VER’s return on investments -2.5% during 1 Jan–30 Sept 2020; ten-year average annual return 5.1%

Published 2020-10-28 at 14:08

INVESTMENT ENVIRONMENT

The economy continued to recover from the spring slide during July–September. The upturn was aided by the opening of shops and restaurants, which allowed people to lead a more or less normal life. However, occupancy rates in the tourism industry remained extremely low. Towards the end of the period, it appeared that restrictions would be retightened. While the spread of the coronavirus continued globally, the situation in Europe reached alarming proportions at the end of the reporting period.

The recovery of the stock market continued during July–September. Companies put in a better-than-expected performance and economic forecasts grew brighter during the period. Interest rates remained stable in the United States and the euro area. Short-term and long-term interest rates hardly changed at all in the second half of the period.

At the same time, the general economic policy debate shifted to concerns about national debt. Central bank balance sheets have not swelled much after the acute phase of the crisis was over. Inflation remained low with no signs of accelerating. Household disposable income remained at a reasonable level despite the crisis. However, the earnings were not spent on consumption as usual, and so failed to underpin economic growth to the required extent. The household saving rate increased.

At the end of the period, there were clear signs of a second wave of the coronavirus in Europe. As it intensified, the number of new cases exceeded those recorded in the spring. Globally, we could witness both the continuation of the first wave and the intensification of the second. The number of infections continued to rise across the world, albeit at a decelerating rate. As far as stock prices and economic growth are concerned, the developments towards the end of the year will most likely be determined by the spread of the coronavirus and the US presidential elections.

VER’S RETURNS ON INVESTMENTS

Future monitoring and evaluation of the State Pension Fund’s investment activities will increasingly focus on long-term outcomes and future prospects instead of quarterly reporting. However, VER will continue to post quarterly figures and comments to the same extent as previously.

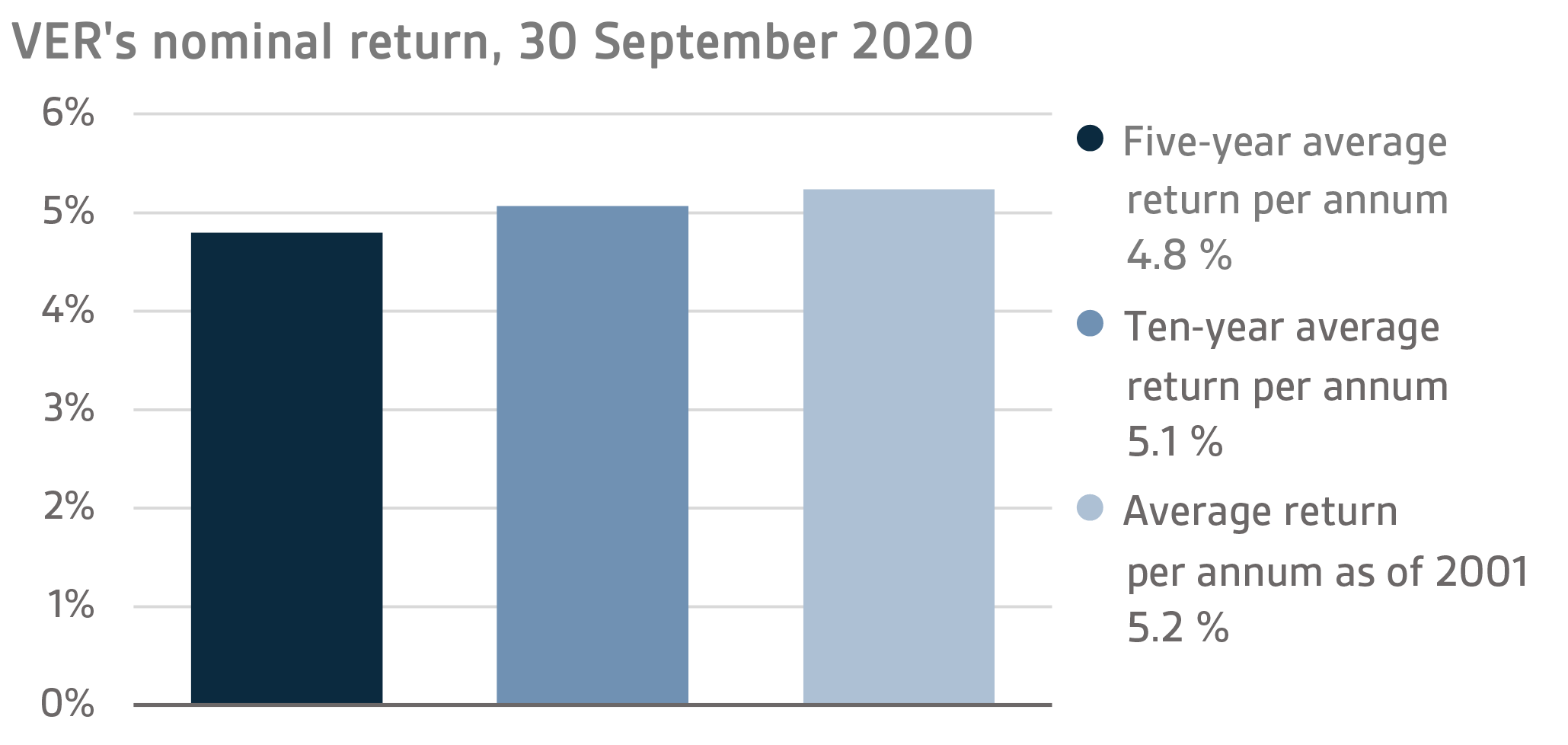

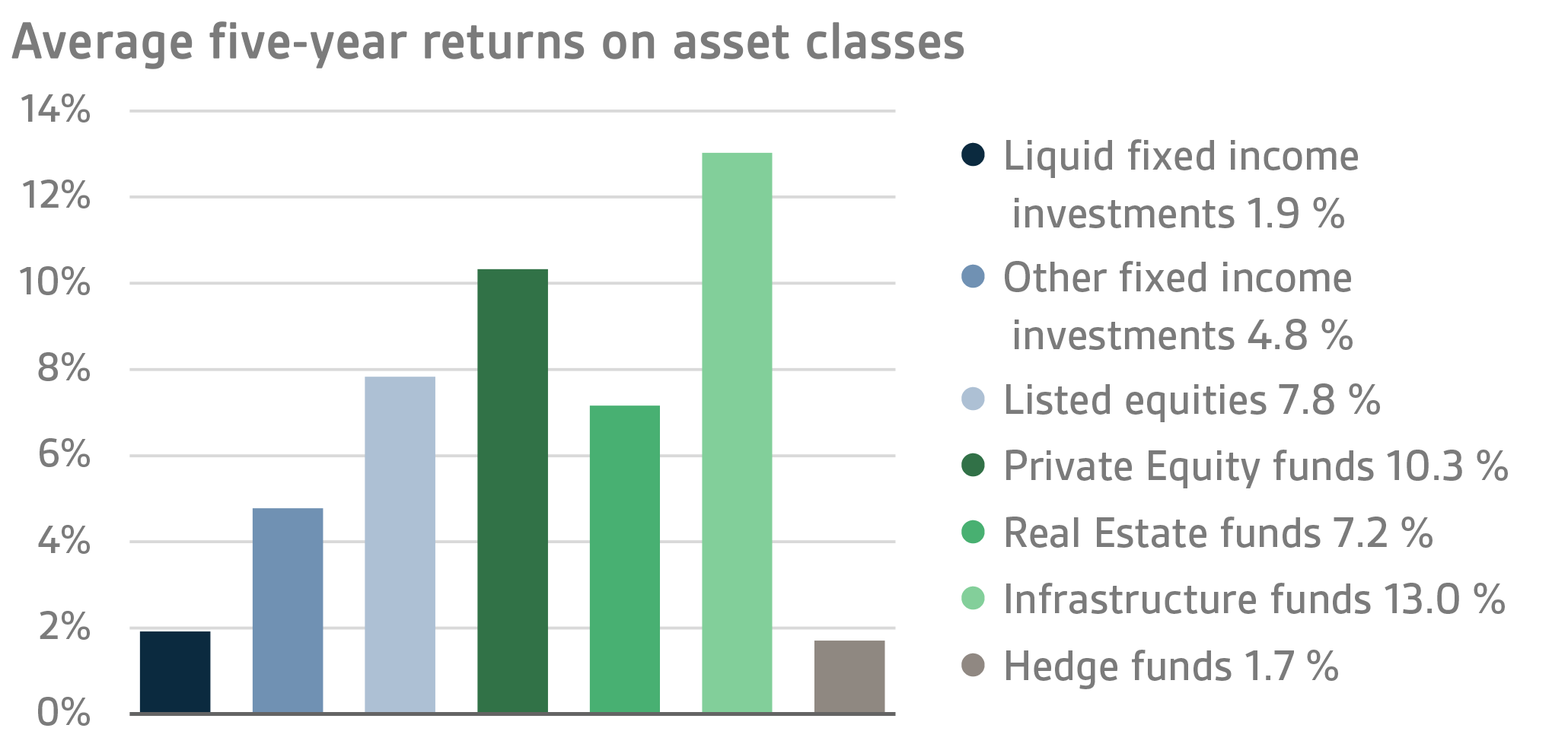

On 30 September 2020, VER’s investment assets totalled EUR 19.8 billion. During the first three quarters, the return on investments at fair values was -2.5 per cent. The average nominal rate of return over the past five years (1 October 2015–30 September 2020) was 4.8 per cent and the annual ten-year return 5.1 per cent. Since 2001, when VER’s activities assumed their current form, the average rate of return has been 5.2 per cent.

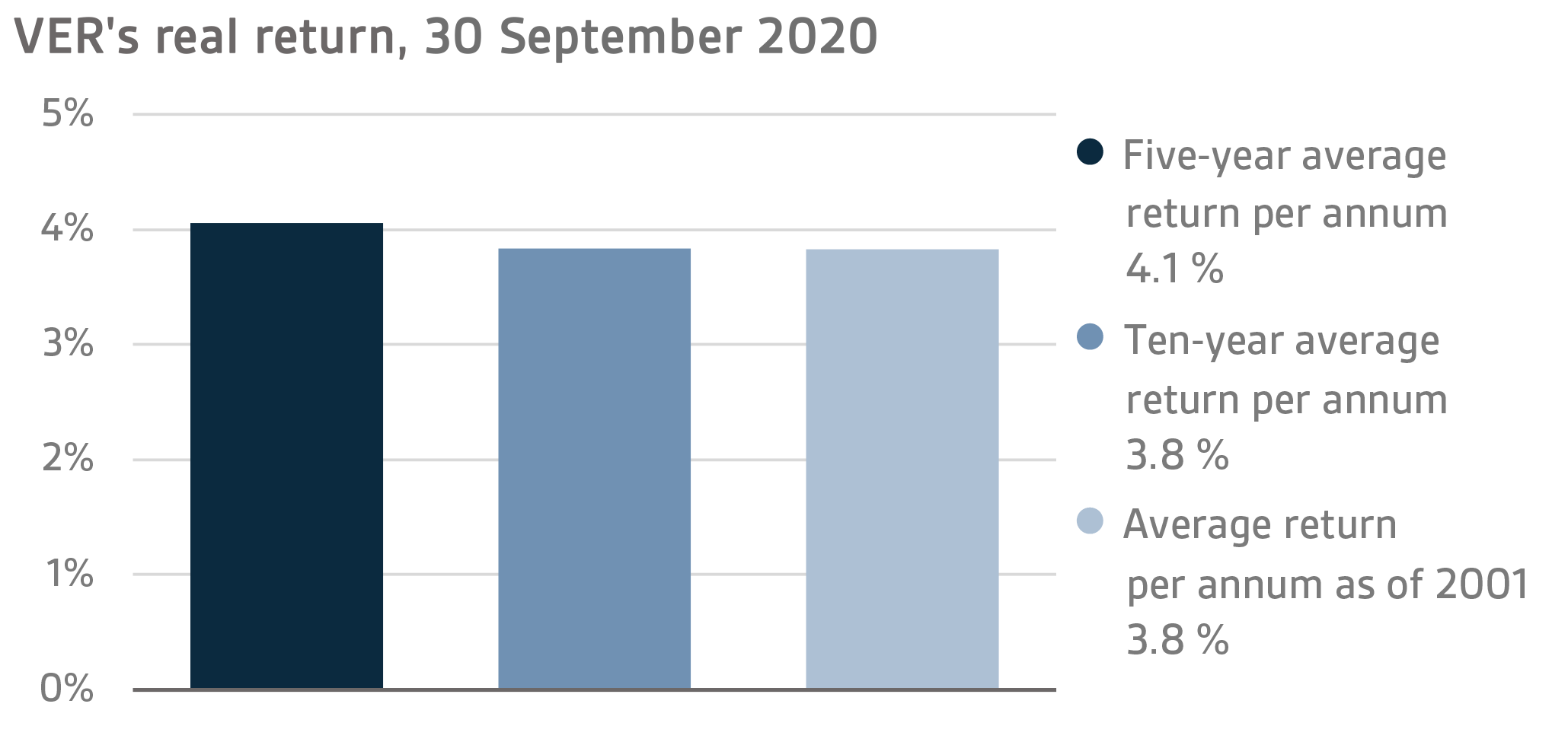

The real rate of return during the first three quarters was -2.5 per cent. VER’s five-year average real return was 4.1 per cent and ten-year real return 3.8 per cent. Since 2001, when VER’s activities assumed their current form, the average real rate of return has been 3.8 per cent.

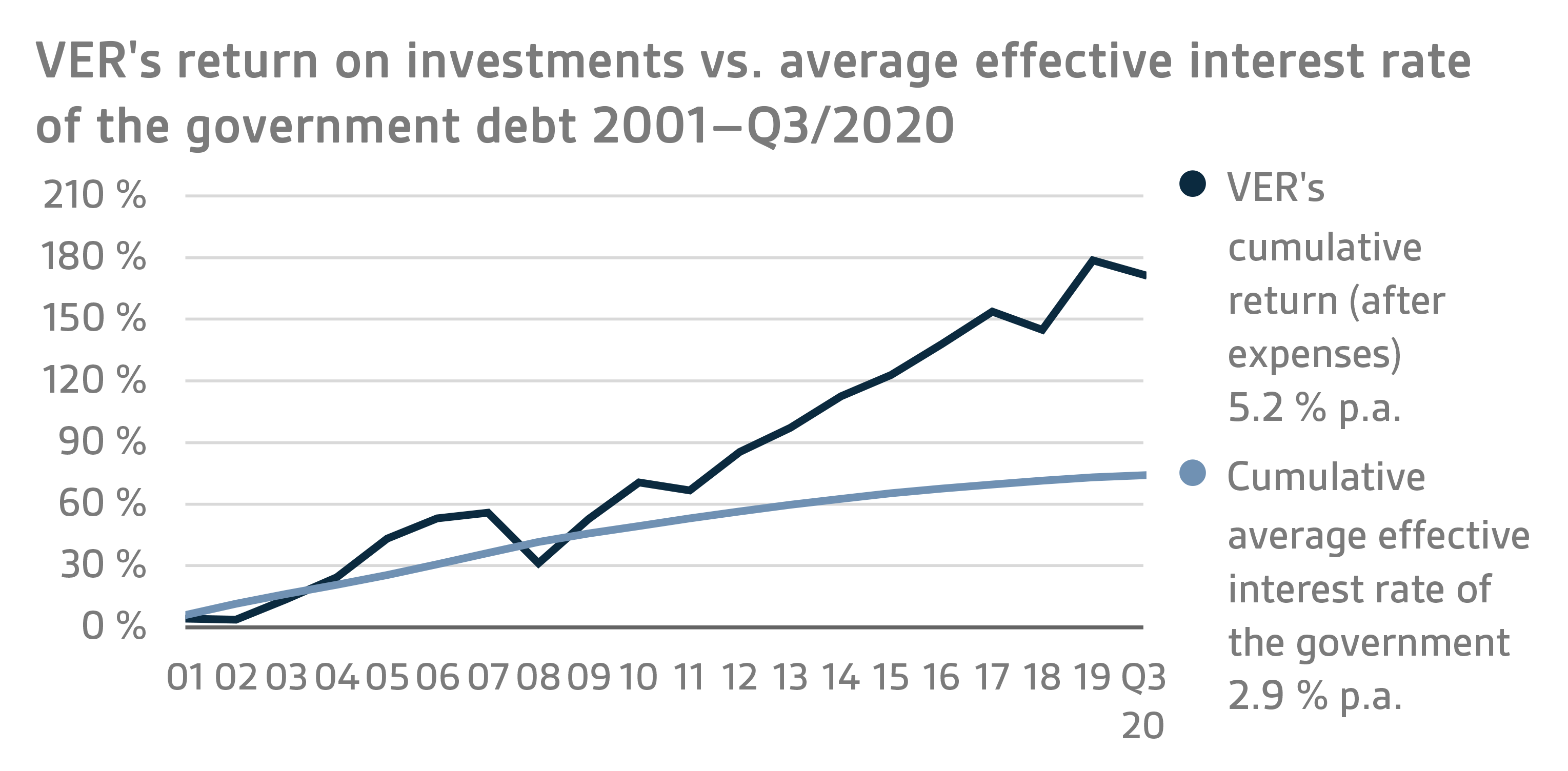

From the State’s point of view, it is pertinent to compare the return on investments with the cost of net government debt, because the funds accumulated in preparation for future pension expenditure can be deemed to reduce such debt. Over the past ten years, VER’s annual rate of return has beaten the cost of net government debt by 3.5 percentage points, on average. Since 2001, the total market-value returns earned by VER have exceeded the cumulative average cost of equivalent government debt by about EUR 6.7 billion over the same period.

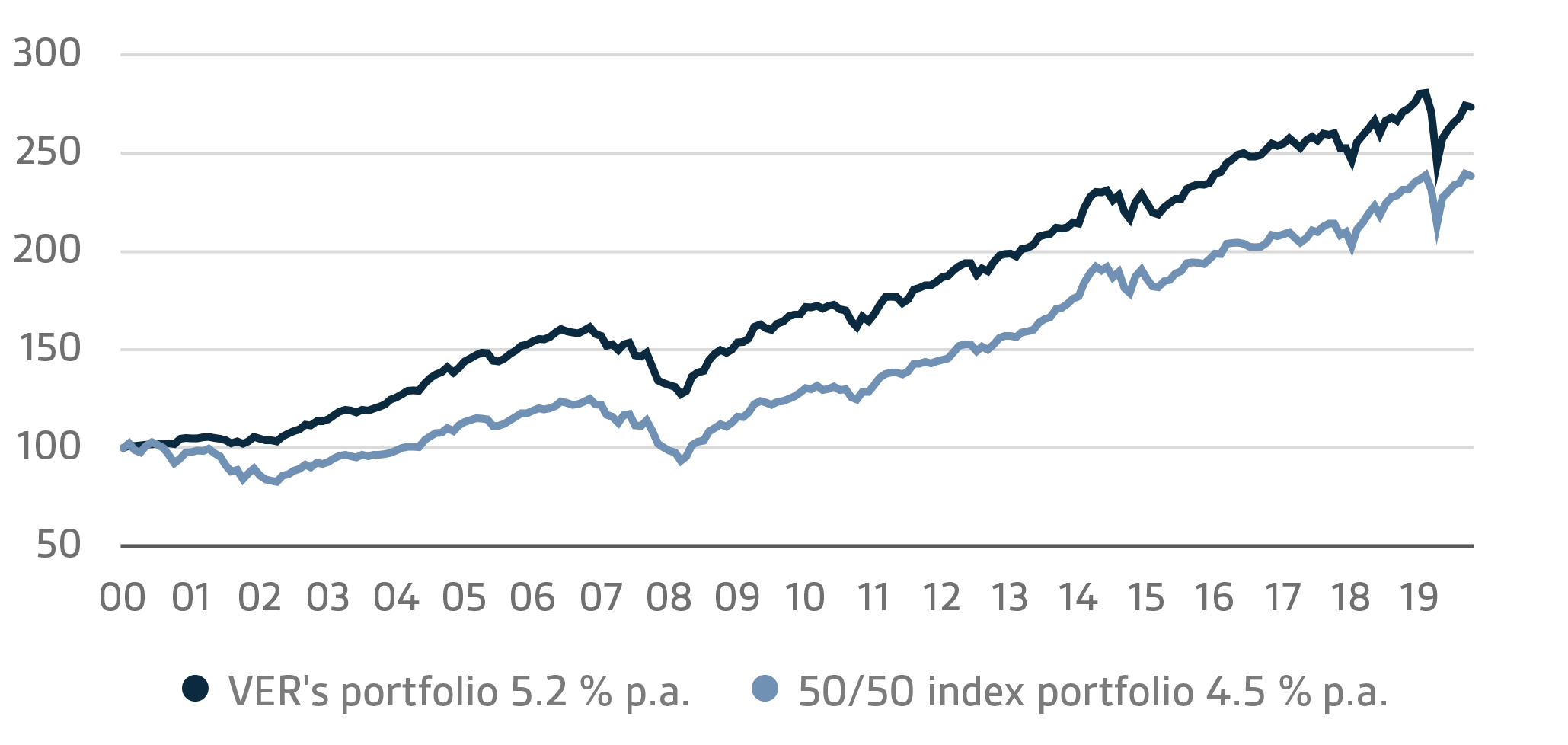

VER monitors long-term return relative to overall market developments by comparing the actual return with a global index, in which the weight of both equities and currency-hedged bonds is 50 per cent.

A CLOSER LOOK AT JANUARY–SEPTEMBER 2020

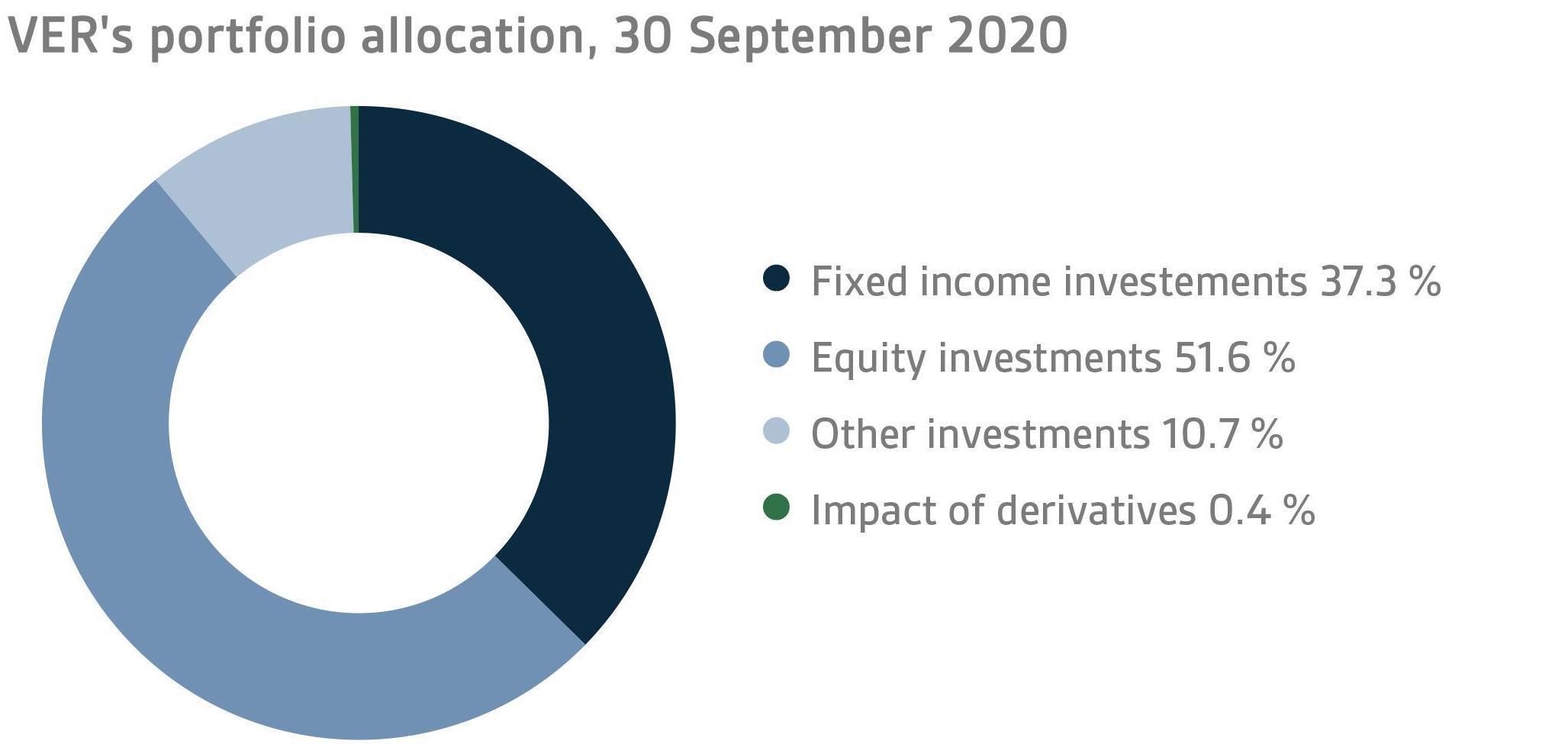

In accordance with the directive of the Ministry of Finance, VER’s investments are divided into fixed income instruments, equities and other investments. At the end of September, fixed income instruments accounted for 37.3 per cent, equities 51.6 per cent and other investments 10.7 per cent of the total. Of the large asset classes, liquid fixed income instruments generated a return of -0.4 per cent and listed equities -4.1 per cent during the first three quarters.

FIXED INCOME INVESTMENTS

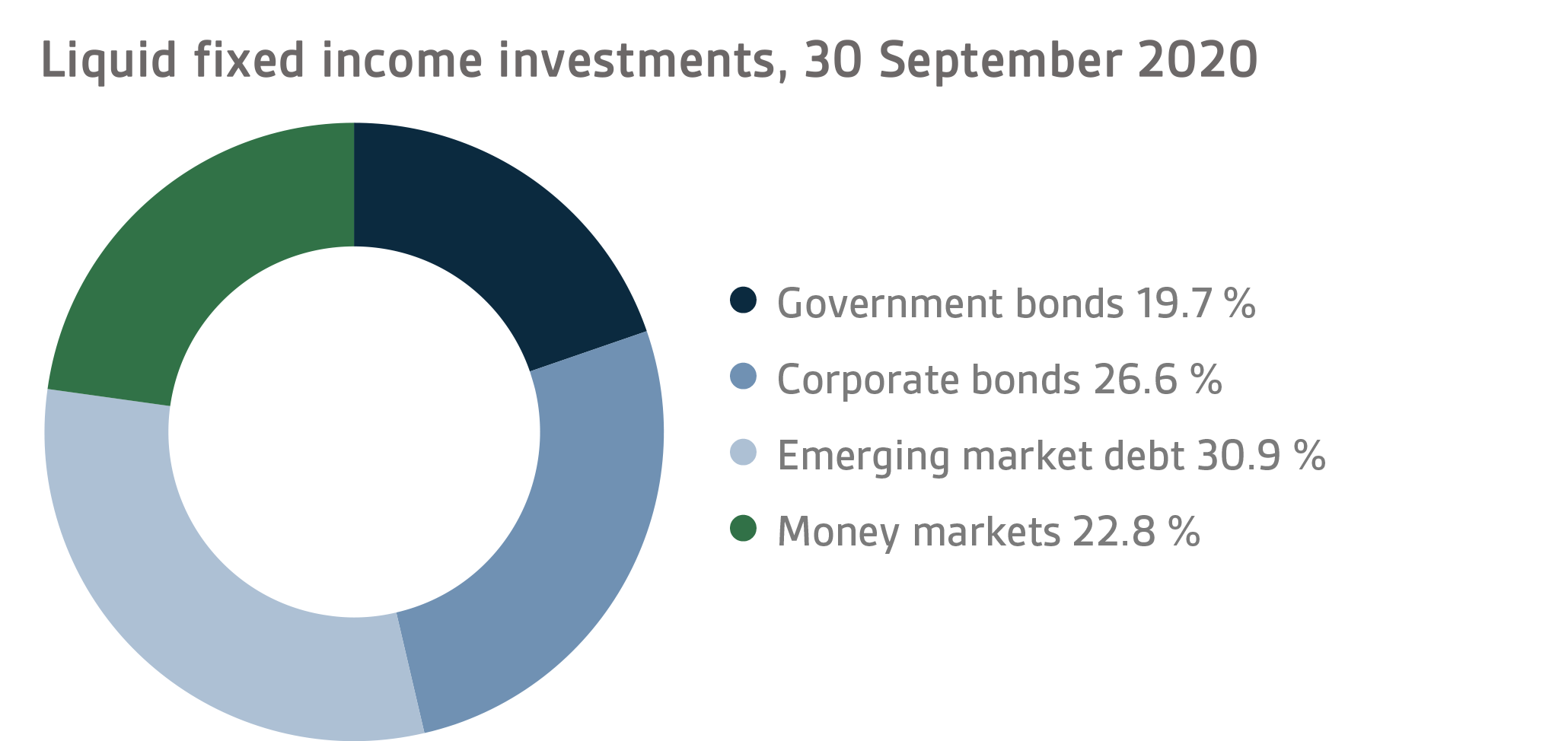

Liquid fixed income investments

During the first three quarters, the return on liquid fixed income instruments was -0.4 per cent.

Developments up to the end of September were dominated by the COVID-19 virus: the measures taken to contain the spread of the infection, the impact of these measures on the economy and the actions taken by central banks and governments to provide support.

The third quarter was relatively tranquil on the fixed income market. Central banks continued the previously launched recovery measures without announcing any new large-scale programmes. In September, the US Federal Reserve announced a new average-inflation target of two percent, as foreseen by the market.

On the whole, the third quarter was positive for the fixed income market. Credit risk premiums continued to fall after the first-quarter spike, but the changes were far more moderate than during the first half of the year.

Other fixed income investments

Other fixed income investments include investments in private credit funds and direct lending to companies.

Private credit investments gave a return of -1.2 per cent.

Since March, the private credit market has also been dominated by the pandemic. In the spring, lockdowns had an adverse impact especially on companies engaged in trade and travel. In early summer, the coronavirus situation calmed down and economic activity recovered to some extent, which improved the prospects of several businesses hit hard in the spring. No real losses of investments were incurred. Managers focusing on distress and special situations have benefitted from the jittery market conditions.

EQUITIES

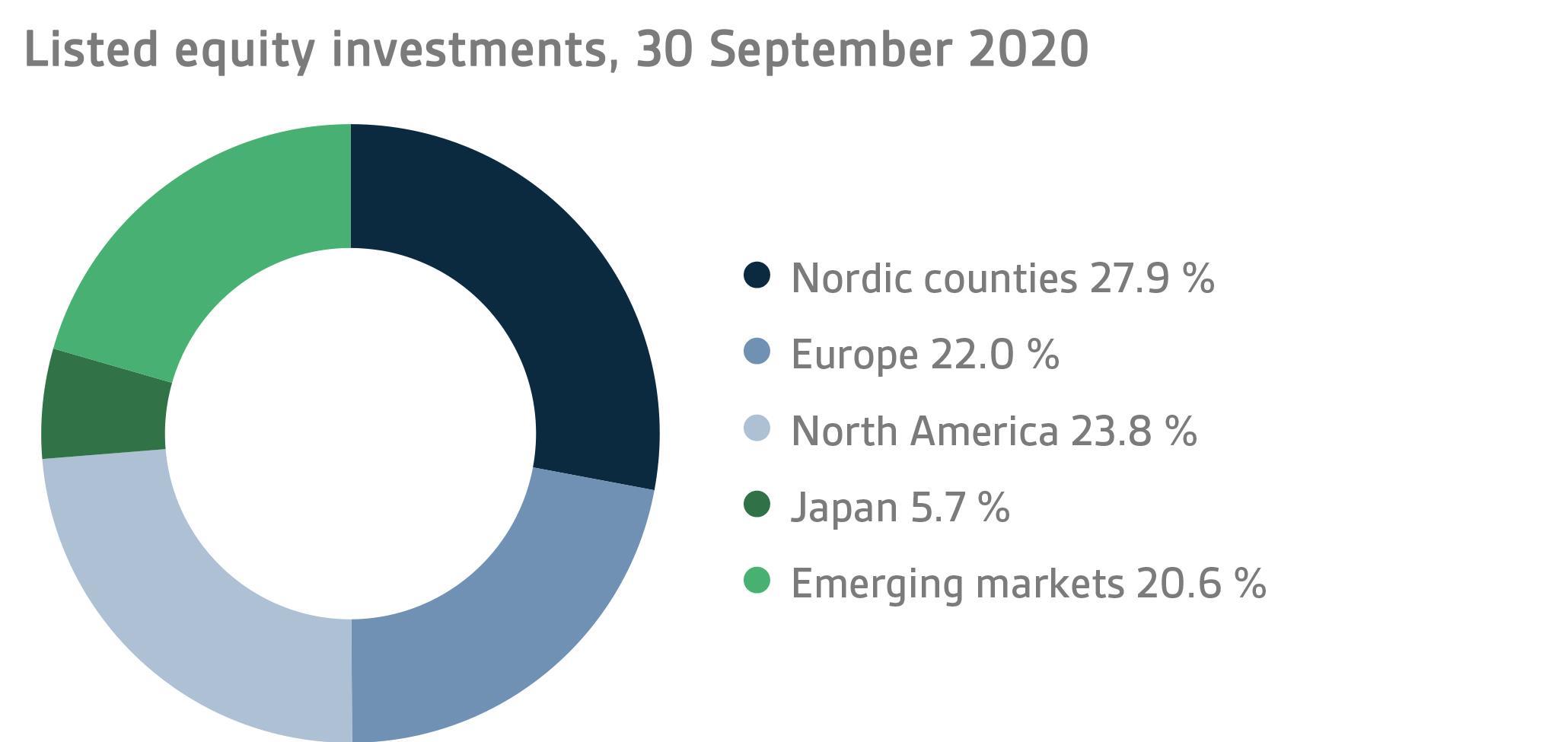

Listed equities

During the first three quarters, the return on listed equities was -4.1 per cent.

The mood in the stock market was quite positive at the beginning of 2020, but the eruption of the coronavirus epidemic into a pandemic turned the situation on its head towards the end of the first quarter. The second quarter was characterised by a very strong recovery, which spilled over to the third quarter, even if somewhat diluted. At the end of the reporting period, the return on listed equities still remained slightly negative, although some stock markets, notably those of Finland and Sweden, had climbed back to positive.

As far as the equities market is concerned, we are witnessing a historic year, which has included an all-encompassing record-fast slide followed by an extremely quick recovery. At least for the time being, governments and central banks have succeeded in stabilising the financial markets through their actions, which include unprecedentedly massive stimulus measures and various types of recovery instruments. Risk-filled asset classes, such as equities, have rebounced from the crisis on a broad front. At the same time, encouraging news about potential coronavirus vaccines has filtered through, which has most likely contributed to this recovery. Year on year, average financial performance by listed companies will clearly fall no matter what happens during the remaining months of the year. However, financial results have not suffered as much as predicted early in the year, and some companies have gone so far as to announce forecasts anticipating a relatively positive performance for the rest of the year. Still, there is a lot of uncertainty in the air, and coronavirus reporting will continue to serve as a powerful explanatory variable for the movements in the financial market for the rest of the year.

Other equity investments

VER’s other equity investments include investments in private equity funds, non-listed stock and listed real estate investment trusts (REITs).

Private equity investments returned -2.6 per cent, unlisted equities 11.8 per cent and listed real estate investment trusts -23.5 per cent.

The impact of the coronavirus crisis on private equity investments were diverged and sector-dependent. Some companies were largely unaffected or even benefitted from the situation. For others, the effects were quite dramatic, even if no investments have been total write-offs so far. The recovery of the stock market from the spring dip has been reflected in the increase in the valuation levels of private equity investments. Listed real estate investment trusts were hit harder than the stock markets. Shopping centre investors have suffered as a result of the bleak economic prospects.

OTHER INVESTMENTS

VER’s other investments are investments in real estate, infrastructure, hedge funds and risk premium strategies.

The return on unlisted real estate funds was -3.0 per cent while infrastructure investments yielded 5.7 per cent.

The effects of the pandemic on individual real estate classes were diverged. Particularly those investing in hotels and commercial properties have suffered from mobility and travel restrictions as well as the uncertain economic prospects. In contrast, logistics, homes and consumable store properties did fairly well under the circumstances, with the fund returns holding up better than other sectors.

With infrastructure, most mobility-related investments have been hit hard by the pandemic. However, basic infrastructure remains indispensable and companies engaged in this line of business have got off lightly.

Hedge funds returned -0.5 per cent during the first three quarters. Most hedge funds have managed to turn losses into profits. Only relative value and quantitative strategy funds continue to generate negative returns since the beginning of the year.

The rate of return on risk premium strategies over the same period was -22.8 per cent. Despite the healthy returns generated by off-stock-market premiums, the total return on the portfolio remained modest mostly due to poor performance by style premiums. The number of risk premium funds was greatly reduced during the year.

STATE PENSION EXPENDITURE, VER’S TRANSFERS TO THE GOVERNMENT BUDGET, PENSION CONTRIBUTION INCOME AND FUNDING RATIO

The State Pension Fund’s role in balancing government finances has grown and will continue to do so. In 2019, the state’s pension expenditure totalled over EUR 4.7 billion while the 2020 budget foresees an expenditure of nearly EUR 4.8 billion. As VER contributes 40 per cent towards these expenses to the government budget, the transfer to the 2020 budget will amount to about EUR 1.9 billion.

By the end of the third quarter, VER had transferred EUR 1458 million to the government budget. Over the same period, VER’s pension contribution income totalled EUR 1147 million. The pension contribution income matched the forecast. VER’s net pension contribution income has now turned permanently negative, meaning that clearly more money is transferred from the Fund to the government budget than VER receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund.

In June 2016, the Board of Directors of the State Pension Fund adopted a strategy that defines its long-term objectives in greater detail. The strategy foresees that the 25 per cent funding ratio target specified by law will be attained by 2033, if not earlier. To achieve this, it is imperative that VER’s pension contribution income remains at the estimated level and that the real return on investments remains relatively high. As the state’s pension liabilities amounted to EUR 92.7 billion at the end of 2019, the funding ratio was approximately 22 per cent. Additionally, the strategy sets out the principles by which the risk level and basic allocation of the investment portfolio are derived from the target funding ratio established for VER.

KEY FIGURES

|

|

|

|

30.9.2020

|

31.12.2019

|

|

Investments, MEUR (market value)

|

19 754

|

20 588

|

|

Fixed income investments

|

7 372

|

7 680

|

|

Equity investments

|

10 192

|

10 486

|

|

Other investments

|

2 105

|

2 146

|

|

Impact of derivatives

|

85

|

276

|

|

|

|

|

Breakdown of the investment portfolio

|

|

|

|

Fixed income investments

|

37,3 %

|

37,3 %

|

|

Equity investments

|

51,6 %

|

50,9 %

|

|

Other investments

|

10,7 %

|

10,4 %

|

|

Impact of derivatives

|

0,4 %

|

1,3 %

|

|

|

|

|

1.1.–30.9.2020

|

1.1.–31.12.2019

|

|

Return on investment

|

-2,5 %

|

13,8 %

|

|

Fixed income investments

|

|

|

|

Liquid fixed income investments

|

-0,4 %

|

5,0 %

|

|

Other fixed income investments

|

0,5 %

|

8,4 %

|

|

Private Credit funds

|

0,5 %

|

1,7 %

|

|

Equity investments

|

|

|

|

Listed equity investments

|

-4,1 %

|

24,6 %

|

|

Private Equity investments

|

-2,6 %

|

14,2 %

|

|

Unlisted equity investments

|

11,8 %

|

8,2 %

|

|

Listed Real Estate funds

|

-23,5 %

|

28,1 %

|

|

Other investments

|

|

|

|

Non-listed Real Estate funds

|

-3,0 %

|

9,8 %

|

|

Infrastructure funds

|

5,7 %

|

12,8 %

|

|

Hedge funds

|

-0,5 %

|

4,9 %

|

|

Risk premium investments

|

-22,8 %

|

-0,5 %

|

|

|

|

|

Pension contribution income, MEUR

|

1 147

|

1 497

|

|

Transfer to state budget, MEUR

|

1 458

|

1 894

|

|

Net contribution income, MEUR

|

-311

|

-396

|

|

Pension liability, BnEUR

|

|

92,7

|

|

Funding ratio, %

|

|

22 %

|

Inquiries: Additional information is provided by CEO Timo Löyttyniemi, firstname.lastname@ver.fi, tel. +358 295 201 210

Established in 1990, the State Pension Fund (VER) is an off-budget fund through which the state prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the state’s pension assets professionally. At the end of September 2020, the market value of the Fund’s investment portfolio stood at EUR 19.8 billion.

All figures presented in this interim report are preliminary and unaudited.