VER’s assets reach EUR 20 billion; 10.1% return on investments during 1 January–30 September 2019 and ten-year average return 6.1%

Published 2019-10-23 at 10:44

INVESTMENT ENVIRONMENT

The first three quarters of 2019 were favourable for the investment markets. The stock market recovered quickly from the sharp decline in late 2018, and although a number of dips were experienced in the course of the year, equity prices went up substantially practically across the world.

Overall developments in the interest rate markets were also favourable as general interest rates declined while at the same time many risk premiums narrowed.

Underlying the positive market developments were the monetary policies pursued by central banks and the expectations regarding future monetary policy. Primarily for these reasons, the stock markets and risky interest rate markets weathered well in the face of the partially weakening prospects for economic growth and less optimistic macro-economic forecasts.

VER’S RETURNS ON INVESTMENTS

Monitoring and evaluation of the State Pension Fund’s investment activities focus increasingly on long-term outcomes and future prospects instead of quarterly reporting. However, VER will continue to post quarterly figures and comments to the same extent as previously.

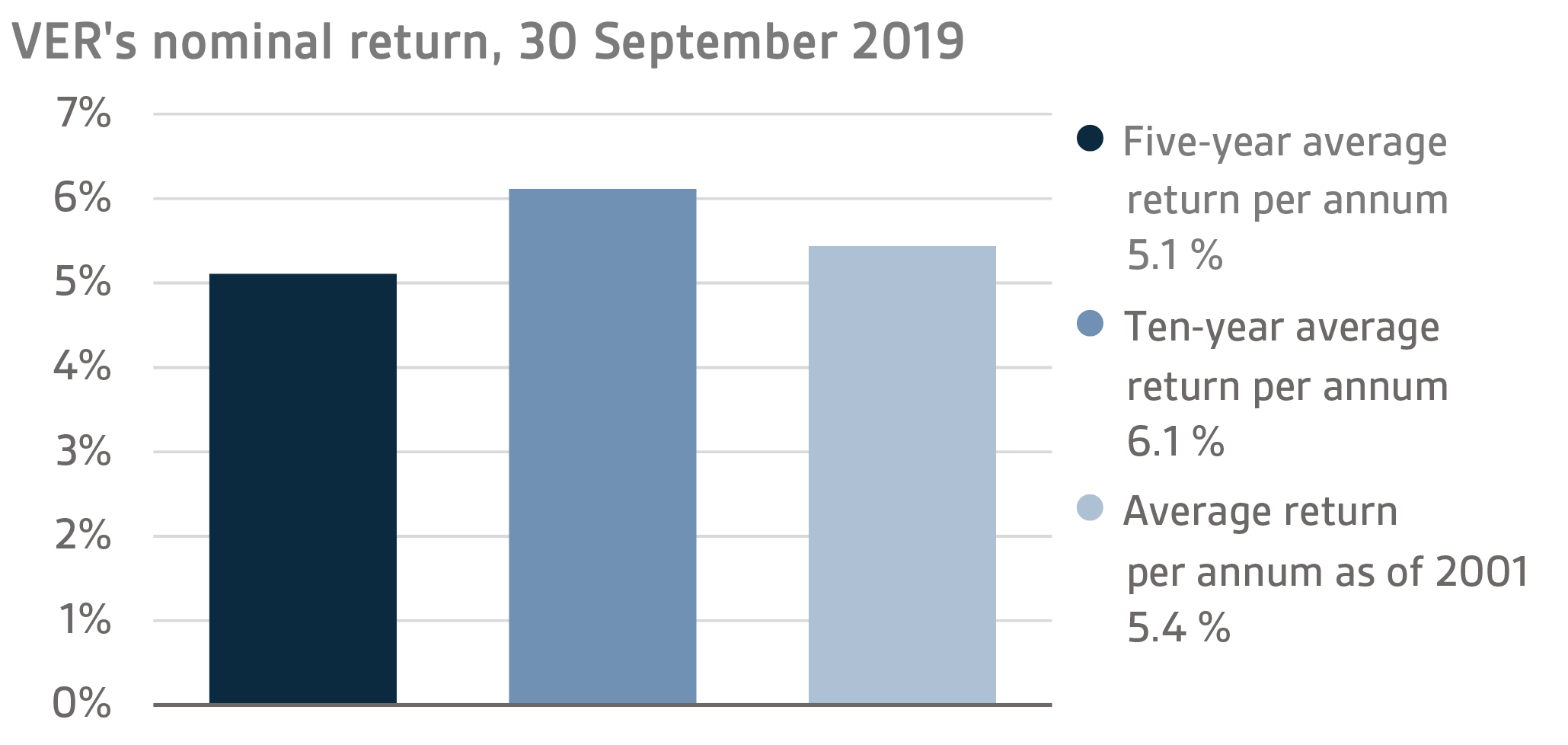

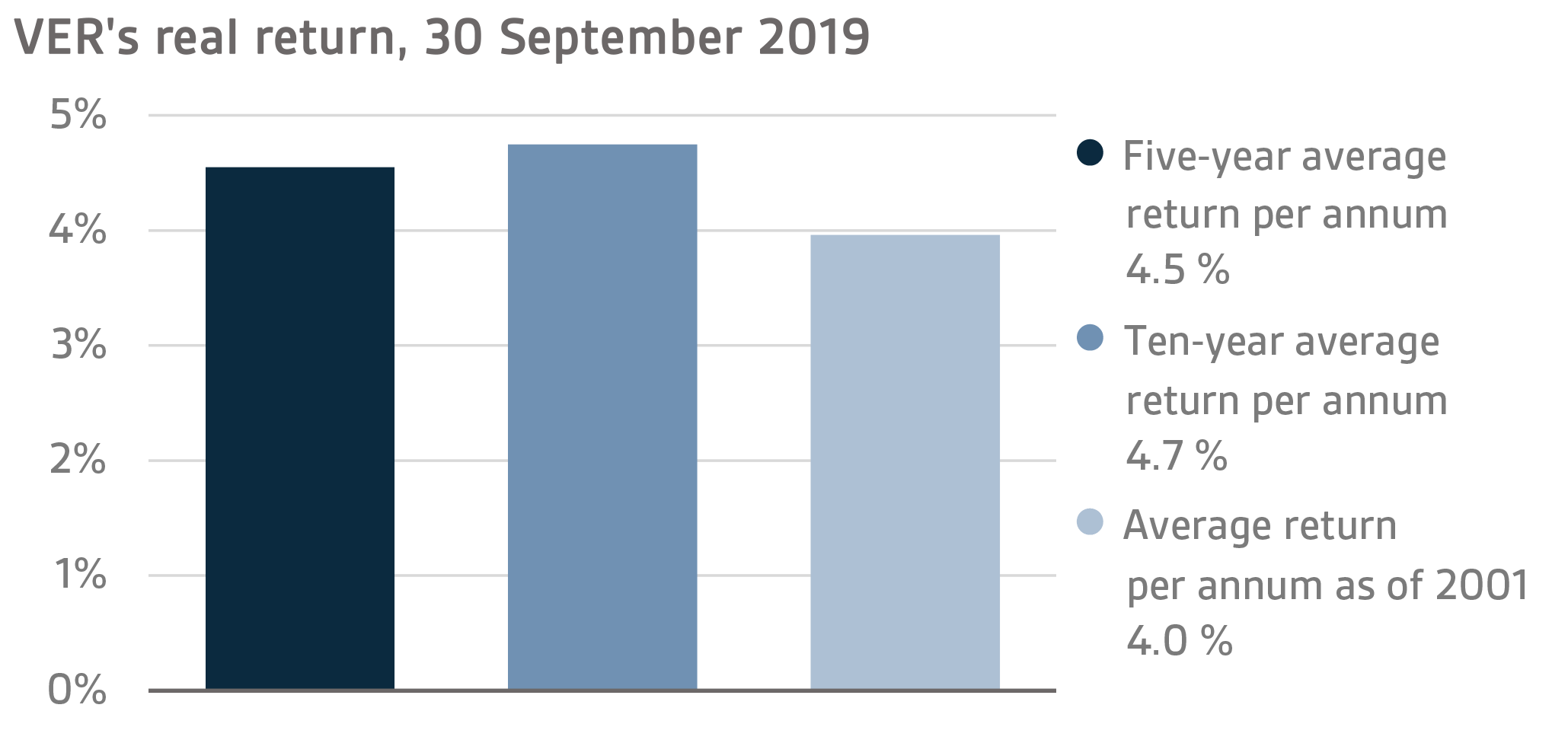

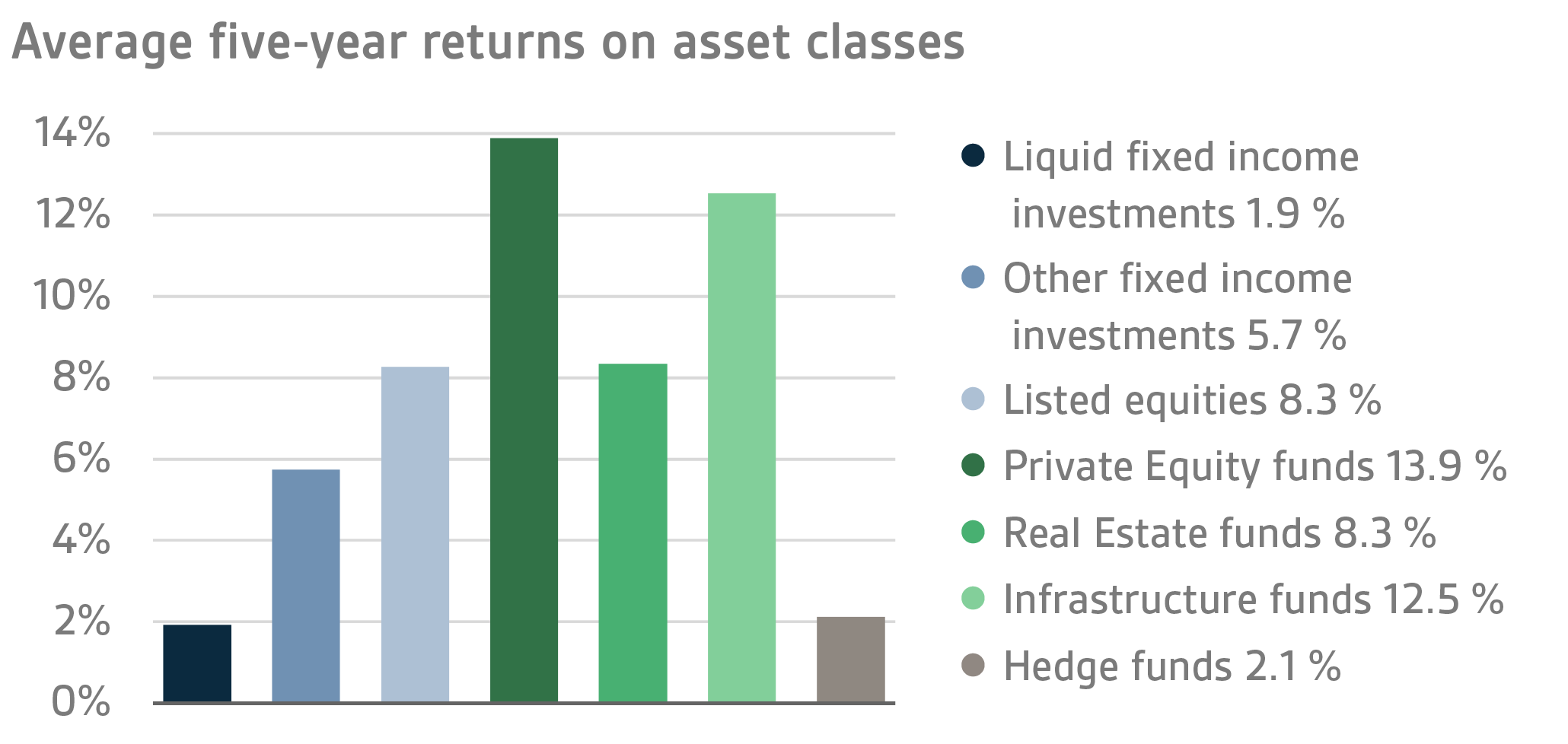

On 30 September 2019, VER’s investment assets totalled EUR 20.0 billion. During the first three quarters, the return on investments at fair values was 10.1 per cent. The average nominal rate of return over the past five years (1 October 2014–30 September 2019) was 5.1 per cent and the annual ten-year return 6.1 per cent. Since 2001, when VER’s activities assumed their current form, the average rate of return has been 5.4 per cent.

The real rate of return during the first three quarters was 9.3 per cent. VER’s five-year average real return was 4.5 per cent and ten-year real return 4.7 per cent.

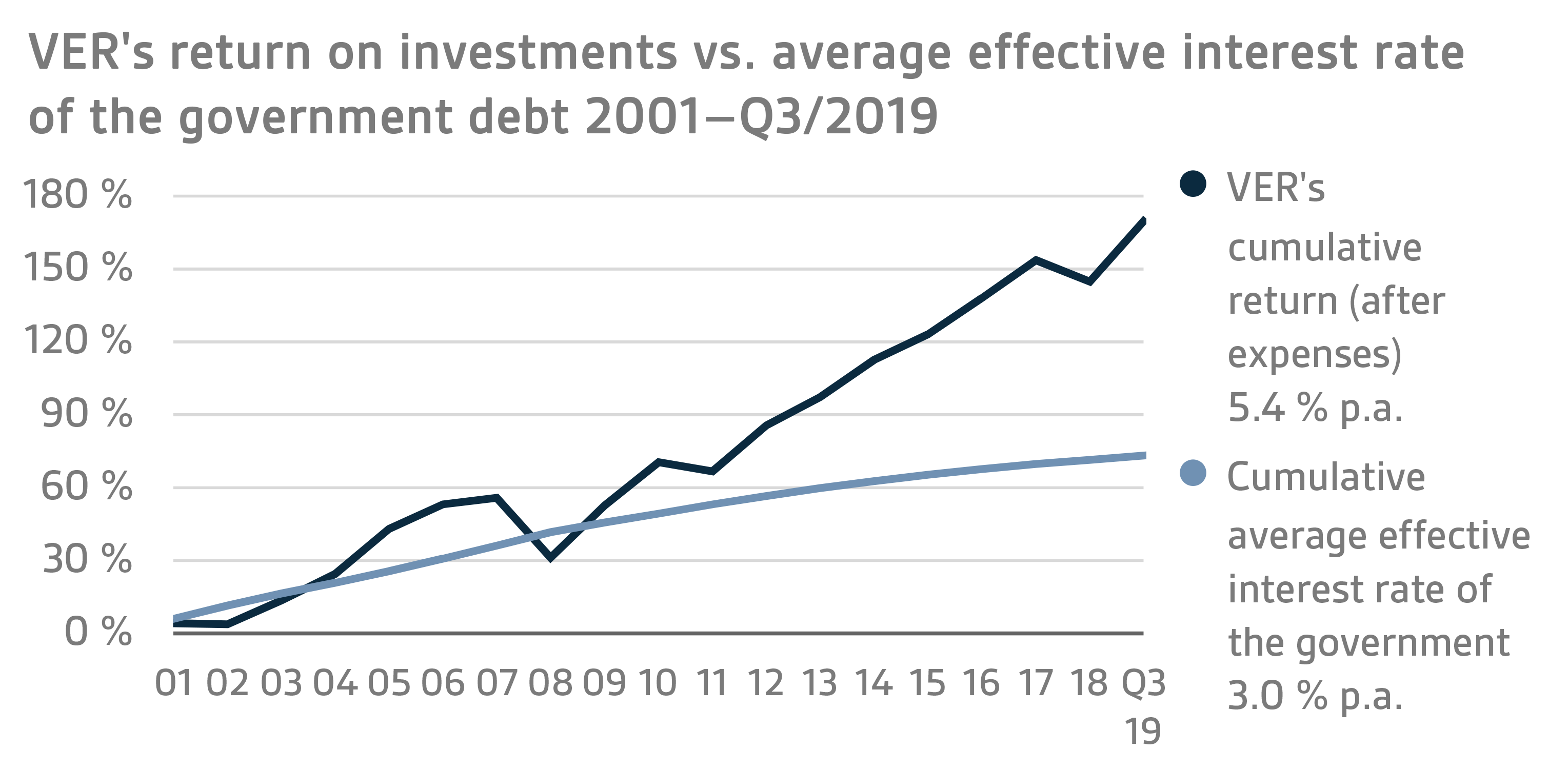

From the state’s point of view, it is pertinent to compare the return on investments with the cost of net government debt, because the funds accumulated in preparation for future pension expenditure can be deemed to reduce such debt. Over the past ten years, VER’s average annual rate of return has beaten the cost of net government debt by 4.3 percentage points. Since 2001, the total market-value returns earned by VER have exceeded the cumulative average cost of equivalent government debt by about EUR 6.7 billion over the same period.

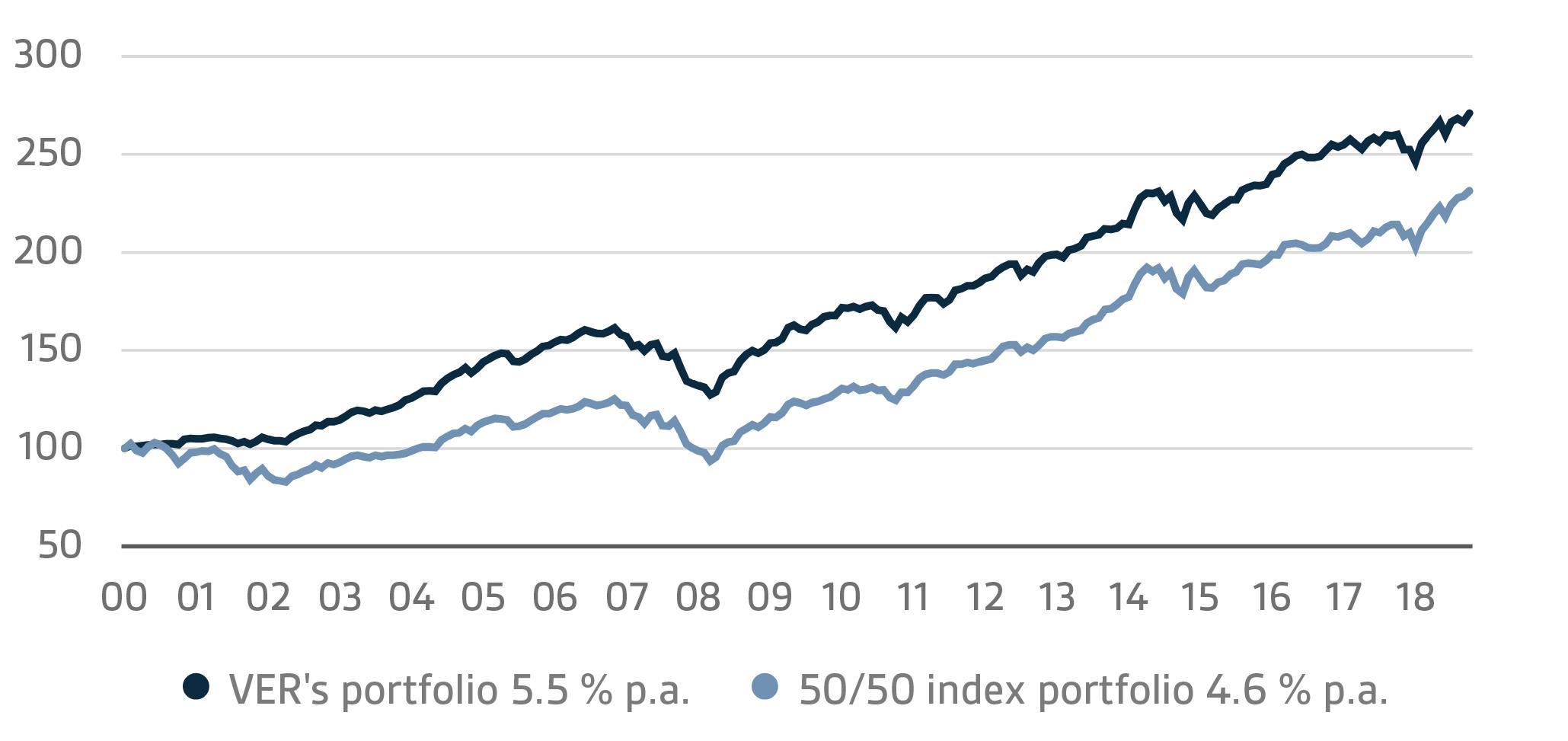

VER monitors long-term return relative to overall market developments by comparing the actual return with a global index, in which the weight of both equities and currency-hedged bonds is 50 per cent.

A CLOSER LOOK AT JANUARY – SEPTEMBER 2019

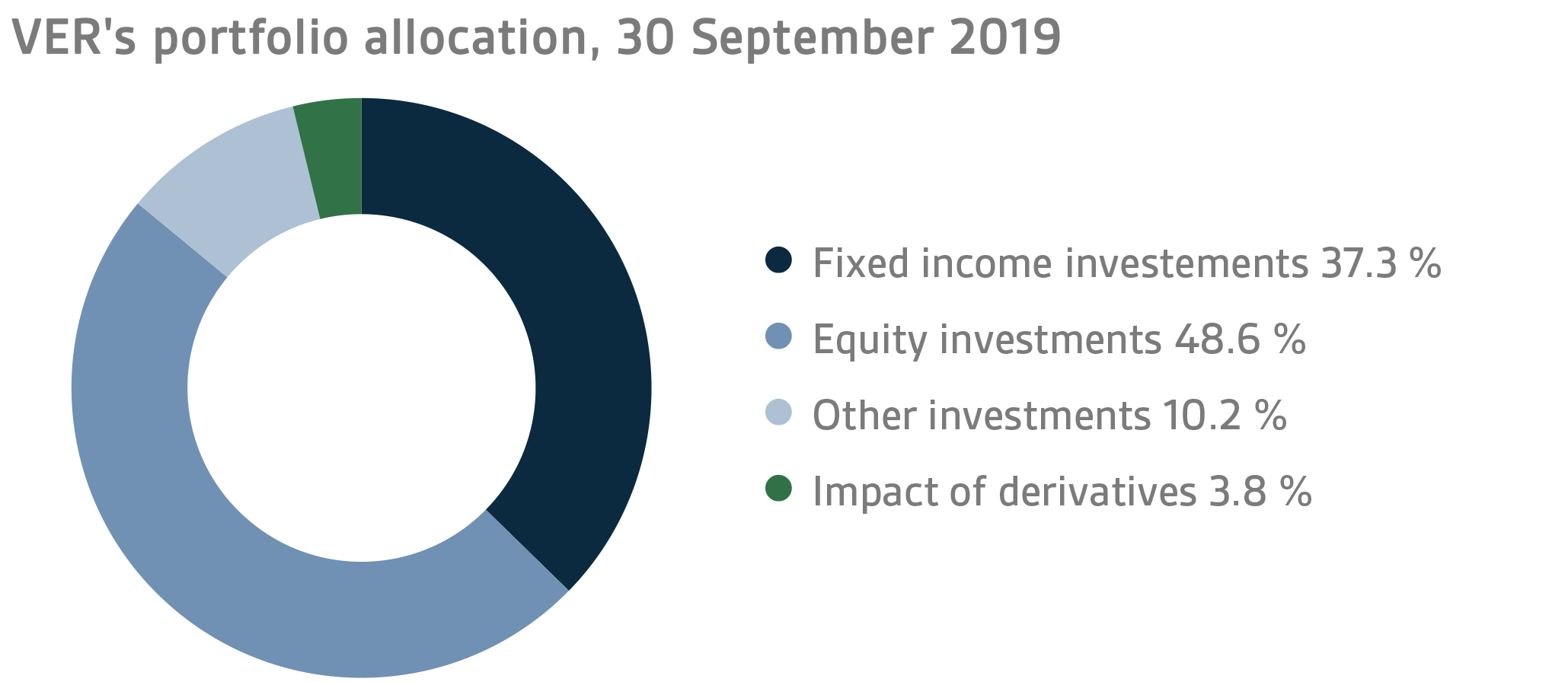

In accordance with the directive of the Ministry of Finance, VER’s investments are divided into fixed income instruments, equities and other investments. At the end of September, fixed income instruments accounted for 37.3 per cent, equities 48.6 per cent and other investments 10.2 per cent of the total. Of the large asset classes, liquid fixed income instruments generated a return of 4.9 per cent and listed equities 17.7 per cent during the first three quarters.

FIXED INCOME INVESTMENTS

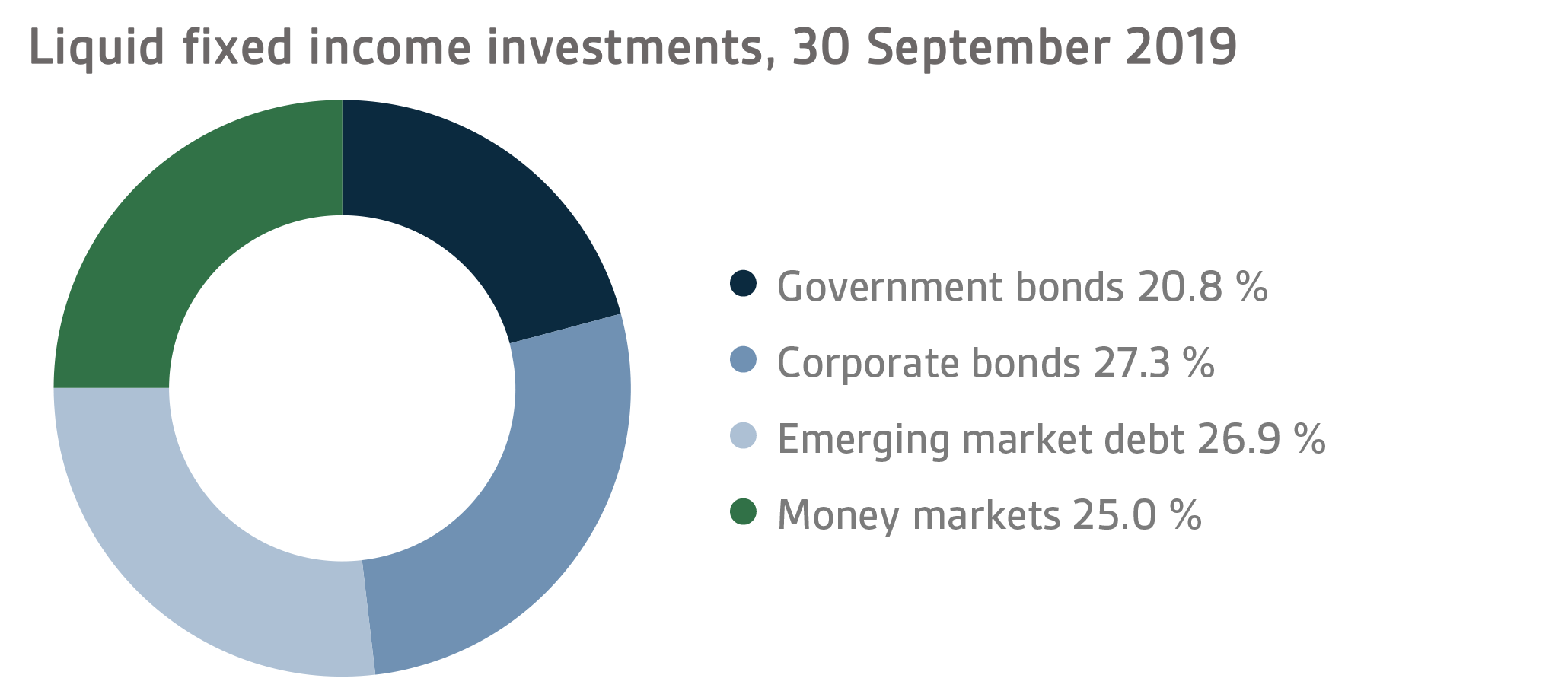

Liquid fixed income investments

During the first three quarters, the return on liquid fixed income instruments was 4.9 per cent.

The highly favourable trend witnessed in early 2019 particularly in more risk-filled fixed income investments levelled off in the third quarter, but returns remained positive. The Federal Reserve (FED) and the European Central Bank (ECB) eased their monetary policies as they had previously indicated, which sustained the fixed income market despite the weak economic data, the uncertainty surrounding Brexit and the trade war between the United States and China. However, volatility increased.

The FED cut its benchmark rate by 25 points both in July and September and stopped unwinding its balance sheet. At the September meeting, the views of FED members on future monetary policy diverged more than usual, but the fixed income markets foresee two cuts of close to 25 point cuts in the last quarter as well as further cuts of the same order in 2020.

The ECB decided at its September meeting to ease its monetary policy considerably. The ECB’s deposit rate was reduced to -0.50 per cent and asset purchases are to be resumed in November. The deposit rate was staggered so that a negative rate will only be charged when a bank’s deposits exceed the minimum reserve obligations six times. At the same time, the interest rate on the previously adopted TLTRO programme was reduced and maturity extended from two to three years. The markets foresee further interest rate cuts by the ECB and an increase in the volume of asset purchases from the current EUR 20 billion per month.

As a result of the central bank driven interest rate rally, interest rate indexes increased substantially during the first three quarters except for the most short-term rates.

Other fixed income investments

Other fixed income investments include investments in private credit funds and direct lending to companies.

Private credit investments yielded a 1.7 per cent return.

The expected corrective adjustment did not materialise in the private credit market. Uncertainty concerning future market developments has not been dispelled. Investors looking for cash flow returns continued to show keen interest in this asset class and funds have been successful in attracting investments.

EQUITIES

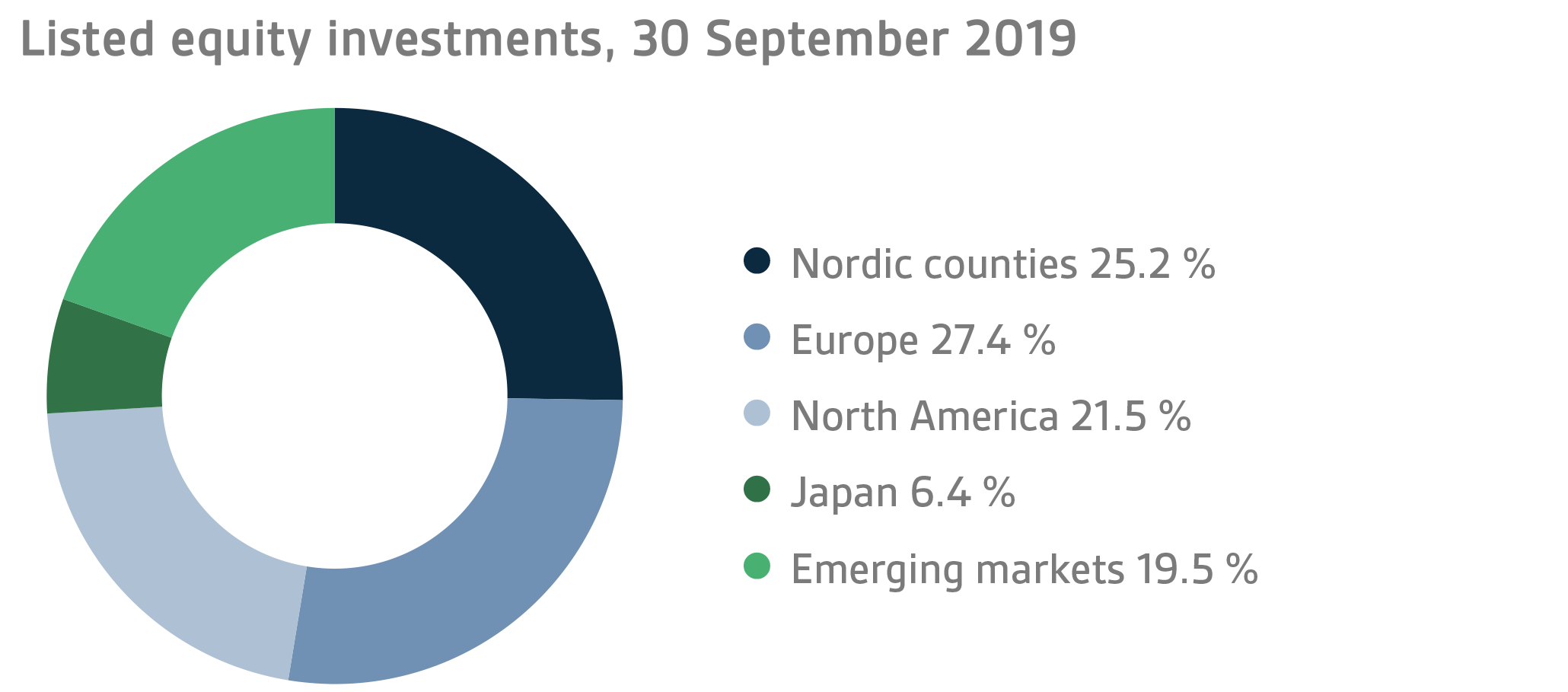

Listed equities

The return on listed equities was 17.7 per cent.

Share prices continued to rise in the third quarter. By the end of the reporting period, equity returns reached a high level. Strong fluctuations were experienced in the world stock markets in the third quarter and early August, in particular, was a nervous period in the stock exchanges. Underling the jittery mood was a familiar reason, i.e., the trade war between the USA and China and its twists and turns. Alarmed by the US President Trumps accouncement of new tariffs on Chinese products at the beginning of August, stock prices plummeted across the world. By mid-August the mood had calmed down thanks to a gradual de-escalation and stock prices resumed a steady climb up to the end of September. Another factor contributing to the equity market was a strong faith in the continuation of the central bank’s expansive monetary policies.

Other equity investments

VER’s other equity investments include investments in private equity funds, non-listed stock and listed real estate investment trusts (REITs).

Private equity investments returned 9.4 per cent, unlisted equities 2.4 per cent and listed real estate investment trusts 22.7 per cent.

The hefty returns generated by both private equity investments and listed real estate investment trusts were due to the strong performance of the stock market. So far, the increased uncertainty in the markets has not been reflected in the actual valuation levels of equity investment portfolio companies, nor in debt ratios. However, there are growing concerns about the future returns of the funds.

OTHER INVESTMENTS

VER’s other investments are investments in real estate, infrastructure, hedge and risk premium funds and risk premium strategies.

The return on unlisted real estate funds was 3.2 per cent while infrastructure investments yielded 9.3 per cent.

For the time being, the situation in the real estate market has remained stable. Demand continues to focus on residential and logistics properties while commercial properties are attracting less interest. The transaction volume has remained high in Finland in 2019 even though it falls short of the record levels achieved in the previous year.

Underlying the excellent performance of infrastructure investments are successful exits and substantial dividends. No major changes have so far taken place in the actual market conditions. This asset class is of interest to investors in the current circumstances because of the cash flow returns it offers.

Hedge funds returned 3.3 per cent during the first three quarters. After a positive start to the year, the returns in the third quarter were slightly negative. The best performance in the reporting period was put in by the long-short funds focusing on the equity market as well as multi-strategy funds focusing on relative value.

The rate of return on risk premium investments in the same period was 0.9 per cent. A partial recovery of value strategies was discernible in equity style premiums. In particular, there was a major shift towards momentum strategies.

STATE PENSION EXPENDITURE, VER’S TRANSFERS TO THE GOVERNMENT BUDGET, PENSION CONTRIBUTION INCOME AND FUNDING RATIO

The State Pension Fund’s role in balancing government finances has grown and will continue to do so. In 2018, the state’s pension expenditure totalled over EUR 4.6 billion while the 2019 budget foresees an expenditure of nearly EUR 4.8 billion. As VER contributes 40 per cent towards these expenses to the government budget, the transfer to the 2019 budget will amount to about EUR 1.9 billion. By the end of September, VER had transferred EUR 1428 million to the government budget.

Over the same period, VER’s 9-month pension contribution income amounted to EUR 1138 million. As of the beginning of 2019, billing for pension contributions is based on the pay information saved in the Income Register. During the first few months of 2019, there were major problems with the deployment of the Income Register and the entry of pay data in the system. However, as successful efforts were made during the third quarter to complete missing and erroneous data, VER’s pension contribution income was close to the forecast in September.

VER’s net pension contribution income has now turned permanently negative, meaning that clearly more money is transferred from the Fund to the government budget than VER receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund.

In June 2016, the Board of Directors of the State Pension Fund adopted a strategy that defines its long-term objectives in greater detail. The strategy foresees that the 25 per cent funding ratio target specified by law will be attained by 2033, if not earlier. To achieve this, it is imperative that VER’s pension contribution income remains at the estimated level and that the real return on investments remains relatively high. As the state’s pension liabilities amounted to EUR 92.1 billion at the end of 2018, the funding ratio was approx. 20 per cent. Additionally, the strategy sets out the principles by which the risk level and basic allocation of the investment portfolio are derived from the target funding ratio established for VER.

KEY FIGURES

|

|

|

| |

30.9.2019

|

31.12.2018

|

|

Investments, MEUR (market value)

|

20 045

|

18 486

|

|

Fixed income investments

|

7 478

|

7 106

|

|

Equity investments

|

9 751

|

8 720

|

|

Other investments

|

2 054

|

1 823

|

|

Impact of derivatives

|

764

|

837

|

| |

|

|

|

Breakdown of the investment portfolio

|

|

|

|

Fixed income investments

|

37,3 %

|

38,4 %

|

|

Equity investments

|

48,6 %

|

47,2 %

|

|

Other investments

|

10,2 %

|

9,9 %

|

|

Impact of derivatives

|

3,8 %

|

4,5 %

|

| |

|

|

| |

1.1.–30.9.2019

|

1.1.–31.12.2018

|

|

Return on investment

|

10,1 %

|

-3,4 %

|

|

Fixed income investments

|

|

|

|

Liquid fixed income investments

|

4,9 %

|

-1,9 %

|

|

Other fixed income investments

|

1,7 %

|

8,4 %

|

|

Equity investments

|

|

|

|

Listed equity investments

|

17,7 %

|

-7,4 %

|

|

Private Equity investments

|

9,4 %

|

13,4 %

|

|

Listed Real Estate funds

|

22,7 %

|

|

|

Other investments

|

|

|

|

Non-listed Real Estate funds

|

3,2 %

|

0,0 %

|

|

Infrastructure funds

|

9,3 %

|

11,2 %

|

|

Hedge funds

|

3,3 %

|

-2,5 %

|

| |

|

|

|

Pension contribution income, MEUR

|

1 138

|

1 425

|

|

Transfer to state budget, MEUR

|

-1 428

|

-1 859

|

|

Net contribution income, MEUR

|

-290

|

-434

|

|

Pension liability, BnEUR

|

|

92,1

|

|

Funding ratio, %

|

|

20 %

|

Inquiries: Additional information is provided by CEO Timo Viherkenttä, firstname.lastname@ver.fi, tel.: +358 295 201 210.

Established in 1990, the State Pension Fund (VER) is an off-budget fund through which the state prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the state’s pension assets professionally. At the end of September 2019, the market value of the Fund’s investment portfolio stood at EUR 20.0 billion.

All figures presented in this interim report are preliminary and unaudited.