VER’s return on investment 9.3% during 1 Jan–30 June 2021; ten-year average annual return 6.5%

Published 2021-08-25 at 16:02

INVESTMENT ENVIRONMENT

The conditions in the investment market were favourable during the first half of the year. Economic prospects were positive and growth vigorous compared to the previous year plagued by the coronavirus crisis. The positive developments were underpinned by an expansionary economic and monetary policy and increased confidence in the progress made in vaccinations. VER’s return on investments was excellent with all asset classes returning positive figures.

Economic growth was robust and companies’ financial performance exceeded expectations. Confidence in the future has been high because both businesses and investors have set sights on the post-crisis period. The expectation that the coronavirus will be brought under control in one way or another has propelled the stock markets to record heights.

Interest rates have remained low, accompanied by growing concerns and a public debate on inflation. Although the prevailing view is that inflation will increase only temporarily, the concerns about the effects of the massive fiscal and monetary easing are partly justified. The current situation is unknown, and there are unforeseen bottlenecks and idling in several sectors of the economy. Some of the monetary policy measures are unprecedented, which complicates the overall assessment of its consequences.

While the overall prospects brightened up in the spring, the so-called delta variant triggered a surge in infections in Finland and globally. When the number of cases began climbing in the summer, people even started talking about a fourth wave. However, more serious cases requiring hospitalisation have remained moderate in number considering the circumstances because the vaccination rate among the elderly population is high in many regions.

VER’S RETURN ON INVESTMENTS

Future monitoring and evaluation of the State Pension Fund’s investment activities will increasingly focus on long-term outcomes and future prospects instead of quarterly reporting. However, VER will continue to post quarterly figures and comments to the same extent as previously.

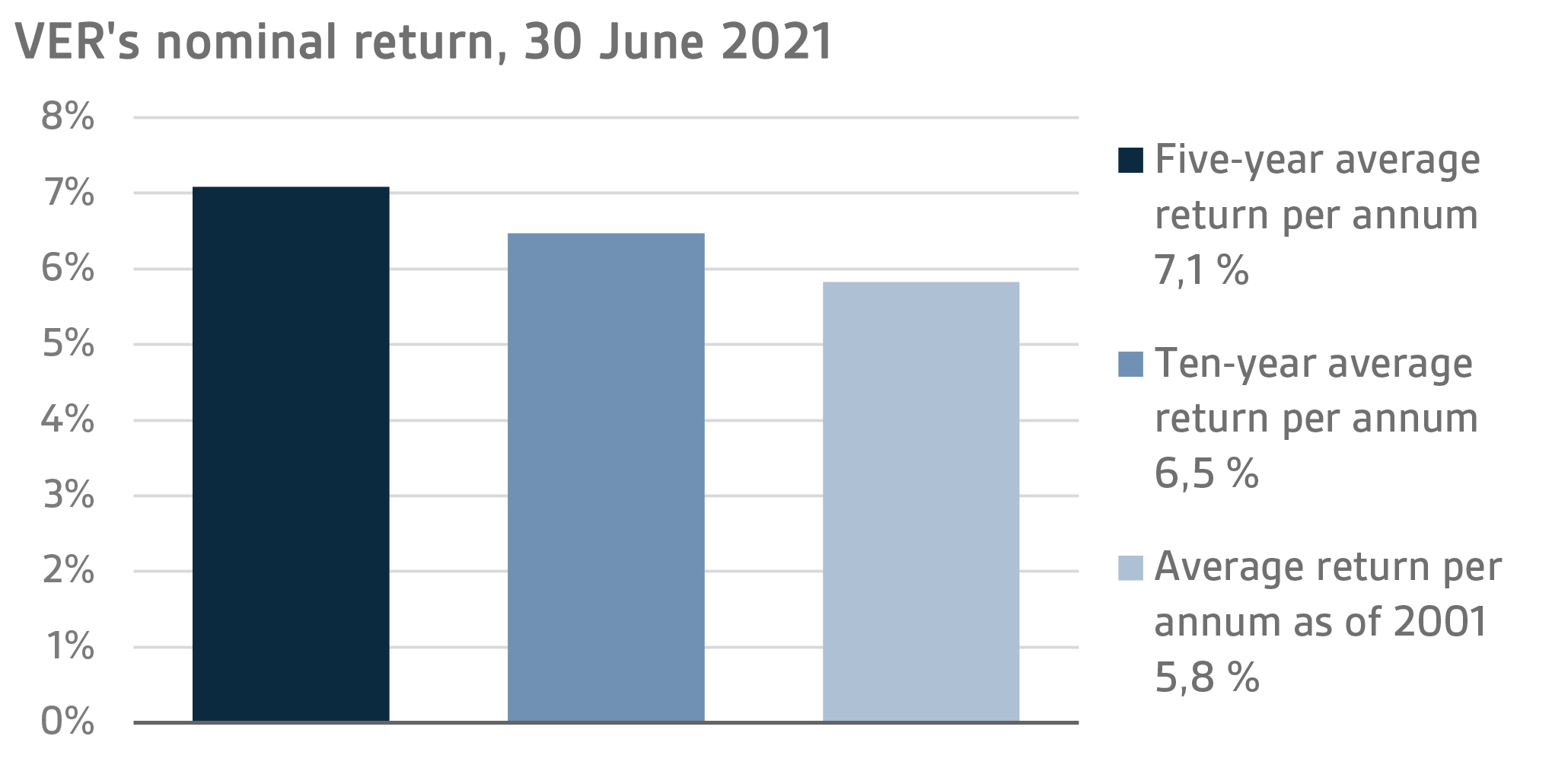

On 30 June 2021, VER’s investment assets totalled EUR 22.7 billion. During the first half of the year, the return on investments at fair values was 9.3 per cent. The average nominal rate of return over the past five years (1 July 2016–30 June 2021) was 7.1 per cent and the annual ten-year return 6.5 per cent. Since 2001, when VER’s activities assumed their current form, the average rate of return has been 5.8 per cent.

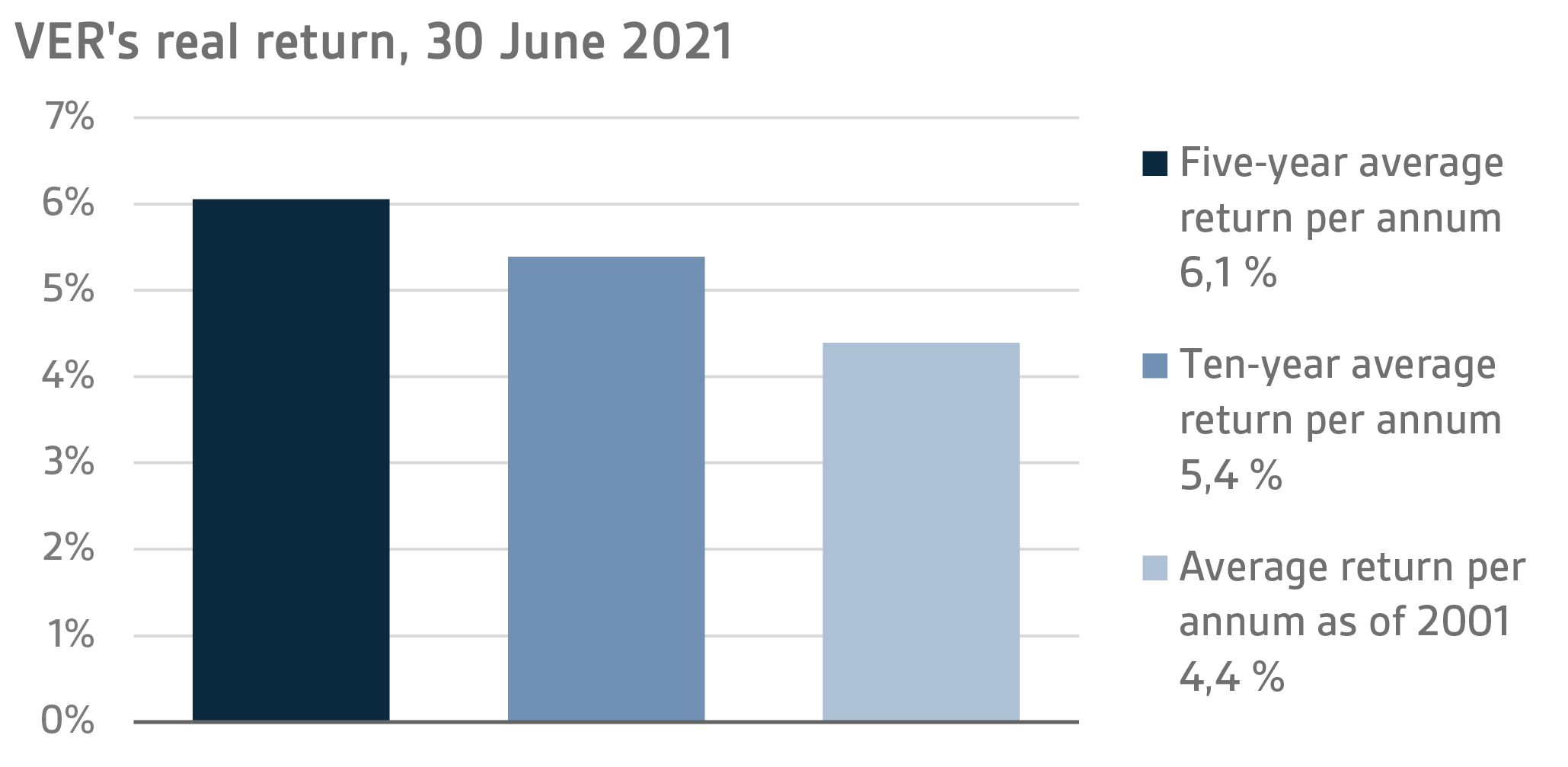

The real rate of return during the first half of 2021 was 7.8 per cent. VER’s five-year average real return was 6.1 per cent and ten-year real return 5.4 per cent. Since 2001, when VER’s activities assumed their current form, the average real rate of return has been 4.4 per cent.

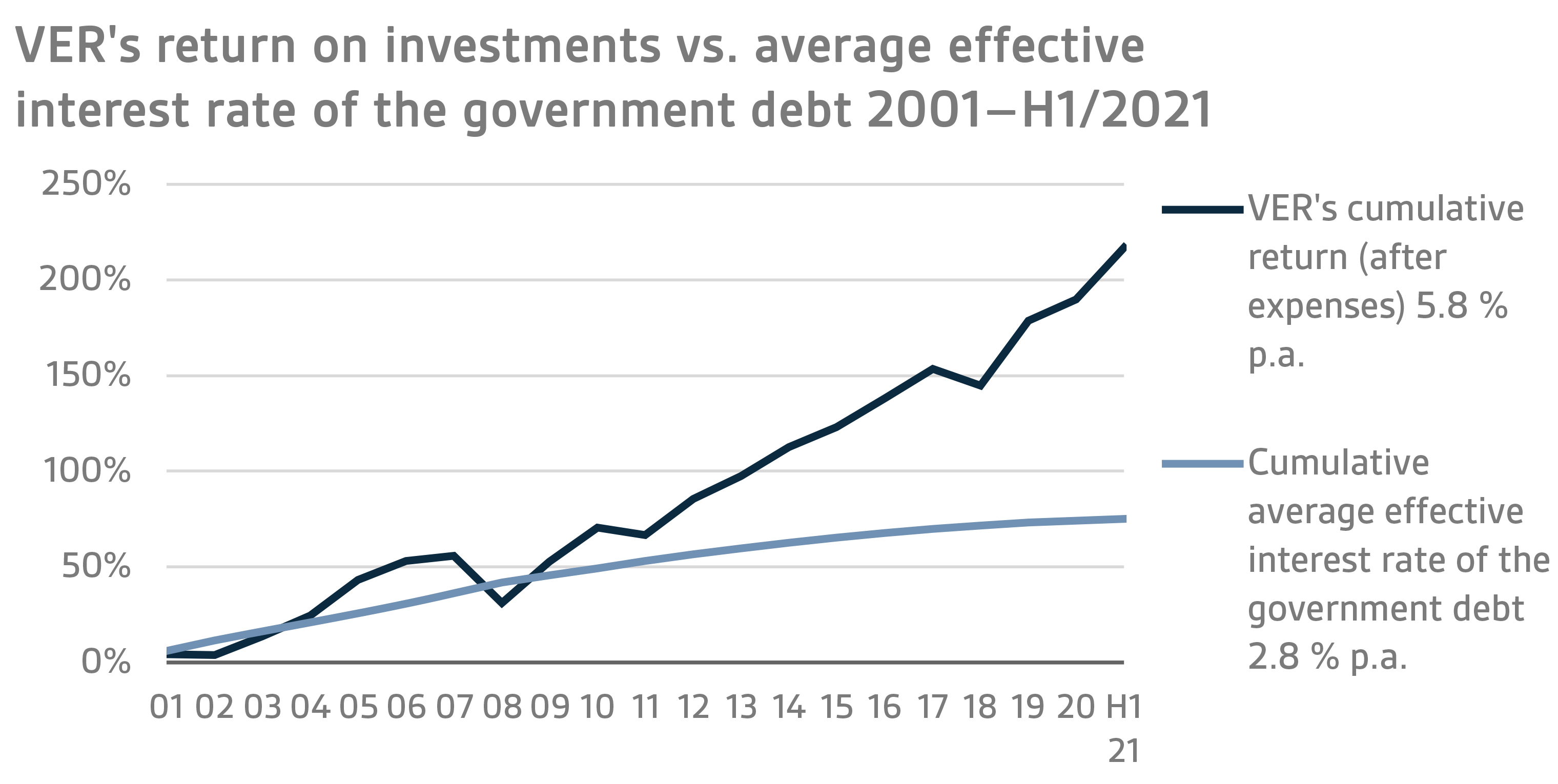

From the State’s point of view, it is pertinent to compare the return on investments with the cost of net government debt, because the funds accumulated in preparation for future pension expenditure can be deemed to reduce such debt. Over the past ten years, VER’s average annual rate of return has beaten the cost of net government debt by 5.0 percentage points. Since 2001, the total market-value returns earned by VER have exceeded the cumulative average cost of equivalent government debt by about EUR 9.9 billion over the same period.

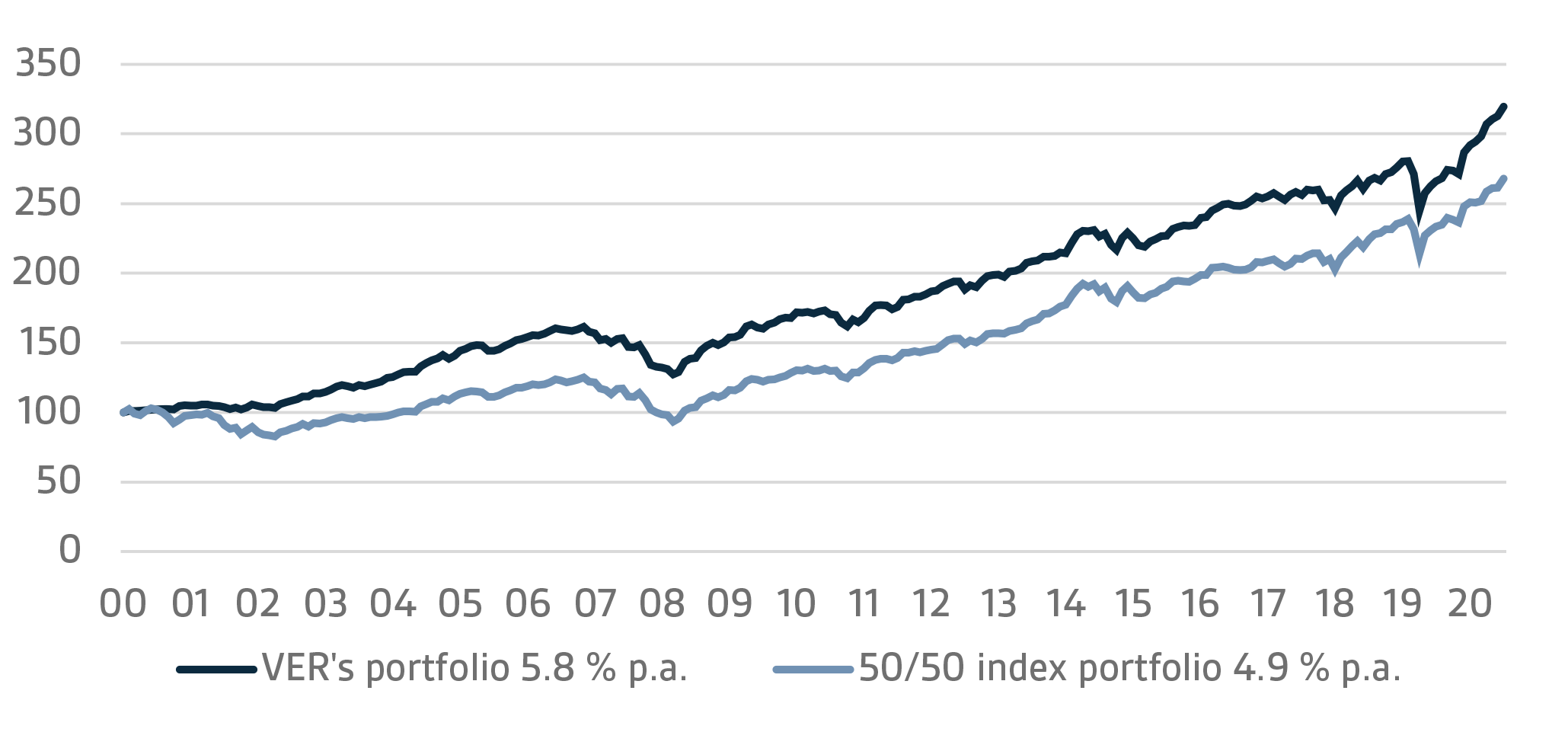

VER monitors long-term return relative to overall market developments by comparing the actual return with a global index, in which the weight of both equities and currency-hedged bonds is 50 per cent.

A CLOSER LOOK AT JANUARY–JUNE 2021

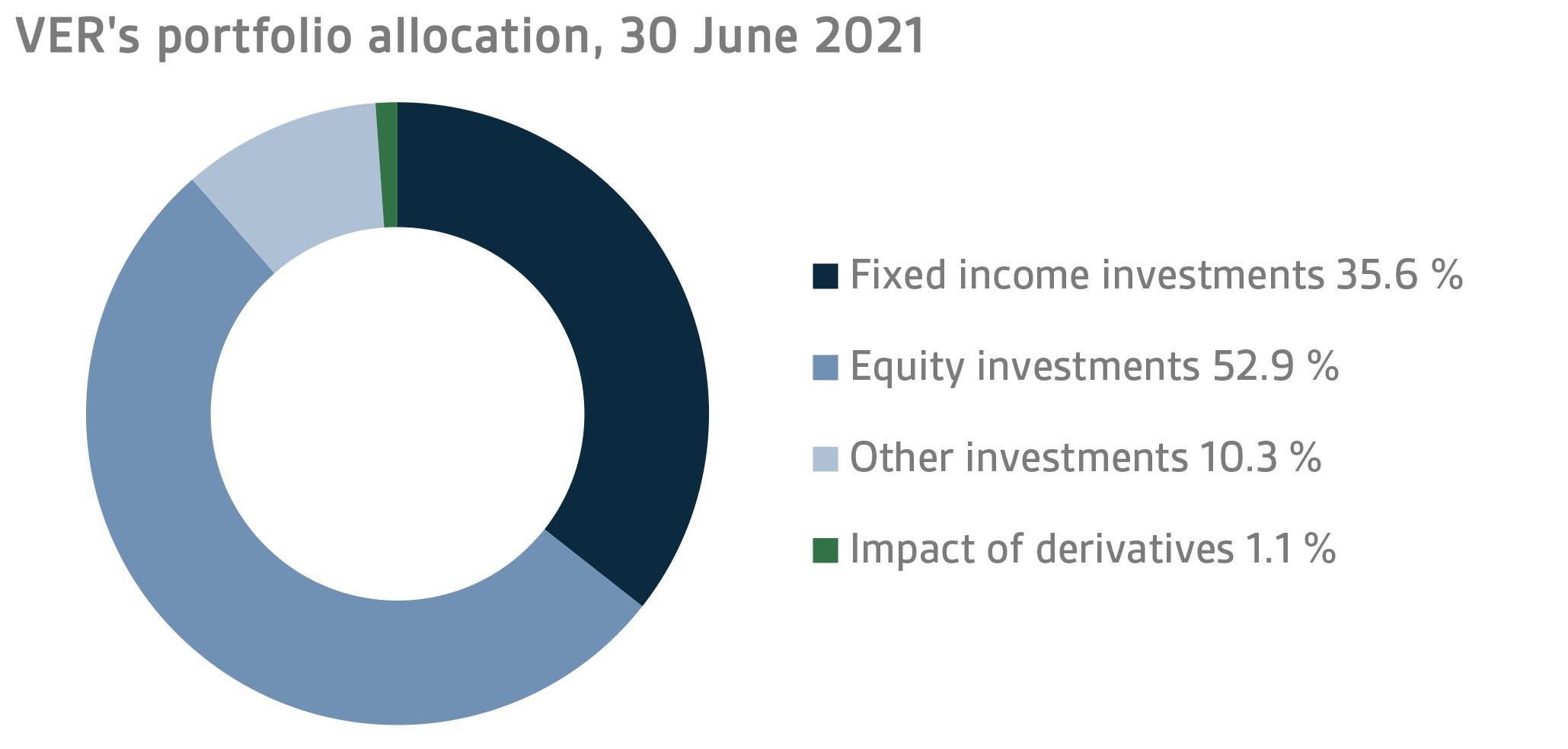

In accordance with the directive of the Ministry of Finance, VER’s investments are divided into fixed income instruments, equities and other investments. At the end of June, fixed income instruments accounted for 35.6 per cent, equities 52.9 per cent and other investments 10.3 per cent of the total. Of the large asset classes, liquid fixed income instruments generated a return of 0.6 per cent and listed equities 15.9 per cent during the first half of the year.

FIXED INCOME INVESTMENTS

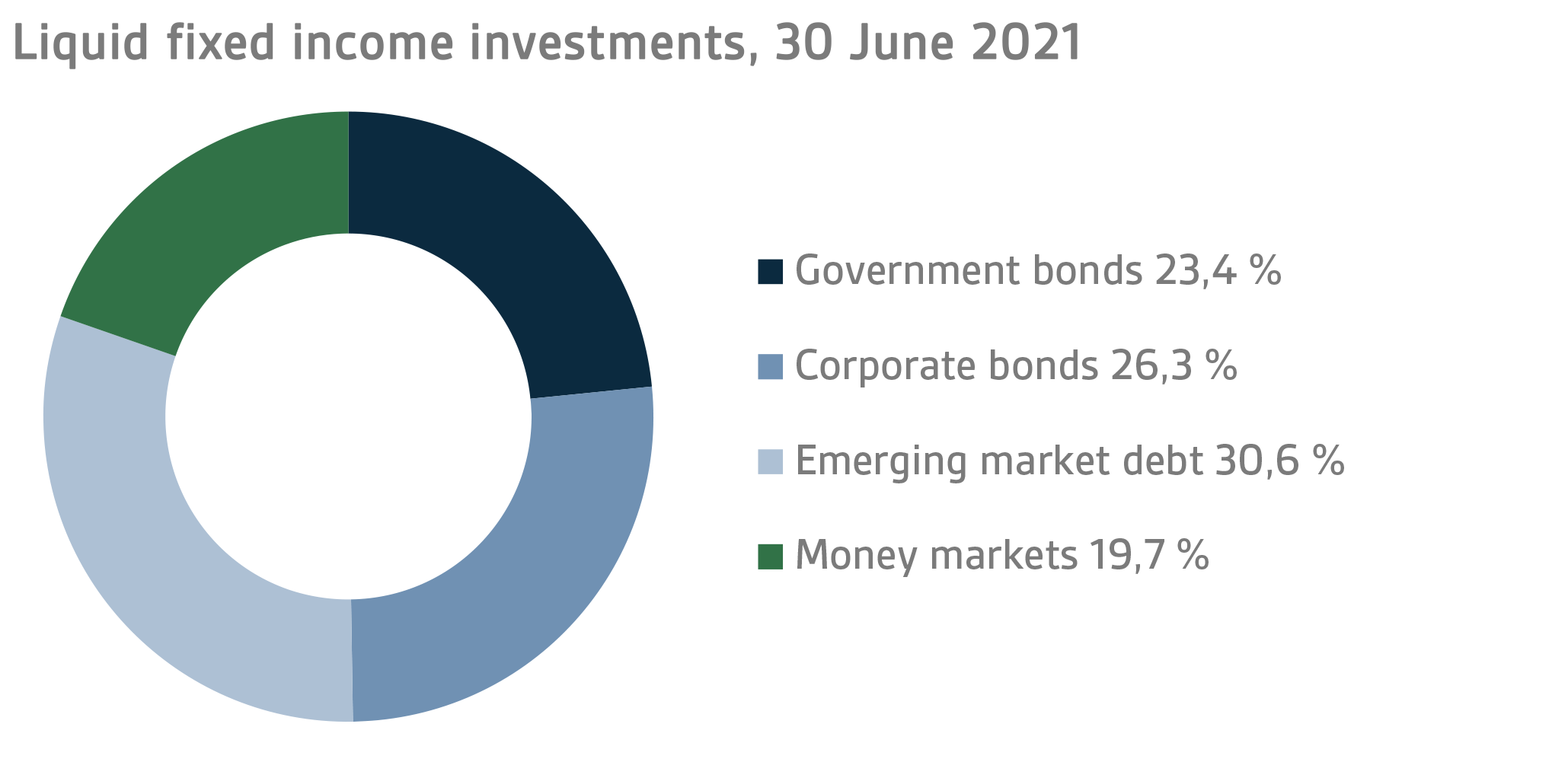

Liquid fixed income investments

During the first half of the year, the return on liquid fixed income instruments was 0.6 per cent.

The developments watched closely during the period included the progress made in COVID-19 vaccinations and infection rates, economic growth and inflation forecasts as well as the communications of central banks regarding the continuation of the easy monetary policy.

At its meeting at the end of June, the Federal Reserve FED revised up its growth and inflation forecasts and updated its assessment of labour market prospects in a more positive direction. As a result, the FED reassessed its forecast for interest rate hikes predicting two 25-point increases in 2023. However, the recent high inflation figures were largely deemed to stem from temporary causes. So far, there has been no discussion as to the point of time when asset purchases would be reduced. As a result of the earlier-than-expected interest rate hikes, the US interest rate curve levelled off considerably in the second quarter, following a sharp increase in the first quarter.

Similarly, the European Central Bank revised up its growth and inflation forecasts at its June meeting without, however, making any adjustments to its monetary policy. The ECB signalled that it would continue to pursue the accelerated PEPP purchases programme in the third quarter. In Europe, the changes in interest rates in the first half of the year were more modest than in the United States.

As far as VER’s liquid fixed income investments are concerned, the levelling off of the US dollar interest rate curve was primarily reflected in the excellent quarter returns on emerging market debt after the difficult first quarter. The risk premiums on corporate loans narrowed slightly in the second quarter but still remained sound, especially in corporate loans with a lower credit rating.

Other fixed income investments

Other fixed income investments include investments in private credit funds and direct lending to companies.

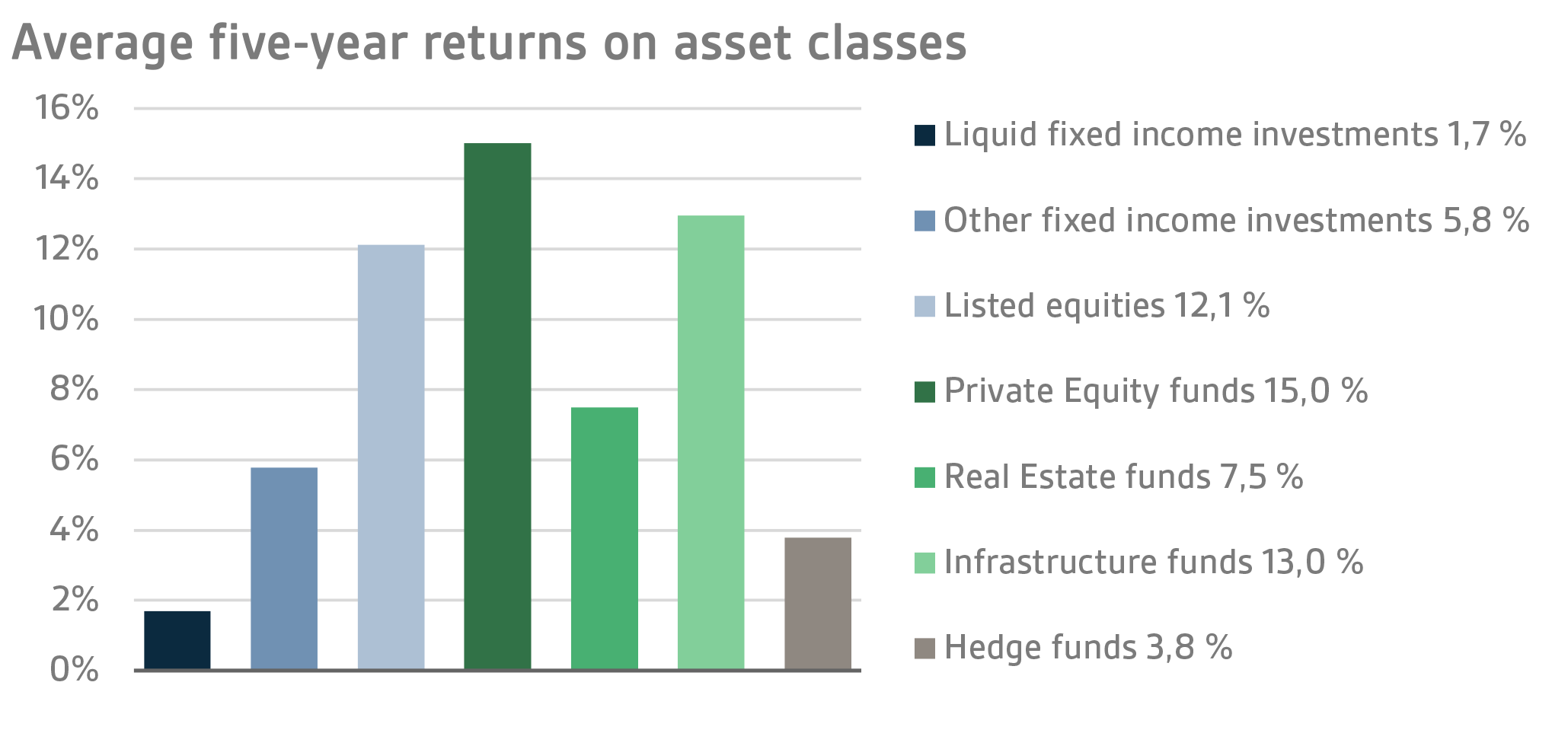

The return on other fixed income investments was 4.5 per cent. Private credit funds returned 4.9 per cent and direct lending 3.1 per cent.

Although private credit investments suffered from the economic effects of the pandemic just like the other asset classes, it is safe to say that, on the whole, private credit managers coped quite well with the crisis. Special situation strategies actually benefitted from the market disruptions, as companies are increasingly looking for refinancing and banks are cutting down on lending to smaller businesses. The biggest problems were faced by funds holding investments in mobility and retail-related sectors. With the opening of the economy, their expected returns have improved.

EQUITIES

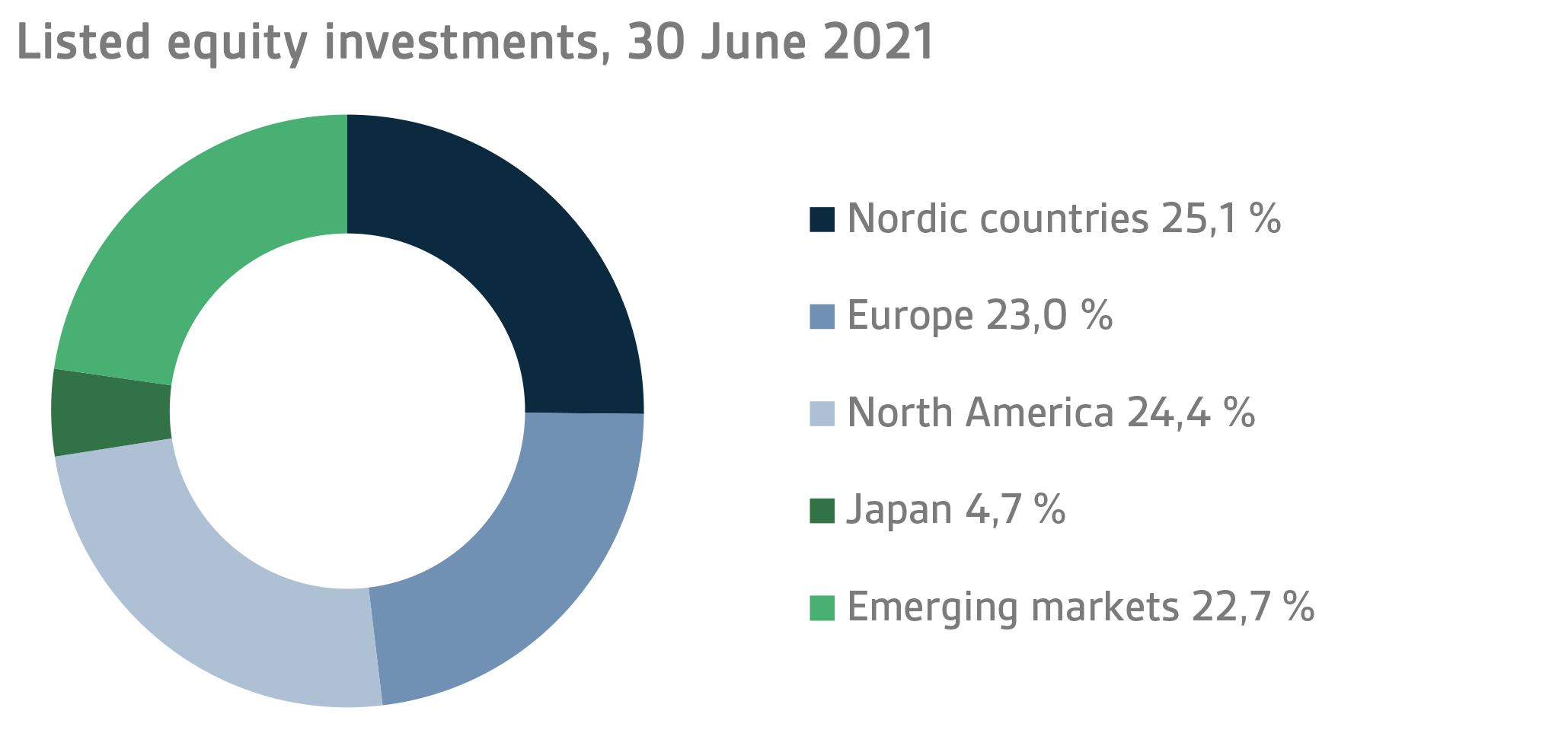

Listed equities

During the first half of the year, the return on listed equities was 15.9 per cent.

The first half of 2021 was extremely favourable for the global stock market. The year got off to a brisk start propelled by positive financial news, and stock market growth held up to the end of the reporting period. The first few months of the year were characterised by clearly better-than-expected financial performance by listed companies as well as positive news from the pandemic front. Towards the end of the reporting period, uncertainty in the financial market increased somewhat, mainly due to the spread of virus mutations, but even so the period ended with healthy returns. The best performance was put in by VER’s investments in the North American stock markets that yielded a return of about 20 per cent.

The global economy continued to recover at a steady rate throughout the first half of the year. The figures posted by listed companies were clearly better than expected, although there were signs of growing uncertainty about future prospects, mainly due to the world-wide shortage of components. At the same time, reports on the COVID-19 pandemic were encouraging, even though clouds started gathering again in the form of new viral variants. Risk appetites remained high through the 6-month period, and there was ample demand for riskier asset classes, such as equities, in this investment environment. Value stocks outperformed growth stocks in these circumstances, even if the difference in returns clearly narrowed at the end of the reporting period. To a great extent, the diminishing difference can be explained by changes in the interest rate environment, but also by the repatriation of profits after the strong first few months of the year. Consequently, valuation levels increased quite a lot towards the end of the reporting period as a result of the strong stock market. Admittedly, as the overall financial performance of listed companies clearly exceeded expectations, the increased valuation levels have not, at least for now, been able to reduce investors’ risk appetite. Earnings growth is expected in the next few years, because the current robust growth is already taken into account in stock prices.

Other equity investments

VER’s other equity investments include investments in private equity funds, non-listed stock and listed real estate investment trusts (REITs).

Private equity investments returned 20.4 per cent, unlisted equities 45.6 per cent and listed real estate investment trusts 12.2 per cent (TWR).

Despite the COVID-19 pandemic, most private equity funds fared quite well with little damage. Government support and opening economies gave a boost to portfolio companies. Underlying the healthy returns on private equity investments is the positive development of the stock market and subsequent increase in valuation levels as well as successful exits at excellent valuation levels.

Similarly, listed real estate investment trusts benefitted from the robust stock market.

OTHER INVESTMENTS

VER’s other investments are investments in real estate, infrastructure, hedge funds and risk premium strategies.

The return on unlisted real estate funds was 4.0 per cent while infrastructure investments yielded 7.9 per cent.

On the whole, the real estate market showed a cautiously positive trend. In particular, returns on logistics and residential properties remained at a sound level. Investor interest in real estate property continued unabated, which was reflected in the recovery of the transaction market. The future performance of offices and particularly shopping centres will very much depend on the opening of the economy and an improvement in the COVID-19 situation.

Underlying the sound returns on infrastructure funds are successful exits and dividends. Also, the impact of the coronavirus crisis on the portfolio funds investing in basic infrastructure remained fairly limited while the valuation levels of companies continued to increase slightly.

Hedge funds and systematic strategies yielded a return of 3.5 per cent in the first half of the year. As the FED was expected to adopt a more hawkish approach to monetary policy, market volatility increased, offering opportunities for hedge funds. Of the hedge funds, a steady overall performance was put in by so-called multi-strategy funds and funds focusing on the Asian market. Similarly, some of the quantitative funds gave a very good return. With regard to systematic strategies, the biggest contribution was made by emerging market currencies and the commodities market.

STATE PENSION EXPENDITURE, VER’S TRANSFERS TO THE GOVERNMENT BUDGET, PENSION CONTRIBUTION INCOME AND FUNDING RATIO

The State Pension Fund’s role in balancing government finances has grown and will continue to do so over the next few years. In 2020, the state’s pension expenditure totalled over EUR 4.8 billion while the 2021 budget foresees an expenditure of nearly EUR 4.9 billion. As VER contributes 40 per cent towards these expenses to the government budget, the transfer to the 2021 budget will amount to about EUR 1.9 billion.

By the end of June, VER had transferred EUR 973 million to the government budget. Over the same period, VER’s pension contribution income totalled EUR 791 million. The pension contribution income matched the forecast. VER’s net pension contribution income has now turned permanently negative, meaning that clearly more money is transferred from VER to the government budget than VER receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund.

On 31 December 2020, the State’s pension liabilities amounted to EUR 93.1 billion, while the funding ratio was 23 per cent. The Board of Directors of the State Pension Fund will update its long-term objectives after the reform to the Act on the State Pension Fund currently under preparation.

KEY FIGURES

|

|

|

|

30.6.2021

|

31.12.2020

|

|

Investments, MEUR (market value)

|

22 666

|

20 964

|

|

Fixed income investments

|

8 071

|

7 599

|

|

Equity investments

|

11 997

|

10 994

|

|

Other investments

|

2 338

|

2 280

|

|

Impact of derivatives

|

258

|

91

|

|

|

|

|

Breakdown of the investment portfolio

|

|

|

|

Fixed income investments

|

35,6 %

|

36,2 %

|

|

Equity investments

|

52,9 %

|

52,4 %

|

|

Other investments

|

10,3 %

|

10,9 %

|

|

Impact of derivatives

|

1,1 %

|

0,4 %

|

|

|

|

|

1.1.–30.6.2021

|

1.1.–31.12.2020

|

|

Return on investment

|

9,3 %

|

4,0 %

|

|

Fixed income investments

|

|

|

|

Liquid fixed income investments

|

0,6 %

|

2,1 %

|

|

Other fixed income investments

|

4,5 %

|

4,4 %

|

|

Private Credit funds

|

4,9 %

|

3,9 %

|

|

Equity investments

|

|

|

|

Listed equity investments

|

15,9 %

|

6,2 %

|

|

Private Equity investments

|

20,4 %

|

6,6 %

|

|

Unlisted equity investments

|

45,6 %

|

12,2 %

|

|

Other investments

|

|

|

|

Non-listed Real Estate funds

|

4,0 %

|

1,2 %

|

|

Infrastructure funds

|

7,9 %

|

12,2 %

|

|

Hedge funds

|

3,5 %

|

4,9 %

|

|

|

|

|

Pension contribution income, MEUR

|

791

|

1 509

|

|

Transfer to state budget, MEUR

|

-973

|

1 931

|

|

Net contribution income, MEUR

|

-182

|

-423

|

|

Pension liability, BnEUR

|

|

93,1

|

|

Funding ratio, %

|

|

23 %

|

Additional information: Additional information is provided by CEO Timo Löyttyniemi, firstname.lastname@ver.fi, tel. +358 (0)295 201 210

Established in 1990, the State Pension Fund (VER) is an off-budget fund through which the State prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the State’s pension assets professionally. At the end of June 2021, the market value of the Fund’s investment portfolio stood at EUR 22.7 billion.

All figures presented in this interim report are preliminary and unaudited.