Annual Report 2022

Published 2023-02-28 at 10:02

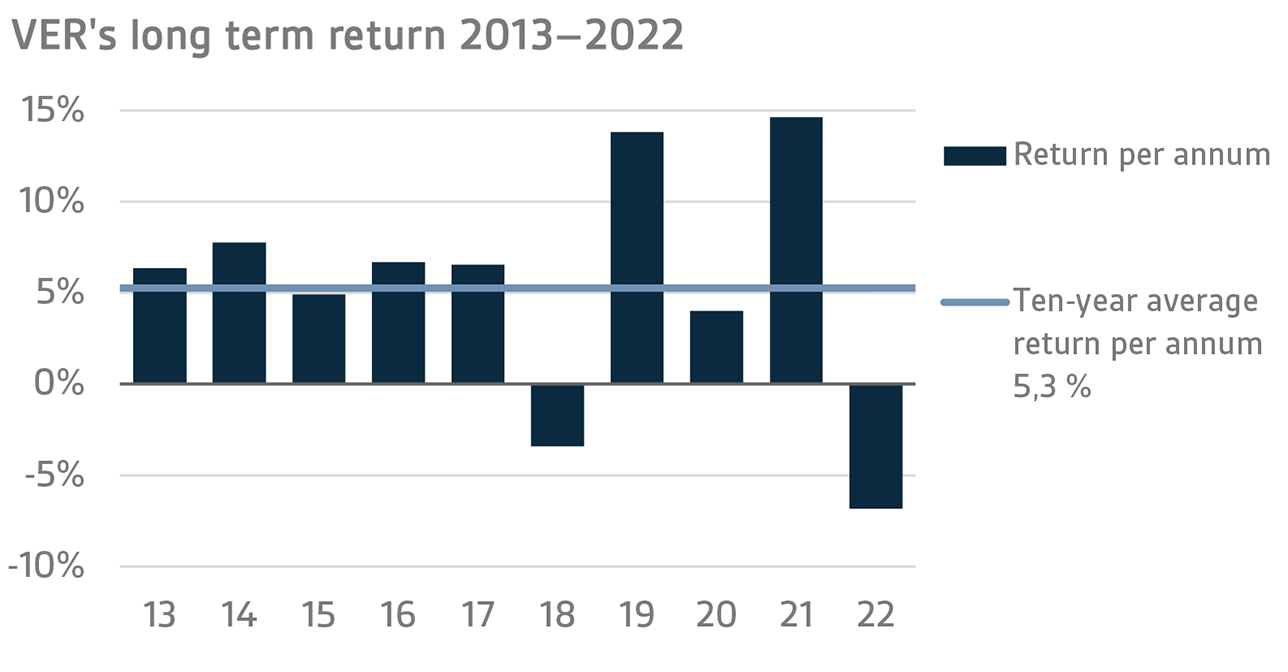

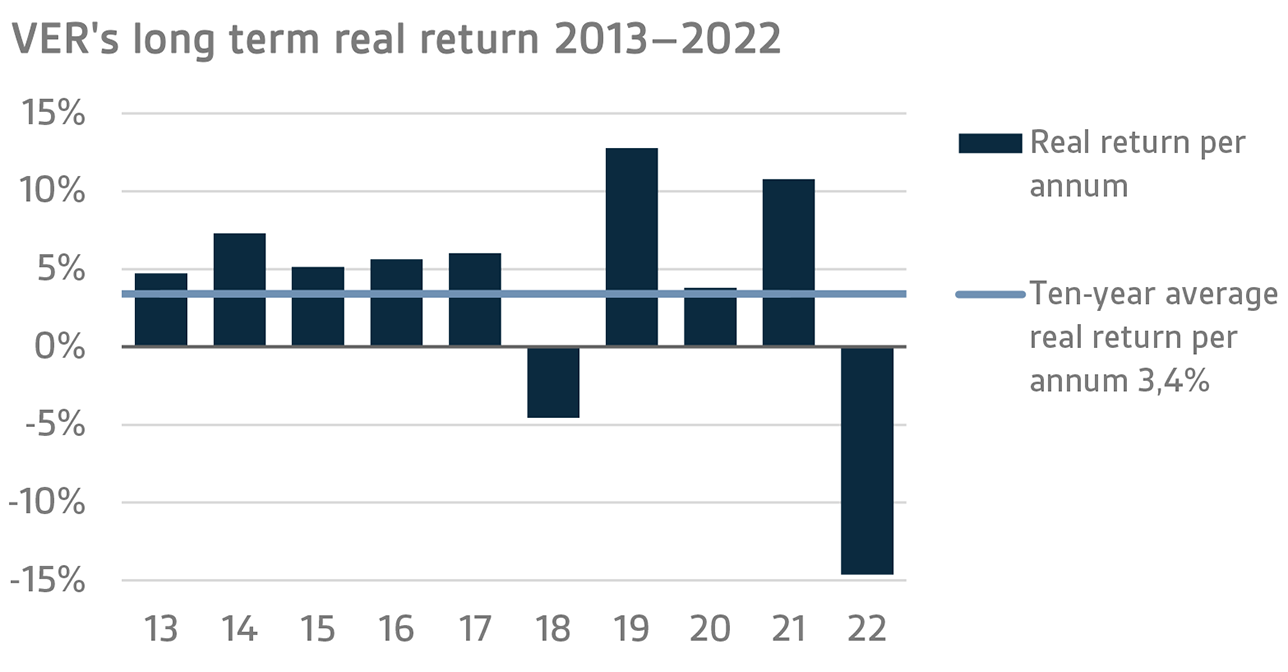

Return on investments -6.8% in 2022; ten-year average return 5.3%

INVESTMENT ENVIRONMENT

The return on VER’s pension assets was negative in 2022 due to the general investment environment characterised by geopolitics and inflation. The central banks’ response was to tighten monetary policy, and interest rates increased globally. All this made the investment environment challenging, as falling stock markets were accompanied by rising interest rates.

Underlying the high rate of inflation in Europe was above all Russia’s war of aggression, which affected the availability and pricing of energy. Energy prices reached an all-time high in August, creating problems for energy companies. Consumer inflation remained high throughout the third quarter, starting to show weak signs of abating only towards the end of the year. There were fears that it could turn into wage inflation. Hence, the central banks tightened their monetary policies and increased benchmark rates. At the same time, long-term interest rates have risen to levels not seen for a decade.

Investment market returns on both fixed income and equity investments remained negative for the year as a whole, despite a slight recovery towards the end of the year. By contrast, returns on illiquid investments were mostly positive; hence, the added value provided by these investments has been significant. The general rise in interest rates will make fixed income investments increasingly attractive in the future.

VER’S RETURN ON INVESTMENTS

At fair values, the total return on the investments made by VER in 2022 was -6.8 per cent. The average nominal rate of return was 4.1 per cent for the past five years and 5.3 per cent for the past ten years.

The real rate of return on investments in 2022 was -14.6 per cent. The five-year average real return was 1.1 per cent and ten-year real return 3.4 per cent.

According to the objective established by the Ministry of Finance, VER’s long-term return must exceed the average cost of net government debt. Over the past ten years, VER’s average market value weighted rate of return has beaten the cost of net government debt by 4.1 percentage points. Since 2001, when VER’s operations assumed their current form, the total returns earned by VER have exceeded the average cost of government debt by about EUR 9 billion.

A CLOSER LOOK AT 2022

VER’s two large asset classes, liquid fixed income investments and listed equities, gave negative returns in 2022. The return on liquid fixed income instruments was -8.2 per cent and that of listed equities -12.4 per cent. Of the other asset classes, the best performance was put in by infrastructure funds at 15.6 per cent and private equity funds at 12.5 per cent.

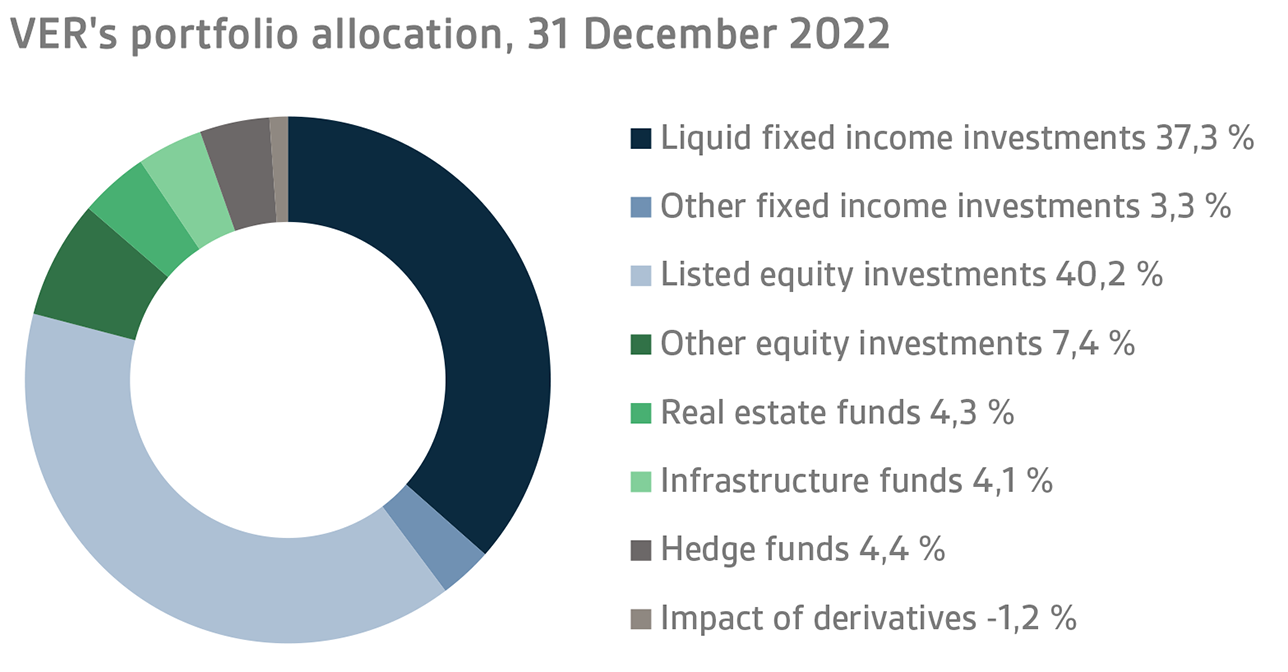

At the end of 2022, the market value of the Fund’s investment portfolio stood at EUR 21.6 billion. Of all the investments, fixed income instruments accounted for 40.7 per cent, equities 47.6 per cent and other investments 12.9 per cent of the total. The allocation effect of derivatives was -1.2 per cent.

FIXED INCOME INVESTMENTS

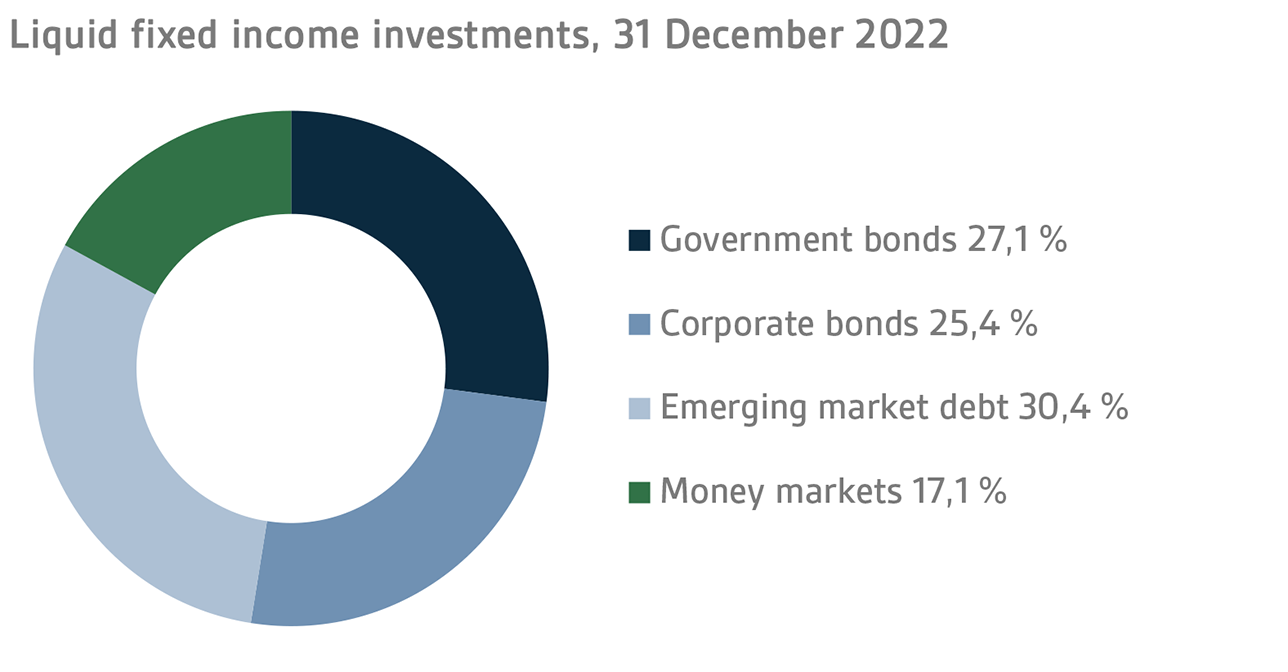

Liquid fixed income investments

In 2022, the liquid fixed income investments returned -8.2 per cent and its risk-adjusted market value at the end of the year stood at EUR 8.1 billion. The duration of the fixed income portfolio remained shorter than the neutral duration of the portfolio for the entire year.

In 2022, central banks tightened monetary policies aggressively in the face of soaring inflation. As inflation accelerated, both the US Federal Reserve (FED) and the European Central Bank (ECB) were forced to revise their view of the need to tighten monetary policy every quarter. The intensity of inflation took the FED and the fixed income markets by surprise. As a result, the FED raised its bank rate seven times by a total of 425 basis points in 2022. At its December meeting, the FED expected the bank rate to exceed 5% in 2023 and remain at that level for a significant period of time, as the tense labour market situation sustained high inflationary pressures and the FED did not anticipate any deep recession as a result of a tighter monetary policy. The ECB, in turn, raised its bank rate by a total of 250 points during 2022. Additionally, the ECB ended its net asset purchases in July. At its December meeting, the ECB signalled that it would raise its benchmark rates by another 50 basis points and keep the monetary policy stance tight for a longer period of time in order to meet its inflation target. At the same time, the ECB announced that it will start to unload its balance sheet at a pace of EUR 15 billion per month as of March 2023.

The risk premiums on corporate loans nearly tripled from early 2022 to October as the economic outlook weakened following the sharp rise in interest rates. In the last quarter, the spread in risk premiums narrowed as central banks slowed the pace of interest rate hikes and the rise in long-term market rates stalled at the same time as long-term interest rates began to fall, for example, in the United States.

As far as VER’s liquid fixed income investments are concerned, the increase in interest rates eroded returns on both German government bonds and emerging market dollar-denominated debt in particular. Higher interest rates and the growing spread in risk premiums also had a negative impact on absolute returns in other fixed income asset classes. Compared to the benchmark indexes used, the relative return on investments was good thanks to the shorter duration and successful choice of securities. In brief, the year 2022 was extremely unusual with negative returns on global indexes in both fixed income instruments and equities.

Other fixed income investments

VER’s other fixed income investments include investments in private credit funds and direct non-liquid loans. Most of the private credit funds in the portfolio are private equity funds investing in non-liquid loans.

At the end of 2022, other fixed income investments accounted for 3.3 per cent of VER’s portfolio.

For private credit funds investing in floating rate debt, the rising interest rate market had a positive impact on expected returns. Some of the funds even increased their target returns in the course of the year. For funds whose valuation is based on market quotes, returns in 2022 were affected by the general developments in the fixed income market. However, long-term expected returns remained unchanged, and the volatile market situation is anticipated to create attractive investment opportunities for private credit funds regardless of strategy.

The return on other fixed income investments was 0.4 per cent in 2022. Private credit funds returned -0.5 per cent and direct loans 5.0 per cent. Unfunded commitments totalled EUR 333 million at the end of the year.

EQUITIES

Listed equities

In 2022, the return on listed equities was -12.4 per cent. Right at the beginning of the year, the mood in the financial market took a turn for the worse as the sharp rise in interest rates increased uncertainty in the stock market. Also, the effects of the Covid-19 pandemic were still visible, particularly during the first few months of the year. As a result of China's Covid-19 policy, companies continued to experience delivery problems with their supply chains. However, the biggest impact was made by Russia’s attack on Ukraine in February. With the aggression, the market sentiment turned sour. For many listed companies the situation proved challenging, as the values of balance sheet items of companies based in Russia had to be largely written down. Moreover, Russia’s war of aggression led to an extremely sharp rise in energy prices, which further pushed up inflation figures. A positive development in the stock market was that the earnings forecasts of listed companies remained fairly strong throughout the year, although a slight decline was visible towards the end of the year. Following the fall in share prices, there was a shift toward more moderate levels in the valuation of listed companies, although much uncertainty remains regarding the earnings forecasts for the coming years.

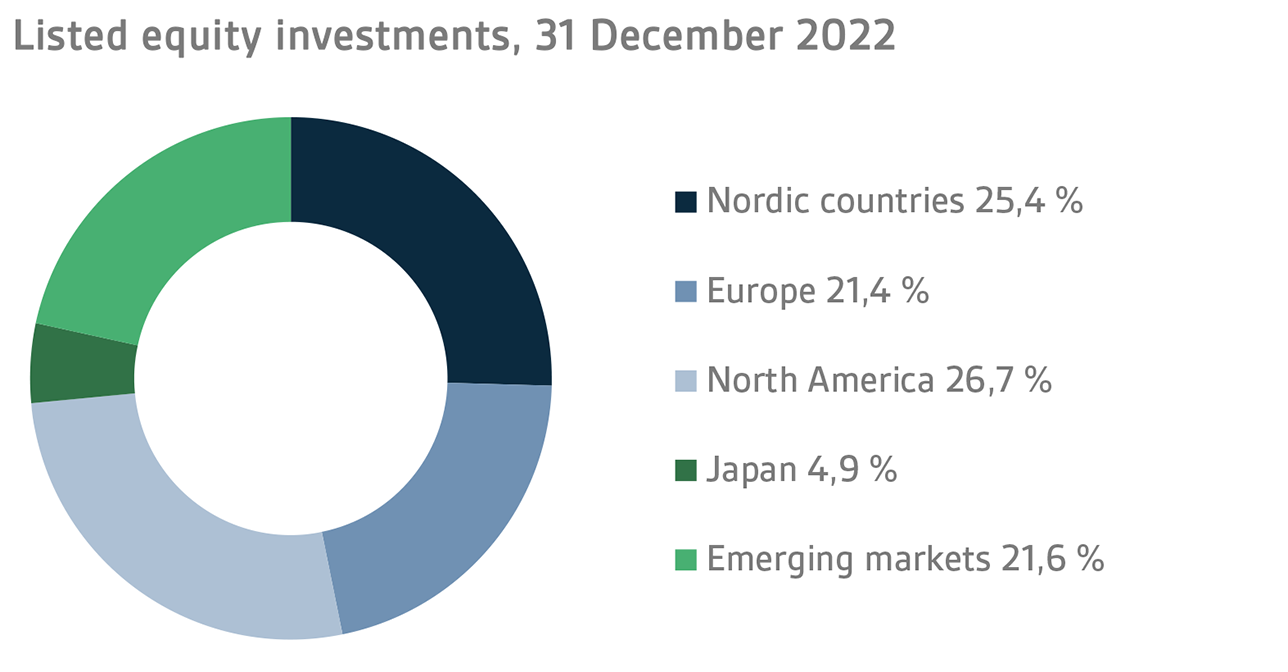

In terms of market capitalisation, the value of VER’s listed equities fell from EUR 10.3 to EUR 8.7 billion during 2022. Net activity in 2022 remained moderate as VER reduced its equity risk by EUR 30 million, compared to EUR 2 billion in the previous year. At the end of 2022, direct equity investments accounted for 23.7 per cent and fund investments for 76.3 per cent of the total. At the end of the year, VER held direct interests in 94 companies and fund units in a total of 59 funds.

Other equity investments

VER’s other equity investments include investments in private equity funds and non-listed stock.

At the end of the year, other equity investments accounted for 7.4 per cent of the portfolio.

Even though 2022 was a challenging year for the stock market, several private equity funds continued to make successful exits at high valuation levels. No significant changes took place in the values of portfolio companies as strong earnings performance compensated for the multiplier effect of the listed market. Towards the end of the year, however, the transaction market slowed down as uncertainty about corporate pricing increased. The year-end return on private equity funds was 12.5 per cent. Unfunded commitments totalled EUR 873 million at the end of the year.

Investments in unlisted stocks consisted of investments in three companies. The return on the portfolio was 7.8 per cent at the end of the year.

OTHER INVESTMENTS

VER’s other investments are made in real asset funds (real estate and infrastructure funds) as well as hedge funds.

At the end of 2022, other investments accounted for 12.9 per cent of VER’s portfolio. Of the invested assets, 4.3 per cent was placed in real estate investment trusts, 4.1 per cent in infrastructure funds and 4.4 per cent in hedge funds.

In some real estate investment trusts, the rise in interest rates was reflected in falling property values at the end of the year, resulting in negative returns for these funds. By contrast, hotel funds, for example, put in a good performance with clearly positive year-end returns as tourism picked up after the Covid-19 pandemic. Shopping centres also performed positively as the retail sector recovered from Covid-19.

The return on investments in non-listed real estate investment trusts was 4.1 per cent at the end of the year, while unfunded commitments totalled EUR 446 million.

Infrastructure funds performed well with a year-end return of 15.6 per cent. Infrastructure assets provide a hedge against inflation, and they have done well in a high inflation environment. So far, rising interest rates have had relatively little impact on asset valuations, and funds have managed to exit at sound valuation levels. At the end of 2022, unfunded commitments totalled EUR 277 million.

The return on hedge funds and systematic strategies in 2022 reached 5.0 per cent. The return on the portfolio remained adequate despite negative returns in the fixed income and equity markets. Among hedge funds, almost all funds offered healthy returns, with the exception of funds focused on Asia and emerging markets. A particularly impressive performance was put in by relative value funds concentrating on the fixed income market as well as macro and quant funds. With regard to derivates-based systematic strategies, successful tactical weightings in the second half of the year helped compensate for the negative returns in the first half of the year.

RESPONSIBLE INVESTING

VER perceives responsibility and sustainability as an integral part of its long-term investment activities. The goal of VER’s responsible investment activities is to identify long-term ESG risks and support sustainable development. Portfolio managers assess sustainability aspects together with other factors affecting the investment both at the time when the investment decision is made and during its lifecycle.

VER’s most important sustainability goal is the mitigation of climate change. VER’s principles for responsible investment address not only the climate risk but also other sustainability risks. To contribute to the attainment of the objectives set out in the Paris Agreement, VER seeks to achieve full carbon neutrality of its entire portfolio in 2050. VER uses weighted carbon intensity as a key measure of greenhouse gas emissions. VER reports on the carbon footprint of the portfolio annually, i.e. the carbon intensity of the portfolio as well as the absolute emissions of the portfolios of listed equities and corporate bonds. The carbon intesity of VER’s listed equities and corporate bonds portfolios were both below the benchmark indices at the end of 2022. VER’s first climate report was published in spring 2022 and the next one will be published in spring 2023.

Aside from emissions, VER monitors portfolio performance with regard to the UN Global Compact principles. This UN corporate responsibility initiative underlines the environmental, social and economic sustainability of companies and communities. The 10 principles of the initiative cover the Universal Declarations of Human Rights, the UN Convention against Corruption, the ILO Declaration on Fundamental Principles and Rights at Work, the Rio Declaration and the Declaration on Sustainable Development. VER seeks to ensure that none of its portfolio companies violate the Global Compact principles. Monitoring is carried out by an external service provider.

The sustainability policy adopted by VER’s Board of Directors provides the basis for its responsible investment activities and serves as a guide for setting sustainability objectives. In addition to the principles of responsible investing, VER's Ownership Policy Guidelines set out its expectations regarding the portfolio companies’ sustainability performance. By stating these expectations, VER seeks to ensure, for its part, that VER-owned companies duly consider the sustainability expectations included in VER's objectives.

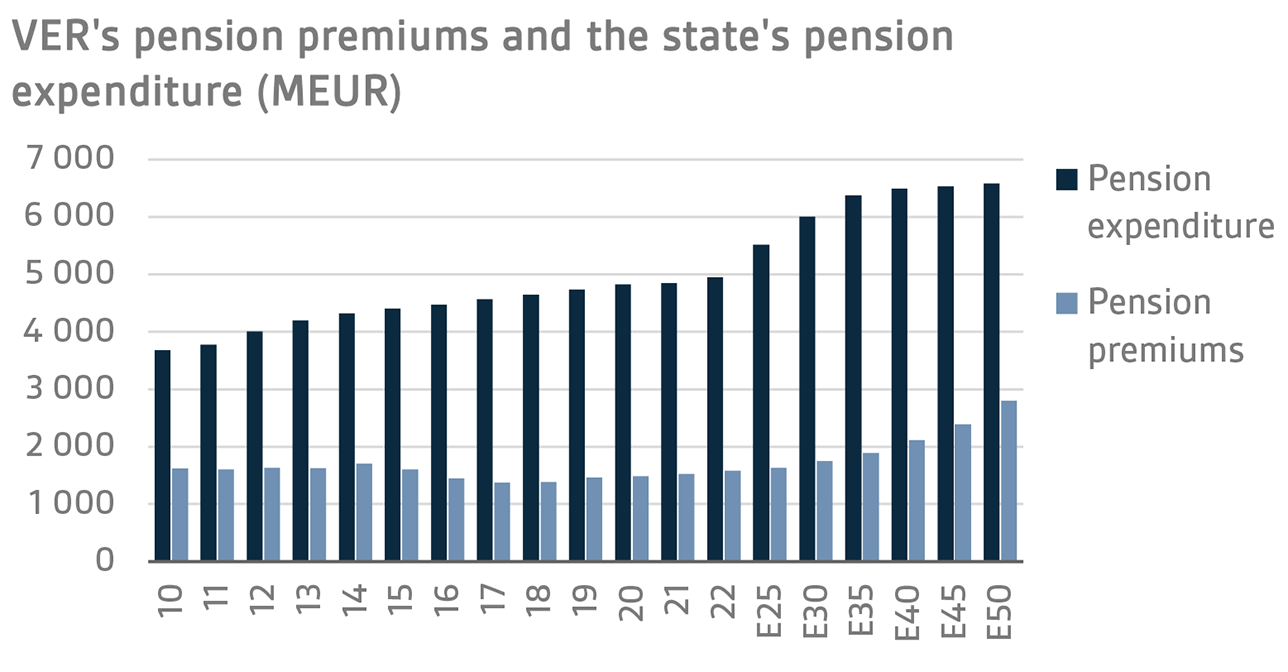

THE STATE’S PENSION EXPENDITURE CONTINUES TO INCREASE

VER’s role in equalising the government’s pension expenditure continues to grow. In 2022, the State’s pension expenditure totalled a little over EUR 5.0 billion. As VER contributes 40 per cent towards these expenses to the government budget, the transfer to the 2022 budget amounted to approximately EUR 2.0 billion. Over the same period, VER received approximately EUR 1.6 billion in pension contributions. Its net pension contribution income has now turned permanently negative, meaning that more money is transferred from VER to the government budget than VER receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund.

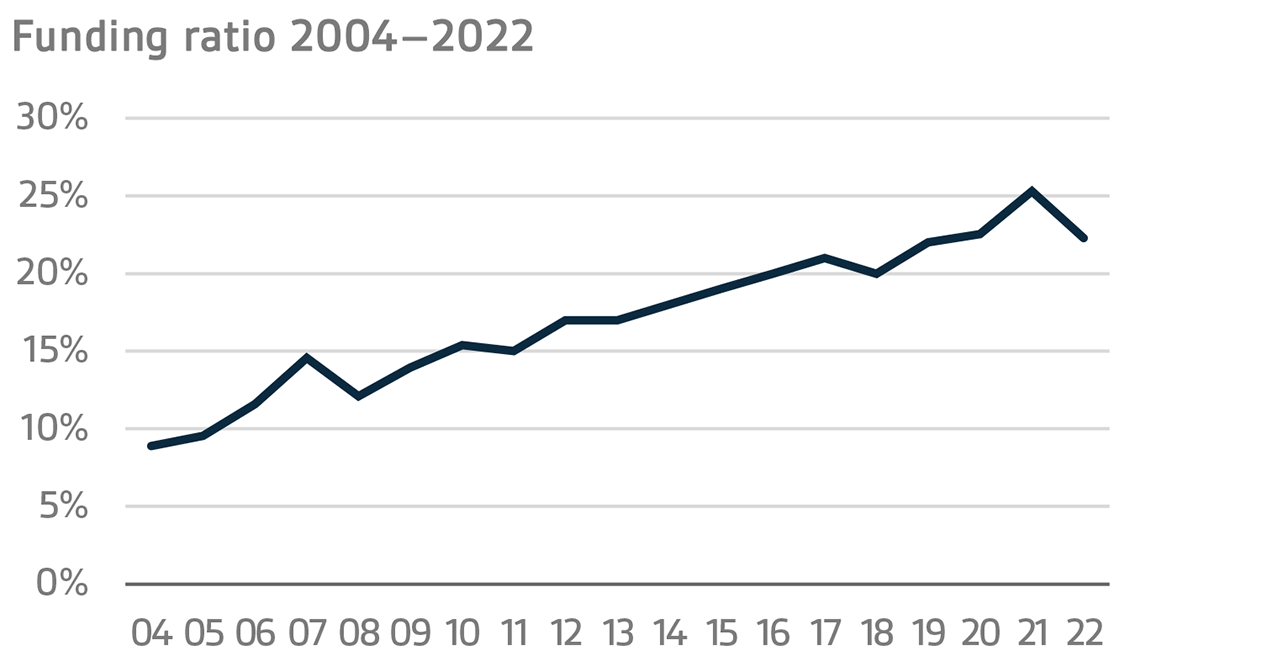

At the end of 2022, the State’s pension liabilities amounted to EUR 97.0 billion, while the funding ratio was 22.4 per cent. At the end of the previous year, the funding ratio was 25.4 per cent, which meant that the Fund had achieved the target 25 per cent ratio specified in the Act on the State Pension Fund.

The Act was amended in spring 2022. As part of this amendment, VER’s contribution to the government budget was increased as of 2024. Consequently, VER’s budget transfers will be increased from the current 40 per cent to 45 per cent during 2024–2028. If the funding ratio exceeds 25 per cent for two consecutive calendar years, an additional transfer of three percentage points will be made to the government budget.

Following the legal reform, VER’s Board of Directors initiated a strategy development process. The strategy was updated concurrently with the 2023 investment plan and adopted in January 2023. The objectives set out in the strategy create the basis for future investment activities. The baseline allocation of the investment portfolio is determined in the annual investment plan. Simulations suggest that the baseline allocation of the portfolio will achieve the long-term objectives established for VER.

VER’S ADMINISTRATION

The State Pension Fund of Finland, established in 1990, is an off-budget entity. Through VER, the State prepares for financing future pensions and seeks to equalise pension expenditure over time. By nature, VER is a buffer fund. VER’s assets are not used to pay out pensions directly; instead, all state pensions are paid out of the appropriations allocated for this purpose in the government budget.

The collection of pension contributions to the state pension system and related duties, like the processing of pension applications and payment of pensions, are handled by the Local Government Pension Institution Keva. VER pays Keva a management fee for these services, which in 2022 amounted to about EUR 15.0 million.

The responsibility for oversight and control of VER’s operations rests with the Ministry of Finance, which is authorised to issue general instructions regarding the organisation of VER’s administration, financial management and the investment of its assets. According to the current operational guidelines issued by the Ministry of Finance (dated 9 Aug 2022), equity investments must not exceed 60 per cent of the value of VER’s portfolio. Fixed income instruments must account for a minimum of 30 per cent, and liquid and low-risk fixed income instruments for a minimum of 20 per cent of the value of the portfolio. Other investments must not exceed 15 per cent of the value of the portfolio at the time the investment is made. Real estate investments must be made in the form of fund investments or equivalent indirect investments.

VER’s Board of Directors is appointed by the Ministry of Finance. The Board has seven members, three of whom are appointed from among candidates proposed by central staff organisations. Jukka Pekkarinen, Doctor of Political Science, served as Chair and member of the Board of Directors up until Sept 2022 when he was succeeded by Vesa Vihriälä, Doctor of Political Science. The Chair of the Investment Advisory Committee is Jussi Laitinen.

VER’s operating costs amounted to EUR 8.2 million, which represents 0.04 per cent of its average annual capital. During the year VER had an average of 28 employees. Job satisfaction is at a good level at VER. VER invests in human resources and offers ample opportunities for skills development, which is important both in seeking maximum returns on investments and in managing risks.

KEY FIGURES 2022

|

|

|

|

|

|

|

|

|

2022

|

2021

|

|

Return on investments

|

-6,8 %

|

14,6 %

|

|

Real return

|

-14,6 %

|

10,8 %

|

|

|

|

|

|

Return by asset class

|

|

|

|

fixed income investments

|

|

|

|

Liquid fixed income investments

|

-8,2 %

|

0,7 %

|

|

Private credit funds

|

-0,5 %

|

13,1 %

|

|

Direct non-liquid lending

|

5,0 %

|

6,1 %

|

|

Equities

|

|

|

|

Listed equities

|

-12,4 %

|

24,2 %

|

|

Private equity funds

|

12,5 %

|

47,7 %

|

|

Unlisted equities

|

7,8 %

|

57,9 %

|

|

Other investments

|

|

|

|

Unlisted real estate funds

|

4,1 %

|

13,3 %

|

|

Infrastructure funds

|

15,6 %

|

14,9 %

|

|

Hedge funds and systematic strategies

|

5,0 %

|

5,1 %

|

|

|

|

|

|

Average returns

|

5 years

|

10 years

|

|

|

|

|

|

Average return on portfolio p.a.

|

4,1 %

|

5,3 %

|

|

Average real return p.a.

|

1,1 %

|

3,4 %

|

|

Average effective interest rate on government debt p.a.

|

0,7 %

|

1,2 %

|

|

|

|

|

|

Portfolio allocation

|

2022

|

2021

|

|

|

|

|

|

Total investments, EURm

|

21 604,1

|

23 595,3

|

|

|

|

|

|

fixed income investments

|

40,7 %

|

37,9 %

|

|

Liquid fixed income investments

|

37,3 %

|

35,3 %

|

|

Other fixed income investments

|

3,3 %

|

2,7 %

|

|

Equity investments

|

47,6 %

|

49,5 %

|

|

Listed equities

|

40,2 %

|

43,5 %

|

|

Other equity investments

|

7,4 %

|

6,1 %

|

|

Other investments

|

12,9 %

|

11,4 %

|

|

Unlisted real estate funds

|

4,3 %

|

3,4 %

|

|

Infrastructure funds

|

4,1 %

|

2,9 %

|

|

Hedge funds and systematic strategies

|

4,4 %

|

5,0 %

|

|

|

|

|

|

Key figures

|

2022

|

2021

|

|

|

|

|

|

Volatility

|

8,1 %

|

4,9 %

|

|

Sharpe ratio

|

-1,2

|

3,1

|

|

|

|

|

|

Other key figures

|

2022

|

2021

|

|

|

|

|

|

Pension contribution income, EURm

|

1 610

|

1 550

|

|

Budget transfers, EURm

|

1 982

|

1 941

|

|

Net contribution income, EURm

|

-372

|

-391

|

|

Balance sheet total, EURm

|

17 093

|

16 869

|

|

Pension liabilities, EUR bn

|

97,0

|

93,3

|

|

Funding ratio

|

22 %

|

25 %

|

Additional information:

Additional information is provided by CEO Timo Löyttyniemi, firstname.lastname@ver.fi, tel. +358 (0)295 201 210.

Established in 1990, the State Pension Fund of Finland (VER) is an off-budget fund through which the State prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the State’s pension assets professionally. At the end of 2022, the market value of the Fund’s investment portfolio stood at EUR 21.6 billion.