VER’s return on investments 0.6% during 1 Jan–31 March 2025; ten-year average annual return 4.8%

Published 2025-04-29 at 15:51

INVESTMENT ENVIRONMENT

Investment markets performed well at the beginning of 2025, raising expectations. Stock market returns were sound for the first two months until the debate on US tariffs started. Towards the end of March, there were growing concerns about the impact of potential higher tariffs on the global economy and stock markets.

The tariff debate also had a spill-over effect on interest rate expectations. Towards the end of the reporting period, expectations of interest rate cuts by the US Federal Reserve and the European Central Bank increased. Any US import tariffs were expected to weaken economic growth. Even though tariffs may accelerate inflation at least temporarily, investors expect that the impact in terms of slowing down economic growth is even greater.

The United States announced significant tariffs in early April right after the end of the reporting period, while some of the tariffs were delayed and subsequently defined in more detail. The overall impact of the tariffs remained an open question, but it became clear during the first part of the year that the tariff debate was itself a source of uncertainty and concern for businesses and investors alike.

The geopolitical crises have continued unabated. From time to time, there was news of a potential ceasefire in Ukraine and peace talks in Gaza. However, the first quarter failed to bring any solution to these crises and warfare continued.

As a result of these factors, investment returns in the first quarter were only slightly positive. There were more uncertainties about economic growth than normally, and volatility in the investment market increased towards the end of the period.

VER’S RETURN ON INVESTMENTS

Future monitoring and evaluation of the State Pension Fund’s investment activities will focus on long-term outcomes and future prospects instead of quarterly reporting. However, VER will continue to post quarterly figures and comments.

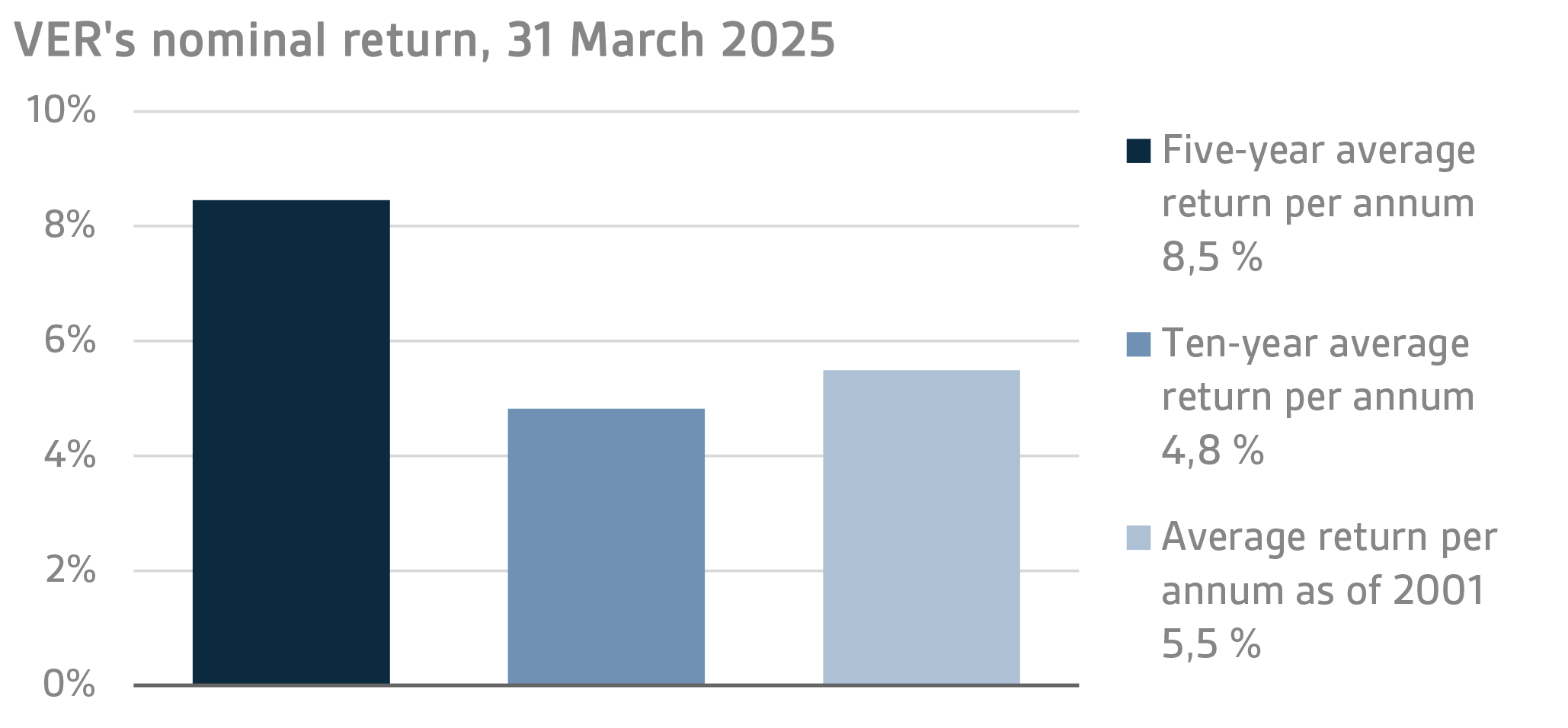

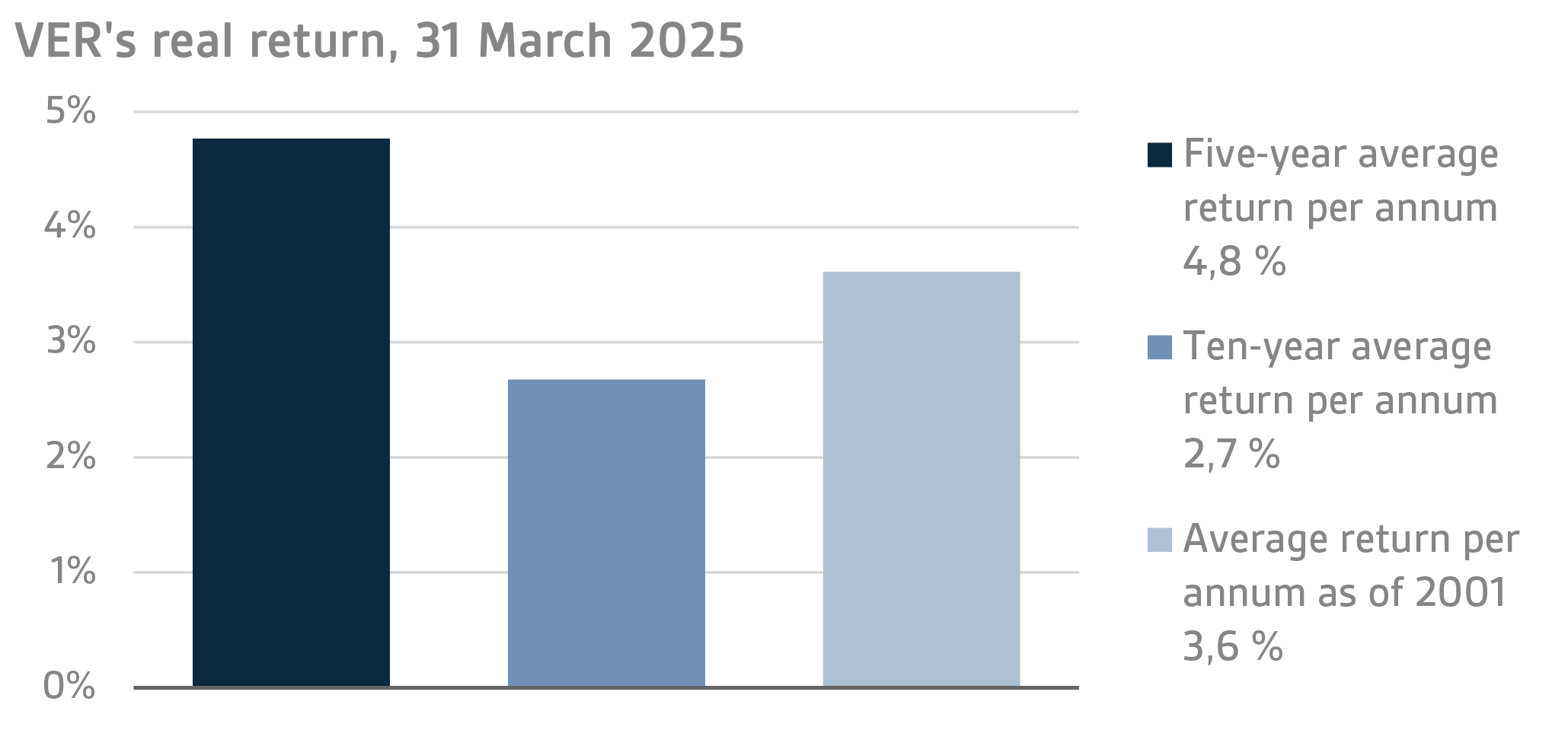

On 31 March 2025, VER’s investment assets totalled EUR 24.2 billion. During the first quarter, the return on investments at fair values was 0.6 per cent. The average nominal rate of return over the past five years (1 April 2020–31 March 2025) was 8.5 per cent and the annual ten-year return 4.8 per cent. Since 2001 when VER’s activities assumed their current form, the average rate of return has been 5.5 per cent.

The real rate of return during the first quarter was 0.1 per cent. VER’s five-year average real return was 4.8 per cent and ten-year real return 2.7 per cent per year. Since 2001, when VER’s activities assumed their current form, the average real rate of return has been 3.6 per cent.

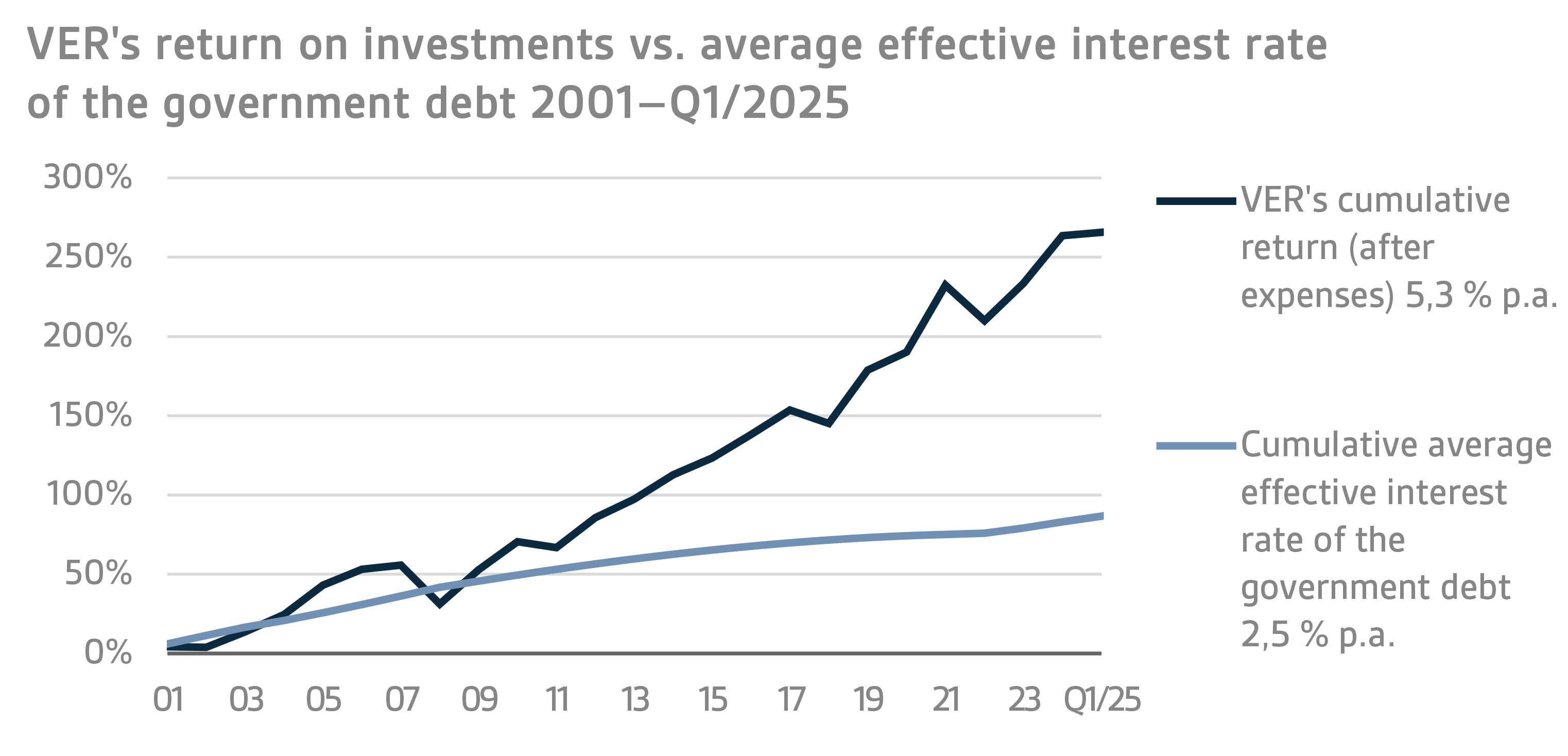

From the State’s point of view, it is pertinent to compare the return on investments with the cost of net government debt, because the funds accumulated in preparation for future pension expenditure can be deemed to reduce such debt. Over the past ten years, VER’s average annual rate of return has beaten the cost of net government debt by 3.6 percentage points. Since 2001, the total market-value returns earned by VER have exceeded the cumulative average cost of equivalent government debt by about EUR 11.8 billion over the same period.

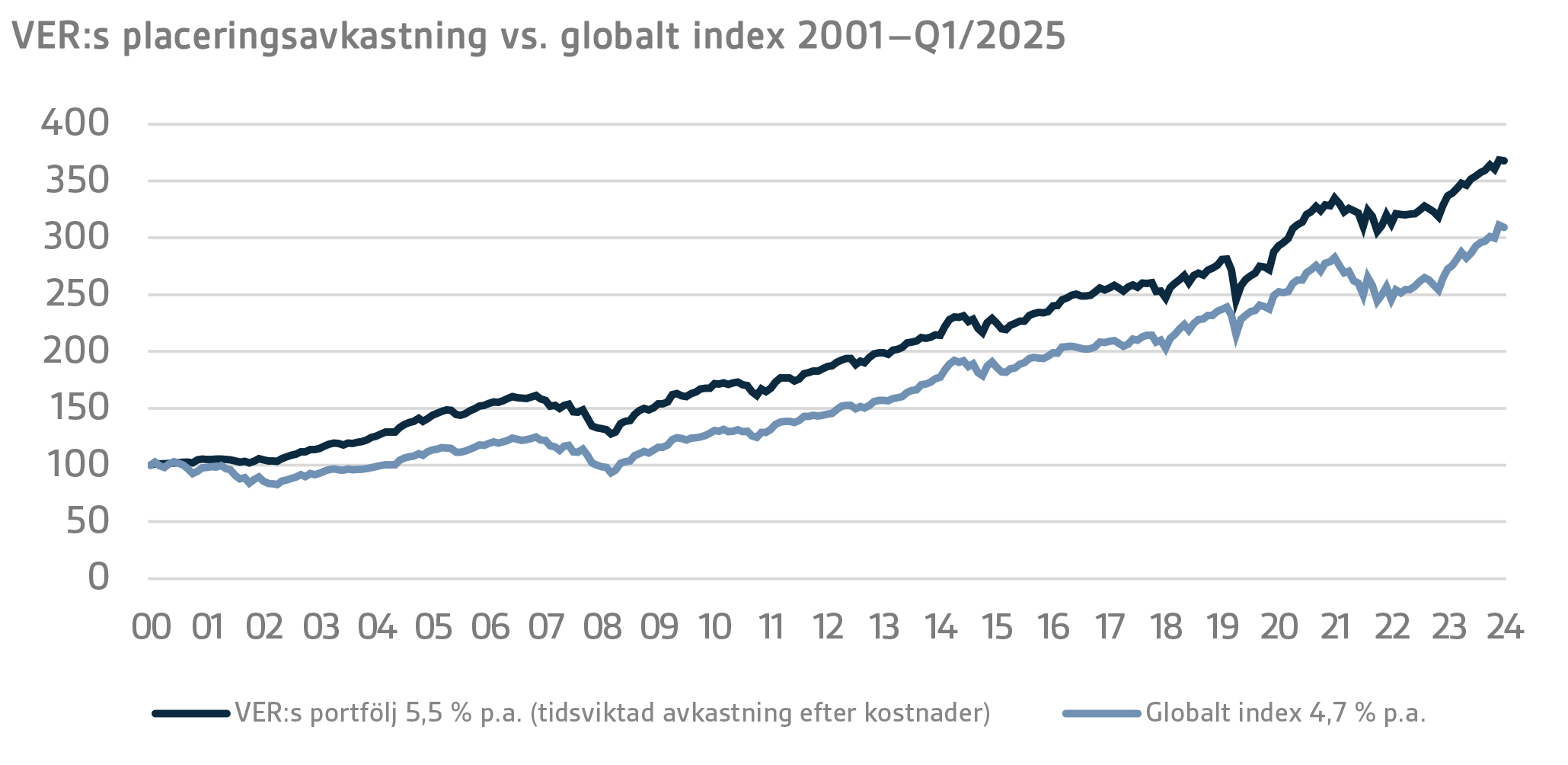

VER monitors long-term return relative to overall market developments by comparing the actual return with a global index, in which the weight of both equities and currency-hedged fixed income instruments is 50 per cent.

A CLOSER LOOK AT JANUARY–MARCH 2025

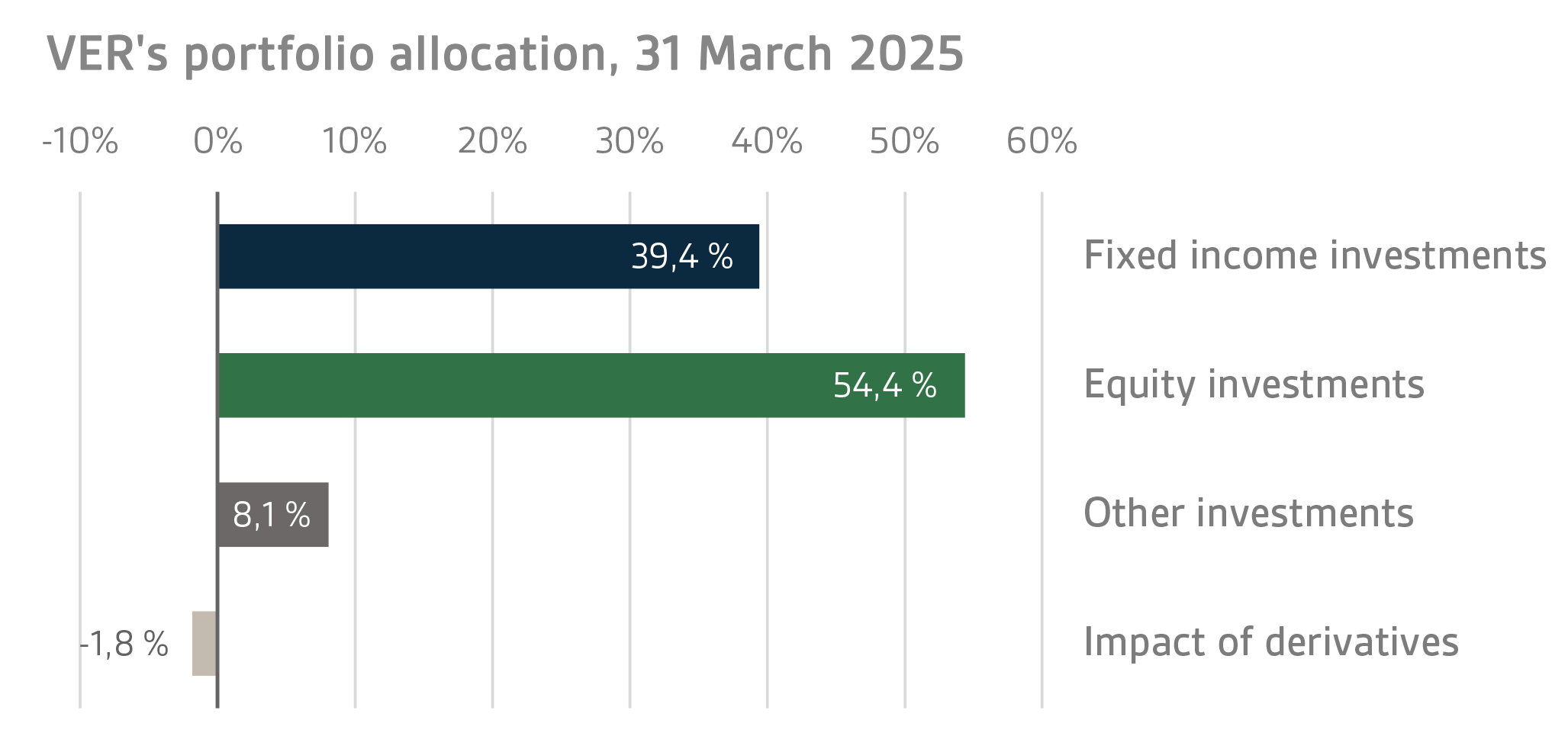

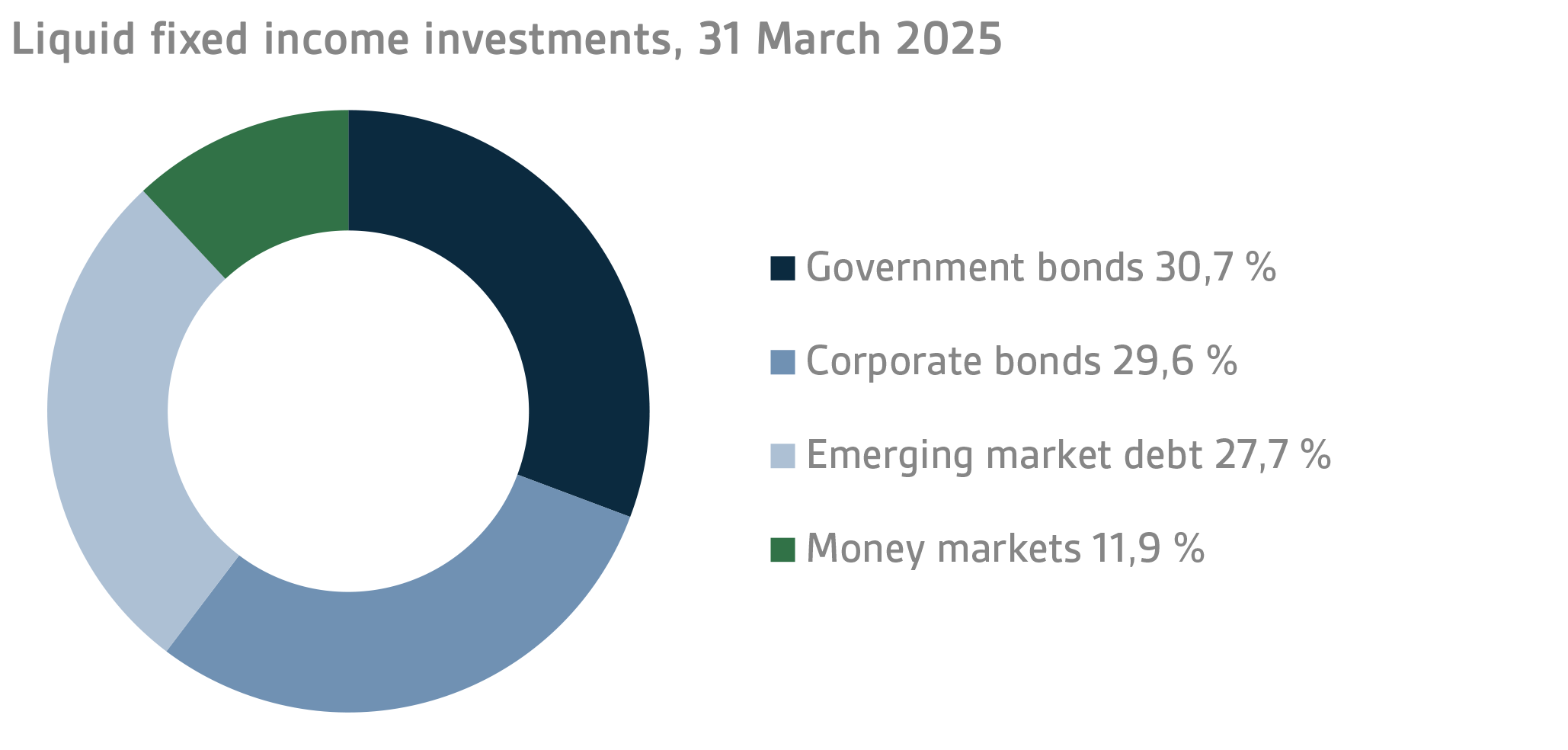

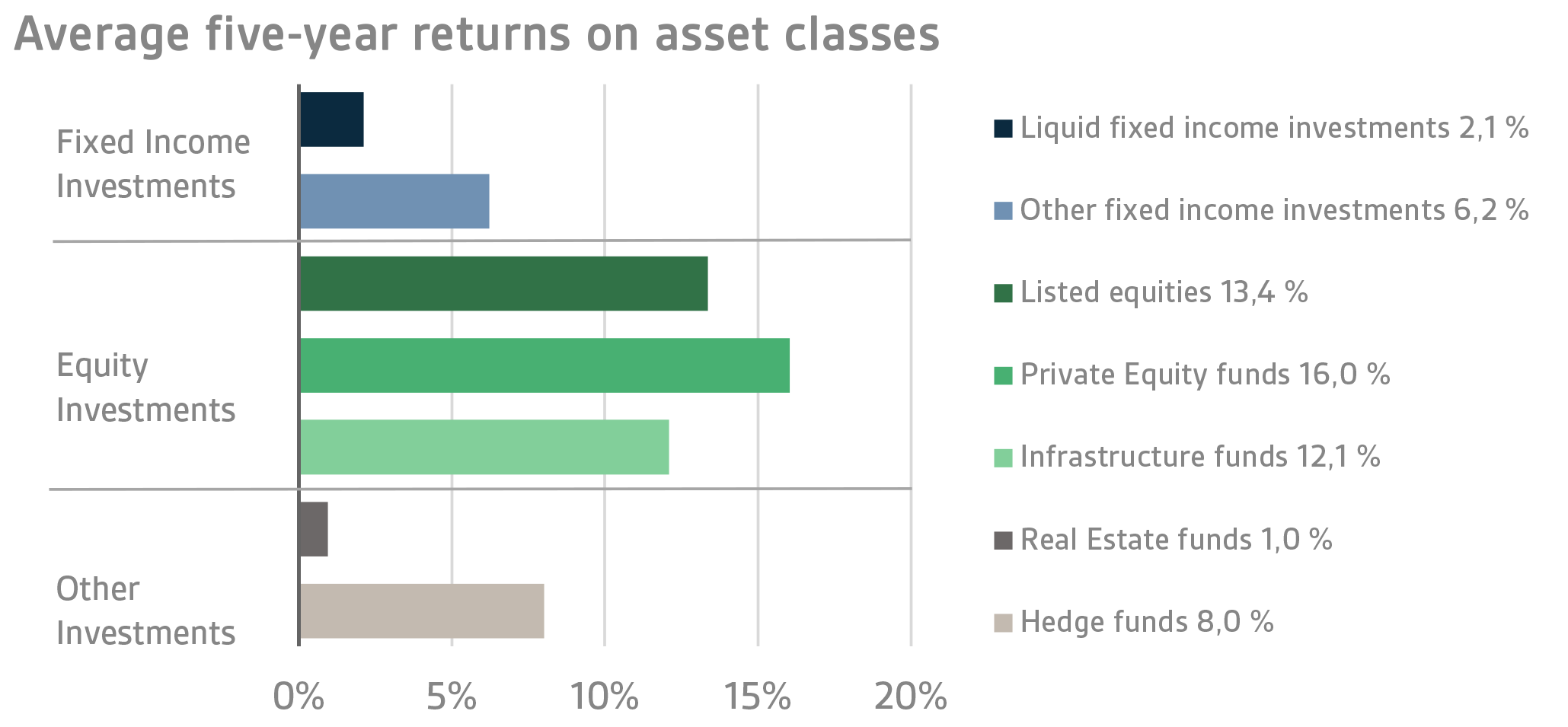

In accordance with the guidelines of the Ministry of Finance, VER’s investments are divided into fixed income instruments, equities and other investments. At the end of March, fixed income instruments accounted for 39.4 per cent, equities 54.4 per cent and other investments 8.1 per cent of the total. Of the large asset classes, liquid fixed income investments generated a return of 0.7 per cent and listed equities -0.3 per cent during the first quarter.

FIXED INCOME INVESTMENTS

Liquid fixed income investments

During the first quarter, the return on liquid fixed income instruments was 0.7 per cent.

In the first quarter of the year, the European Central Bank (ECB) cut its policy rates by 25 basis points at both its January and March meetings, ending with a deposit rate of 2.50%. Although the US Federal Reserve did not touch its policy rate, US government bond rates fell sharply in the first quarter, with European government bond rates rising significantly, with the exception of short-term government bonds. Interest rates on both two- and ten-year US government bonds fell by around 35 basis points, with the ten-year rate ending at 4.20%. In Germany, short-term government bond rates fell slightly, with the ten-year rate rising by around 35 basis points to around 2.70%.

The uneven interest rate movements were driven by the uncertainty caused by Trump's tariff policy and the ensuing safe-haven buying of US government bonds, on the one hand, and the significant investments in defence planned in Europe, on the other. In particular, Germany’s decision to lift the debt brake and to invest heavily in infrastructure and defence pushed up interest rates sharply in early March and steepened the yield curve. At the end of the quarter, the Federal Reserve was priced to cut its policy rate three times by 25 basis points by the end of the year. As for the ECB, expectations were for just under three rate cuts on top of the previous cuts already made.,

As a result of the increased uncertainty, corporate loan risk premia rose moderately, ending around last year's high, with emerging market risk premia rising slightly less than corporate loans.

Of VER's liquid fixed income investments, the best returns were generated by higher-risk instruments, such as the investments in emerging market debt and lower-rated corporate bonds, as well as in low-risk investments in US Treasuries.

Other fixed income investments

Other fixed income investments include investments in private credit funds and direct lending to companies.

The return on other fixed income investments was 0.2 per cent. Private credit funds returned 0.3 per cent and direct lending -0.5 per cent.

In the private credit market, expectations for the current year are mixed. The private equity market, which showed signs of picking up at the end of 2024, also gave private credit managers indications of a normalisation of the transaction market. However, the threat of a trade war in the early months of the year has led to a slower-than-expected start of LBO transactions. However, for Special Situation strategies, the current uncertain market situation creates excellent investment opportunities if disruptions to world trade increase causing financial problems for companies, for example due to indebted balance sheets.

EQUITIES

Listed equities

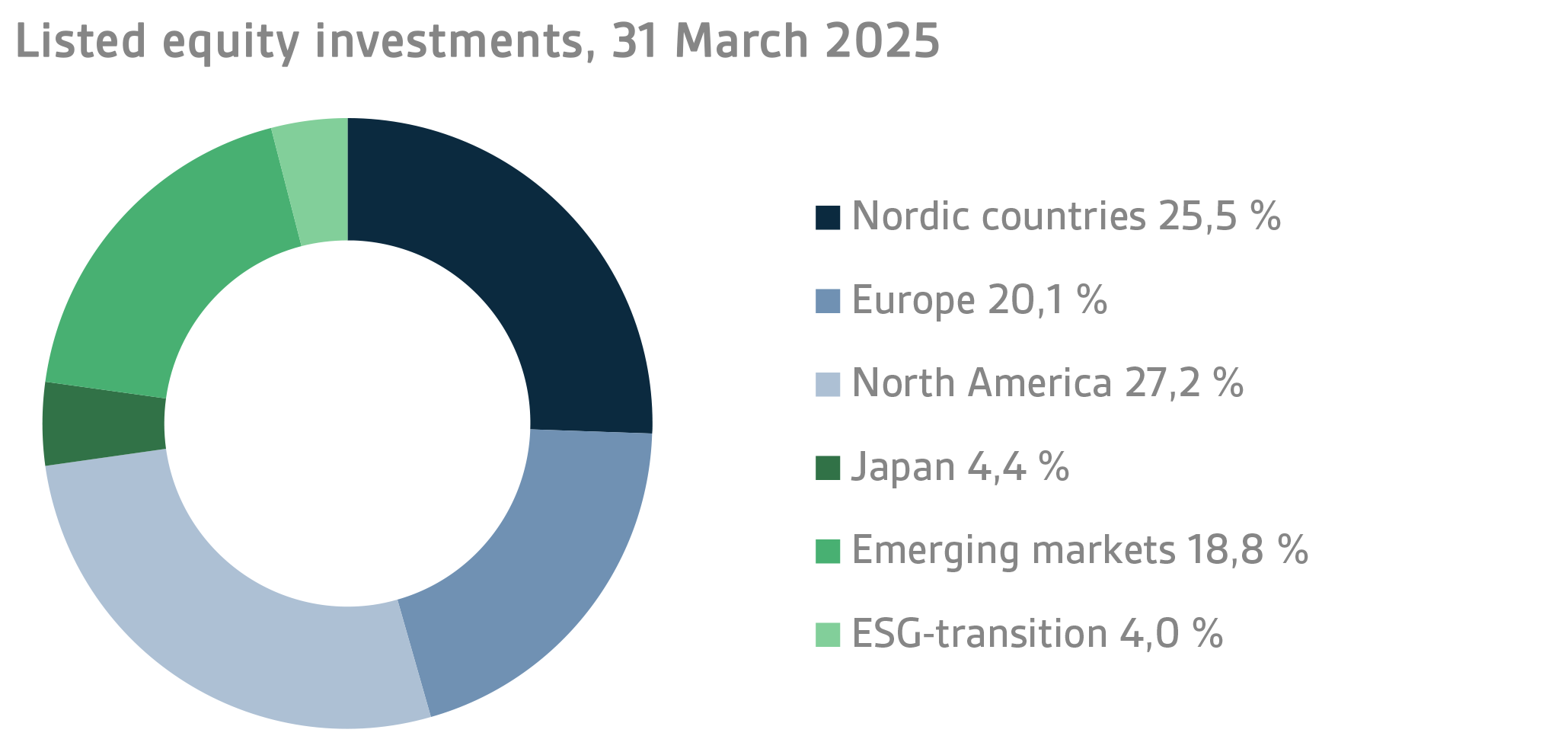

The return on listed equities during the first quarter was -0.3 per cent.

2025 got off to a strong start in global stock markets, despite all the uncertainties. European shares, including Nordic shares, performed well at the beginning of the year up to the last weeks of February. European equities were boosted by the announcement of major investments in defence and infrastructure by the EU, and Germany in particular. Underlying the investments were heightened fears about US President-elect Trump's planned actions on both trade and defence policy. In his election campaign, President Trump had, among other things, spoken about significant future tariffs on USA’s trading partners. Quickly after his inauguration we received a flurry of announcements about forthcoming tariffs, the first of which were imposed on the neighbouring countries Mexico and Canada. Since then, market attention has very much focused on the US Administration’s mixed tariff announcements made up to the end of the reporting period. Uncertainty related to the growth prospects in the global economic as a result of the tariffs also had a significant impact on stock market sentiment, and towards the end of the period equity market returns fell markedly from the sound levels prevailing in late February, pushing VER's listed equity returns slightly into negative territory by the end of the period.

The best returns on listed equities during the period were earned on European stocks. Even the Nordic sub-portfolio performed well during the period, despite all the tariff-related uncertainties. By far the weakest returns were generated, for the first time in a very long time, by investments in North American stock markets in the wake of the uncertainty created by President Trump's tariff announcements and lower earnings forecasts for listed companies.

Other equity investments

VER’s other equity investments include investments in private equity funds, infrastructure and unlisted stock.

Private equity investments returned 2.4 per cent, infrastructure funds -0.5 per cent and unlisted equities 22.8 per cent.

After two years of a rather quiet transaction market, the autumn of 2024 saw a slight pick-up in the private equity market and expectations for the current year were cautiously optimistic. However, the US tariff policy has reversed the mood on the market and the number of new transactions in the first quarter was lower than expected. Nevertheless, the fall in interest rates and the uninvited capital waiting to be invested in funds may encourage funds to become active in the transaction market despite the uncertainty.

As with other illiquid asset classes, the first quarter returns for infrastructure funds consist of updated returns from the last quarter of the previous year. Expectations for this year's returns have remained quite positive, despite increased uncertainty in the markets due to the threat of a trade war. The asset class provides a hedge against inflation, which should protect the funds' returns even if inflation accelerates in response to increased tariffs.

OTHER INVESTMENTS

VER’s other investments include investments in real estate investment trusts, hedge funds and systematic strategies.

The return on investments in non-listed real estate trusts was -0.8 per cent.

As far as real estate is concerned, market sentiment turned positive again at the end of 2024, helped by falling interest rates. Markets believe that prices have finally bottomed out, and the transaction market and valuation levels are expected to recover during 2025. However, uncertainty in the global economy may turn expectations more pessimistic, but so far, the year has started on a more optimistic note than last year, based on the first fund reports, while fund returns have been mostly positive.

Hedge funds and systematic strategies gave a 1.7 per cent return during the first quarter.

The quarter was mixed in terms of hedge fund returns. In January, the strong performance of the previous year continued, and returns were very solid across a wide range of strategies. In February and March, part of the early year's returns were eaten up as market uncertainty led to strong risk aversion. Equity L/S, CTA and multi-strategy funds in the portfolio suffered. In the uncertain market environment, the portfolio's relative value strategies and tail hedge strategies that benefit from increased volatility were the best performers.

STATE PENSION EXPENDITURE, VER’S TRANSFERS TO THE GOVERNMENT BUDGET, PENSION CONTRIBUTION INCOME AND FUNDING RATIO

The role of the State Pension Fund in equalising the government’s pension expenditure continues to grow. In 2024, the State’s pension expenditure totalled over EUR 5.5 billion while the 2025 budget foresees an expenditure of nearly EUR 5.6 billion. As VER contributes 42 per cent towards these expenses to the government budget, the transfer to the 2025 budget will amount to over EUR 2.4 billion.

By the end of March, VER had transferred EUR 0.6 billion to the government budget. Over the same period, VER’s pension contribution income totalled EUR 0.4 billion. The pension contribution income matches the forecast. VER’s net pension contribution income has now turned permanently negative, meaning that clearly more money is transferred from VER to the government budget than VER receives in pension contribution income. According to current estimates, this gap between budget transfers and income will continue to grow up to the mid-2030s, which will slow down the growth of the Fund. The negative cash flow is expected to continue until the 2050s.

The Act on the State Pension Fund was amended in spring 2022. As part of this amendment, VER’s contribution to the government budget was increased as of 2024. Consequently, VER’s budget transfers will be gradually increased from the current 41 per cent to 45 per cent during 2024–2028. If the funding ratio exceeds 25 per cent for two consecutive calendar years, an additional transfer of three percentage points will be made to the government budget.

|

KEY FIGURES

|

|

|

|

|

31.3.2025

|

31.12.2024

|

31.3.2024

|

|

Investments, MEUR (market value)

|

24 186

|

24 240

|

23 324

|

|

Fixed income investments

|

9 531

|

9 936

|

9 573

|

|

Equity investments

|

13 152

|

12 784

|

12 428

|

|

Other investments

|

1 950

|

1 949

|

1 845

|

|

Impact of derivatives

|

-447

|

-429

|

-522

|

|

|

|

|

|

Breakdown of the investment portfolio

|

|

|

|

|

Fixed income investments

|

39,4 %

|

41,0 %

|

41,0 %

|

|

Equity investments

|

54,4 %

|

52,7 %

|

53,3 %

|

|

Other investments

|

8,1 %

|

8,0 %

|

7,9 %

|

|

Impact of derivatives

|

-1,8 %

|

-1,8 %

|

-2,2 %

|

|

|

|

|

|

1.1.–31.3.2025

|

1.1.-31.12.2024

|

1.1.–31.3.2024

|

|

Return on investment

|

0,6 %

|

9,0 %

|

3,0 %

|

|

Fixed income investments

|

|

|

|

|

Liquid fixed income investments

|

0,7 %

|

3,1 %

|

0,6 %

|

|

Private Credit funds

|

0,3 %

|

8,5 %

|

0,3 %

|

|

Direct lending

|

-0,5 %

|

5,4 %

|

1,2 %

|

|

Equity investments

|

|

|

|

|

Listed equity investments

|

-0,3 %

|

14,6 %

|

6,6 %

|

|

Private Equity investments

|

2,4 %

|

13,4 %

|

2,8 %

|

|

Infrastructure funds

|

-0,5 %

|

13,4 %

|

1,6 %

|

|

Unlisted equity investments

|

22,8 %

|

3,9 %

|

-8,6 %

|

|

Other investments

|

|

|

|

|

Unlisted Real Estate funds

|

-0,8 %

|

-5,0 %

|

-4,7 %

|

|

Hedge funds and systematic strategies

|

1,7 %

|

10,9 %

|

3,6 %

|

|

|

|

|

|

Pension contribution income, MEUR

|

389

|

1 709

|

402

|

|

Transfer to state budget, MEUR

|

589

|

2 274

|

572

|

|

Net contribution income, MEUR

|

-200

|

-565

|

-169

|

|

Pension liability, BnEUR

|

|

101

|

|

|

Funding ratio, %

|

|

24,2 %

|

|

Additional information: Additional information is provided by Chief Executive Officer Timo Löyttyniemi, firstname.lastname@ver.fi, tel. +358 (0)295 201 210

Established in 1990, the State Pension Fund (VER) is an off-budget fund through which the State prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the State’s pension assets professionally. At the end of March 2025, the market value of the Fund’s investment portfolio stood at EUR 24.2 billion.

All figures presented in this interim report are preliminary and unaudited.