VER’s return on investment 6.6% during 1 Jan–31 March 2019; ten-year average annual return 7.4%

Published 2019-05-07 at 11:34

Investment environment

For investors, the first quarter of 2019 was exceptionally strong. The equity market, in particular, experienced a vigorous recovery after the steep fall in December 2018. Similarly, the more risk-laden fixed income market developed favourably during the first few months of the year, and as the general interest rates declined, government bonds also generated positive returns.

The market developments may be regarded as particularly favourable considering that clear signs of weakening performance in the macro economy have been discernible across the world. For example, many European indicators were weak during the first quarter. The US economy continues to perform reasonably well, while expansive measures taken in China have contributed to its performance.

The biggest single factor underlying the positive market development is the policy pursued by central banks in the past few years and their communications regarding future monetary policy. In the United States, the tightening of the monetary policy seems to have reached the end of the road with the markets anticipating a fall in interest rates. At the same time, the normalisation of the European Central Bank’s monetary policy appears increasingly distant.

VER’s returns on investments

Future monitoring and evaluation of the State Pension Fund’s investment activities will increasingly focus on long-term outcomes and future prospects instead of quarterly reporting. However, VER will continue to post quarterly figures and comments to the same extent as previously.

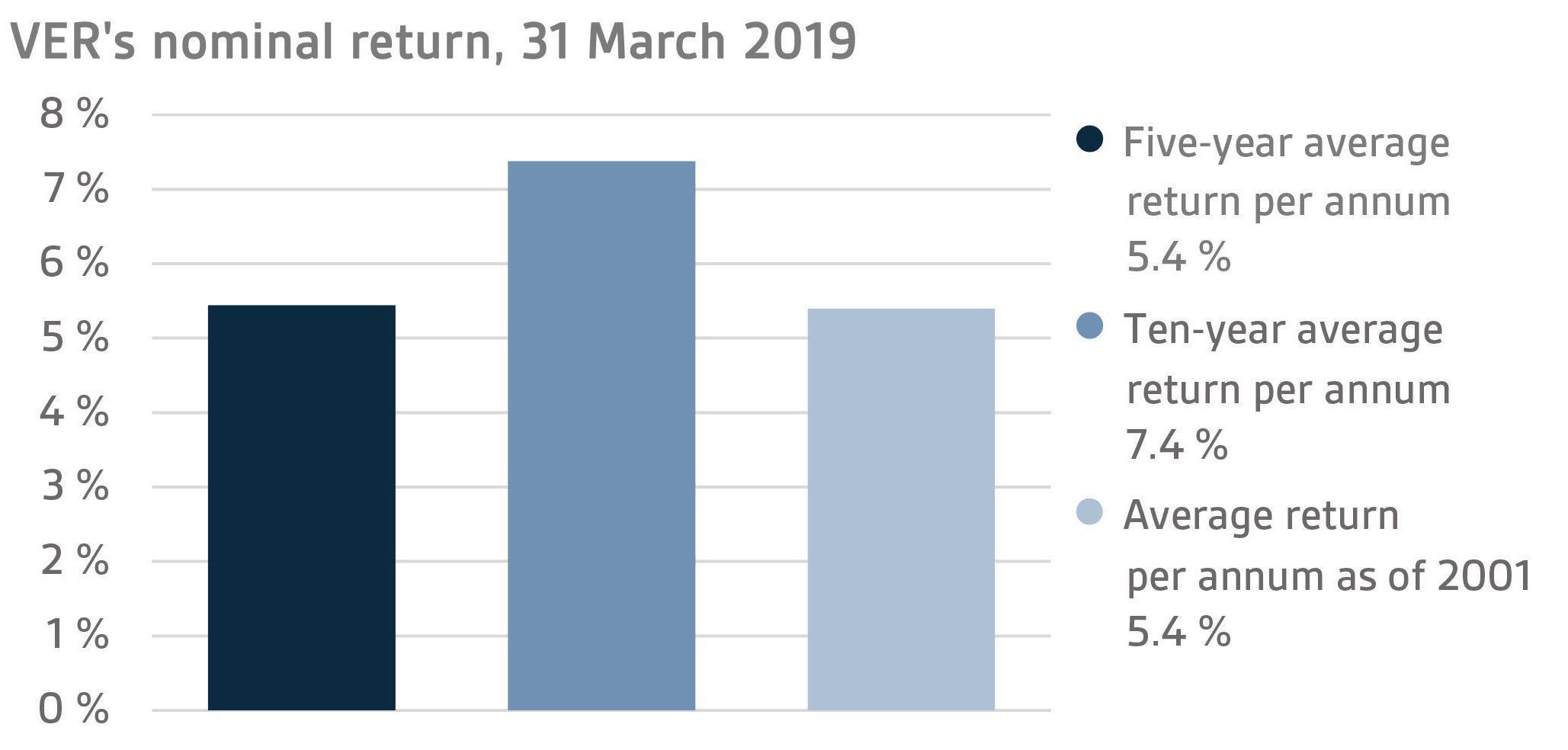

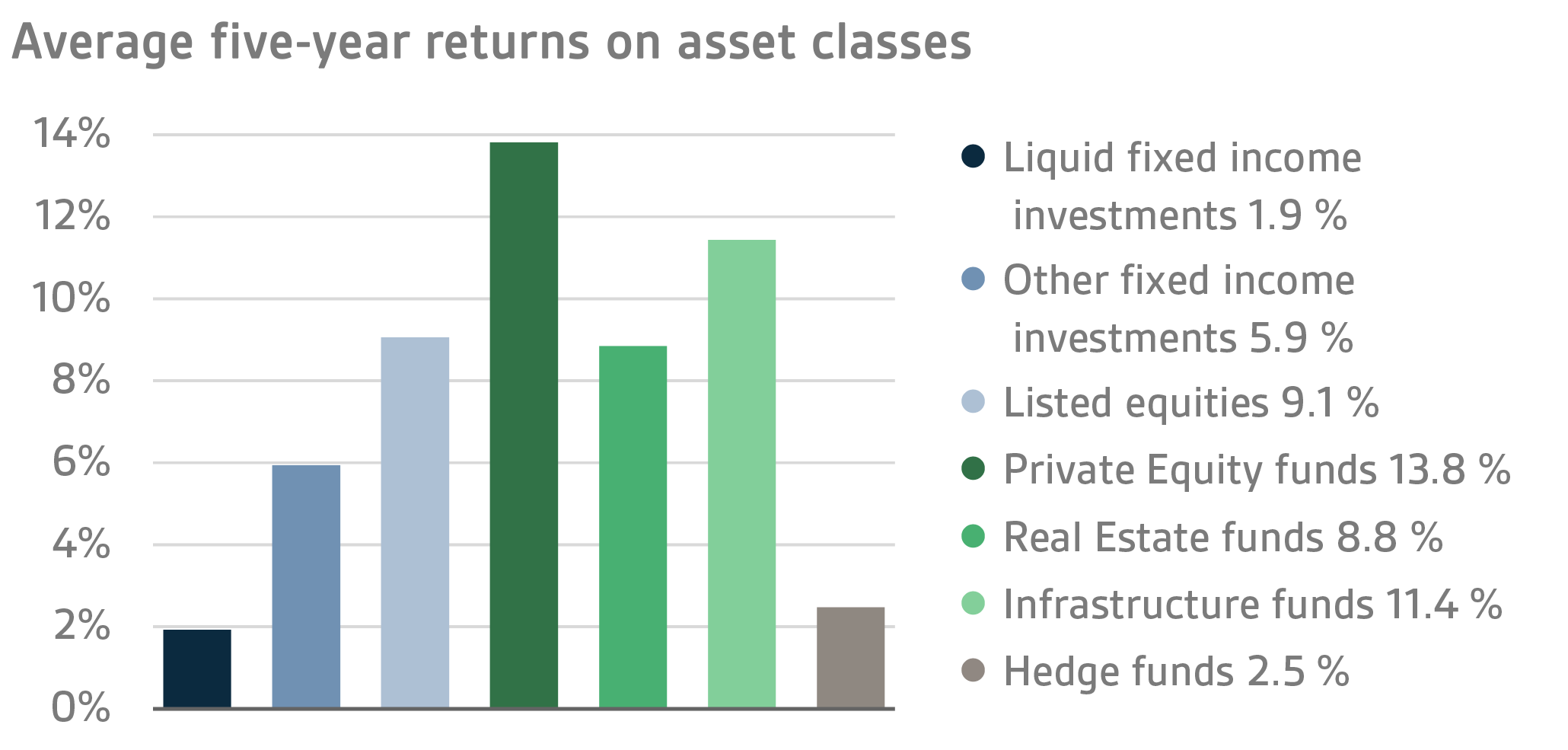

On 31 March 2019, VER’s investment assets totalled EUR 19.5 billion. During the first quarter, the return on investments at fair values was 6.6 per cent. The average nominal rate of return over the past five years (1 April 2013–31 March 2019) was 5.4 per cent and the annual ten-year return 7.4 per cent. Since 2001 when VER’s activities assumed their current form, the average rate of return has been 5.4 per cent.

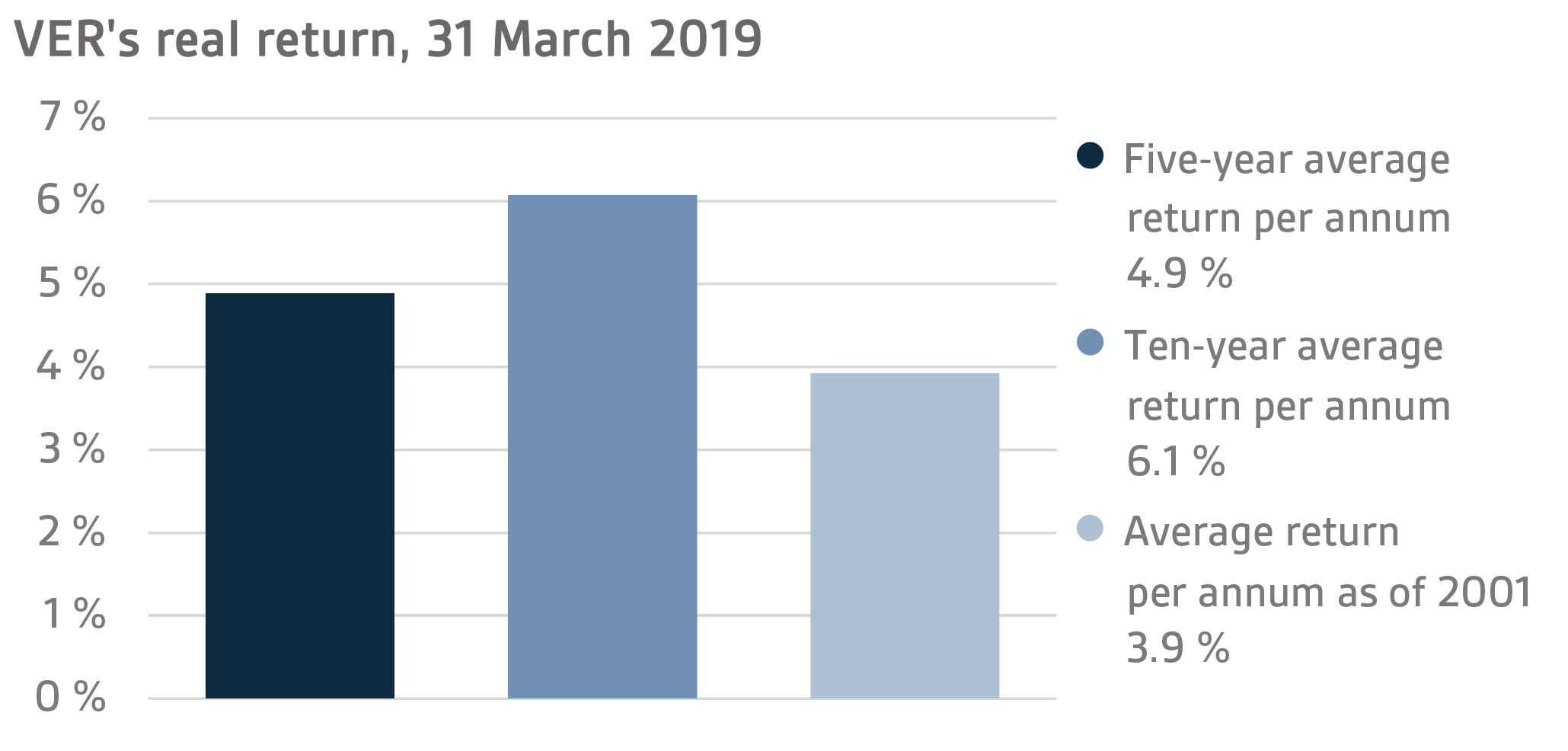

The real rate of return during the first quarter of 2019 was 6.4 per cent. VER’s five-year average real return was 4.9 per cent and ten-year real return 6.1 per cent.

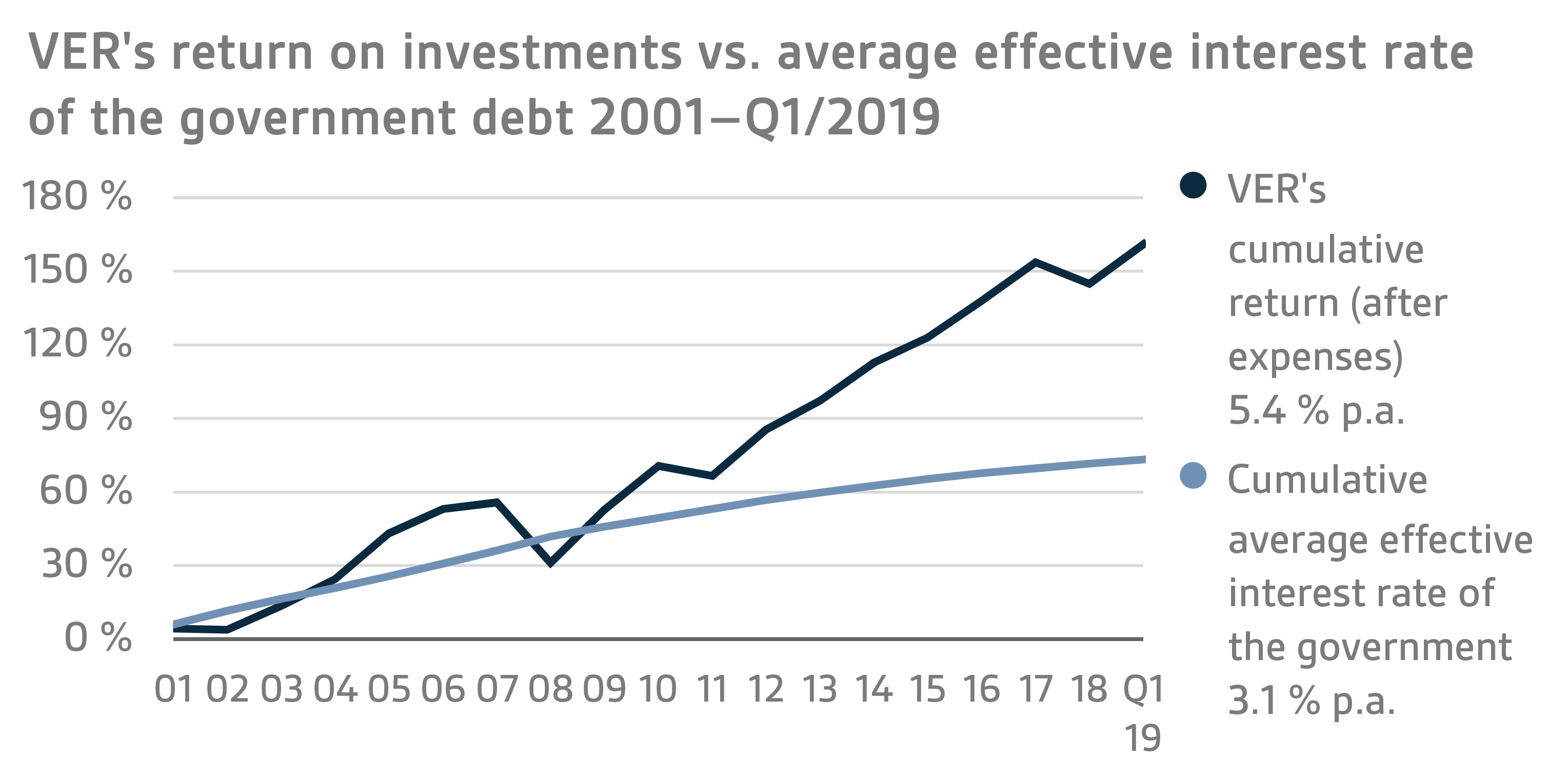

From the state’s point of view, it is pertinent to compare the return on investments with the cost of net government debt, because the funds accumulated in preparation for future pension expenditure can be deemed to reduce such debt. Over the past ten years, VER’s average annual rate of return has beaten the cost of net government debt by 5.5 percentage points. Since 2001, the total market-value returns earned by VER have exceeded the cumulative average cost of equivalent government debt by about EUR 6 billion over the same period.

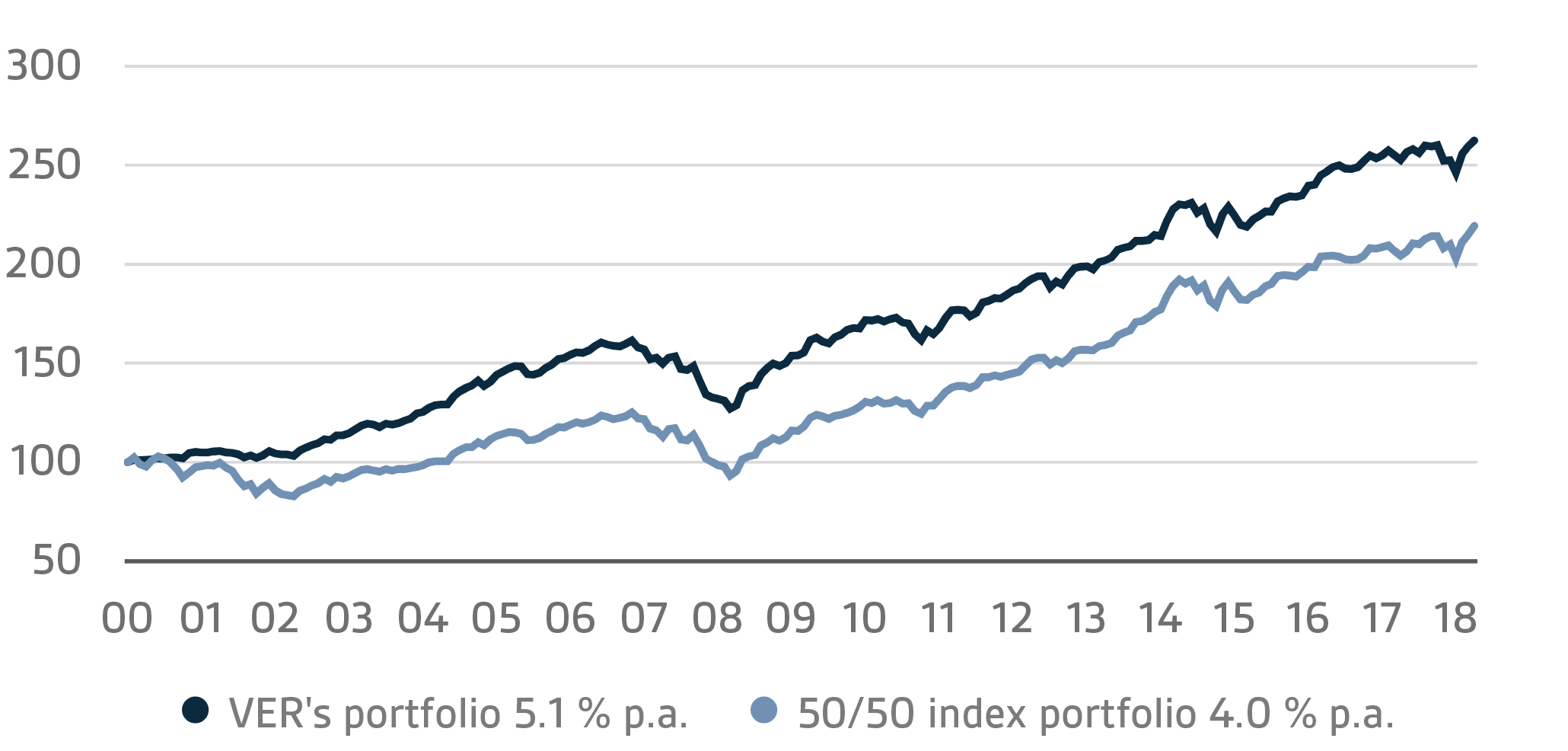

VER monitors long-term return relative to overall market developments by comparing the actual return with a global index, in which the weight of both equities and currency-hedged bonds is 50 per cent.

A closer look at January–March 2019

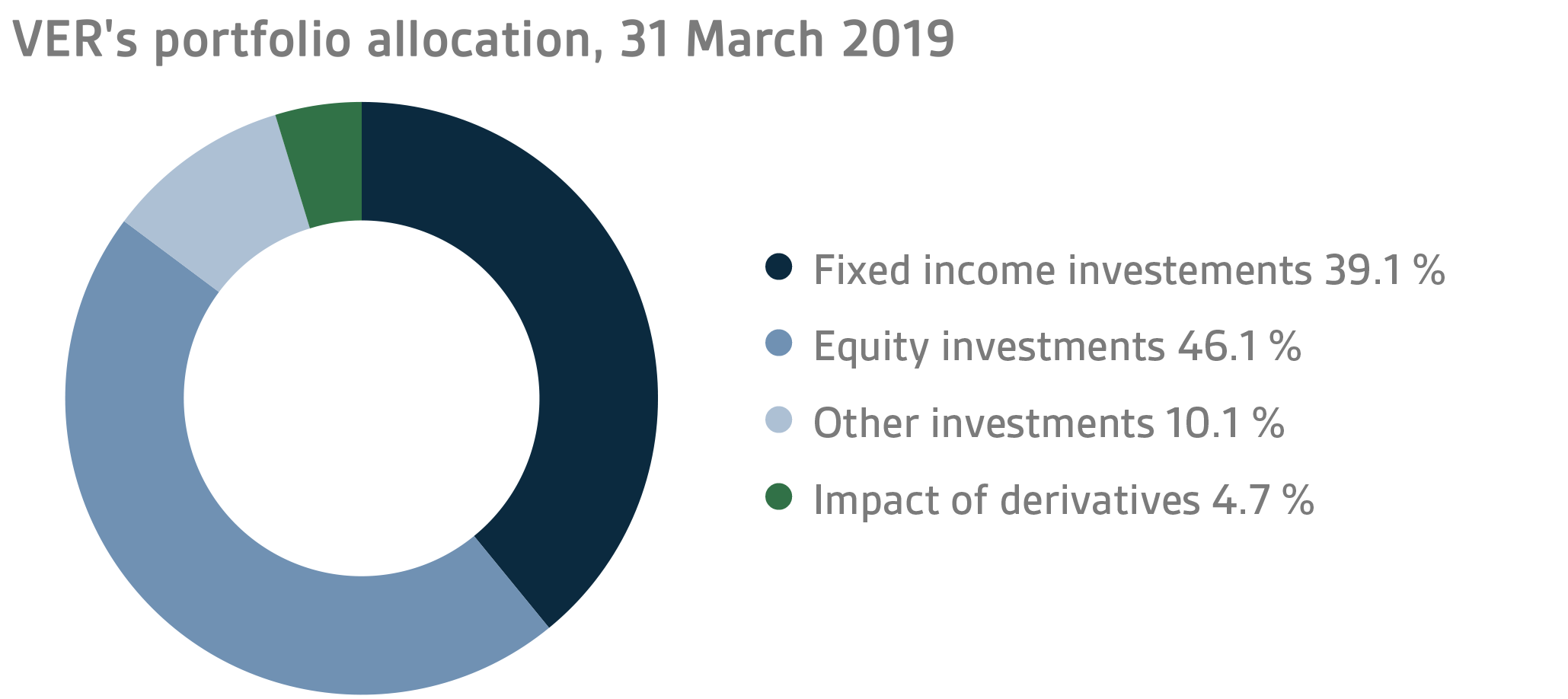

In accordance with the directive of the Ministry of Finance, VER’s investments are divided into fixed income instruments, equities and other investments. At the end of March, fixed income instruments accounted for 39.1 per cent, equities 46.1 per cent and other investments 10.1 per cent of the total. Of the large asset classes, liquid fixed income instruments generated a return of 2.1 per cent and listed equities 12.7 per cent during the first quarter of the year.

FIXED INCOME INVESTMENTS

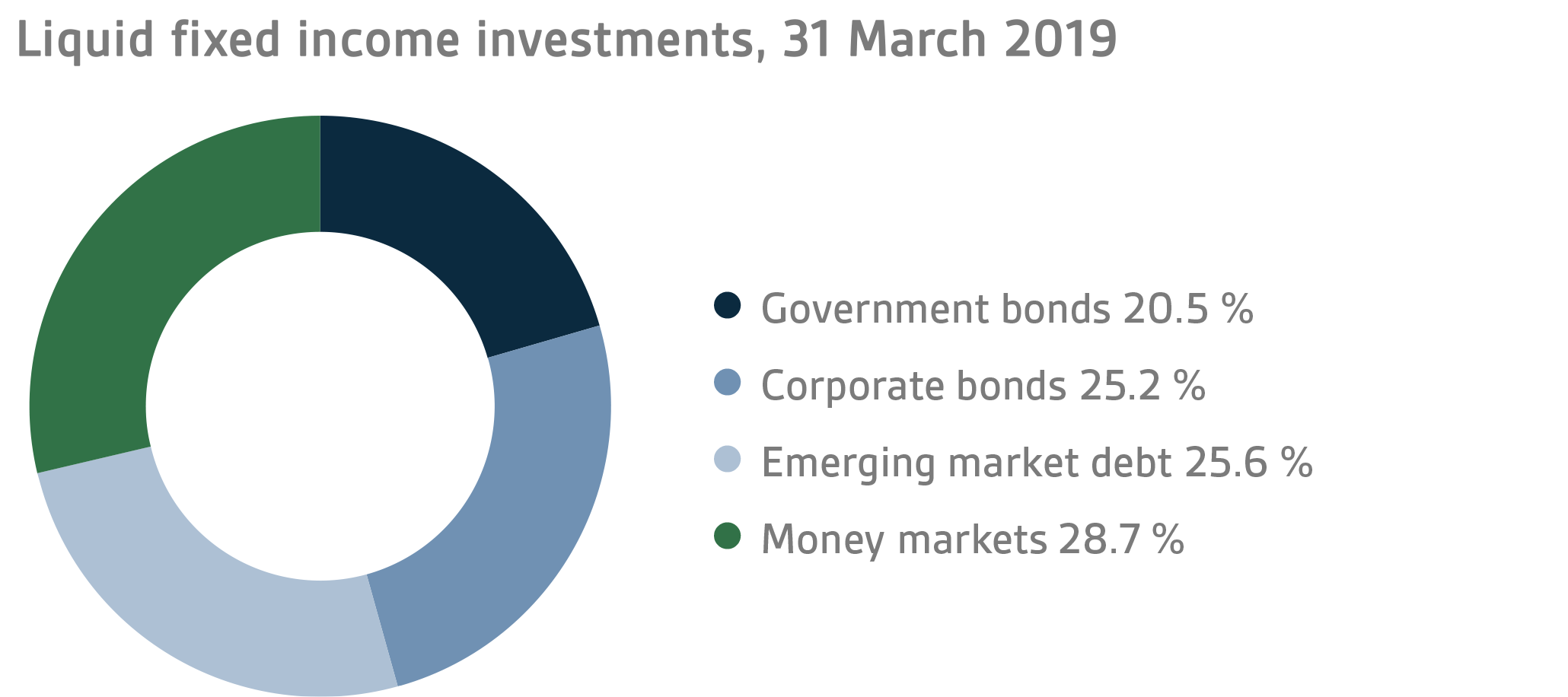

Liquid fixed income investments

During the first quarter, the return on liquid fixed income was 2.1 per cent.

In particular, the most risk-filled fixed income investments improved considerably relative to their weak performance in 2018. Despite the consistently poor economic data, the risk premiums on emerging debt and corporate loans shrunk substantially. These trends were supported by hopes for a trade settlement between the United States and China, and expectations of a lighter monetary policy on the part of central banks. At its March rate-setting meeting, the European Central Bank announced that it will leave the rates unchanged at least up to the end of 2019, and commence long-term two-year financing operations through quarterly adjustments to the reference rate in September 2019. These operations are to continue until March 2021. As a result, the interest rate on German government bonds turned negative for the first time since October 2016. Similarly, the US Federal Reserve indicated in March that it would not raise its benchmark rate in 2019 and that it would end the reduction of its balance sheet in September. At the end of March, the markets anticipated a 50 interest point cut in the benchmark rate by the FED by the end of 2020. At the same time, the US 3-month vs. 10-year yield curve was temporarily inverted.

Other fixed income investments

Other fixed income investments include investments in private credit funds and direct lending to companies.

Private credit investments yielded a negative return of -0.5 per cent.

In the private credit market, the rising debt ratios combined with the bleaker economic prospects created concerns about companies’ ability to meet their debt servicing obligations. However, investors’ interest in this asset class continued, which will partly increase the risks associated with this class because of the large amounts of capital accumulated. The capital is looking for investment opportunities, even if it involves elevated risks.

EQUITIES

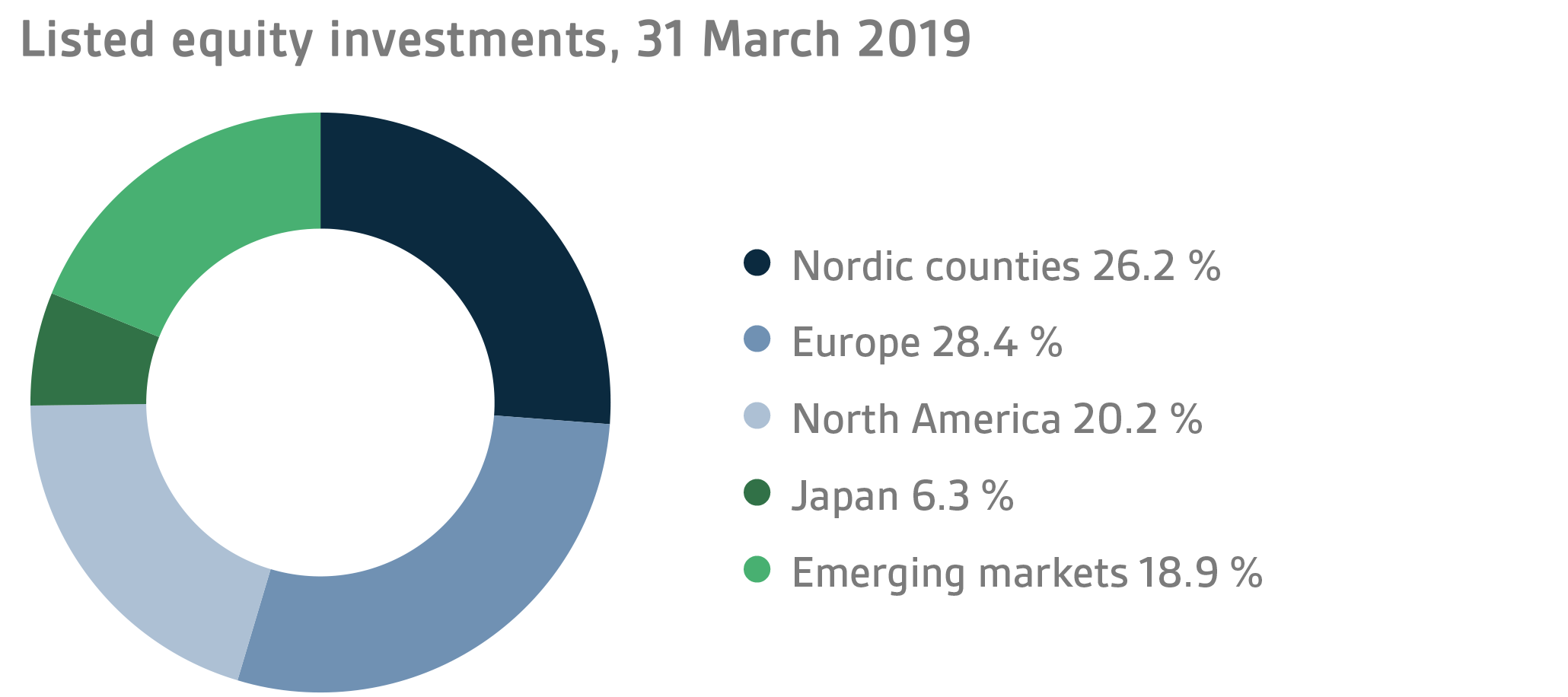

Listed equities

The return on listed equities during the first quarter was 12.7 per cent.

Year 2019 got off to a brisk start in the world equity market: by the end of the quarter, the returns on listed equities had reached high levels. Investors’ risk sentiment remained high throughout the quarter with the most risky asset classes, such as equities, giving a healthy return.

Previously, stock prices had plummeted across the world during the last quarter of 2018. At the turn of the year, the mood in the equity market clearly improved, which gave added momentum right from the beginning of January despite the fact that macro-economic figures remained fairly weak throughout the quarter. While there were several reasons contributing to the good performance of the equity market, the biggest role was played by the monetary policy adjustments by central banks and the trade talks between the United States and China. No further tightening of the central bank monetary policies is expected, which considerably increased investors’ risk appetite during the first quarter. Moreover, the US-China negotiations were reportedly being conducted in a congenial atmosphere, and although no concrete results were achieved, this was enough for the financial market. Brexit received a great deal of media attention during the quarter, but the general confusion did not undermine the risk sentiment. As a result, the first quarter proved extremely positive for equity investors.

Other equity investments

VER’s other equity investments include investments in private equity funds, non-listed stock and listed real estate investment trusts (REITs).

Private equity investments returned 3.0 per cent, unlisted equities 1.6 per cent and listed real estate investment trusts 14.3 per cent.

As in the previous years, the first-quarter return on private equity investments is based on updated returns earned in the last quarter of 2018. Even though the equity market performed poorly towards the end of 2018, the effect on private equity investments was marginal. Partly due to the recovery of the stock market, no fall in the valuations of portfolio companies or debt ratios was visible in the marketplace. However, indications of bleaker prospects raised concerns about future returns on private equity investments.

The positive first-quarter return on listed real estate investment trusts is a reflection of the strong performance of the stock market.

OTHER INVESTMENTS

VER’s other investments are investments in real estate, infrastructure, hedge funds and risk premium strategies.

The return on unlisted real estate funds was 0.6 per cent while infrastructure fund investments yielded 2.7 per cent.

No significant changes relative to 2018 took place in the real estate and infrastructure markets during the first quarter of 2019. Practically all the returns on infrastructure funds are based on the robust performance of a single fund.

Hedge funds returned 1.9 per cent during the first quarter. Considerable variations in returns were discernible within the investment styles adopted by hedge funds. The best returns were generated by strategies focusing on equities and emerging markets. For volatility funds, the reporting period was more challenging than for others.

Risk premium strategies returned 0.4 per cent during the first quarter. Funds focusing on conventional risk premium strategies gave a more modest return than funds employing more dynamic premium selection policies.

State’s pension expenditure, VER’s transfers to the government budget, pension contribution income and funding ratio

The State Pension Fund’s role in balancing government finances has grown and will continue to do so. In 2018, the state’s pension expenditure totalled over EUR 4.6 billion while the 2019 budget foresees an expenditure of nearly EUR 4.8 billion. As VER contributes 40 per cent towards these expenses to the government budget, the transfer to the 2019 budget will amount to about EUR 1.9 billion. During the first quarter, VER transferred EUR 476 million to the government budget.

During the first quarter, VER’s pension contribution income totalled EUR 296 million, some EUR 60 million less than foreseen. As of the beginning of 2019, billing for pension contributions is based on the pay information saved in the Income Register. However, as the deployment of the Income Register has been beset by major problems and all pay data has not been duly recorded in it, part of the pension contribution income due to VER will be billed at a later date. Even without this delay, VER’s net pension contribution income has turned permanently negative, meaning that clearly more money is transferred by VER to the government budget than VER receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund.

In June 2016, the Board of Directors of the State Pension Fund adopted a strategy that defines its long-term objectives in greater detail. The strategy foresees that the 25 per cent funding ratio target specified by law will be attained by 2033, if not earlier. To achieve this, it is imperative that VER’s pension contribution income remains at the estimated level and that the real return on investments remains relatively high. As the state’s pension liabilities amounted to EUR 92.1 billion at the end of 2018, the funding ratio was approx. 20 per cent. Additionally, the strategy sets out the principles by which the risk level and basic allocation of the investment portfolio are derived from the target funding ratio established for VER.

|

KEY FIGURES

|

|

|

| |

31.3.2019

|

31.12.2018

|

|

Investments, MEUR (market value)

|

19 531

|

18 486

|

|

Fixed-income investments

|

7 631

|

7 106

|

|

Equity investments

|

9 013

|

8 720

|

|

Other investments

|

1 964

|

1 823

|

|

Impact of derivatives

|

923

|

837

|

| |

|

Breakdown of the investment portfolio

|

|

Fixed-income investments

|

39,1 %

|

38,4 %

|

|

Equity investments

|

46,1 %

|

47,2 %

|

|

Other investments

|

10,1 %

|

9,9 %

|

|

Impact of derivatives

|

4,7 %

|

4,5 %

|

| |

| |

1.1.–31.3.2019

|

1.1.–31.12.2018

|

|

Return on investment

|

6,6 %

|

-3,4 %

|

|

Fixed-income investments

|

|

Liquid fixed-income investments

|

2,1 %

|

-1,9 %

|

|

Other fixed-income investments

|

-0,5 %

|

8,4 %

|

|

Equity investments

|

|

Listed equity investments

|

12,7 %

|

-7,4 %

|

|

Private Equity investments

|

3,0 %

|

13,4 %

|

|

Listed Real Estate funds

|

14,3 %

|

|

|

Other investments

|

|

Non-listed Real Estate funds

|

0,6 %

|

0,0 %

|

|

Infrastructure funds

|

2,7 %

|

11,2 %

|

|

Hedge funds

|

1,9 %

|

-2,5 %

|

| |

|

Pension contribution income, MEUR

|

296

|

1 425

|

|

Transfer to state budget, MEUR

|

-476

|

-1 859

|

|

Net contribution income, MEUR

|

-180

|

-434

|

|

Pension liability, BnEUR

|

|

92,1

|

|

Funding ratio, %

|

|

20 %

|

Inquiries: Additional information is provided by CEO Timo Viherkenttä, firstname.lastname@ver.fi, tel.: +358 295 201 210.

Established in 1990, the State Pension Fund (VER) is an off-budget fund through which the state prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the state’s pension assets professionally. At the end of March 2019, the market value of the Fund’s investment portfolio stood at EUR 19.5 billion.

All figures presented in this interim report are preliminary and unaudited.