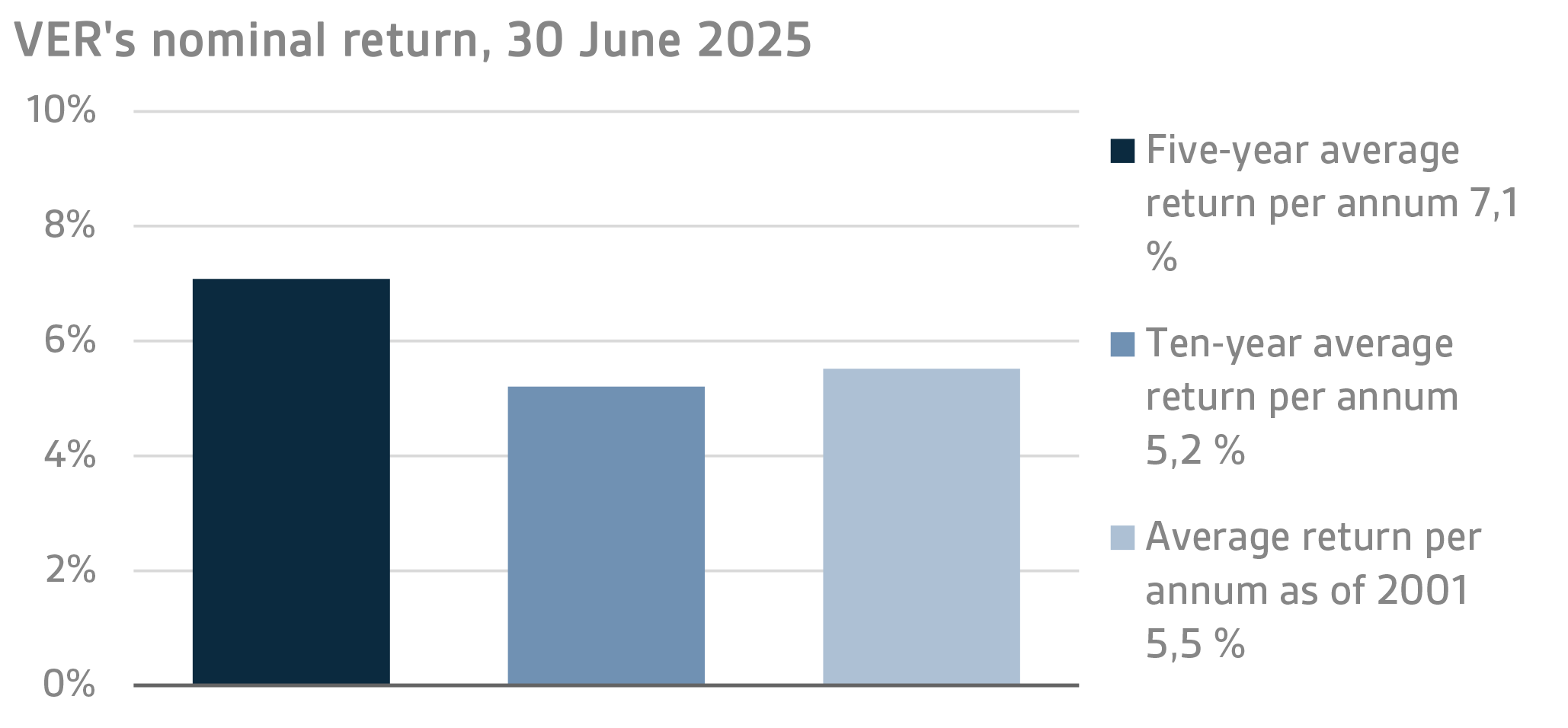

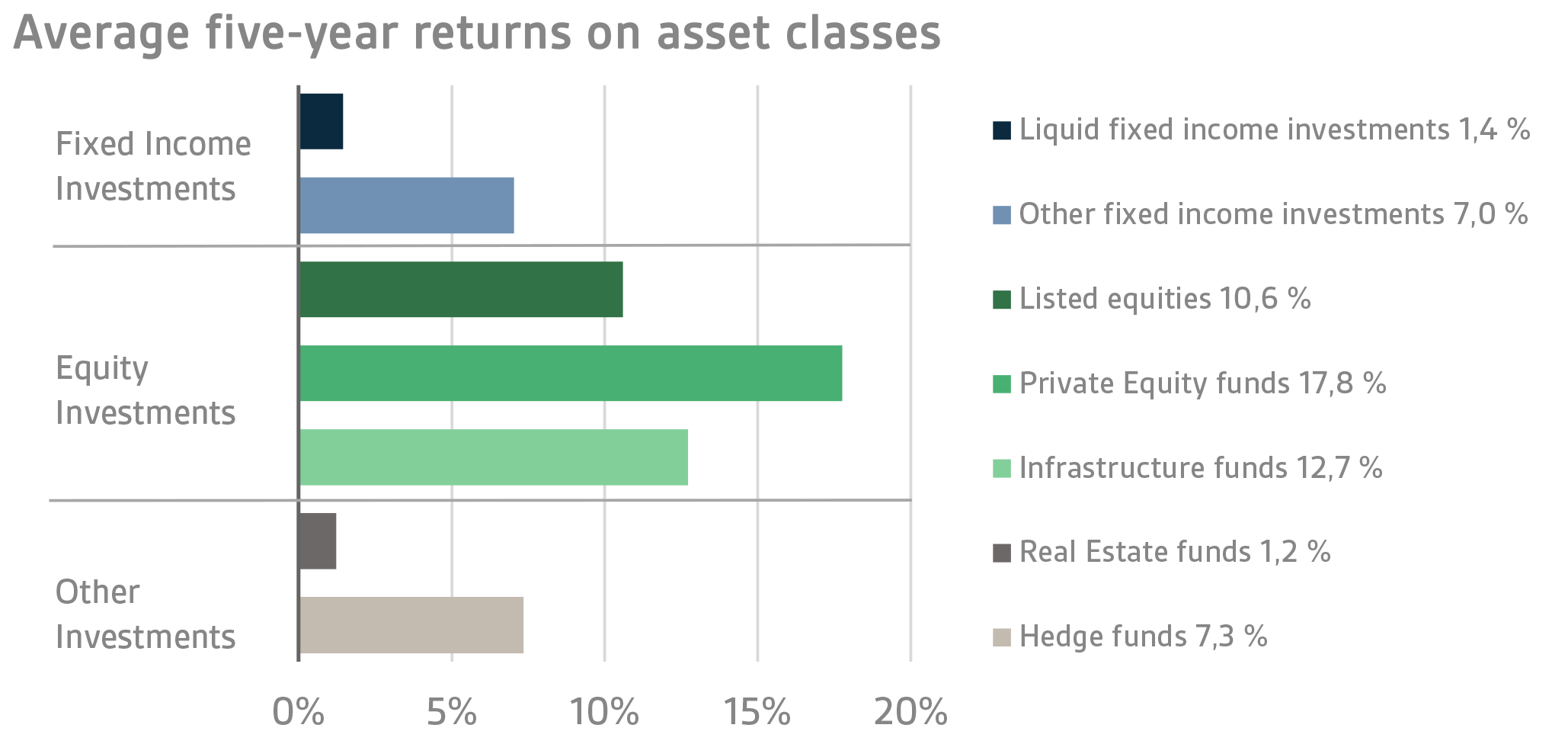

On 30 June 2024, VER’s investment assets totalled EUR 24.5 billion. During the first half of the year, the return on investments at fair values was 2.5 per cent. The average nominal rate of return over the past five years (1 July 2020–30 June 2025) was 7.1 per cent and the annual ten-year return 5.2 per cent. Since 2001, when VER’s activities assumed their current form, the average rate of return has been 5.5 per cent.

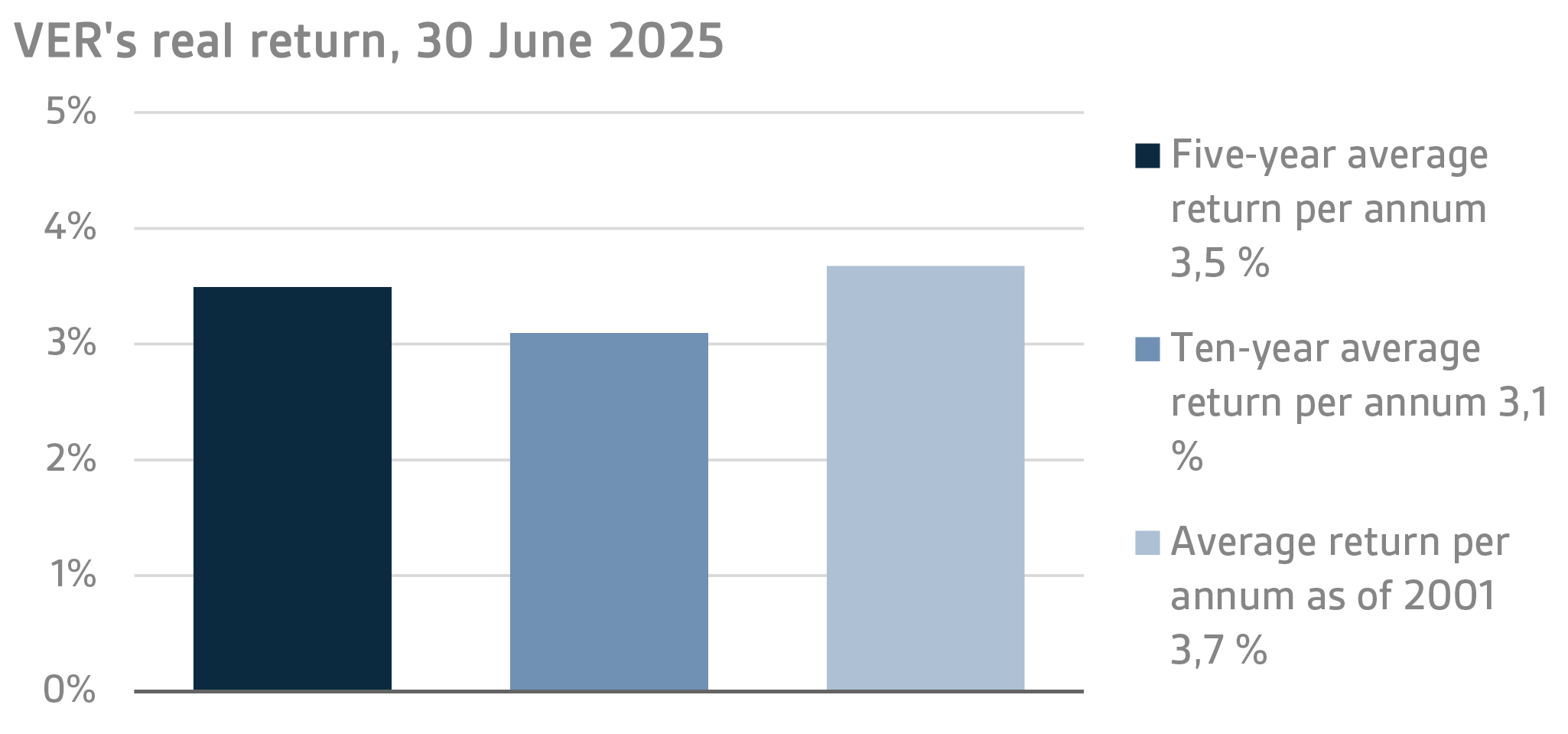

To determine real returns, the Finnish consumer price index was used as the inflation indicator. The real rate of return during the first half of 2025 was 2.4 per cent. VER’s five-year average real return was 3.5 per cent and ten-year real return 3.1 per cent per year. Since 2001, when VER’s activities assumed their current form, the average real rate of return has been 3.7 per cent.

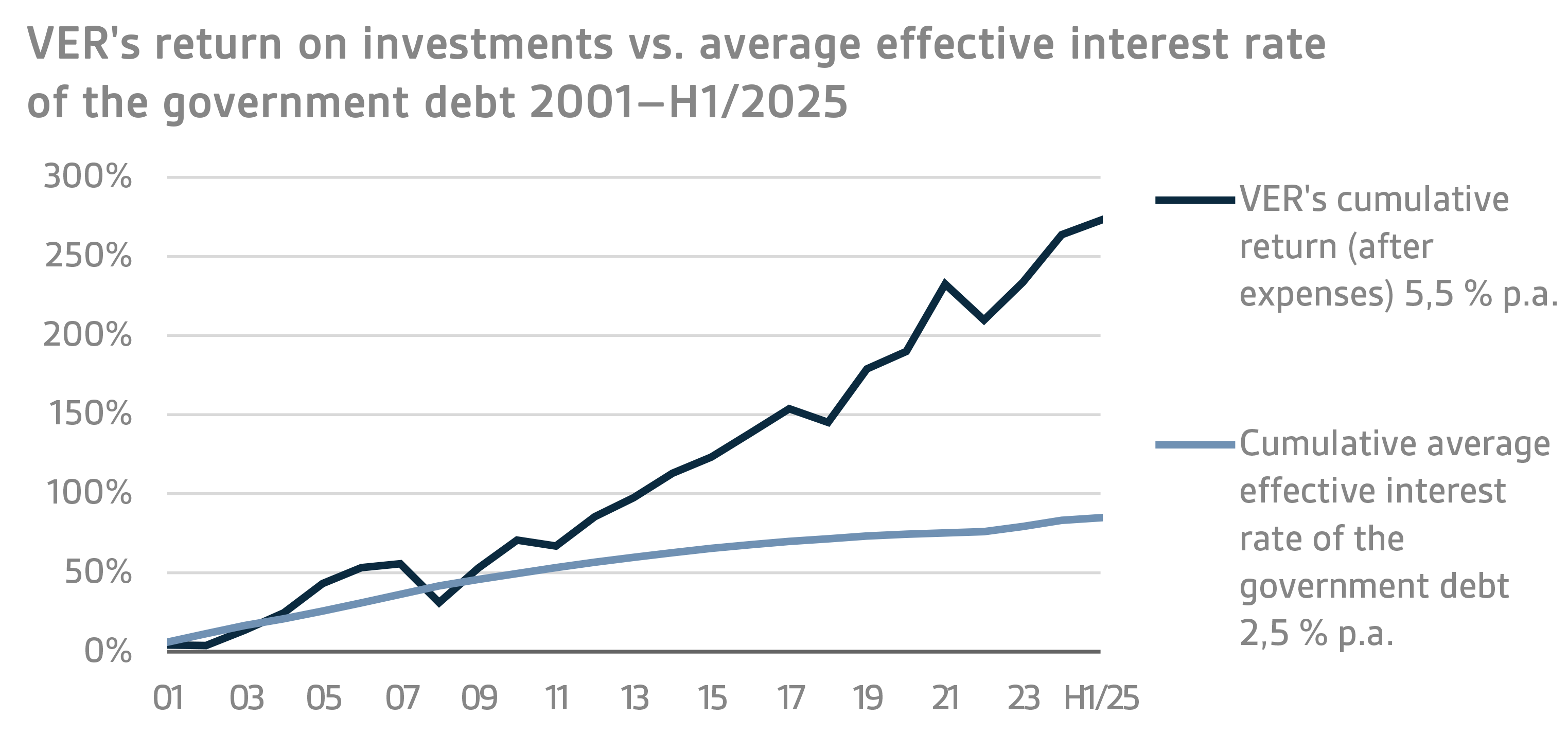

From the State’s point of view, it is pertinent to compare the return on investments with the cost of net government debt, because the funds accumulated in preparation for future pension expenditure can be deemed to reduce such debt. Over the past ten years, VER’s average annual rate of return has beaten the cost of net government debt by 4.0 percentage points. Since 2001, the total market-value returns earned by VER have exceeded the cumulative average cost of equivalent government debt by about EUR 12.3 billion over the same period.

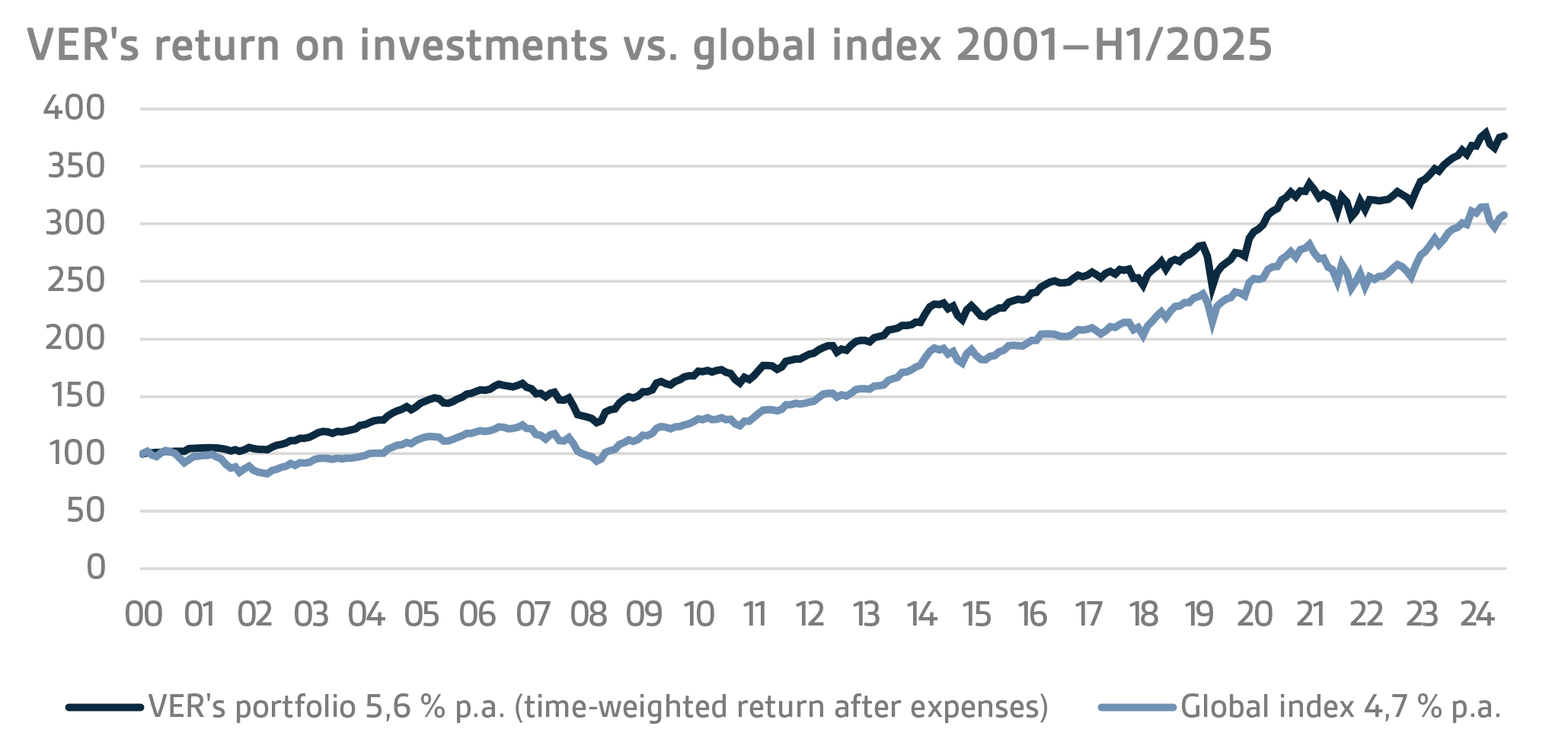

VER monitors long-term return relative to overall market developments by comparing the actual return with a global index, in which the weight of both equities and currency-hedged fixed income instruments is 50 per cent.

A CLOSER LOOK AT JANUARY–JUNE 2025

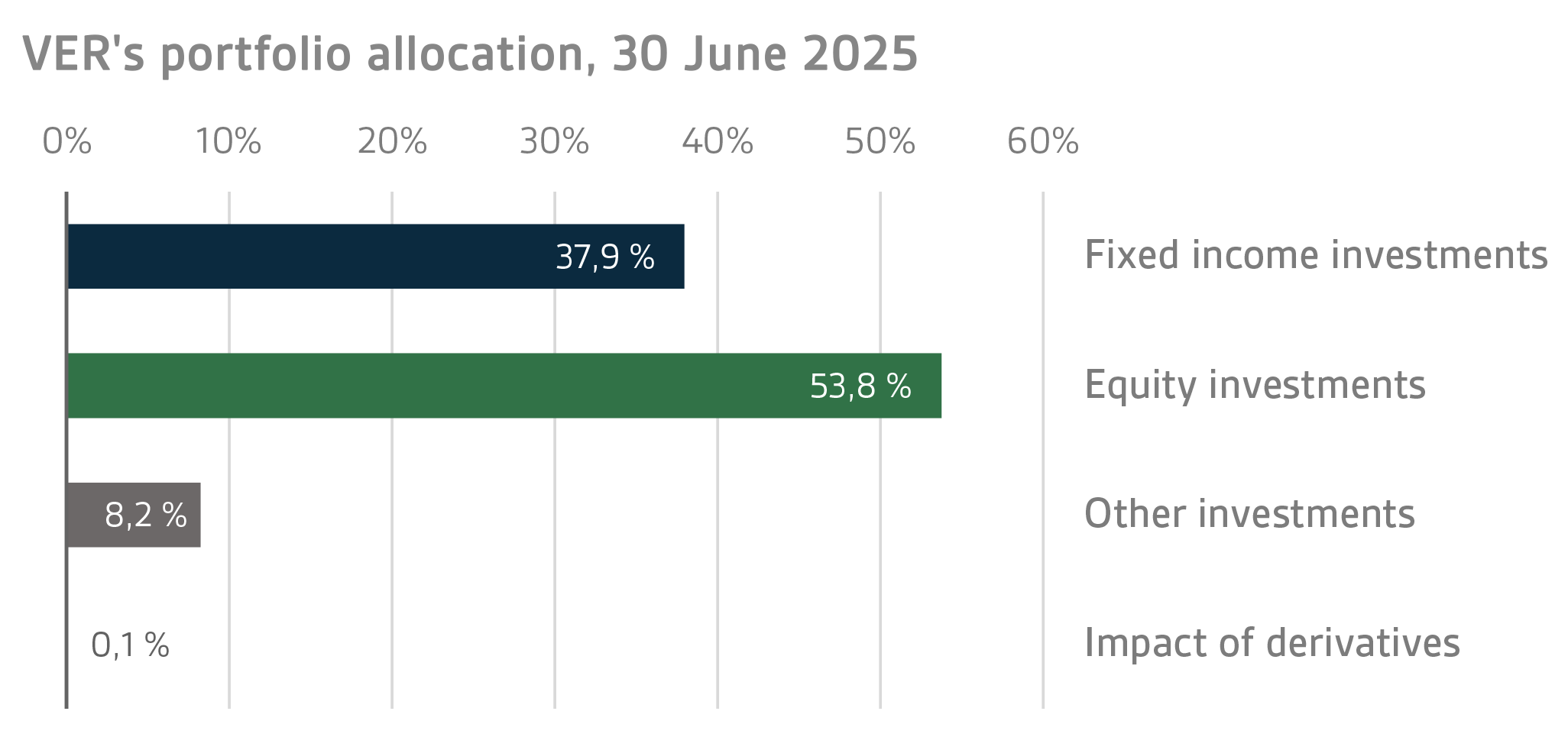

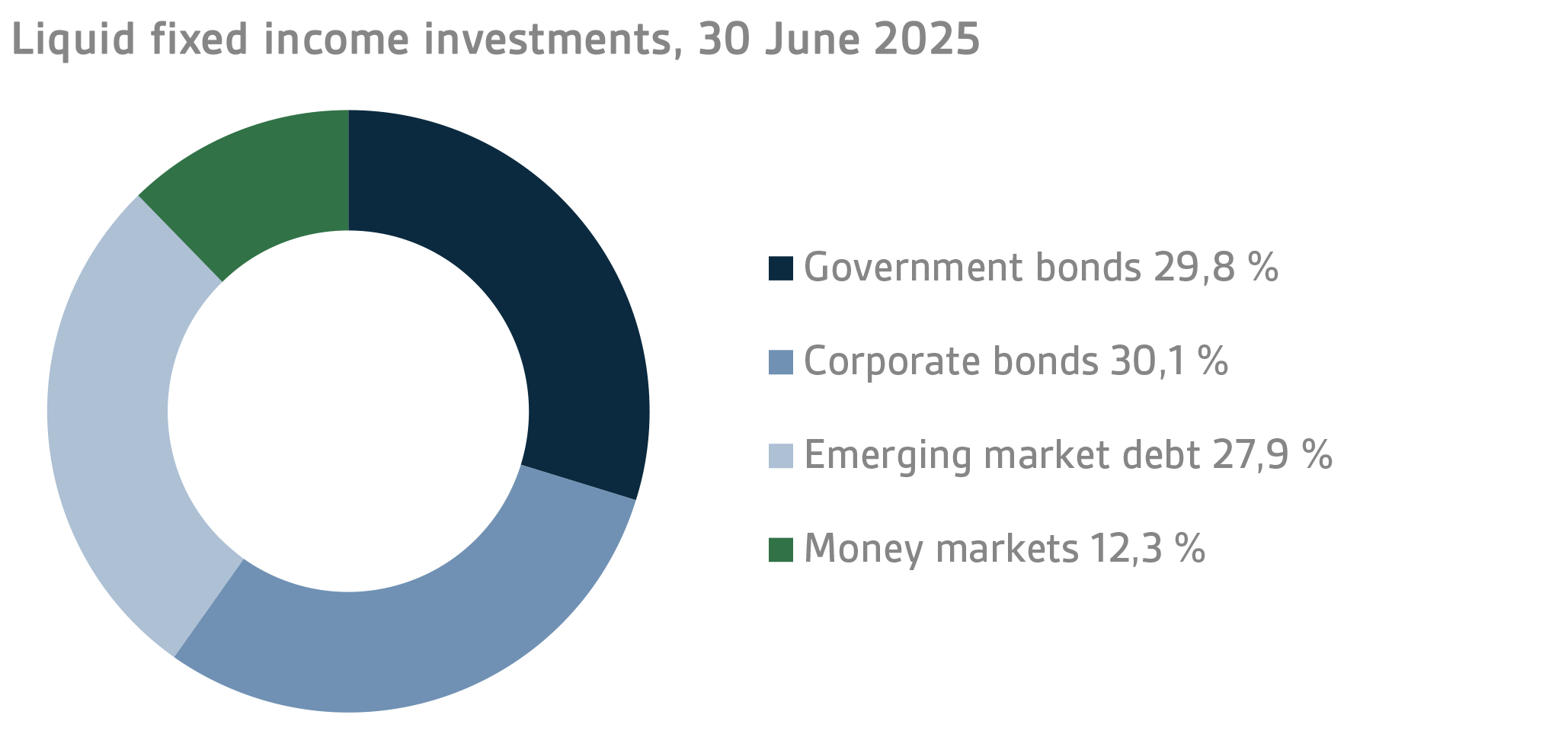

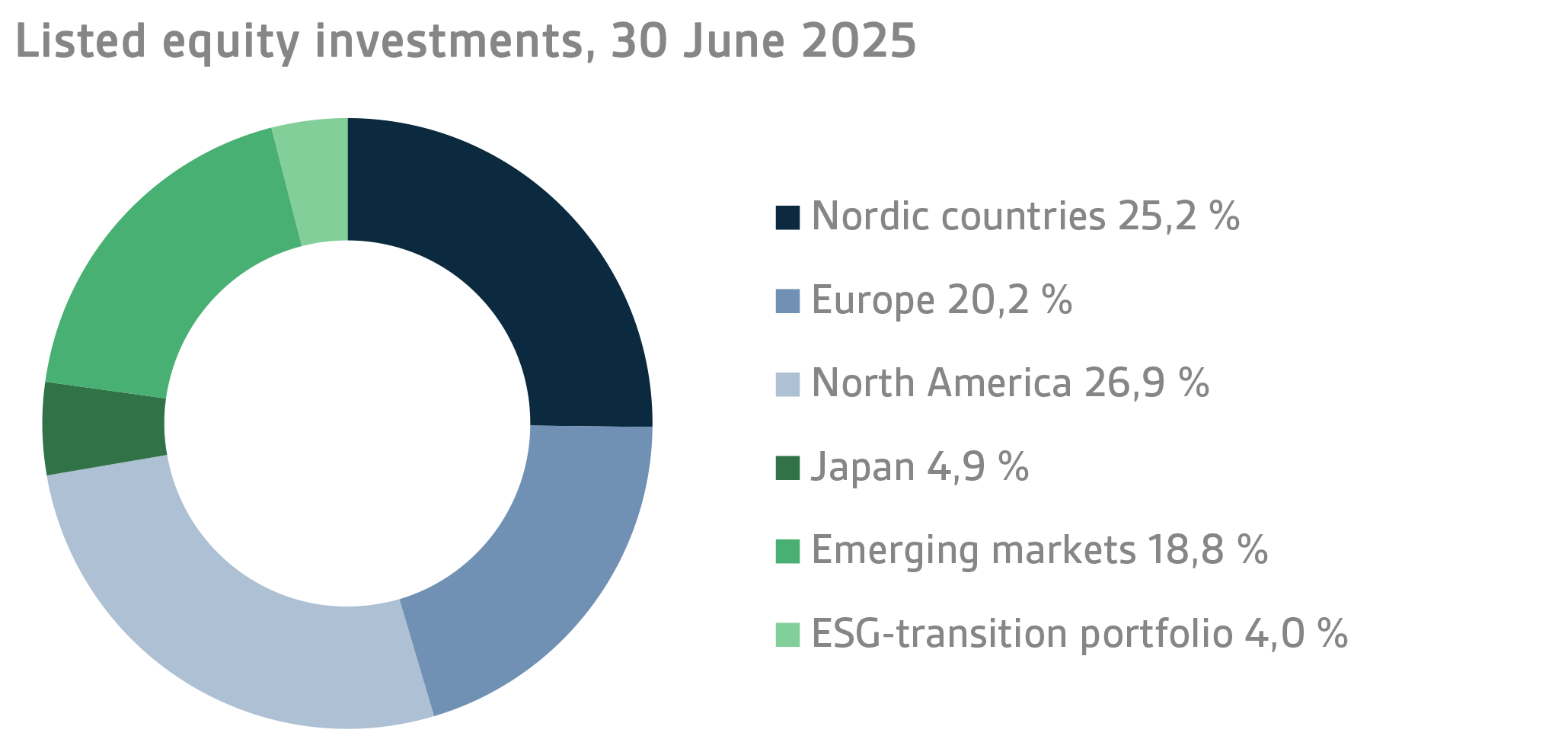

In accordance with the guidelines of the Ministry of Finance, VER’s investments are divided into fixed income instruments, equities and other investments. At the end of June, fixed income investments accounted for 37.9 per cent, equities 53.8 per cent and other investments 8.2 per cent of the total. Of the large asset classes, liquid fixed income instruments generated a return of 2.1 per cent and listed equities 2.8 per cent during the first half of the year.

FIXED INCOME INVESTMENTS

Liquid fixed income investments

During the first half of the year, the return on liquid fixed income investments was 2.1 per cent.

The second quarter was dominated by news of Trump's trade and fiscal policy plans and the escalation of the conflict between Israel and Iran, in which the United States was also actively involved. At the beginning of the quarter, Trump's announcement of significant tariffs also unsettled the fixed income market, widening risk premiums on corporate loans in particular. However, the imposition of customs duties was postponed, which calmed the situation. The markets were also concerned about Trump's planned tax cuts and the predicted significant increase in the budget deficit. The markets even began to question the safe haven status of both the dollar and US government bonds. The escalation of the Israeli-Iran conflict was met with relative calm in the fixed income markets. Towards the end of the quarter, market interest rates fell on growing expectations that the US Federal Reserve (FED) would cut interest rates, as Trump planned to appoint a successor to Fed Chair Powell at an unusually early stage. Additionally, it was believed that the trade negotiations would result in an agreement on significantly lower tariffs than those originally proposed by Trump.

In the second quarter of the year, the European Central Bank (ECB) continued to cut its policy rates by 25 basis points at both its April and June meetings, ending with a deposit rate of 2.0%. Also, yields on longer-term European government bonds declined slightly after rising sharply in the first quarter as a result of planned significant defence and infrastructure investments. The FED did not touch its key interest rate, but the increased expectations of interest rate cuts pushed down the short end of the yield curve, with the 10-year government bond yield ending the second quarter at the same level as at the beginning of the quarter.

At the end of the quarter, the FED was priced to cut its policy rate three times by 25 basis points by its January 2026 meeting. As for the ECB, expectations were for just one more 25 basis point rate cut during this cycle, in addition to the cuts already made.

Despite the increase in spreads at the beginning of the quarter, risk premiums on corporate loans and emerging market loans ended slightly lower than at the beginning of the quarter.

Of VER's liquid fixed income investments, the best returns were generated by higher-risk instruments, such as the investments in emerging market debt and lower-rated corporate bonds, as well as in low-risk investments in US Treasuries.

In the private credit market, expectations for the current year remain mixed. The US tariff policy caused significant uncertainty in the capital investment market during the spring and summer, and the positive expectations for the transaction market at the beginning of the year did not materialize. However, for Special Situation strategies, the current market situation creates excellent investment opportunities if disruptions to world trade increase causing financial problems for companies, for example due to indebted balance sheets.

EQUITIES

Listed equities

During the first half of the year, the return on listed equities was 2.8 per cent.

It turned positive in the second quarter, after being slightly negative at the end of the first quarter. The second quarter got off to a very weak start on the stock markets when the US administration announced significant tariffs at the beginning of April. The announcement caused jitters in the financial markets, and share prices fell significantly in the wake of the tariff news. The situation calmed down after President Trump announced that the imposition of high tariffs would be postponed in the hope of a positive outcome in the trade negotiations. The tariffs, and the twists and turns surrounding customs duties that continued throughout the second quarter, became a clear theme in the financial markets during the first half of the year. Aside from tariffs, the fiscal policy measures outlined by President Trump also attracted attention. There were fears that US national debt would swell significantly as a result of proposals such as the planned large tax cuts. The nervousness surrounding US debt was reflected in the clear weakening of the US dollar against the euro during the spring.

The geopolitical situation deteriorated further in the second quarter, partly due to the escalation of the Israeli-Iran conflict. However, the impact on the financial markets remained fairly limited, even after the US Air Force’s strike on nuclear facilities on Iranian soil. The situation in Ukraine showed no signs of improvement, quite the contrary. However, geopolitical developments had very little impact on the stock markets, and reactions were very short-lived.

During the first half of the year, VER's best-performing stocks were Nordic equities, mainly due to the excellent performance of Finnish stocks during the first six months of 2025. The weakest performance was put in by investments in the North American market, due to the significant weakening of the US dollar.

Other equity investments

VER’s other equity investments include investments in private equity funds, infrastructure and unlisted stock.

Private equity investments returned 0.5 per cent, infrastructure funds 2.3 per cent and unlisted equities 23.4 p

er cent during the first six months of the year.

The uncertainty in the capital markets triggered by changes in the US tariff policy spilled over to the spring and summer. As a result, the transaction market remained fairly quiet, despite the high expectations at the beginning of the year. However, there was a slight upturn at the end of the second quarter when some large transactions were closed. Towards the end of the year, the market is expected to pick up as fund managers seek to sell companies that have been held in their portfolios for a long time.

The return on VER's infrastructure portfolio in January–June was mainly based on the positive performance of European low-risk funds. The return profile of core/core+ funds is fairly stable, as they are not affected by global economic uncertainty to the same extent as riskier strategies. Steady returns and the inflation-hedging properties of this asset class have kept investor interest in infrastructure funds high this year as well. Expectations for year-end returns have also remained high.

OTHER INVESTMENTS

VER’s other investments include investments in real estate investment trusts, hedge funds and systematic strategies.

During the first half of the year, the return on real estate investment trusts was -0.6 per cent.

Although VER's real estate investment returns remained negative, expectations for year-end returns have turned more positive. Underlying this optimism is the belief that real estate values have bottomed out and that falling interest rates will kick-start the long-sluggish transaction market. So far this year, positive fund income has been largely based on rental cash flows.

Hedge funds and systematic strategies returned 5.0 per cent in January–June.

Hedge funds performed well in the first half of the year, considering the operating environment riddled with uncertainties. The turbulent period benefited, in particular, the portfolio's volatility fund, which posted a double-digit return for the period. Also, the period was profitable for quantitative strategies and some Asian funds. The CTA strategy was the only one in the portfolio that posted a clearly negative return for the period, suffering from the absence of a clear longer-term trend during the period.

STATE PENSION EXPENDITURE, VER’S TRANSFERS TO THE GOVERNMENT BUDGET, PENSION CONTRIBUTION INCOME AND FUNDING RATIO

The role of the State Pension Fund of Finland in equalising the government’s pension expenditure continues to grow. In 2024, the State’s pension expenditure totalled over EUR 5.5 billion while the 2025 budget foresees an expenditure of nearly EUR 5.6 billion. As VER contributes 42 per cent towards these expenses to the government budget, the transfer to the 2025 budget will amount to over EUR 2.4 billion.

By the end of June, VER had transferred EUR 1.2 billion to the government budget. Over the same period, VER’s pension contribution income totalled EUR 0.8 billion. The pension contribution income matches the forecast. VER’s net pension contribution income has now turned permanently negative, meaning that clearly more money is transferred from VER to the government budget than VER receives in pension contribution income. According to current estimates, this gap between budget transfers and income will continue to grow up to the mid-2030s, which will slow down the growth of the Fund and the improvement of the funding ratio. The negative cash flow is expected to continue until the 2050s.

The Act on the State Pension Fund was amended in spring 2022. As part of this amendment, VER’s contribution to the government budget was increased as of 2024. Consequently, VER’s budget transfers will be gradually increased from the current 41 per cent to 45 per cent during 2024–2028. If the funding ratio exceeds 25 per cent for two consecutive calendar years, an additional transfer of three percentage points will be made to the government budget. Additional budget transfers from 2026 onwards, presented by the Government to Parliament in April 2025, are currently being prepared. It is proposed that the budget transfer be increased by 1.2 percentage points so that in 2028 the transfer would be 46.2 per cent of pension expenditure. Additionally, the Government has proposed that the budget transfer for 2027 be increased on a one-off basis to reach 63.9 per cent of the state's annual pension expenditure.

|

KEY FIGURES

|

|

|

|

|

30.6.2025

|

31.12.2024

|

30.6.2024

|

|

Investments, MEUR (market value)

|

24 452

|

24 240

|

23 630

|

|

Fixed income investments

|

9 278

|

9 936

|

9 743

|

|

Equity investments

|

13 147

|

12 784

|

12 574

|

|

Other investments

|

2 012

|

1 949

|

1 851

|

|

Impact of derivatives

|

16

|

-429

|

-538

|

|

|

|

|

|

Breakdown of the investment portfolio

|

|

|

|

|

Fixed income investments

|

37,9 %

|

41,0 %

|

41,2 %

|

|

Equity investments

|

53,8 %

|

52,7 %

|

53,2 %

|

|

Other investments

|

8,2 %

|

8,0 %

|

7,8 %

|

|

Impact of derivatives

|

0,1 %

|

-1,8 %

|

-2,3 %

|

|

|

|

|

|

1.1.–30.6.2025

|

1.1.

–

31.12.2024

|

1.1.–30.6.2024

|

|

Return on investment

|

2,5 %

|

9,0 %

|

5,1 %

|

|

Fixed income investments

|

|

|

|

|

Liquid fixed income investments

|

2,1 %

|

3,1 %

|

0,9 %

|

|

Private Credit funds

|

1,4 %

|

8,5 %

|

3,5 %

|

|

Direct lending

|

1,2 %

|

5,4 %

|

-1,9 %

|

|

Equity investments

|

|

|

|

|

Listed equity investments

|

2,8 %

|

14,6 %

|

10,3 %

|

|

Private Equity investments

|

0,5 %

|

13,4 %

|

5,3 %

|

|

Infrastructure funds

|

2,3 %

|

13,4 %

|

3,7 %

|

|

Unlisted equity investments

|

23,4 %

|

3,9 %

|

1,4 %

|

|

Other investments

|

|

|

|

|

Unlisted Real Estate funds

|

-0,6 %

|

-5,0 %

|

-4,5 %

|

|

Hedge funds and systematic strategies

|

5,0 %

|

10,9 %

|

5,9 %

|

|

|

|

|

|

Pension contribution income, MEUR

|

847

|

1 709

|

882

|

|

Transfer to state budget, MEUR

|

1 178

|

2 274

|

1 143

|

|

Net contribution income, MEUR

|

-331

|

-565

|

-261

|

|

Pension liability, BnEUR

|

|

101

|

|

|

Funding ratio, %

|

|

24,2 %

|

|

Additional information: Additional information is provided by Chief Executive Officer Timo Löyttyniemi, firstname.lastname@ver.fi, tel. +358 (0)295 201 210

Established in 1990, the State Pension Fund (VER) is an off-budget fund through which the State prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the State’s pension assets professionally. At the end of June 2025, the market value of the Fund’s investment portfolio stood at EUR 24.5 billion.

All figures presented in this interim report are preliminary and unaudited.