VER’s 1 January–30 September 2018 return 2.0%; five-year annual return 6.0%

Published 2018-10-29 at 10:27

INVESTMENT ENVIRONMENT AND RETURN ON INVESTMENTS

The world economy continued to grow relatively strongly during the reporting period, but its peak seems to have passed in many economic regions. Since last spring, protectionist measures, rising interest rates in the United States and specific problems in individual countries have undermined the economic sentiment.

The equity markets developed especially favourably in the United States, where corporate profits reached an all-time high as a result of robust economic growth and tax cuts. Finnish equities also yielded healthy returns.

The fixed income markets have been under pressure during the beginning of the year. The emerging market bonds that have given VER excellent returns over the past few years have suffered as a result of interest rate hikes in the United States, the strengthening of the U.S. dollar and the escalating trade war.

Future monitoring and evaluation of the State Pension Fund’s investment activities will increasingly focus on long-term outcomes and future prospects instead of quarterly reporting. However, VER will continue to post quarterly figures and comments to the same extent as previously.

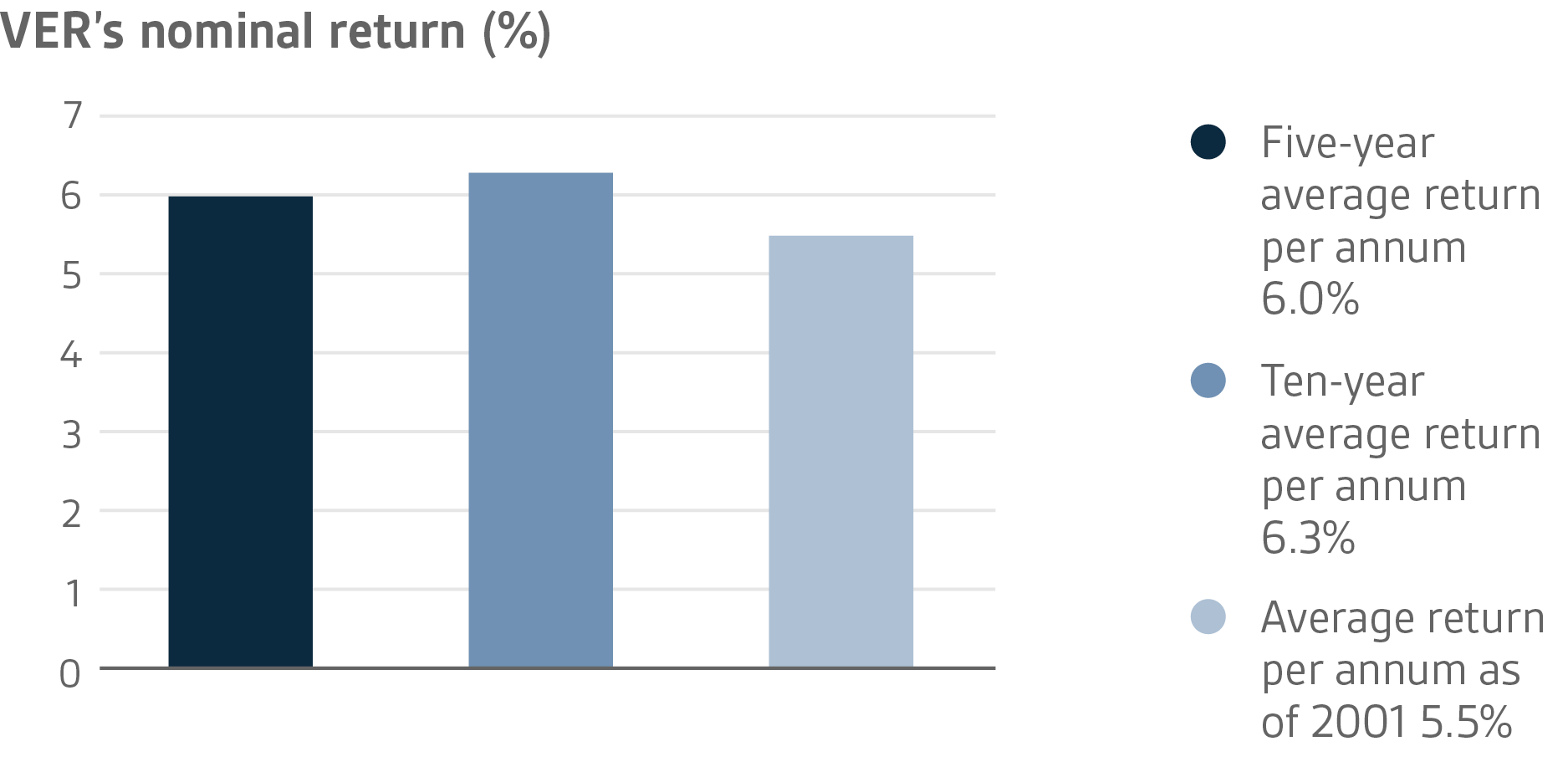

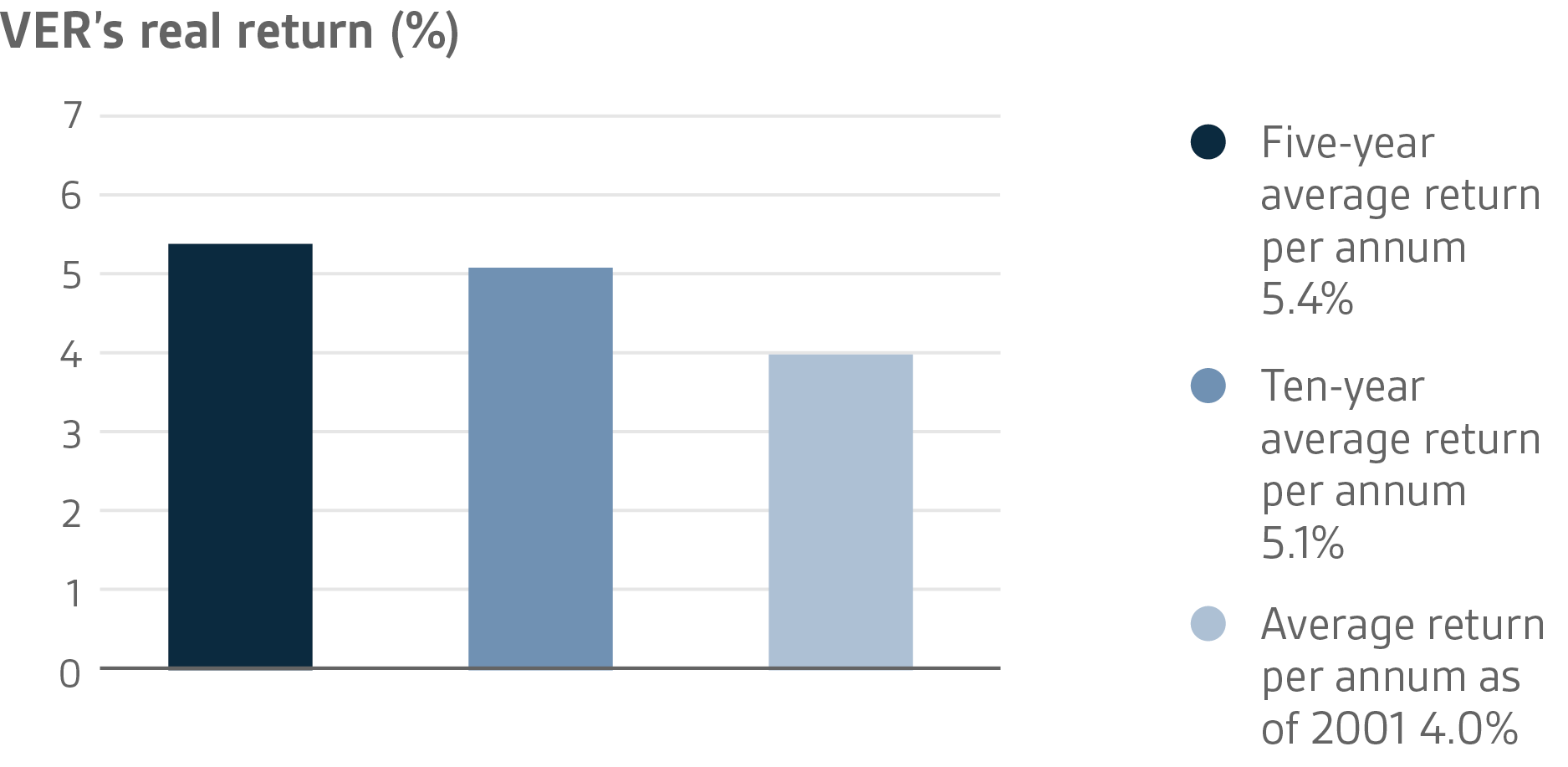

On 30 September 2018, VER’s investment assets totalled EUR 19.7 billion. The return on investments at fair values was 2.0 per cent during the first three quarters and 1.5 per cent in the third quarter. Over the past five years, the average nominal rate of return (1 October 2013–30 September 2018) was 6.0 per cent and the annual ten-year return 6.3 per cent. Since 2001 when VER’s activities assumed their current form, the average rate of return has been 5.5 per cent.

The real rate of return during the first three quarters was 1.0 per cent. The average five-year real return was 5.4 per cent and ten-year real return 5.1 per cent.

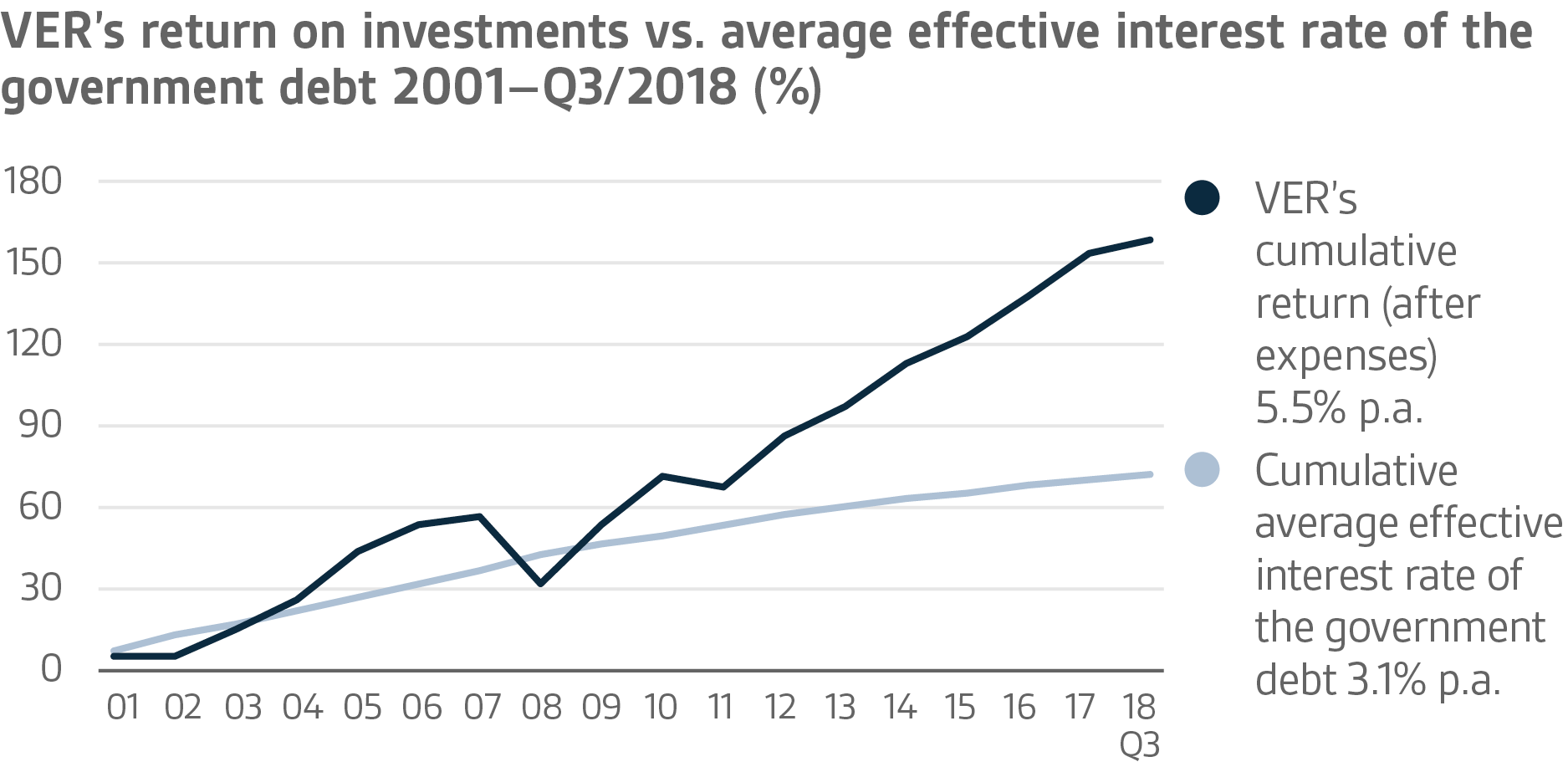

From the state’s point of view, it is pertinent to compare the return on investments with the cost of net government debt because the funds accumulated in preparation for future pension expenditure can be deemed to reduce such debt. Over the past ten years (1 October 2008–30 September 2018), VER’s average annual rate of return has beaten the cost of net government debt by 2.8 percentage points. Since 2001, the total market-value returns earned by VER have exceeded the cumulative average cost of equivalent government debt by more than EUR 6 billion over the same period.

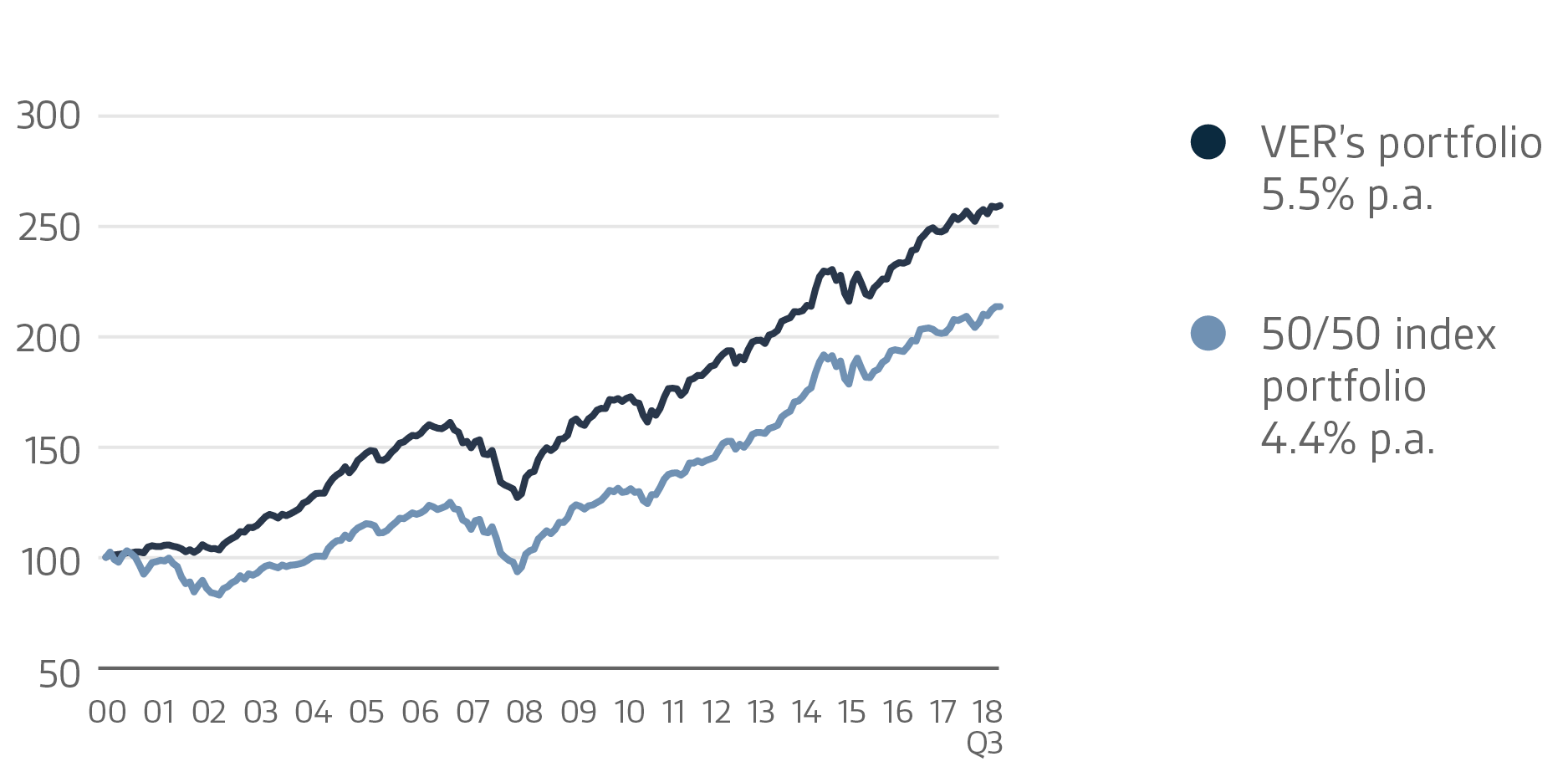

VER monitors long-term return relative to overall market developments by comparing the actual return with a global index in which the weight of both equities and currency-hedged bonds is 50 per cent.

A CLOSER LOOK AT JANUARY–SEPTEMBER 2018

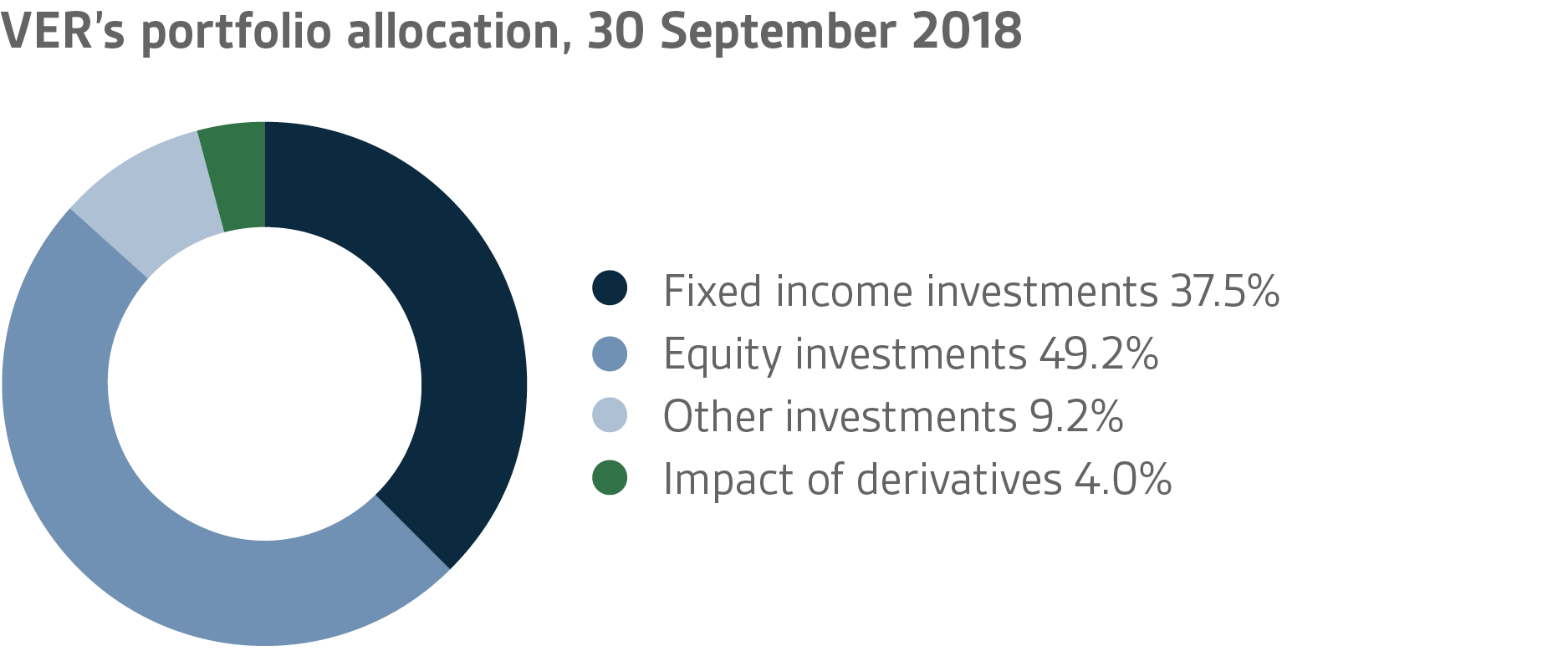

In accordance with the directive of the Ministry of Finance, VER’s investments are divided into fixed income instruments, equities and other investments. At the end of September, fixed income instruments accounted for 37.5 per cent, equities 49.2 per cent and other investments 9.2 per cent of the total. The rest of the effect was due to derivatives. Of the large asset classes, liquid fixed income instruments generated a return of -1.6 per cent and listed equities 4.6 per cent during the first three quarters.

Fixed income instruments

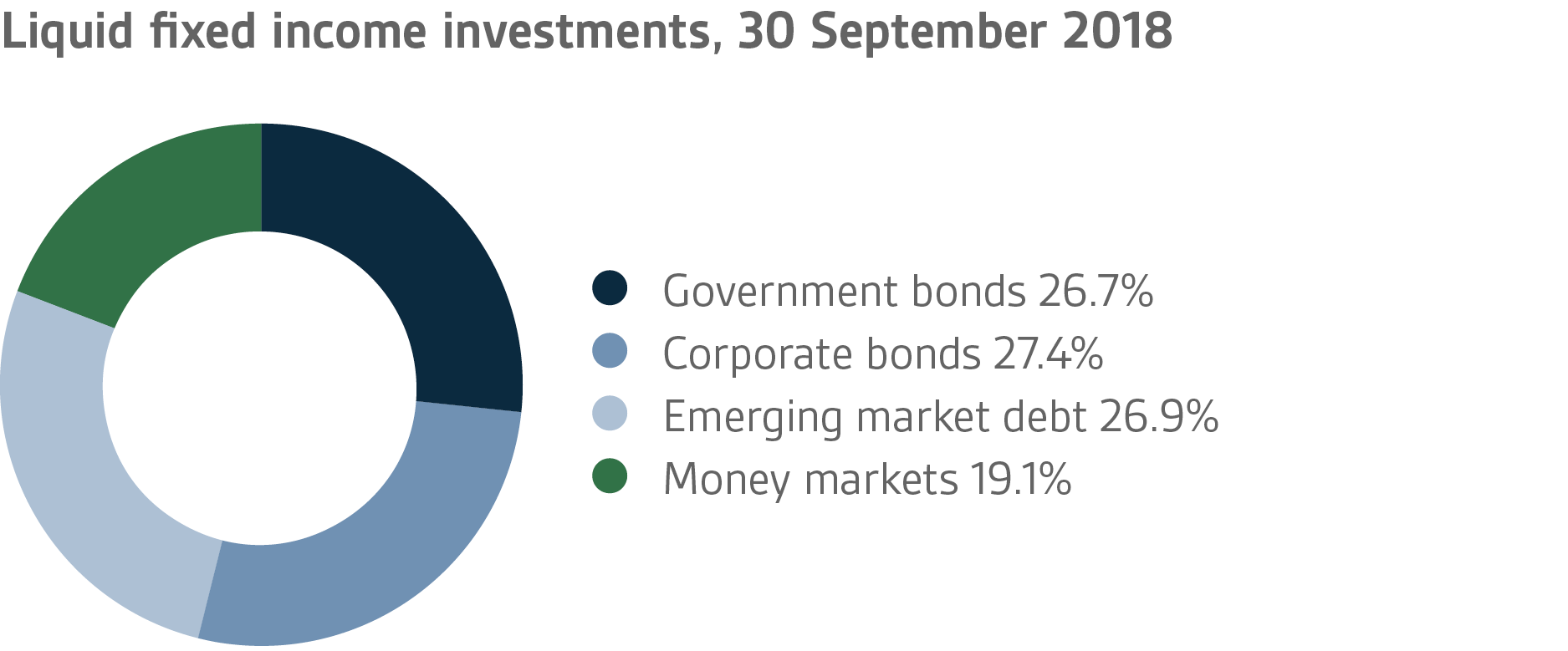

Liquid fixed income investments

Liquid fixed income investments gave a return of -1.6 per cent.

During the first few months of the year, the interest rates increased sharply as investors expected inflation to accelerate, particularly in the United States following the tax cuts, and central banks to continue to tighten their monetary policies. The risk premiums on corporate loans increased clearly from the previously extremely low levels. The emerging markets suffered as a result of raised U.S. interest rates and the stronger dollar. Additionally, fears of a trade war rattled the markets.

In Europe, interest rates were affected by the political situation in Italy and suspicions of a deficit budget. The sharp increase in interest rates on Italian government bonds caused investors to seek a safe haven in German government papers. The European Central Bank’s decision to continue its monthly net asset purchases with EUR 15 billion from September to December and the message that the benchmark rates will remain unchanged at least until autumn 2019 eased tensions in the interest rate swap markets.

In August, the problems in Turkey were extensively reflected in the emerging markets. Countries with current account and budget deficits were hit the hardest. In September, there was a rebound from the strong movements experienced in August, but big differences between countries remained in the emerging markets. As safe-haven investments decreased and the worst fears concerning the negative consequences of a trade war were somewhat allayed, the interest rates on German and U.S. government bonds began to rise.

Other fixed income investments

VER’s other fixed income investments include investments in private credit funds and

direct lending to companies.

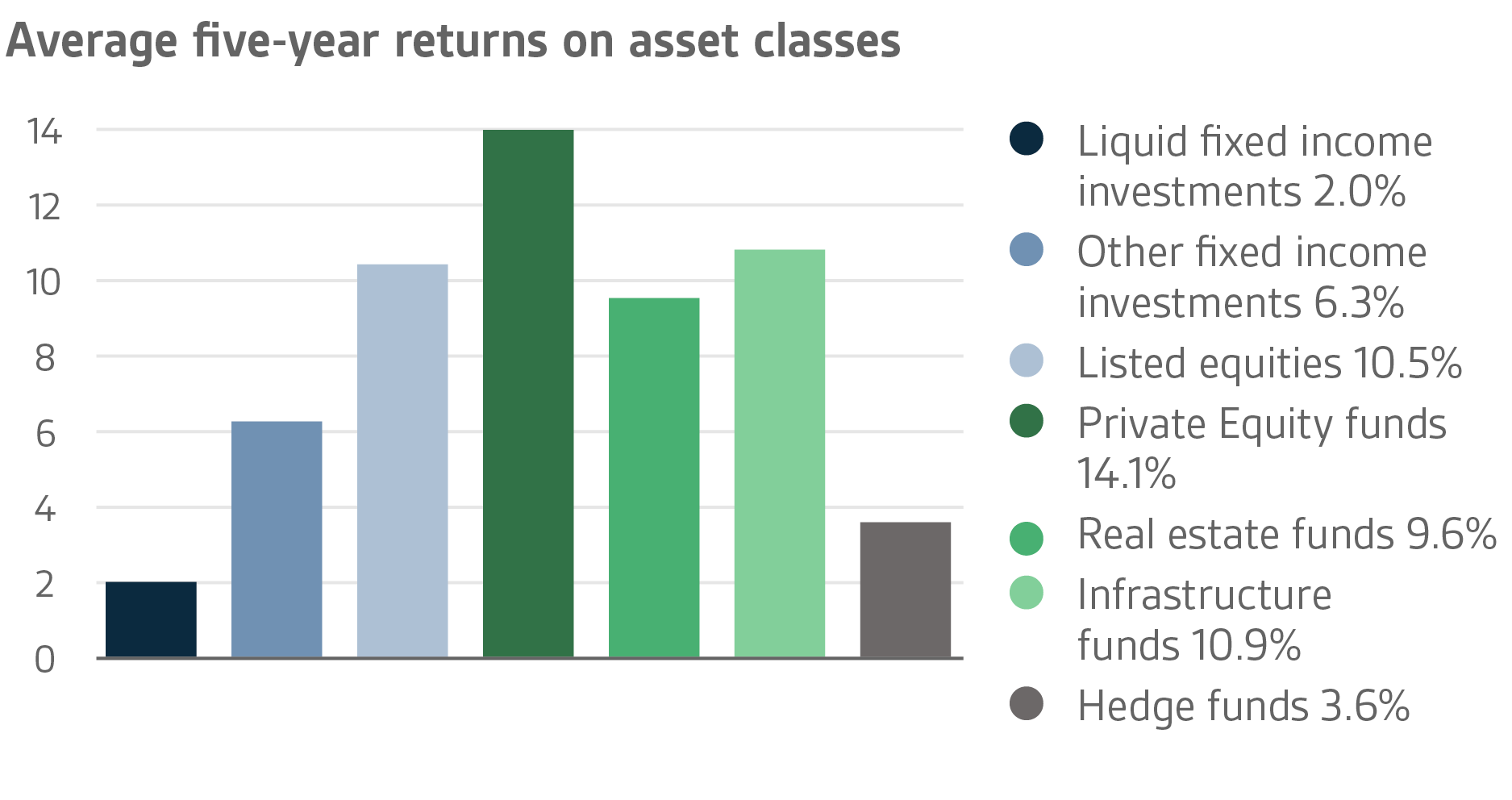

The return on other investments was 4.9 per cent.

VER’s private credit funds gave a solid return (TWR 9.1%). As expected, the best returns were generated by distress credit and mezzanine strategies, but property debt and senior loan funds also put in a good performance.

Uncertainty about future returns on private credit funds increased during the reporting period. In particular, concerns were raised about the increased use of borrowing in LBO transactions while the provisions protecting the interests of creditors deteriorated.

Equities

Listed equities

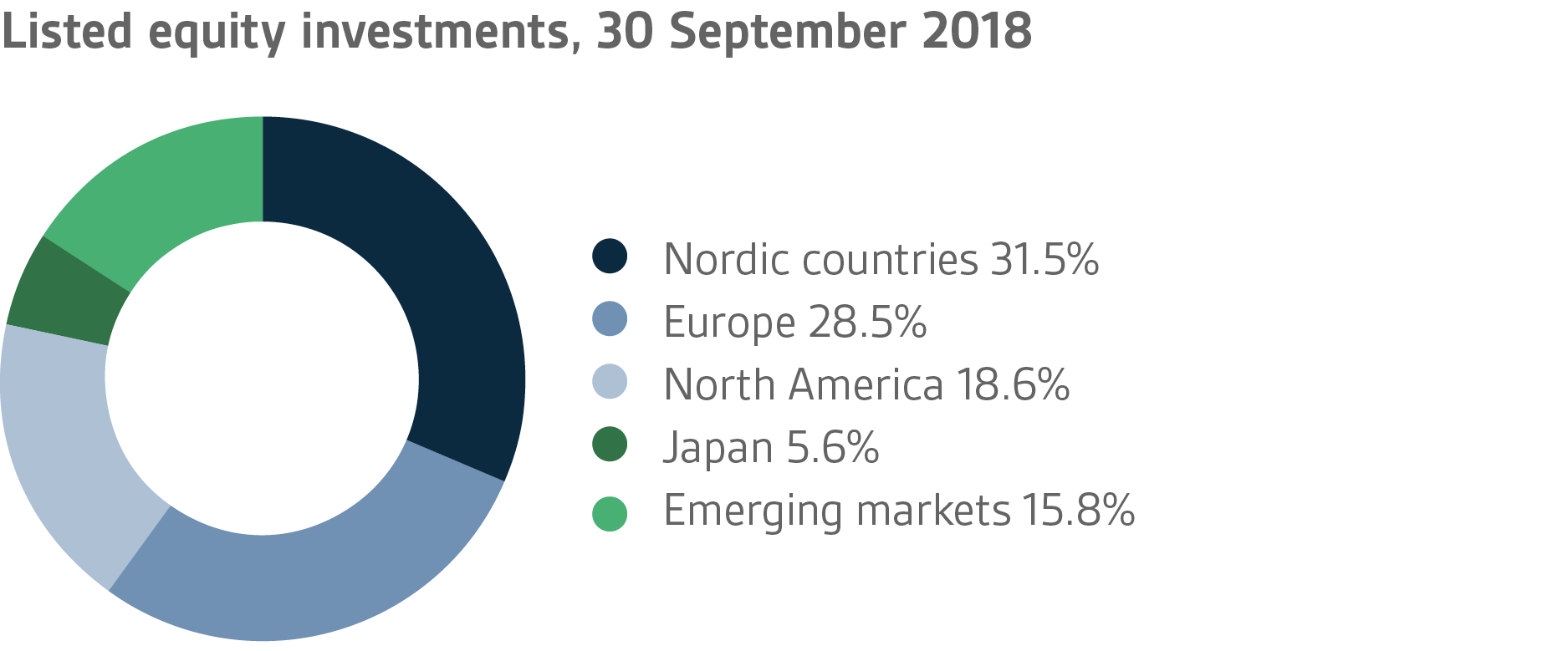

The return on listed equities was 4.6 per cent.

The mood in the global equity market was upbeat for most of the first three quarters of 2018. Of course, there were some fluctuations during the reporting period, and the swings in market sentiments were at times abrupt. However, the returns earned on equities by the end of the third quarter were positive, except for the emerging markets, which have given a lot of cause for concern. As most of the trade policy measures taken by the United States have targeted China, the Asian stock markets have been quite jittery. Additionally, a number of crises have afflicted individual countries during the year, notably Turkey and Argentina. Moreover, the gradual phasing-out of the unprecedented infusion of capital will cause concerns, particularly with regard to the emerging markets. This will also be reflected in valuation levels in the emerging markets that have dropped considerably during the year.

As far as developed markets are concerned, particularly in the United States and the Nordic countries, the situation is different. The risk sentiment has been very strong, supported by the sound performance of listed companies, especially in the United States. The U.S. tax reform early this year greatly improved corporate profits accompanied by a robust financial performance in general. Similarly, the Nordic countries have been performing well as a result of which share prices have developed favourably. In mainland Europe, the development has been less robust. While financial performance in Europe has been positive on the whole, a number of factors, such as the concerns over Italy’s forthcoming budget and complications in the Brexit negotiations, have had a negative impact on the market sentiment. A lot of question marks remain in the global economy, and it remains to be seen what the equity market has to offer to investors during the rest of the year.

Other equity investments

VER’s other equity investments include investments in private equity funds, non-listed stock and listed real estate investment trusts.

Private equity investments returned 12.2 per cent, unlisted equities 5.6 per cent and listed real estate investment trusts -2.2 per cent (TWR).

A positive mood continued to prevail in the private equity market during the reporting period. As in early 2018, the valuation levels of portfolio companies continued to rise at the same time as managers made successful exits at sound valuation levels. However, high valuations and the increased indebtedness of companies have increased uncertainty about future market developments.

The negative return on real estate investments was due to the rising U.S. interest rates.

Other investments

VER’s other investments are investments in unlisted real estate, infrastructure and hedge funds and risk premium strategies.

The return on real estate funds was 7.2 per cent (TWR) while infrastructure investments yielded 9.6 per cent.

The market conditions for real estate and infrastructure investments remained positive. Particularly with infrastructure investments, the excellent returns were due to successful exits and hefty dividends.

By the end of September, hedge funds had yielded a return of 0.5 per cent. Macro funds continued to put in a strong performance in the third quarter. The problems experienced in the emerging markets were reflected not only in the funds specialising in these markets but also in other style classes.

By the end of September, risk premium strategies had generated a return of -9.8 per cent. The problems experienced early in the year spilled over to the third quarter, with value and carry strategies, in particular, giving a poor return. The biggest problems were due to the strength of growth stock in the United States.

THE STATE’S PENSION EXPENDITURE CONTINUES TO INCREASE

The State Pension Fund’s role in balancing government finances has grown and will continue to do so. In 2017, the state’s pension expenditure totalled approx. EUR 4.6 billion while the 2018 budget foresees an expenditure of nearly EUR 4.7 billion. As VER contributes 40 per cent towards these expenses to the government budget, the transfer to the 2018 budget amounted to close to EUR 1.9 billion. By the end of September 2018, VER had transferred EUR 1400 million to the government budget. Over the same period, VER earned an estimated EUR 1080 million in pension contributions.

In June 2016, the Board of Directors of the State Pension Fund adopted a strategy that defines its long-term objectives in greater detail. The strategy foresees that the 25 per cent funding ratio target specified by law will be attained by 2033, if not earlier. To achieve this, it is imperative that VER’s pension contribution income remains at the estimated level and that the real return on investments remains relatively high. As the state’s pension liabilities amounted to EUR 92.6 billion at the end of 2017, the funding ratio was approx. 21 per cent. Additionally, the strategy sets out the principles by which the risk level and basic allocation of the investment portfolio are derived from the target funding ratio established for VER.

KEY FIGURES

|

|

|

| |

30.9.2018

|

31.12.2017

|

|

Investments, MEUR (market value)

|

19 652

|

19 586

|

|

Fixed-income investments

|

7 372

|

7 890

|

|

Equity investments

|

9 671

|

9 308

|

|

Other investments

|

1 815

|

1 860

|

|

Impact of derivatives

|

795

|

528

|

| |

|

Breakdown of the investment portfolio

|

|

Fixed-income investments

|

37,5 %

|

40,3 %

|

|

Equity investments

|

49,2 %

|

47,5 %

|

|

Other investments

|

9,2 %

|

9,5 %

|

|

Impact of derivatives

|

4,0 %

|

2,7 %

|

| |

| |

1.1.-30.9.2018

|

1.1.-31.12.2017

|

|

Return on investment

|

2,0 %

|

6,6 %

|

|

Fixed-income investments

|

|

Liquid fixed-income investments

|

-1,6 %

|

2,0 %

|

|

Other fixed-income investments

|

4,9 %

|

7,3 %

|

|

Equity investments

|

|

Listed equity investments

|

4,6 %

|

11,0 %

|

|

Private Equity investments

|

12,2 %

|

15,6 %

|

|

Other investments

|

|

Real Estate funds

|

4,7 %

|

7,4 %

|

|

Infrastructure funds

|

9,6 %

|

14,8 %

|

|

Hedge funds

|

0,5 %

|

4,8 %

|

| |

|

Pension contribution income, MEUR

|

1 080

|

1 427

|

|

Transfer to state budget, MEUR

|

1 400

|

1 827

|

|

Net contribution income, MEUR

|

-319

|

-401

|

|

Pension liability, MEUR

|

|

92 600

|

|

Funding ratio

|

|

21 %

|

Inquiries: Additional information is provided by CEO Timo Viherkenttä, firstname.lastname@ver.fi, tel.: +358 (0)9 2515 7010.

Established in 1990, the State Pension Fund (VER) is an off-budget fund through which the state prepares to finance future pensions and equalise pension expenditure. VER is an investment organisation responsible for investing the state’s pension assets professionally. At the end of September 2018, the market value of the Fund’s investment portfolio stood at EUR 19.7 billion.

All figures presented in this interim report are preliminary and unaudited.