VER’s 1 January–31 March 2018 return -1.0%; five-year annual return 5.6%

Published 2018-04-27 at 8:05

Investment environment

The surprisingly low volatility characteristic of the equity market in 2017 did not spill over into 2018. In contrast, share prices fluctuated strongly during the first quarter. The positive price trend early in the year was followed by a substantial fall at the beginning of February, and the equity markets remained somewhat volatile thoughout the first quarter.

In macroeconomic terms, the economy continued to grow across the globe in all sectors. This also contributed to companies’ financial performance. The easy monetary policies pursued by the European Central Bank and the Bank of Japan bolstered the real economy while the United States tax reform fuelled demand. However, an increasing number of economic indicators are beginning to suggest that the most intensive growth period is over in many economic regions.

Developments in the fixed income markets remained modest in early 2018.

VER’s returns on investments

Future monitoring and evaluation of the State Pension Fund’s (VER) investment activities will increasingly focus on long-term outcomes and future prospects instead of quarterly reporting. However, VER will continue to post quarterly figures and comments to the same extent as previously.

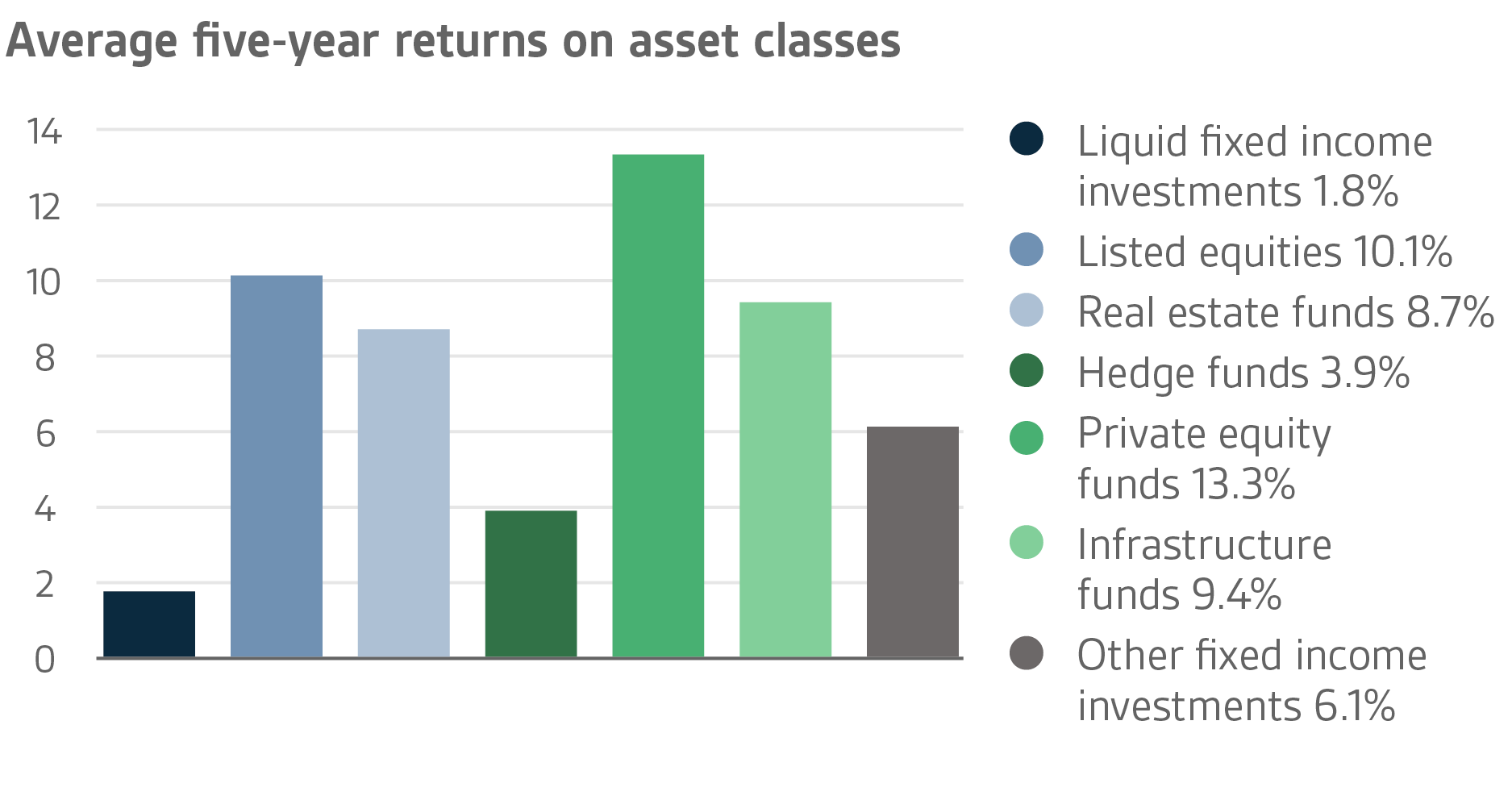

On 31 March 2018, VER’s investment assets totalled EUR 19.3 billion. During the first quarter, the return on investments at fair values was -1.0 per cent. The average annual nominal rate of return over the past five years (1 April 2013–31 March 2018) was 5.6 per cent and the annual ten-year return 5.4 per cent. Since 2001 when VER’s activities assumed their current form, the average rate of return has been 5.5 per cent.

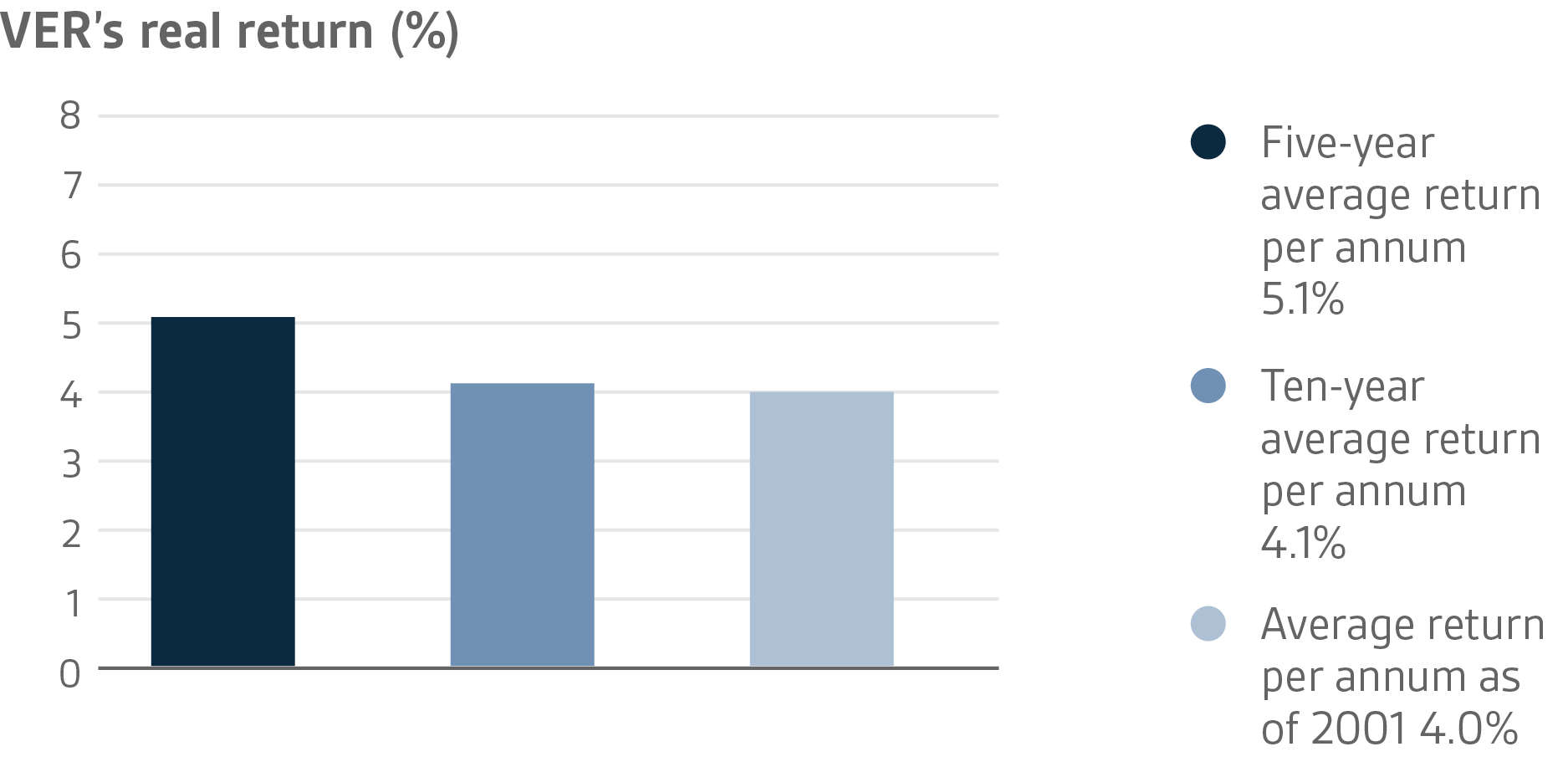

The real rate of return during the first quarter of 2018 was -1.2 per cent. VER’s five-year average real return was 5.1 per cent and ten-year real return 4.1 per cent.

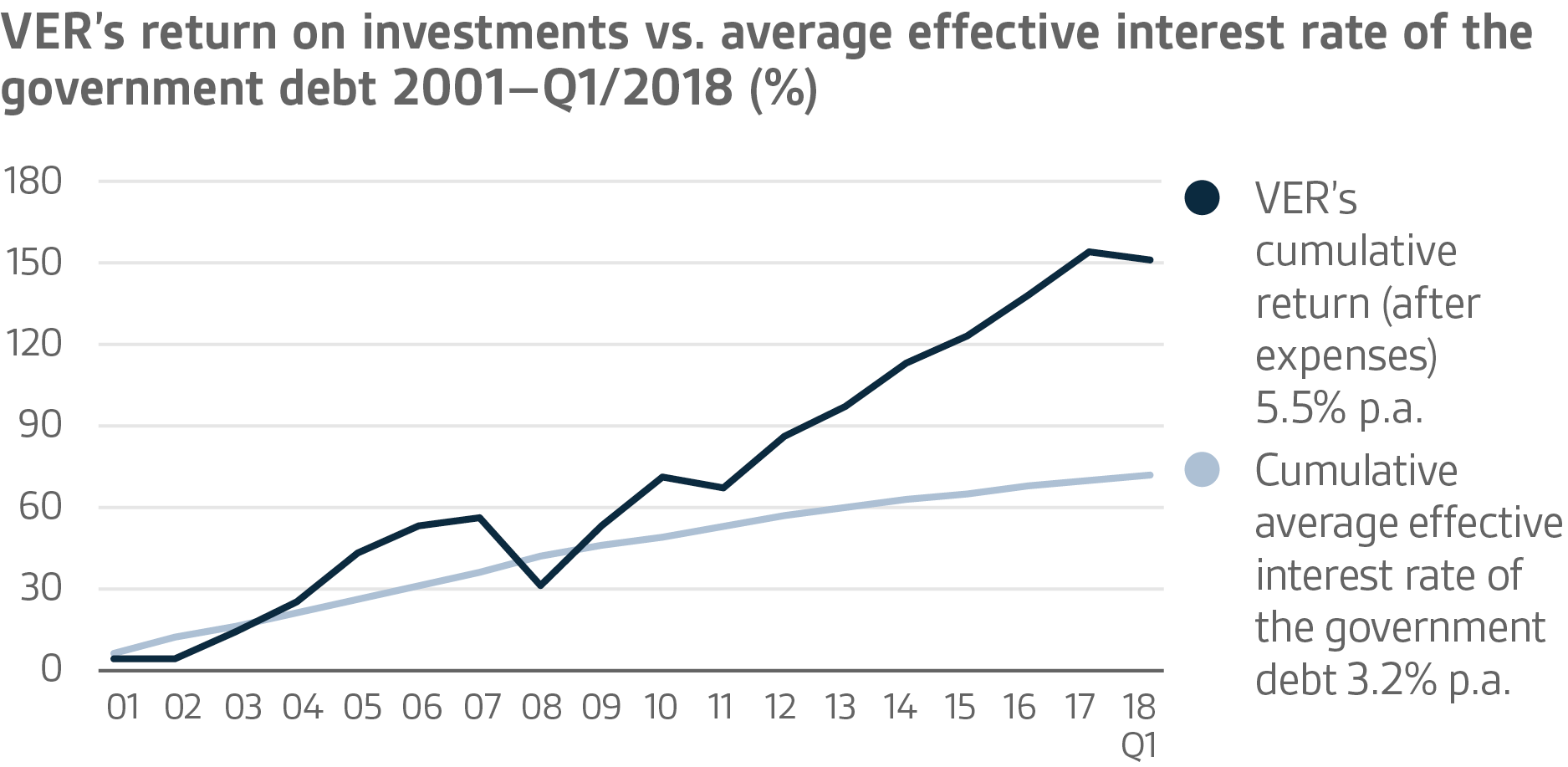

From the state’s point of view, it is pertinent to compare the return on investments with the cost of net government debt because the funds accumulated in preparation for future pension expenditure can be deemed to reduce such debt. Over the past ten years, VER’s average annual rate of return has beaten the cost of net government debt by 2.3 percentage points. Since 2001, the total market-value returns earned by VER have exceeded the cumulative average cost of equivalent government debt by about EUR 5.5 billion over the same period.

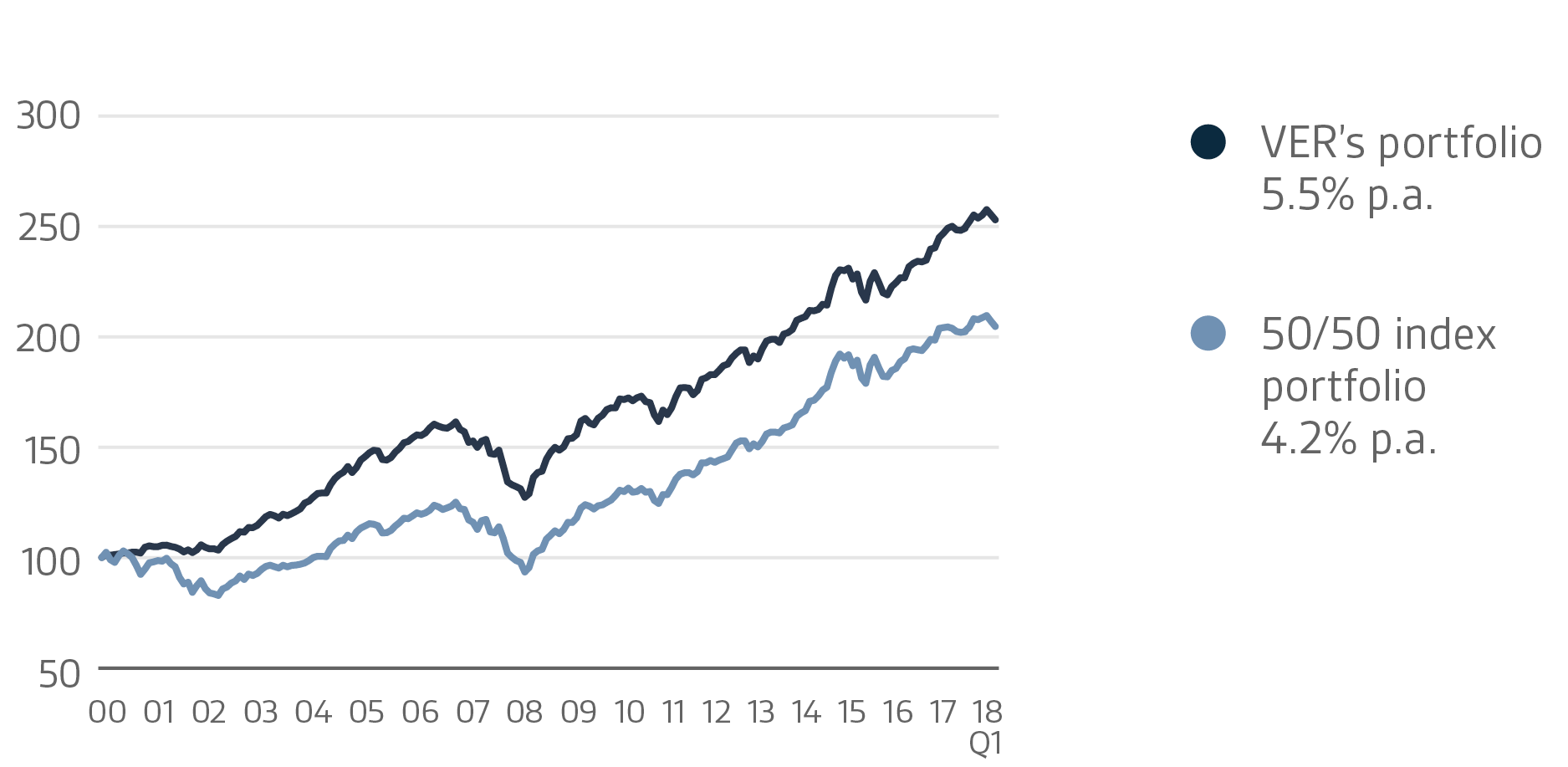

VER monitors long-term return relative to overall market developments by comparing the actual return with a global index in which the weight of both equities and currency-hedged bonds is 50 per cent.

A closer look at January–March 2018

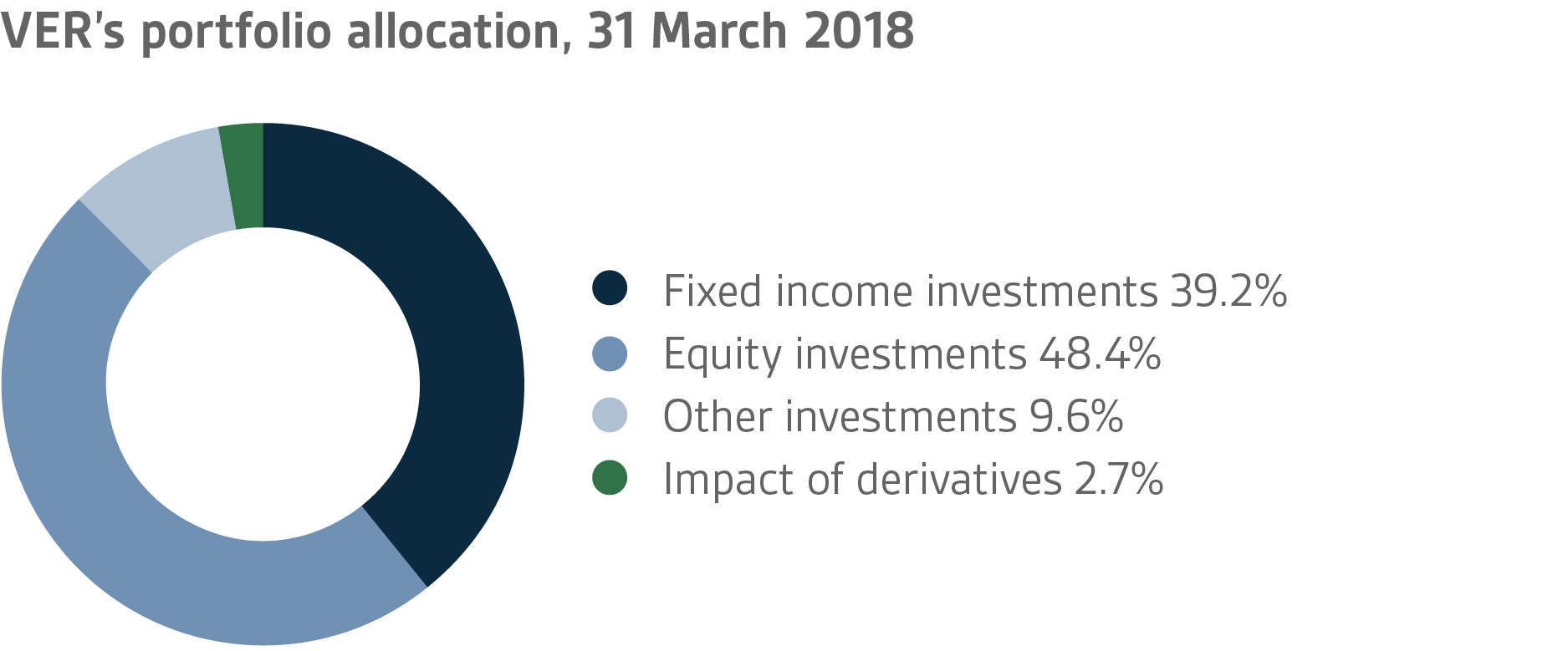

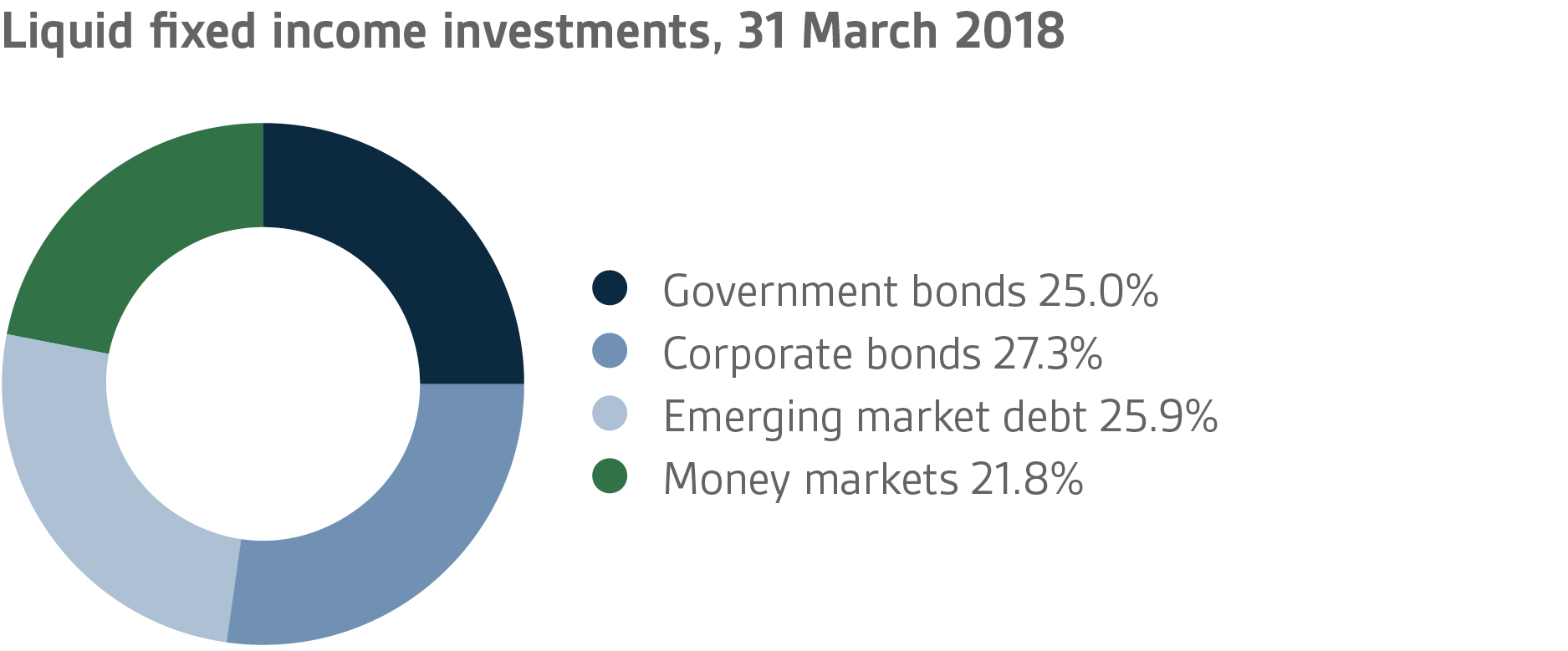

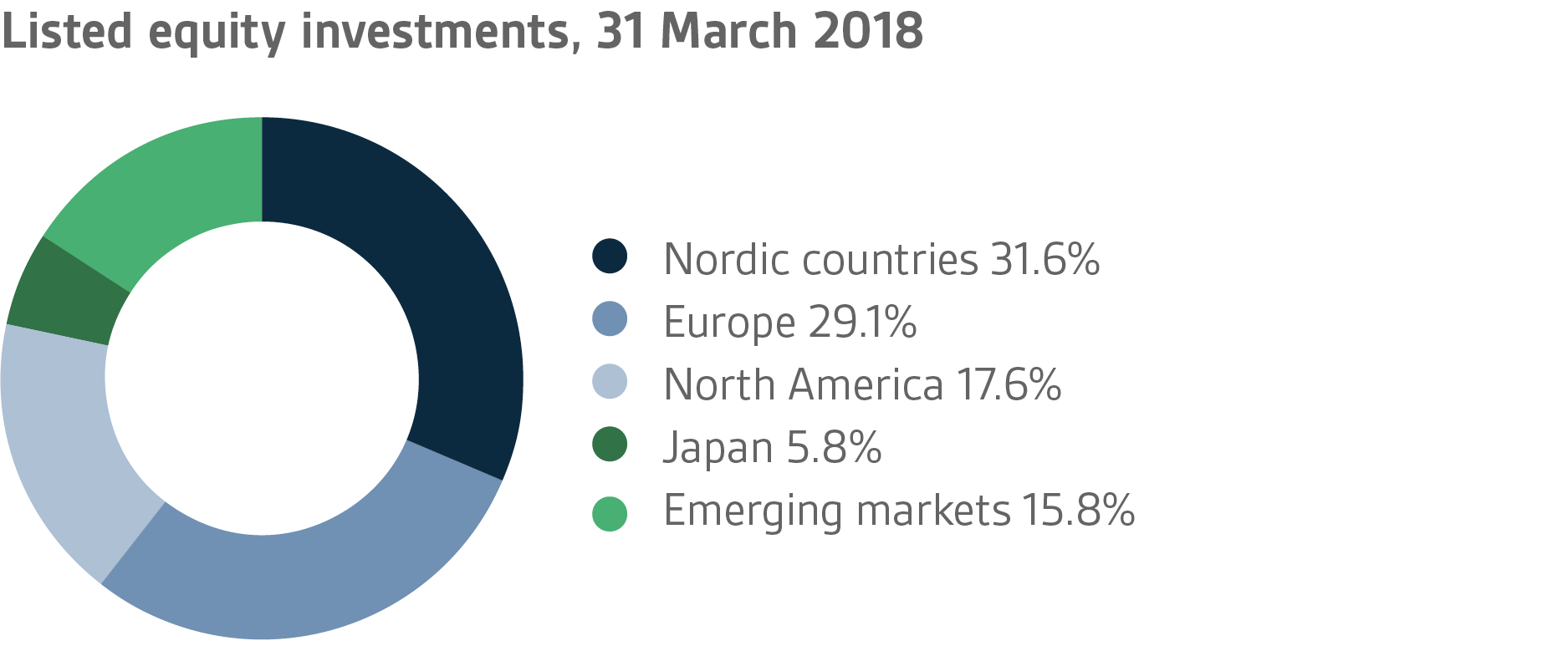

In accordance with the directive of the Ministry of Finance, VER’s investments are divided into fixed income instruments, equities and other investments. At the end of March, fixed income instruments accounted for 39.2 per cent, equities 48.4 per cent and other investments 9.6 per cent of the total. Of the large asset classes, liquid fixed income instruments generated a return of -0.3 per cent and listed equities -2.1 per cent during the first quarter.

FIXED INCOME INVESTMENTS

Liquid fixed income investments

Fixed income investments gave a return of -0.3 per cent.

At the beginning of the year, the interest rates increased sharply as investors expected inflation to accelerate, particularly in the United States following the tax cuts, and central banks to continue to tighten their monetary policies. At the turn of the year, the US ten-year bond rate rose by over 50 basis points reaching about 2.95 per cent towards the end of February. Over the same period, the German interest rates went up by over 30 basis points to about 0.75. per cent. Corporate bond spreads also increased clearly.

While the increase in interest rates levelled off in March, the market remained jittery. At its meeting on 8 March 2018, the European Central Bank refrained from adjusting its monetary policy but reformulated its forward-looking communications by deleting a wording suggesting the possibility that asset purchases under the QE programme could be increased. At the same time, the ECB revised its inflation forecast down to 1.4 per cent, implying that there was no acute need to raise interest rates. The United States Federal Reserve increased its benchmark rate by 0.25 per cent on 21 March 2018, as expected. The median for interest rate estimates remained unchanged at two additional hikes this year, but the estimates for 2019 and 2020 were raised (three and two hikes, respectively).

Aside from central banks and forecast inflation, fears of a trade war rattled the markets in March. Faced with the weak equity market, investors sought refuge in fixed income instruments. Euro area sovereign debt, in particular, performed well following a period of modest returns at the beginning of the year.

Other fixed income investments

Other fixed income investments include investments in private credit funds and

direct lending to companies.

Private credit investments yielded a 0.7 per cent return.

Expectations of a market correction have been growing during the first few months of the year. Added concerns were created by rising corporate valuation levels and increased use of debt leverage, particularly in the transactions concluded by private equity funds. On average, corporate debt ratios have reached the levels preceding the financial crisis. Additionally, debt funds providing funding for major corporations have been compelled to accept investments with no or weak covenant coverage.

EQUITIES

Listed equities

Listed equities gave a return of -2.1 per cent.

The mood in the equity market during the first quarter of 2018 was highly variable. The year began on a positive note with share prices rising across the board up until the last week of January. The tax reform completed in the United States at the end of the previous year was welcomed by the market and the figures posted by listed companies for the last quarter of 2018 made pleasant reading.

At the beginning of February, the mood in the market darkened dramatically. The macro-economic figures received from the United States suggested an increase in inflation, which sent US bond rates up. The equity market responded to this very negatively with the share prices plummeting across the world while, at the same time, volatility increased significantly. As a result of increased volatility, some market players were compelled to reduce their risk exposure considerably, which triggered massive sales. The situation calmed down to some extent in mid-February and share prices recovered quite nicely towards end of the month. However, the trade policy measures announced by the United States or, more precisely, President Trump caused jitters across the market at the end of February. As a result, the equity markets fluctuated strongly for the rest of the quarter. Most of the returns on equities remained negative at the end of the reporting period with some exceptions, such as the Finnish equity market.

Other equity investments

VER’s other equity investments include investments in private equity funds, non-listed stock and listed real estate investment trusts.

Private equity investments returned 3.5 per cent, unlisted equities 3.0 per cent and listed real estate investment trusts (REIT) -4.33 per cent (TWR).

In reality, the first-quarter return on private equity investments is based on updated 2017 returns in the last quarter of 2017 when equity markets were buoyant, which also had a positive impact on the valuations of private equity funds’ portfolio companies. The persistent positive market sentiment fuelled concerns in the first quarter about the future returns of private equity funds over the next few years due to high acquisition prices and increasing use of debt leverage. Moreover, growing uncertainty in the equity market will reflect on these returns with some delay.

The negative first-quarter return on listed real estate investment trusts is a reflection of the developments taking place in the share market.

OTHER INVESTMENTS

VER’s other investments are investments in real estate and infrastructure funds, hedge funds and risk premium strategies.

The (TWR) return on real estate funds was 0.4 per cent while infrastructure investments yielded 0.4 per cent.

Compared with year-end developments, no significant changes took place in the real estate and infrastructure market during the first quarter of 2018. In recent times, the price levels in infrastructure transactions have been relatively high, which also holds true for private equity funds.

Hedge funds yielded a return of 1.6 per cent in the first quarter. It may be considered a fair performance in a turbulent environment in which sudden peaks in volatility posed problems, particularly to risk-controlled strategies. The best return in the portfolio was generated by strategies focusing on the fixed income markets.

The return on risk premiums was -2.6 per cent. The sharply increased volatility at the beginning of February combined with the fall in share prices was challenging especially to momentum strategies, while other strategies gave a slightly positive return.

The state’s pension expenditure continues to increase

The State Pension Fund’s role in balancing government finances has grown and will continue to do so. In 2017, the state’s pension expenditure totalled approx. EUR 4.6 billion while the 2018 budget foresees an expenditure of nearly EUR 4.7 billion. As VER contributes 40 per cent towards these expenses to the government budget, the transfer to the 2018 budget amounts to close to EUR 1.9 billion. During the first quarter, VER transferred EUR 467 million to the government budget. Over the same period, VER earned an estimated EUR 336 million in pension contributions. Its net pension contribution income has now turned permanently negative, meaning that more money is clearly transferred by VER to the government budget than VER receives in pension contribution income. This gap between income and budget transfers will continue to grow year on year and slow down the growth of the Fund.

In June 2016, the Board of Directors of the State Pension Fund adopted a strategy that defines its long-term objectives in greater detail. The strategy foresees that the 25 per cent funding ratio target specified by law will be attained by 2033, if not earlier. To achieve this, it is imperative that VER’s pension contribution income remains at the estimated level and that the real return on investments remains relatively high. As the state’s pension liabilities amounted to EUR 92.6 billion at the end of 2017, the funding ratio was approx. 21 per cent. Additionally, the strategy sets out the principles by which the risk level and basic allocation of the investment portfolio are derived from the target funding ratio established for VER.

|

KEY FIGURES

|

|

|

| |

31.3.2018

|

31.12.2017

|

|

Investments, MEUR (market value)

|

19 269

|

19 586

|

|

Fixed-income investments

|

7 562

|

7 890

|

|

Equity investments

|

9 336

|

9 308

|

|

Other investments

|

1 856

|

1 860

|

|

Impact of derivatives

|

516

|

528

|

| |

|

Breakdown of the investment portfolio

|

|

Fixed-income investments

|

39,2 %

|

40,3 %

|

|

Equity investments

|

48,4 %

|

47,5 %

|

|

Other investments

|

9,6 %

|

9,5 %

|

|

Impact of derivatives

|

2,7 %

|

2,7 %

|

| |

| |

1.1.–31.3.2018

|

1.1.–31.12.2017

|

|

Return on investment

|

-1,0 %

|

6,6 %

|

|

Fixed-income investments

|

|

Liquid fixed-income investments

|

-0,3 %

|

2,0 %

|

|

Other fixed-income investments

|

0,7 %

|

7,3 %

|

|

Equity investments

|

|

Listed equity investments

|

-2,1 %

|

11,0 %

|

|

Private Equity investments

|

3,5 %

|

15,6 %

|

|

Other investments

|

|

Real Estate funds

|

-0,8 %

|

7,4 %

|

|

Infrastructure funds

|

0,4 %

|

14,8 %

|

|

Hedge funds

|

1,6 %

|

4,8 %

|

| |

|

Pension contribution income, MEUR

|

337

|

1 427

|

|

Transfer to state budget, MEUR

|

467

|

1 827

|

|

Net contribution income, MEUR

|

-129

|

-401

|

|

Pension liability, MEUR

|

|

92 600

|

|

Funding ratio, %

|

|

21 %

|

Inquiries:

Additional information is provided by Managing Director Timo Viherkenttä, firstname.lastname@ver.fi, tel.: +358 (0)9 2515 7010.

Established in 1990, the State Pension Fund (VER) is an off-budget fund through which the state prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the state’s pension assets professionally. At the end of March 2018, the market value of the Fund’s investment portfolio stood at EUR 19.3 billion.

All figures presented in this interim report are preliminary and unaudited.